- Home

- »

- Renewable Chemicals

- »

-

Cellulose Derivatives Market Size & Share Report, 2030GVR Report cover

![Cellulose Derivatives Market Size, Share & Trends Report]()

Cellulose Derivatives Market (2023 - 2030) Size, Share & Trends Analysis Report By Type, (Methyl Cellulose, Ethyl Cellulose, Hydroxypropyl Methylcellulose) By Grade (Industrial Grade, Pharmaceutical Grade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-042-3

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

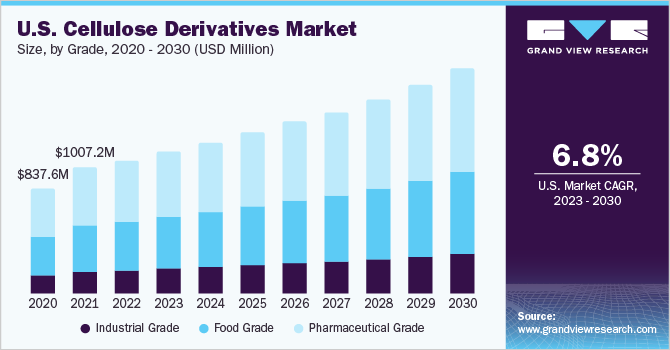

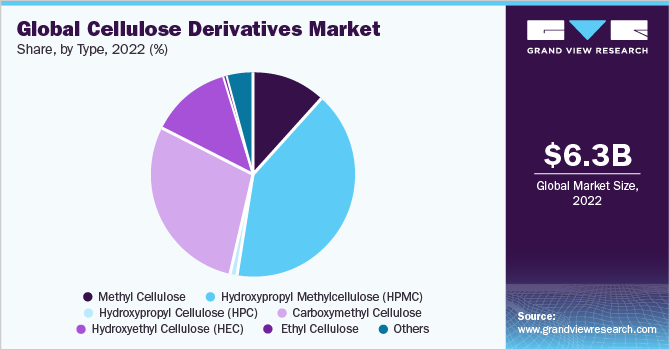

The global cellulose derivatives market size was valued at USD 6.3 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The market growth is attributed to the rising demand for low-fat products owing to the rise in health consciousness among consumers. Cellulose derivatives are compounds derived from cellulose, which is the main component of plant cell walls. These derivatives are modified chemically to obtain specific properties for a various industrial and consumer application. Some examples of cellulose derivatives include cellulose acetate, ethyl cellulose, cellulose nitrate, and methyl cellulose. They are used in various industries such as textiles, pharmaceuticals, food, and cosmetics, among others.

The market is expected to grow in the coming years due to the increasing demand for sustainable and biodegradable materials in various industries such as food packaging, pharmaceutical, and personal care. Furthermore, the increasing application of the product in the production of high-value products, such as cellulose acetate fibers and films, is expected to boost the market growth. However, fluctuating raw material prices and environmental regulations may hinder market growth.

Cellulose derivatives are widely used in various end-use industries such as textile, pharmaceutical, food & beverage, and cosmetics. The textile industry is driving the demand for various derivatives such as methylcellulose, hydroxypropyl methylcellulose (HPMC), and hydroxypropyl cellulose (HPC) owing to their application as performance-enhancing additives in the production of textile products. Cellulose derivatives are used in the production of textiles, fabric softeners, and nonwovens to improve their properties such as softness, moisture resistance, and durability.

The growing demand for high-performance textiles and the increasing trend toward sustainable and eco-friendly products are expected to drive demand for the product in the textile industry. In addition, rising consumer awareness about the environmental sustainability is boosting demand for the biodegradable and renewable products in the textile industry.

The demand for biodegradable products is driving the cellulose derivatives market as the product is used as a key raw material in the production of biodegradable products such as biodegradable plastics, food packaging, and other disposable items. The growing concern for the environmental sustainability and the need to reduce plastic waste has increased demand for the biodegradable products, which, in turn, is driving market growth. In addition, government regulations promoting the use of biodegradable products have further contributed to the growth of demand for the product.

