- Home

- »

- Next Generation Technologies

- »

-

Cash Management System Market, Industry Report, 2030GVR Report cover

![Cash Management System Market Size, Share & Trends Report]()

Cash Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Operation, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-255-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cash Management System Market Summary

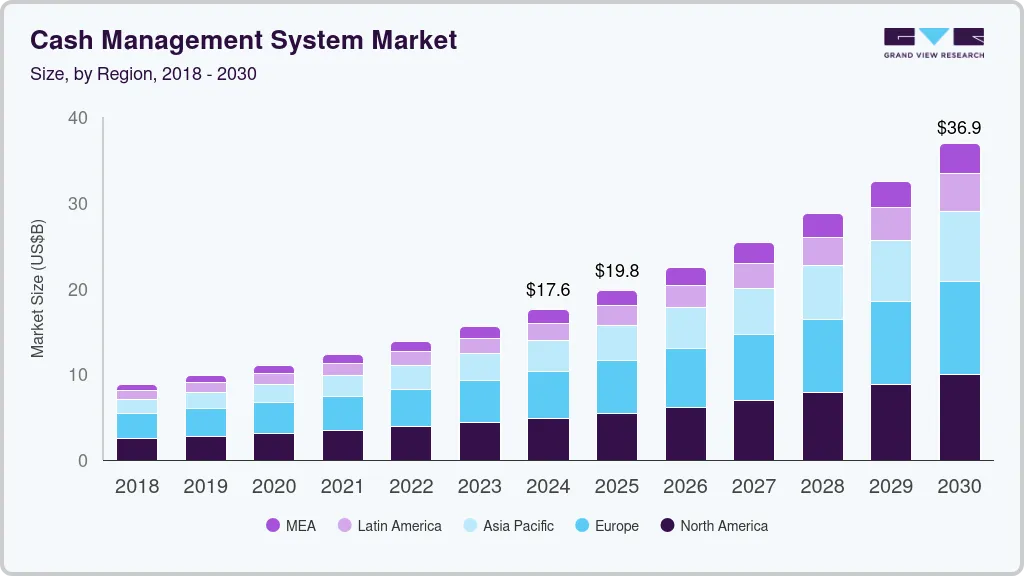

The global cash management system market size was estimated at USD 17.6 billion in 2024 and is projected to reach USD 36.92 billion by 2030, growing at a CAGR of 13.3% from 2025 to 2030. This expansion can be attributed to the rising need for effective cash flow management among businesses.

Key Market Trends & Insights

- The Europe cash management system market dominated the global market with a share of 31.1% in 2024.

- The U.S. cash management system market dominated the regional market in 2024.

- Based on component, the solution segment dominated the market with 65.2% revenue share in 2024.

- Based on deployment, the on-premise segment held the largest market revenue share in 2024.

- Based on operation, the balance and transaction reporting segment dominated the market in 2024.

- Based on enterprise size, the large enterprises segment held the highest market revenue share in 2024.

- Based on end-use, the banks segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.6 Billion

- 2030 Projected Market USD 36.92 Billion

- CAGR (2025-2030): 13.3%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

With organizations seeking to optimize their financial operations and maintain liquidity, there has been a significant rise in the demand for advanced cash management systems. In addition, companies increasingly recognize that efficient cash management enhances visibility over cash positions and supports strategic decision-making, fostering overall financial stability and growth.

Technological advancements play a crucial role in driving the cash management system industry forward. The integration of cloud-based solutions has transformed how businesses manage their finances, providing real-time access to cash flow data and seamless connectivity with existing Enterprise Resource Planning (ERP) systems. This shift allows organizations to automate various cash-handling processes, reducing operational costs and improving the accuracy of financial reporting. Moreover, the incorporation of Artificial intelligence (AI) and advanced analytics enhances forecasting capabilities and fraud detection, making cash management systems indispensable tools for modern enterprises.

The expansion of the e-commerce sector is another key factor fueling market growth. With growing online transactions, businesses require robust cash management solutions to efficiently handle increased transaction volumes. Consequently, the rising demand for multi-currency support and real-time transaction monitoring underscores the importance of sophisticated cash management systems. Furthermore, as companies increasingly adopt automated applications within banking operations, the need for advanced cash management systems is expected to surge significantly, positioning these solutions as vital components in achieving operational efficiency and maintaining a competitive edge in a rapidly evolving marketplace.

