- Home

- »

- Biotechnology

- »

-

Cell Culture Vessels Market Size, Industry Report, 2033GVR Report cover

![Cell Culture Vessels Market Size, Share & Trends Report]()

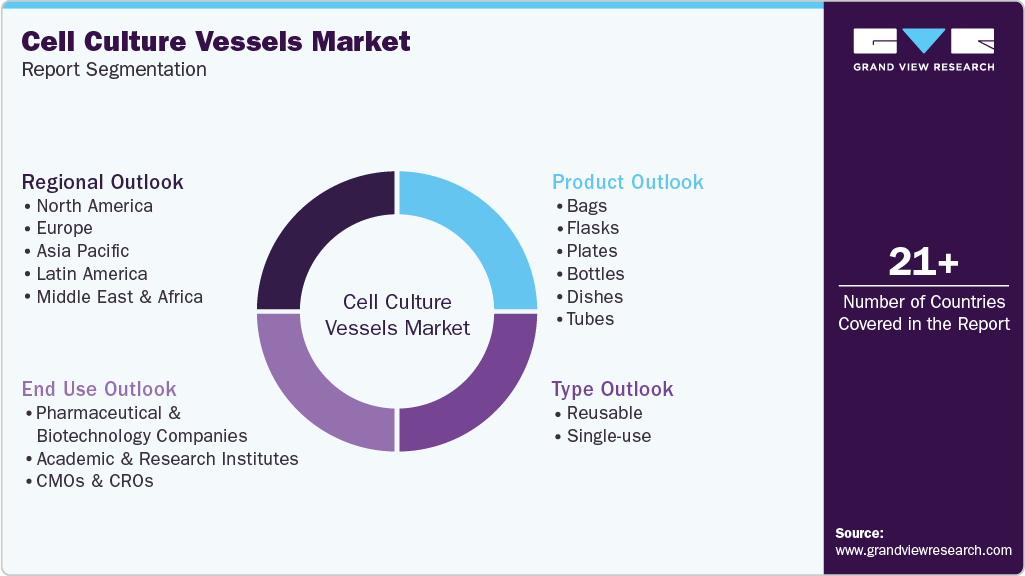

Cell Culture Vessels Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Bags, Flasks, Plates, Bottles, Dishes, Tubes), By Type (Reusable, Single-use), By End Use (Pharmaceutical & Biotechnology Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-443-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Culture Vessels Market Summary