Type Insights

Hydroxypropyl Methylcellulose (HPMC) type dominated the market with a revenue share of above 40.0% in 2022. The market growth can be attributed to use of the product in various industries such as construction, pharmaceutical, paints & coatings, and printing inks industries. In the construction industry, it is widely used as a water-retention agent, a binder, and a thickener in various applications such as tile adhesives, plaster and mortar, and cementations systems in this industry.

It is used in tile adhesives to improve their flow properties and workability. It ensures a strong bond between the tiles and the substrate. In plaster and mortar, it acts as a binder for improving the strength and workability of the mix and offering a smooth and durable finish. In cementations systems such as self-levelling flooring compounds and grouts, (HPMC) improves the rheology, workability, and water retention properties besides extends the setting time.

Carboxymethyl cellulose (CMC) is commonly used as a thickener, emulsifier, and stabilizer in personal care and cosmetic products such as shampoos, conditioners, lotions, creams, and makeup products. It helps improve the texture, viscosity, and stability of these products, and can also enhance their ability to retain moisture, making the skin feel more hydrated and nourished. CMC is often used in toothpaste as a bulking agent to provide a smooth consistency and help distribute active ingredients evenly.

Methyl cellulose is also added to paints used in the construction industry. When it is added as a rheology modifier to paints, it also enables enhanced control over the flow and levelling properties of the paints, resulting in their improved application and a highly consistent finish. It also reduces the formation of drips and runs, making the application process of the paints smooth and highly efficient.

The growth of the global construction industry is expected to have a positive impact on the consumption of methylcellulose. For instance, the capital project and infrastructure market in the Asia Pacific is anticipated to grow by 7.0-8.0% every year in the next 10 years to reach USD 5,300 billion by 2025. Moreover, large investment projects are currently booming across Southeast Asia and beyond, as the region benefits from a healthy investment influx.

Grade Insights

Pharmaceutical grade dominated the global market with the highest revenue share of 45.9% in 2022. Its high share is attributable to the rising utilization as excipients, binders, disintegrants, and sustained-release matrices in various drug formulations. Some of the key products used in the pharmaceutical industry include microcrystalline cellulose (MCC), (HPC), and (HPMC). These derivatives offer excellent flow properties, compressibility, and stability in different pH conditions, making them suitable for a wide range of applications in the pharmaceutical industry.

Food-grade products are used as thickeners in various food products such as soups, sauces, and dressings to improve viscosity and texture. They are also used as emulsifiers and stabilizers in food products such as margarine, shortening, spreads, ice cream, yogurt, and processed meats among others. Additionally, they are used as fat replacers in low-fat and low-calorie food products to provide a creamy texture. Some of the major cellulose derivatives used in the food industry include (CMC), (HEC), and (MCC). These derivatives offer several functional benefits such as improved texture, stability, and viscosity of the food products, making them ideal for a wide range of food applications.

The increasing demand for the processed and packaged food is the major driving factor for the product demand. Overall, the versatility, non-toxicity, and safety of the product make them ideal for use in various food-based applications; their ability to improve the texture and stability of the food products makes them popular among food manufacturers.

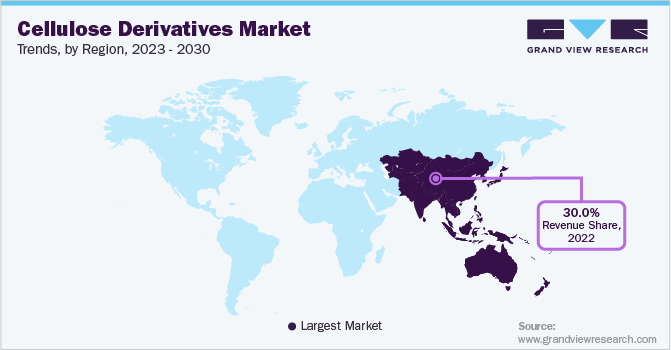

Regional Insights

Asia Pacific region dominated the global market with the highest revenue share of more than 30.0% in 2022. This is attributed to the rising demand for the packaged food and beverages, along with the rising population, which is driving growth of the product market in the region. In addition, the growing awareness of the health benefits of cellulose derivatives is also fuelling their demand. The major players in the market are investing heavily in research and development to enhance their product portfolio and gain a competitive edge. Some of the key countries contributing to the growth of the cellulose derivatives market in the Asia-Pacific region are China, India, Japan, and South Korea.

