- Home

- »

- Homecare & Decor

- »

-

Cast Iron Cookware Market Size, Share, Growth Report 2030GVR Report cover

![Cast Iron Cookware Market Size, Share & Trends Report]()

Cast Iron Cookware Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Unseasoned, Seasoned, Enamel Coated), By Product, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-224-6

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cast Iron Cookware Market

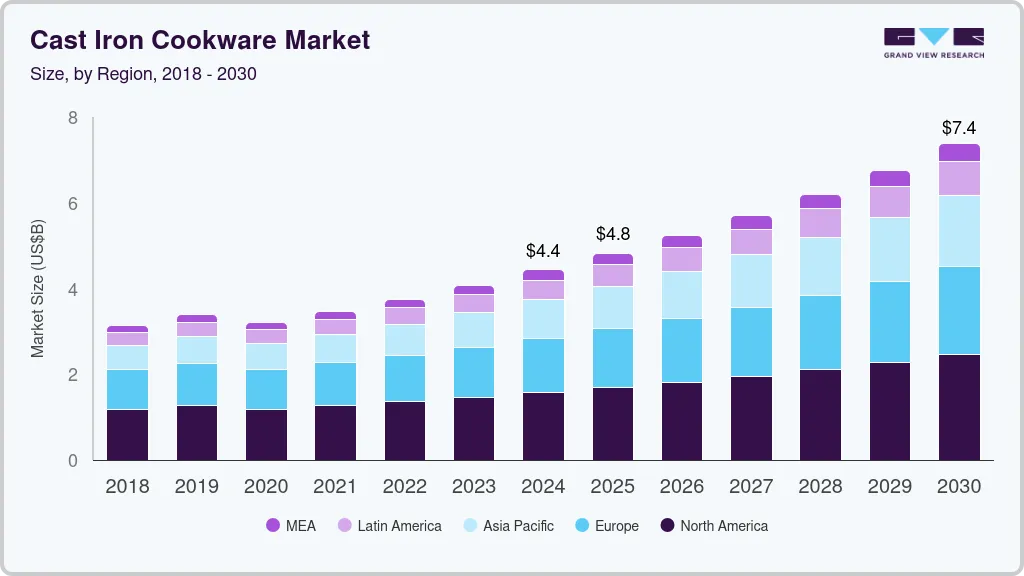

The global cast iron cookware market was estimated at USD 4.43 billion in 2024 and is projected to reach USD 7.37 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. One of the primary driving factors behind the popularity of cast iron cookware is its low maintenance requirements following the initial seasoning process.

Key Market Trends & Insights

- North America dominated the global cast iron cookware market with the largest revenue share of 17% in 2023.

- By type, the unseasoned segment led the market, holding the largest revenue share of 42.74% in 2023.

- By application, the commercial segment is projected to expand at a CAGR of 9.4% from 2024 to 2030.

- By distribution channel, the supermarket/hypermarket segment held the revenue share of 39.85% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 4.43 billion

- 2030 Projected Market Size: USD 7.37 billion

- CAGR (2025-2030): 8.9%

- North America: Largest market in 2023

In addition, its affordability sets it apart from other materials of similar quality.

Cast iron ensures even heating and reduces the need for added fats such as oil or butter, promoting healthier cooking practices. Its versatility allows for use on various cooking surfaces including kitchen stovetops, outdoor grills, and campfires. Several renowned companies such as Staub, Le Creuset, Lodge Cast Iron, Victoria, Kuhn Rikon, and Stellar offer a wide range of products in this market, catering to diverse consumer preferences.

The surge in home cooking spurred by the COVID-19 lockdown, along with evolving consumer preferences, has significantly contributed to the growth of the cast iron cookware market. As more people experiment with cooking at home, there is a heightened demand for reliable and versatile cookware options like cast iron.

Pascal Glorieux, a representative from the International Housewares Association (IHA) in September 2020, noted that approximately 37% of the French population explored new recipes during the lockdown period. This increased interest in home cooking is expected to persist, driven by a preference for culinary experiences within the comfort of one's home.

Cast iron cookware aligns perfectly with these trends due to its durability, even heating, and suitability for various cooking methods. As a result, manufacturers and retailers in the cast iron market are likely to see continued growth as consumers prioritize high-quality cookware for their home culinary experiments.

The demand for cookware made from cast iron has been increasing in the commercial sector. The quick-heating properties and affordability of these materials are boosting product penetration as the industry requires cookware in bulk.

Matfer Bourgeat USA offers cookware made of cast iron, including a pan with a spatula and spreader, a casserole pot with a lid, and a rectangular terrine. The products are suitable for a variety of cooking styles and temperatures. Cast iron cookware products are a natural mineral material promoting healthy cooking, making the products free of any harsh chemicals, coatings, PTFE, and PFOA.