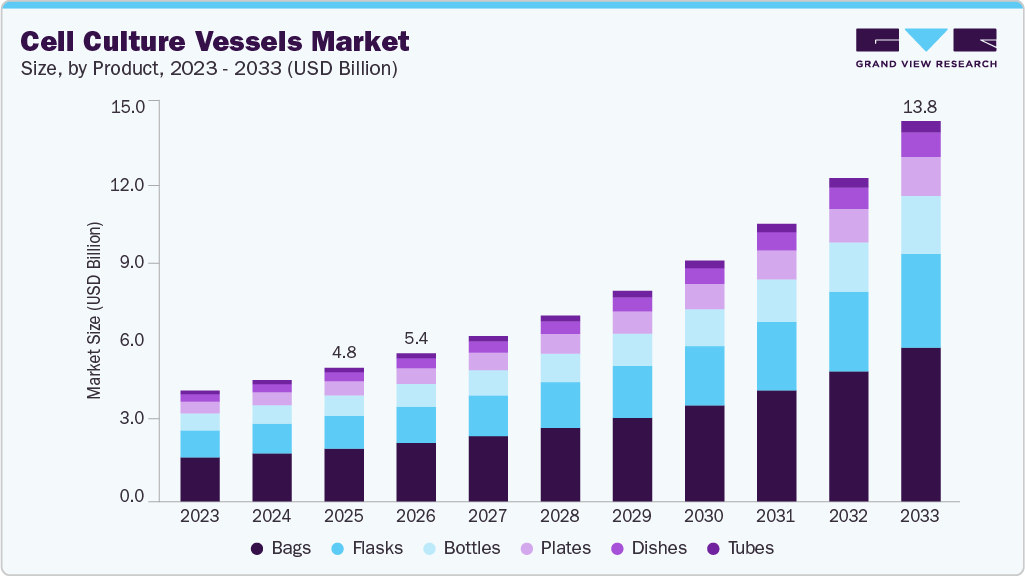

The global cell culture vessels market size was estimated at USD 4.83 billion in 2025 and is projected to reach USD 13.77 billion by 2033, growing at a CAGR of 14.4% from 2026 to 2033. The rising prevalence of chronic diseases, increased investments in research and development, and a growing number of clinical trials for cell-based therapies are driving the market growth.

Key Market Trends & Insights

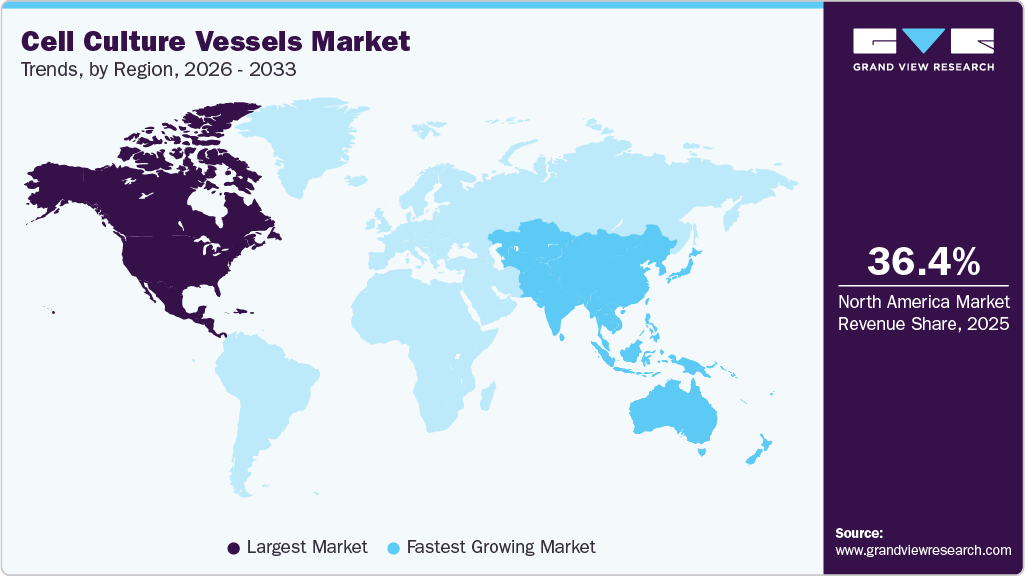

- The North America cell culture vessels market held the largest share of 36.42% of the global market in 2025.

- The cell culture vessels industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the bags segment held the largest market share of 39.47% in 2025.

- By type, the single-use segment held the largest market share in 2025.