Germany, the U.K., France, Turkey, and Russia emerged as the key economies in the European market. The personal care industry is growing rapidly in the region, driven by high demand for the men’s care and sun protection products. The increasing requirement for various personal care & cosmetics products in Europe has triggered production, which has further contributed to the product demand. Increased penetration of cosmetics producers in the region has led to demand for the customized hair care formulations, skin care creams, lotions, and makeup products.

Germany's per capita yearly cosmetics spending is quite high among European countries, at USD 175/year, with significant demand for the premium cosmetics. New product launches and innovations are likely to drive sales in Germany during the forecast period, despite the market's increasing maturity and competition.

Key Companies & Market Share Insights

Companies have an extensive presence throughout the value chain. A few major companies engaged in manufacturing cellulose derivatives include Dow, Ashland, Borregaard AS, and others. These companies have been the industry leaders due to constant product innovation backed by the rapid adoption of the latest technological interface. Some key players in global cellulose derivatives market include:

-

Daicel Corporation

-

Shin-Etsu Chemical Co., Ltd.

-

Ashland Inc.

-

Eastman Chemical Company

-

Dow

-

SE Tylose GmbH & Co. KG

-

CP Kelco U.S., Inc.

-

Colorcon

Cellulose Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.7 billion

Revenue forecast in 2030

USD 10.7 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, grade, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Daicel Corporation; Shin-Etsu Chemical Co., Ltd.; Ashland Inc.; Eastman Chemical Company; Dow; SE Tylose GmbH & Co. KG; CP Kelco U.S., Inc.; Colorcon

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellulose Derivatives Market Segmentation

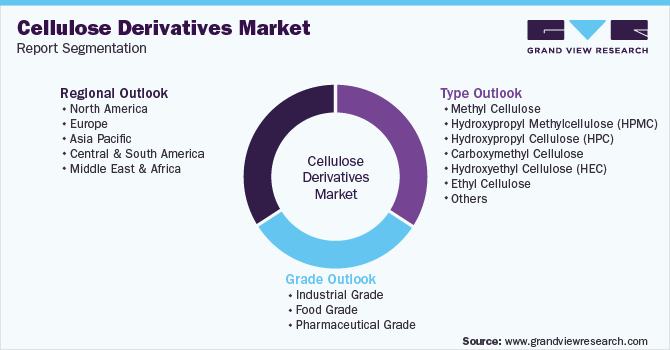

This report forecasts revenue growth at global, regional, and country levels in addition to provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cellulose derivativesmarket report based on the type, grade, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Methyl Cellulose

-

Methyl Cellulose Application Outlook

-

Construction

-

Refractory Material

-

Paints

-

Fiber Wall

-

Others

-

-

Personal Care & Cosmetics

-

Hair Care

-

Skin care

-

Body Care

-

Others

-

-

Food & Beverages

-

Baked Food

-

Frozen Food

-

Dairy Food

-

Concentrated Juices

-

Others

-

-

Pharmaceutical

-

Capsules

-

Tablets

-

Drops

-

Ointments

-

Others

-

-

Paints & Coatings

-

Waterborne Coatings

-

Powder Coatings

-

Specialty Coatings

-

Others

-

-

Printing Inks

-

Packaging & Labels

-

Corrugated Cardboards

-

Publication & Commercial Printing

-

Others

-

-

Electronics

-

Flexible Electronics

-

Semiconductors

-

Sensors

-

Others

-

-

Others

-

-

-

Hydroxypropyl Methylcellulose (HPMC)

-

Hydroxypropyl Methylcellulose Application Outlook

-

Construction

-

Cement Mortar

-

Plasters

-

Refractory Material

-

Paints

-

Gypsum Concrete Slurry

-

Fiber Wall

-

Others

-

-

Personal Care & Cosmetics

-

Hair Care

-

Skin care

-

Body Care

-

Others

-

-

Food & Beverages

-

Baked Food

-

Frozen Food

-

Dairy Food

-

Concentrated Juices

-

Others

-

-

Pharmaceutical

-

Capsules

-

Tablets

-

Drops

-

Ointments

-

Others

-

-

Paints & Coatings

-

Waterborne Coatings

-

Powder Coatings

-

Specialty Coatings

-

Others

-

-

Printing Inks

-

Packaging & Labels

-

Corrugated Cardboards

-

Publication & Commercial Printing

-

Others

-

-

Textiles

-

Mining

-

Others

-

-

-

Hydroxypropyl Cellulose (HPC)