Market Concentration & Characteristics

The expansion of this market stems from rising consumer investment in multifunctional cast iron cookware. Designed with versatility in mind, these products feature interchangeable lids and modular components, offering users a range of options for diverse cooking methods and recipes.

In the forthcoming years, prominent global corporations are anticipated to prioritize strategic acquisitions to strengthen their market position and expand their international presence. The emphasis is expected to be on acquiring small and medium-sized enterprises within the industry to facilitate regional expansion efforts.

Stringent regulations ensure that cast iron cookware products adhere to safety standards, addressing concerns regarding harmful substances or materials. Compliance requirements could impact manufacturing processes and material selections, influencing product development and design.

Competitive dynamics are shaped by end-user concentration, prompting manufacturers to vie for relationships with key customers. Companies may need to differentiate their products and services to secure and sustain partnerships with major retailers or distributors.

Type Insights

Based on type, the unseasoned segment led the market with the largest revenue share of 42.74% in 2023. The relatively lower price point of unseasoned cast iron compared to pre-seasoned options makes it an attractive choice for budget-conscious shoppers. As consumers become more conscious of health and environmental factors, the simplicity and longevity of unseasoned cast iron align with sustainability trends, further driving its appeal in the market.

The seasoned segment is projected to grow at a fastest CAGR of 9.5% over the forecast period. Seasoned cast iron develops a natural non-stick surface over time, reducing the need for additional fats and oils during cooking. This property, combined with its ability to retain and evenly distribute heat, ensures consistent and flavorful results across various cooking techniques. In addition, the low maintenance requirements and long lifespan of seasoned cast iron make it a cost-effective and sustainable choice for home cooks, further fueling its demand in the market.

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 68.36% in 2023. The introduction of new cooking shows on television and social media platforms, fosters interest in new cuisines and with it, new cookware, among consumers. The trend of experimenting with cooking and a preference for aesthetically appealing utensils, such as seasoned, and enameled-coated cast iron cookware, have positively impacted the market.

The commercial segment is projected to grow at a fastest CAGR of 9.4% during the forecast period. The increasing inclination for dining out at restaurants, bars, hotels, and similar establishments has led to a higher demand for robust and heat-resistant cast iron cookware essential for cooking and keeping food warm for patrons. Furthermore, the flourishing restaurant industry in the country, emphasizing top-notch cuisine and service, has prompted restaurant proprietors to make substantial investments in contemporary and high-quality cast iron cookware.

Distribution Channel Insights

Based on distribution channel, the supermarket/hypermarket segment led the market with the largest revenue share of 39.85% in 2023.Many consumers opt to buy nonstick cookware alongside their grocery purchases at supermarkets and hypermarkets. The convenience of finding a wide range of product options across various price points in these stores is appealing to shoppers. In addition, consumers tend to be more selective and attentive when shopping in such environments, as they can easily compare products from different brands before making a purchase decision.

The online segment is projected to grow at a fastest CAGR of 10.6% over the forecast period. Online channels provide manufacturers with the opportunity to connect with potential customers, improve communication, streamline financial tracking, and boost brand visibility in a cost-effective manner. The market has experienced significant advantages from digitalization, as it has unlocked numerous growth prospects for industry players. This has enabled them to access an engaged consumer base that favors online shopping.

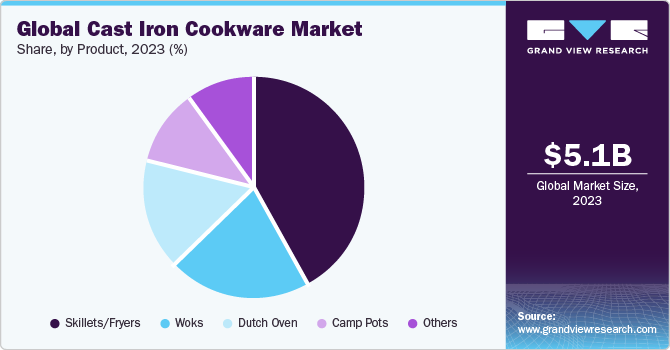

Product Insights

Based on product, the skillets/fryers segment led the market with the largest revenue share of 41.60% in 2023. The increasing preference for skillets/fryers is closely linked to the market growth due to their durability and ability to enhance flavor. Cast iron skillets/fryers develop a natural non-stick surface over time, making them ideal for frying, searing, and browning foods. This characteristic, combined with their ability to retain and evenly distribute heat, enhances the flavor and texture of dishes, contributing to the expansion of the cast iron cookware market.