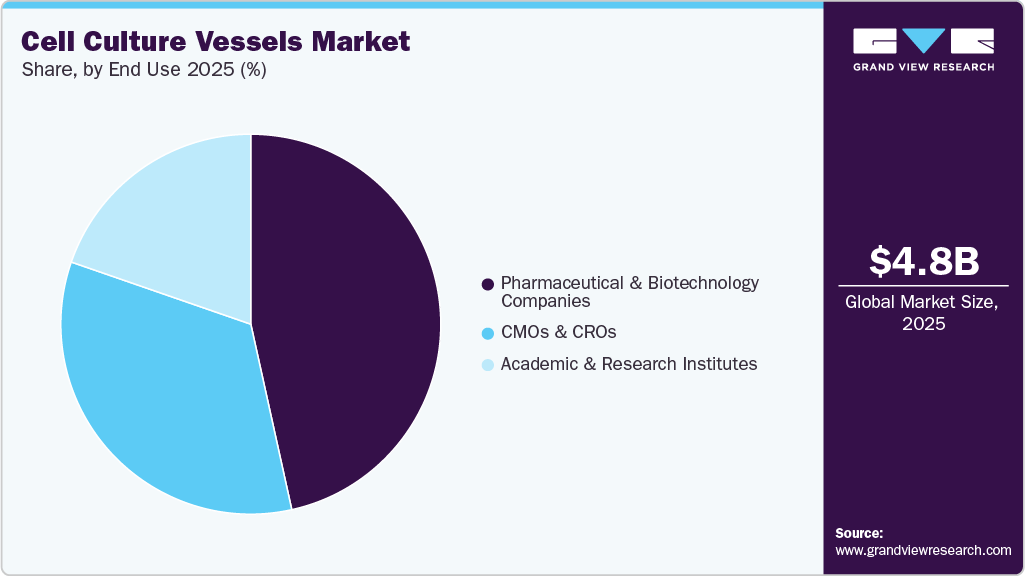

- By end use, the pharmaceutical & biotechnology companies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.83 Billion

- 2033 Projected Market Size: USD 13.77 Billion

- CAGR (2026-2033): 14.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, growing collaborations and partnerships among market players are expected to contribute to the market growth.

Technological Advancements

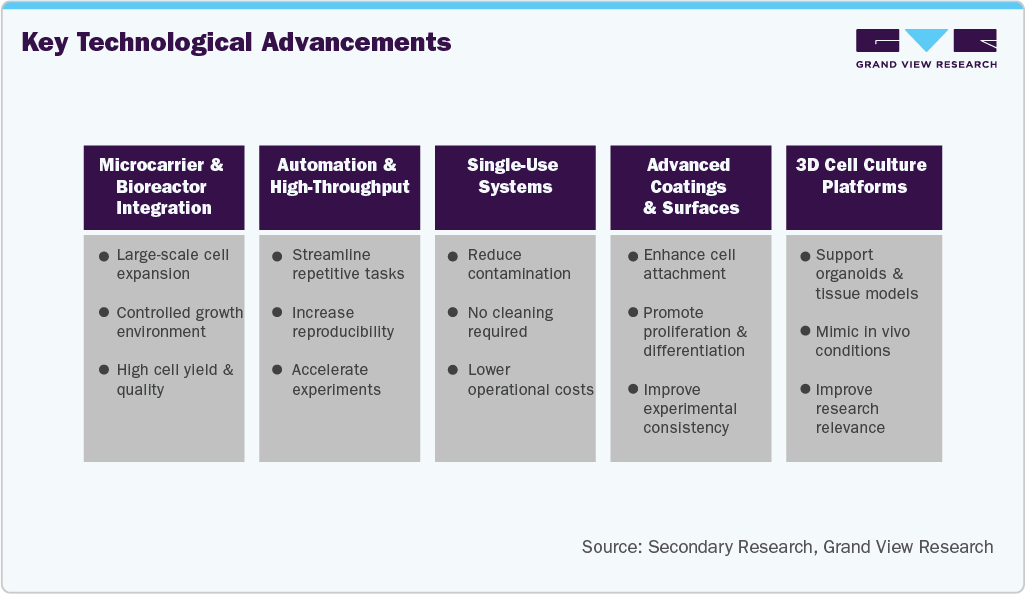

Continuous technological advancements in the 3D cell culture vessels market are driving overall market growth by improving process efficiency, safety, and scalability across research and biomanufacturing. Innovations such as multi-layer flasks, 3D culture platforms, microcarrier systems, and automated high-throughput vessels enhance cell yield, minimize manual handling and error, accelerate experimental timelines, and ensure controlled microenvironments for consistent, reproducible outcomes benefits that are increasingly vital in biopharmaceutical R&D, regenerative medicine, and drug discovery.