Component Insights

The solution segment dominated the market with 65.2% revenue share in 2024. This growth is attributable to the increasing demand for comprehensive financial management tools that automate cash-handling processes. In addition, businesses are also seeking solutions that enhance visibility over cash positions and streamline financial operations. Furthermore, advancements in AI and analytics within these systems improve forecasting and fraud detection capabilities. With organizations prioritizing efficiency and accuracy, the solution segment is expected to maintain its dominance in the cash management system industry in the coming years.

The service segment is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to the increasing need for ongoing support and maintenance services as businesses adopt advanced cash management solutions. In addition, organizations are recognizing the importance of training and consulting services to maximize the effectiveness of their systems. Furthermore, the demand for integration services is rising as companies seek to connect cash management systems with existing financial and operational tools. With businesses focusing on optimizing their cash management processes, the need for services to enhance overall system performance and user satisfaction is also increasing. This is expected to drive the segment growth.

Deployment Insights

The on-premise segment held the largest market revenue share in 2024. This growth can be attributed to the increasing need for data security and compliance among financial institutions. In addition, many banks prefer on-premise solutions for their control over data management and integration with existing IT infrastructure. Furthermore, the ability to customize security measures and ensure compatibility with legacy systems is expected to sustain the growth of this segment in the coming years.

The cloud segment is expected to witness the highest CAGR during the forecast period. This growth is driven by the increasing demand for scalable, flexible banking solutions. In addition, financial institutions favored cloud-based systems for their ability to enhance operational efficiency, improve customer experience, and streamline banking processes. Moreover, the rapid adoption of digital banking and the need for real-time data access further contribute to the growth of the cloud segment in the cash management system market.

Operation Insights

The balance and transaction reporting segment dominated the market in 2024. This dominance is due to the increasing need for accurate and timely financial information. In addition, organizations rely heavily on balance and transaction reporting to enhance cash flow visibility and ensure effective liquidity management. Furthermore, these capabilities support strategic decision-making by providing insights into financial performance and operational efficiency. With companies prioritizing financial transparency and control, the demand for robust reporting solutions continues to drive growth in this segment.

The cash flow forecasting segment is expected to witness the highest CAGR during the forecast period. This growth is expected due to the rising need for accurate liquidity management and prediction of future cash requirements. These tools enable businesses to avoid liquidity crises, optimize operations, and make strategic decisions. Moreover, economic uncertainties and competitive pressure underscore the importance of cash flow forecasting in enhancing financial performance within the cash management system industry.

Enterprise Size Insights

The large enterprises segment held the highest market revenue share in 2024. This growth is attributable to the growing complexity of cash management needs in large organizations. In addition, large enterprises require advanced solutions to manage cash flows, real-time reporting, and financial operations. Furthermore, sophisticated systems improve visibility and automate processes, optimizing liquidity management. Moreover, the rise of digital banking, mobile payment solutions, and the overall digital transformation in banking and finance further drives the adoption of integrated cash management solutions.

The Small and Medium Enterprises (SMEs) segment is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to the increasing demand for efficient cash management solutions in SMEs. In addition, many of these enterprises are adopting software-based systems to better control cash flow. Moreover, the rise of digital banking and mobile payment solutions further supports this trend. Consequently, this segment is expected to contribute significantly to the growth of the cash management system industry in the coming years.

End-use Insights

The banks segment dominated the market in 2024. This dominance is due to the increasing adoption of digital transformation strategies within financial institutions. In addition, banks seek to enhance operational efficiency and improve customer experience through automated cash management solutions. These systems enable effective liquidity management and streamline cash-handling processes. Moreover, the integration of advanced technologies, such as AI and data analytics, supports real-time cash flow monitoring. Hence, banks are investing significantly in cash management systems to maintain a competitive edge in the industry.

The commercial enterprises segment is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the increasing need for efficient cash management solutions in commercial enterprises. In addition, these organizations are adopting automated systems to improve cash flow visibility and streamline financial operations. Furthermore, the rise of e-commerce and digital transactions encourages commercial enterprises to invest in advanced cash management technologies. Consequently, this segment is expected to play a significant role in the overall expansion of the cash management system industry.

Regional Insights

The North America cash management system market held a significant revenue share in 2024. This growth can be attributed to the increasing adoption of automated banking applications and the rise of e-commerce. In addition, financial institutions are focusing on digital transformation strategies to enhance operational efficiency and customer experience. Moreover, regulatory changes and the need for improved compliance are driving banks and businesses to invest in advanced cash management solutions. Therefore, the demand for cloud-based cash management solutions is expected to drive further growth in this region.