The wok segment is projected to grow at a fastest CAGR of 9.9% over the forecast period. The rising demand for woks highlight the growth of the cast iron cookware market, with these versatile pans becoming essential tools for modern cooking enthusiasts. It is mainly utilized for stir-frying, steaming, deep-frying, and more, cast iron woks excel in evenly distributing heat and accommodating various cooking techniques. This versatility caters to the evolving preferences of home cooks, further propelling the expansion of the global market.

Regional Insights

North America dominated the market with the revenue share of 17% in 2023. Cast iron cookware, such as skillets and Dutch ovens, holds a deep cultural significance in North American culinary traditions, especially in Southern and Midwestern cooking. This cultural tie drives the demand for cast iron cookware as consumers seek to preserve and continue culinary traditions.

U.S. Cast Iron Cookware Market Trends

The cast iron cookware market in the U.S. is expected to grow at the fastest CAGR of 7.5% from 2024 to 2030. The trend towards home cooking and wellness in the U.S. has also fueled the demand for cast iron cookware. Consumers are looking for reliable, versatile cookware that enhances their cooking experience at home, and cast iron fulfills these requirements well.

Asia Pacific Cast Iron Cookware Market Trends

The cast iron cookware market in Asia Pacific held a share of 40.53% of the global revenue in 2023. The evolving dining culture, characterized by the popularity of social and casual dining, has driven an increased demand for innovative cookware products, including cast iron cookware, in the region. The growing influence of Southern European culinary trends, such as French and Italian cuisine, and the preference for high-quality kitchenware, has extended to cast iron cookware in Northern Europe. Consequently, more consumers are investing in cast iron cookware to elevate their food preparation and dining experiences with family and friends.

Europe Cast Iron Cookware Market Trends

The cast iron cookware market in Europe is projected to grow at a fastest CAGR of 8.3% from 2024 to 2030. Shifting trends in eating culture, such as the rising prominence of social and casual dining, have resulted in an increased demand for innovative cast iron cookware products in the region. The growing influence of trends in Southern Europe, such as French cuisine, Italian food culture, and the use of high-end kitchenware products, has fueled the application of cast iron cookware products in Northern Europe as well.

Key Cast Iron Cookware Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Cast Iron Cookware Companies:

The following are the leading companies in the cast iron cookware market. These companies collectively hold the largest market share and dictate industry trends.

- Groupe SEB

- Werhahn Group

- Target

- Meyer Corporation

- Fissler

- Tramontina

- Newell Brands Inc.

- SCANPAN

- TTK Prestige Ltd.

- The Vollrath Co.

- L.L.C.

Recent Developments

-

In May 2023, Groupe SEB completed the acquisition of Pacojet, a Swiss family-owned company renowned for its distinctive culinary appliance, highly favored by chefs for over three decades. This strategic move aligns with Groupe SEB's objective of bolstering its footprint in the cast iron cookware market

-

In April, 2023, Meyer Corporation, U.S. unveiled Rachael Beam NITRO Cast Iron, an innovative range incorporating advanced NITRO heat treatment technology to address common issues found in traditional and plated cast iron cookware

Cast Iron Cookware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.81 billion

Revenue forecast in 2030

USD 7.37 billion

Growth rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Groupe SEB; Werhahn Group; Target; Meyer Corporation; Fissler; Tramontina; Newell Brands Inc.; SCANPAN; TTK Prestige Ltd.; The Vollrath Co.; L.L.C.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Cast Iron Cookware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cast iron cookware market report based on type, product, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unseasoned

-

Seasoned

-

Enamel Coated

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skillets/Fryers

-

Woks

-

Dutch Oven

-

Camp Pots

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket/ Hypermarket

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the cast iron cookware market include Procter & Gamble; Kimberly-Clark Corporation; Johnson & Johnson Services, Inc.; Essity AB; Unicharm Corporation; Ontex Group NV; Domtar Corporation; Kao Corporation; Edgewell Personal Care Company; Hengan International Group Co. Limited

b. Key factors that are driving the cast iron cookware market growth include an increasing surge in demand for high-quality kitchenware, expansion of the food service industry, and demand for aesthetically pleasing cookware

b. The cast iron cookware market was estimated at USD 5.08 billion in 2023 and is expected to reach USD 5.52 billion in 2024.

b. The cast iron cookware market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 9.18 billion by 2030.

b. Asia Pacific dominated the cast iron cookware market with a share of around 40.5% in 2023. The market in the region is witnessing a rise in demand for multi-use cast iron cookware due to changes in lifestyle and demand for luxury kitchenware.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.