The growing shift toward single-use and modular vessels is transforming the market by delivering significant operational and economic advantages. Disposable bioreactors and culture bags reduce contamination risks and eliminate cleaning and sterilization steps, supporting compliance with stringent GMP requirements especially valuable in biologics manufacturing and cell-based therapies that rely on sterile closed systems. With scalable formats ranging from benchtop to industrial production, labs and manufacturers can expand capacity without major facility upgrades. As biopharma companies, CMOs, and research institutes push to shorten development timelines and improve efficiency, demand for scalable, automation-ready single-use culture vessels continues to rise.

Rising interest and investments in cell-based therapies, regenerative medicine, and advanced research

The growing focus on cell-based therapies and regenerative medicine is one of the most powerful forces driving the demand for cell culture vessels. Therapies such as stem-cell treatments, gene therapy, CAR-T immunotherapy, and tissue engineering require reliable and scalable platforms to culture, differentiate, and expand viable cells. These cutting-edge therapeutic modalities depend on strict control of cellular microenvironments, sterility, and reproducibility factors that make high-quality flasks, plates, bioreactors, and single-use vessels indispensable. As clinical pipelines expand and more cell-based therapies progress toward commercialization, research institutions, biotech companies, and pharmaceutical manufacturers are increasing their consumption of culture vessels to support both discovery-stage R&D and large-scale therapeutic production.

At the same time, personalized medicine and precision oncology are further accelerating the need for sophisticated cell-culture infrastructure. The development of patient-specific treatments, high-content drug screening, organoids, and 3D cell culture models demands advanced vessel systems that support accurate biological modelling and high productivity. Governments, private investors, and healthcare systems worldwide are allocating significant funding to regenerative medicine research, resulting in new laboratories, biomanufacturing sites, and cell-therapy production centers all of which require continuous supply of cell culture vessels.

Market Concentration & Characteristics

The cell culture vessels industry has seen significant growth in recent years. This is attributed to factors such as steady advancements in cell culture technologies, increasing investments in biotechnology and pharmaceutical research, and a growing focus on regenerative medicine and personalized therapies. Thus, these are propelling to boost the demand for cell culture vessels market.

In the cell culture vessels industry, partnerships and collaboration activities are moderately established, with research institutions, biotech companies, and pharmaceutical firms working together to drive innovation and develop new technologies. For instance, in September 2023, Cell Culture Collective, Inc. entered a partnership with Defined Bioscience, Inc. to distribute its serum-free stem cell culture products. Through this agreement, Cell Culture Collective will serve as an authorized distributor for Defined Bioscience's optimized animal/serum-free stem cell culture products. Thus, propelling the demand for cell culture products over the forecast period.

Regulation significantly impacts the cell culture vessels industry by ensuring product safety, quality, and efficacy, which are crucial for applications in research, drug development, and clinical settings. Additionally, evolving regulations around cell and gene therapies are pushing the industry toward more advanced and specialized cell culture solutions, shaping market dynamics and growth strategies.

The cell culture vessels industry has seen moderate growth in product expansion. This includes the development of specialized vessels designed for specific applications, such as 3D cell cultures and high-throughput screening, meeting the growing demand for more advanced and versatile cell culture solutions.

The cell culture vessels industry is experiencing a high level of regional expansion, indicating rapid growth and increasing market presence across different geographic regions. The rising demand for advanced cell culture technologies, growing investments in biotech and pharmaceutical sectors, and the establishment of new research facilities in emerging markets.

Product Insights

The bags segment dominated the market with a share of 39.47% in 2025 and is anticipated to grow at the fastest CAGR from 2026 to 2033. This is attributed to the growing preference for flexible, single-use bags in cell culture applications due to their ease of use, reduced risk of contamination, and cost-effectiveness. Bags are increasingly favored for their suitability in operating a range of applications, from research to large-scale production. For instance, in March 2024, Getinge announced the launch of a novel SUPR system, a scalable single-use bioreactor for pilot and GMP manufacturing. It features larger versions of their lab-scale bioreactors, comes sterilized by gamma irradiation, and is more space-efficient. It also includes easy-to-use click-n-go bag loading. Such launches are further anticipated to boost the growth of the segment over the forecast period.