U.S. Cash Management System Market Trends

The U.S. cash management system market dominated the regional market in 2024. This growth can be attributed to the increasing adoption of digital transformation strategies among financial institutions. In addition, the growing adoption of automated cash management solutions has significantly enhanced operational efficiency and customer experience. Moreover, the local presence of major banking and financial services companies further supports this dominance. Furthermore, investments in advanced technologies, such as AI and data analytics, are expected to continue driving growth in the U.S. market in the coming years.

Europe Cash Management System Market Trends

The Europe cash management system market dominated the global market with a share of 31.1% in 2024. This dominance can be attributed to the increasing adoption of advanced financial management solutions among regional businesses. In addition, the growing focus on regulatory compliance and risk management also contributes to the demand for robust cash management systems. Furthermore, the rise of e-commerce and digital transactions encourages organizations to invest in technologies that enhance cash flow visibility and operational efficiency. Hence, Europe is expected to maintain its leading position as businesses prioritize effective liquidity management in a rapidly evolving financial landscape.

Germany cash management system market dominated the regional market in 2024. This dominance can be attributed to the significant adoption of advanced cash management solutions among businesses in the country. In addition, government initiatives, such as the German stability programme, emphasize fiscal policies that support investment in digital transformation and infrastructure, enhancing liquidity management capabilities. Furthermore, growth initiatives undertaken by the government strengthen competitiveness by incentivizing investments and improving the policy environment for businesses. These measures, along with a focus on regulatory compliance, contribute to the growth of the market.

Asia Pacific Cash Management System Market Trends

The Asia Pacific cash management system market is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the extensive digital transformation initiatives across various industries. In addition, increasing economic activity in the region is driving higher demand for real-time financial insights. Moreover, advancements in cloud-based technologies and automation further support this growth by providing scalability and affordability, appealing to regional businesses. Therefore, the Asia Pacific market is expected to significantly expand as organizations prioritize efficiency and innovation in their cash management practices.

China cash management system market accounted for the highest revenue share in the region as of 2024, driven by the rapid adoption of digital payment solutions and a significant shift toward cashless transactions. In addition, the government's initiatives to promote a cashless society and enhance financial infrastructure have further supported this growth. Moreover, the booming e-commerce sector and high smartphone penetration rates facilitate the widespread use of mobile payment platforms. Hence, businesses in China are increasingly investing in advanced cash management systems to optimize liquidity and improve operational efficiency.

Key Cash Management System Company Insights

Some key companies in the cash management system market are SBS, Oracle, NTT DATA Group Corporation, and Yokogawa Deutschland GmbH. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. In order to achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

-

SBS provides cash management solutions designed to optimize liquidity and improve operational efficiency. Its software enables real-time cash flow tracking and automates bank reconciliations. Moreover, seamless integration with existing financial systems helps organizations streamline financial operations and enhance cash flow management.

-

Oracle offers cash management solutions that improve financial efficiency and liquidity of businesses. Its software includes features such as real-time cash flow tracking, automated reconciliations, and robust financial reporting. Furthermore, seamless integration with enterprise systems allows organizations to streamline cash management processes and make informed financial decisions.

Key Cash Management System Companies:

The following are the leading companies in the cash management system market. These companies collectively hold the largest market share and dictate industry trends.

- SBS

- Oracle

- Giesecke+Devrient GmbH

- Aurionpro Solutions Limited

- NTT DATA Group Corporation

- Glory Global Solutions (International) Limited

- Yokogawa Deutschland GmbH

- Sage Group plc

- National Cash Management Systems

- ALVARA

Recent Developments

-

In October 2023, NTT DATA announced the expansion of its banking modernization capabilities. The initiative was designed to help banks minimize risks and improve speed to market through a new suite of core banking modernization accelerators. The key advancements included tools for application re-architecture, data management, and cloud integration, enabling financial institutions to enhance operational efficiency and adapt to evolving market demands.

-

In September 2023, Oracle expanded its banking cloud services to enhance payments and transaction banking capabilities. The new offerings include cash management, liquidity management, and virtual account management, which aim to improve visibility and forecasting for banks and its corporate customers.

Cash Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.82 billion

Revenue forecast in 2030

USD 36.92 billion

Growth rate

CAGR of 13.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, operation, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

SBS; Oracle; Giesecke+Devrient GmbH; Aurionpro Solutions Limited; NTT DATA Group Corporation; Glory Global Solutions (International) Limited; Yokogawa Deutschland GmbH; Sage Group plc; National Cash Management Systems; ALVARA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cash Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cash management system market report based on component, operation, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Service

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Balance And Transaction Reporting

-

Cash Flow Forecasting

-

Corporate Liquidity Management

-

Payables

-

Receivables

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Banks

-

Retail

-

Non-banking Financial Corporations

-

Commercial Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.