-

Hydroxypropyl Cellulose Application Outlook

-

Personal Care & Cosmetics

-

Hair Care

-

Skin care

-

Body Care

-

Others

-

-

Food & Beverages

-

Baked Food

-

Frozen Food

-

Dairy Food

-

Concentrated Juices

-

Others

-

-

Construction

-

Cement Mortar

-

Plasters

-

Gypsum Concrete Slurry

-

Others

-

-

Pharmaceutical

-

Capsules

-

Tablets

-

Drops

-

Ointments

-

Others

-

-

Oil & Gas

-

Paints & Adhesives

-

Textiles

-

Others

-

-

-

Carboxymethyl Cellulose

-

Carboxymethyl Cellulose Application Outlook

-

Personal Care & Cosmetics

-

Hair Care

-

Skin care

-

Body Care

-

Others

-

-

Food & Beverages

-

Baked Food

-

Frozen Food

-

Dairy Food

-

Concentrated Juices

-

Others

-

-

Pharmaceutical

-

Capsules

-

Tablets

-

Drops

-

Ointments

-

Others

-

-

Printing Inks

-

Packaging & Inks

-

Corrugated Cardboards

-

Publication & Commercial Printing

-

Others

-

-

Oil & Gas

-

Paints & Adhesives

-

Detergents

-

Construction

-

Textiles

-

Mining

-

Others

-

-

-

Hydroxyethyl Cellulose (HEC)

-

Hydroxyethyl Cellulose Application Outlook

-

Personal Care & Cosmetics

-

Hair Care

-

Skin care

-

Body Care

-

Others

-

-

Food & Beverages

-

Baked Food

-

Frozen Food

-

Dairy Food

-

Concentrated Juices

-

Others

-

-

Pharmaceutical

-

Capsules

-

Tablets

-

Drops

-

Ointments

-

Others

-

-

Printing Inks

-

Packaging & Inks

-

Corrugated Cardboards

-

Publication & Commercial Printing

-

Others

-

-

Building Materials

-

Water Borne Paints & Coatings

-

Oil Fields

-

Textiles

-

Others

-

-

-

Ethyl Cellulose

-

Ethyl Cellulose Application Outlook

-

Construction

-

Cement Mortar

-

Plasters

-

Refractory Materials

-

Fiber Wall

-

Others

-

-

Food & Beverages

-

Baked Food

-

Frozen Food

-

Dairy Food

-

Concentrated Juices

-

Others

-

-

Personal Care & Cosmetics

-

Hair Care

-

Skin care

-

Body Care

-

Others

-

-

Pharmaceutical

-

Capsules

-

Tablets

-

Drops

-

Ointments

-

Others

-

-

Paints & Coatings

-

Waterborne Coatings

-

Powder Coatings

-

Specialty Coatings

-

Others

-

-

Printing Inks

-

Packaging & Inks

-

Corrugated Cardboards

-

Publication & Commercial Printing

-

Others

-

-

Electronics

-

Flexible Electronics

-

Semiconductor

-

Sensors

-

Others

-

-

Textiles

-

Others

-

-

Others

-

-

-

Grade Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Industrial Grade

-

Food Grade

-

Pharmaceutical Grade

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the cellulose derivative market with a share of 33.8% in 2022. This is attributable to the rising health consciousness of consumers

b. Some key players operating in the cellulose derivative market include DOW, Ashland Inc., and Eastman Chemical Company among others

b. Key factors that are driving the market growth include increasing consumer spending power, the rapidly expanding economy, and the growth of end-use industries such as pharmaceutical, construction, and food & beverage

b. The global cellulose derivatives market size was estimated at USD 6.3 billion in 2022 and is expected to reach USD 6.7 billion in 2023.

b. The global cellulose derivatives market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 10.6 billion by 2027.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.