The flasks segment is expected to register a significant CAGR over the forecast period. Flasks are widely used in laboratories for various applications, including cell growth, maintenance, and experimentation, due to their ability to support different types of cell cultures and their compatibility with various laboratory processes. Thus, increasing R&D activities is anticipated to boost the demand for flasks over the forecast period.

Type Insights

The single-use segment dominated the market in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the increasing adoption of single-use technologies in research and production environments, which offer significant advantages such as reduced risk of contamination and lower operational costs. In August 2024, Freudenberg Medical announced the expansion of its biopharma products to include custom single-use assemblies, such as Y-connector manifolds, tubing assemblies, and multi-inlet bottle caps. These would be used in labs and CGMP bioprocesses for critical fluid transfers. Thus, anticipated to boost the growth of the segment over the forecast period.

The reusable segment is expected to register a significant CAGR over the forecast period. This is attributed to the advantages of reusable cell culture vessels, such as their durability and long-term cost efficiency, thereby making them a better option for large-scale and high-volume applications.

End Use Insights

The pharmaceutical & biotechnology companies segment held a revenue share of 46.54% in 2025. The primary reason for this is the large-scale use of cell culture vessels in drug discovery, development, and production. Besides, the investment in R&D is very high, and the focus on advanced therapies and personalized medicine is growing. Thus, the demand for cell culture vessels is significantly growing.

The CMOs & CROs segment is expected to register the largest CAGR over the forecast period. The rising outsourcing of research and manufacturing by pharmaceutical and biotechnology companies is anticipated to drive segmental growth over the forecast period. Furthermore, the provision of services such as drug discovery, preclinical and clinical trials, and manufacturing of cell-based therapies is contributing to the demand for cell culture vessels by CMOs & CROs.

Regional Insights

North America cell culture vessels market accounted for the largest revenue share of 36.42% in 2025. This considerable portion is caused by a mixture of a strong biopharmaceutical sector, high funding for research and development, and modern healthcare infrastructure. The area’s dominance in innovation and technological progress, coupled with an increasing occurrence of chronic diseases and a friendly regulatory framework, are the main reasons the cell culture vessels are in demand.

U.S Cell Culture Vessels Market Trends

The cell culture vessels industry in the U.S. is expected to grow over the forecast period. In July 2023, MilliporeSigma announced an investment of USD 25 million to expand its cell culture media production in Kansas, U.S.

Europe Cell Culture Vessels Market Trends

Europe cell culture vessels industry was identified as a lucrative region in this industry. A robust biotechnology and pharmaceutical sector drive this growth. New companies and startups are emerging, and increased collaboration among research institutions is expected to boost the market further.

The cell culture vessels market in the UK held a significant share in 2025. The rapid growth of the market can be credited to the state-of-the-art research facilities, potent pharmaceutical and biotechnology sectors, and great healthcare innovation investments. Moreover, the increasing emphasis on next-generation cell culture technologies, vast clinical research, and favorable regulatory climate are also augmenting the market growth.

Germany cell culture vessels market is anticipated to grow significantly over the forecast period. In April 2024, Merck announced an investment of over USD 333.76 million (€300 million) in a new Life Science Research Center in Germany, which will consolidate research on key technologies to accelerate the development of biopharmaceutical products. Thereby propel the demand for cell culture vessels over the forecast period.

Asia Pacific Cell Culture Vessels Market Trends

The Asia Pacific cell culture vessels industry is projected to record the fastest CAGR of 17.25% over the forecast period, supported by the rapid expansion of biopharmaceutical manufacturing, increasing investment in cell-based research, and government initiatives to boost domestic biologics and vaccine production. China, Japan, South Korea, and India are strengthening bioprocessing infrastructure and accelerating the adoption of advanced and single-use vessel technologies.

China Cell Culture Vessels Market Trends

The cell culture vessels market in China is expected to grow steadily over the forecast period, driven by the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders. The increasing requirement for potent therapeutics is positively impacting research, clinical applications, and drug development activities, thus causing a rise in the need for cell culture vessels and supporting the continuous growth of the market.

The Japan cell culture vessels industry is witnessing rapid growth over the forecast period, driven by the expansion of biotechnology and biopharmaceutical research, increased adoption of regenerative medicine and cell-based therapies, and rising demand for scalable and efficient culture systems.

MEA Cell Culture Vessels Market Trends

The MEA cell culture vessels market is expected to grow exponentially over the forecast period, driven by expanding biotechnology and pharmaceutical research, the rising prevalence of chronic diseases that increases demand for advanced drug development, and growing investment in regenerative medicine and biologics production.

The cell culture vessels market in Kuwait is anticipated to grow moderately over the forecast period. This is attributed to rising healthcare expenditure aimed at improving healthcare infrastructure services, and the adoption of new technologies.

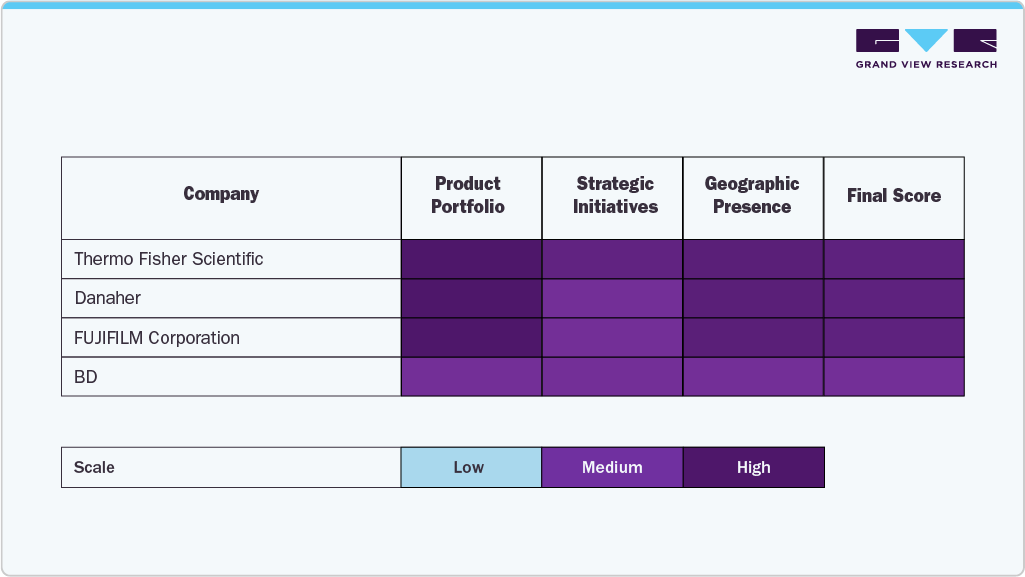

Key Cell Culture Vessels Company Insights

The cell culture vessels market is characterized by several established players who dominate through robust product portfolios, strategic collaborations, and continuous investments in research and development. Leading companies such as Thermo Fisher Scientific Inc., STEMCELL Technologies, Merck KGaA, Greiner Bio-One International GmbH, and Corning Incorporated have maintained significant market share thanks to their advanced vessel technologies, wide application range, and extensive global distribution networks.

Companies like Wilson Wolf, DWK Life Sciences, Cell Culture Company, LLC, VWR International, LLC, Danaher, and Sartorius Stedim Biotech are expanding their presence by offering innovative solutions and customized culture vessel products that cater to the growing needs of research laboratories, pharmaceutical companies, and biotechnology enterprises.

Companies that successfully integrate technological innovation with customer-centric solutions are positioned to drive sustained value in this rapidly evolving sector.

Key Cell Culture Vessels Companies:

The following are the leading companies in the cell culture vessels market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies

- Merck KGaA

- Greiner Bio-One International GmbH

- Corning Incorporated

- Wilson Wolf

- DWK Life Sciences

- Cell Culture Company, LLC

- VWR International, LLC.

- Danaher

- Sartorius Stedim Biotech

Recent Developments

-

In April 2024, Fujifilm Corporation, announced an investment of USD1.2 billion to expand its cell culture CDMO business and increase its investment in the Fujifilm Diosynth Biotechnologies facility in Holly Springs, North Carolina, to over USD 3.2 billion in total.

-

In March 2024, Novartis announced an investment of €500 million ($556.26 million) each in its Kundl and Schaftenau sites to improve the continuous production of biopharmaceuticals from Austria and support its strategy to expand cell culture technology. Thereby, boosting the demand for cell culture vessels.

-

In February 2024, Thermo Scientific launched the CultiMaxx Shelving System to enhance incubator capacity for the four most common cell culture vessels. The system, compatible with Heracell VIOS 250i and Forma Steri-Cycle i250 CO2 incubators, supports up to a 150% increase in G-Rex bioreactors, enabling scalable cell therapy production without compromising performance.

Cell Culture Vessels Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.36 billion

Revenue forecast in 2033

USD 13.77 billion

Growth rate

CAGR of 14.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; STEMCELL Technologies; Merck KGaA; Greiner Bio-One International GmbH; Corning Incorporated; Wilson Wolf; DWK Life Sciences; Cell Culture Company, LLC; VWR International, LLC.; Danaher; Sartorius Stedim Biotech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Cell Culture Vessels Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell culture vessels market based on product, type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Bags

-

2D Bags

-

Up to 10L

-

11L - 100L

-

Above 100L

-

-

3D Bags

-

5L - 100L

-

101L - 500L

-

501L - 1500L

-

Above 1500L

-

-

-

Flasks

-

T-flasks

-

Spinner Flasks

-

Gas Permeable Membrane Flasks

-

Others

-

-

Plates

-

Up to 5 Well

-

6 Well - 15 Well

-

16 Well - 50 Well

-

51 Well - 100 Well

-

101 Well - 500 Well

-

Above 500 Well

-

-

Bottles

-

Up to 100 mL

-

101 mL - 500 mL

-

501 mL - 1000 mL

-

-

Dishes

-

30 mm - 60 mm

-

61 mm - 100 mm

-

101 mm - 150 mm

-

-

Tubes

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Reusable

-

Single-use

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

CMOs & CROs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture vessels market size was estimated at USD 4.83 billion in 2025 and is expected to reach USD 5.36 billion in 2026.

b. The global cell culture vessels market is expected to grow at a compound annual growth rate of 14.43% from 2026 to 2033 to reach USD 13.77 billion by 2033.

b. The bags segment dominated the market with 39.47% share in 2025 and is anticipated to grow at the fastest CAGR from 2026 to 2033. This is attributed to the growing preference for flexible, single-use bags in cell culture applications due to their ease of use, reduced risk of contamination, and cost-effectiveness.

b. Some of the key players operating in the cell culture vessels market include Thermo Fisher Scientific Inc.; STEMCELL Technologies; Merck KGaA; Greiner Bio-One International GmbH; Corning Incorporated; Wilson Wolf; DWK Life Sciences; Cell Culture Company, LLC; VWR International, LLC.; Danaher, and Sartorius Stedim Biotech.

b. Factors such as the rising prevalence of chronic diseases, increased investments in research and development, and a growing number of clinical trials for cell-based therapies, and the growing collaborations & partnerships among market players are expected to contribute to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.