- Home

- »

- Renewable Energy

- »

-

Carbon Footprint Management Market, Industry Report 2030GVR Report cover

![Carbon Footprint Management Market Size, Share & Trends Report]()

Carbon Footprint Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud), By Type, By End-use (Energy & Utilities, Manufacturing, Transportation, IT & Telecommunication), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-159-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Footprint Management Market Summary

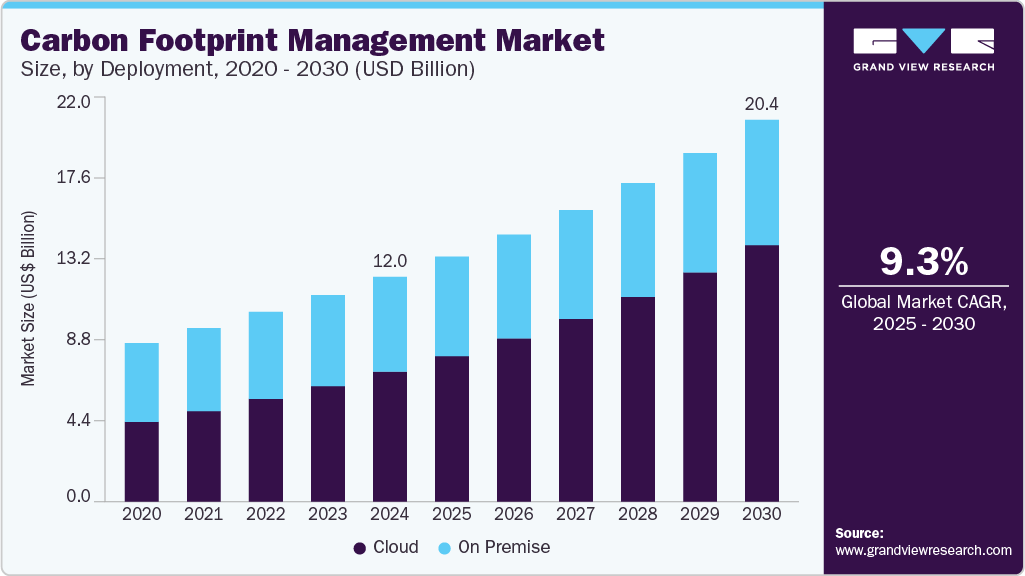

The global carbon footprint management market size was estimated at USD 12.0 billion in 2024 and is projected to reach USD 20.44 billion by 2030, growing at a CAGR of 9.3% from 2025 to 2030. Increasing concerns regarding detrimental effect of carbon emissions on environment have prompted adoption of carbon footprint management solutions.

Key Market Trends & Insights

- The Asia Pacific held the largest revenue share of over 56.0% in 2024.

- Based on deployment, the cloud held the largest revenue share of over 42.0% in 2024.

- Based on end-use, the energy and utilities held the largest revenue share of over 31.0% in 2024.

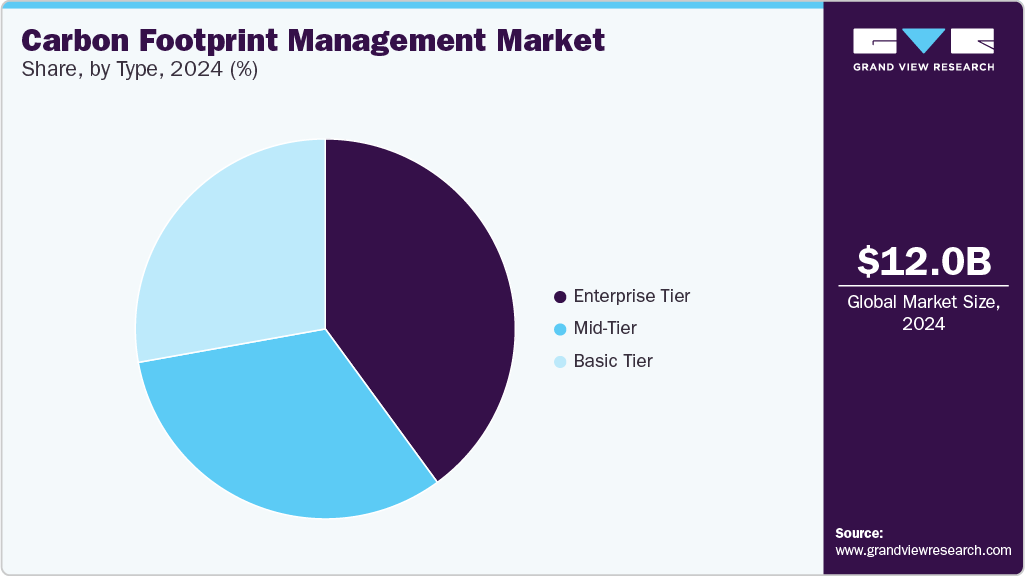

- Based on type, the enterprise tier segment held the largest revenue share of over 39.0% in 2024

Market Size & Forecast

- 2024 Market Size: USD 12.0 Billion

- 2030 Projected Market USD 20.44 Billion

- CAGR (2025-2030): 9.3%

- Asia Pacific: Largest market in 2024

Various major companies have implemented carbon footprint tracking and management technology through pilot projects across various industries. This is attributed to ability of technology to serve as a large-scale solution for tracking and helping in CO2 emission reduction targets and climate control goals.

Various major companies have implemented carbon footprint tracking and management technology through pilot projects across various industries. This is attributed to ability of technology to serve as a large-scale solution for tracking and helping in CO2 emission reduction targets and climate control goals.

The government also employed favorable policies and projects to boost CCS trends in economy such as the provision of tax incentives to stimulate CCS projects. Also, USDA Rural Utilities Service (RUS) facilitated direct loans and loan guarantees to power plants with a minimum of one CCS infrastructure. Support mechanisms employed by government in past including the Clean Coal Power Initiative Program, and the U.S. Recovery Act 2009 are also proving effective in boosting current carbon capture and storage trends.

Energy-intensive industries in U.S., such as iron and steel manufacturing, oil & gas, and cement, combust huge quantities of fossil fuels and account for significant carbon emissions. In addition to these combustion sources, natural gas operations produce concentrated CO2 by-products for which incremental cost of capture and compression is relatively low. Similarly, most of hydrogen utilized in ammonia manufacture, oil refining, and other industries is derived from the decarburization of fossil fuels, which also generates a by-product stream of CO2 and presents low-cost opportunities for CCS. Carbon footprint management solutions plays vital role in carbon capture and storage facilities with application to keep track of emissions from facility.

Drivers, Opportunities & Restraints

Increasing R&D and testing of several pilot projects are expected to lower cost of CCS technology and enhance its commercial viability. Low-carbon investment programs such as NER300 and NER400, which have provisions for financing large-scale commercial CCS pilot projects, have accelerated the carbon footprint management market growth. Moreover, development of EU and Emissions Performance Standard (EPS) has majorly propelled carbon footprint management technology penetration. Provision of a cap-and-trade system, which puts a price on carbon emissions is stimulating CCS installations across several industries such as power generation, chemical processing, oil & gas, iron & steel, and others.

The carbon footprint management market is poised for significant growth, driven by stringent environmental regulations and increasing corporate commitments to sustainability. Governments worldwide are implementing policies to reduce greenhouse gas emissions, compelling industries to adopt carbon management solutions. Technological advancements, such as AI and IoT integration, are enhancing the efficiency and accuracy of carbon tracking systems. In addition, the rising demand for transparency in environmental reporting is encouraging organizations to invest in comprehensive carbon footprint management tools. Emerging economies are also recognizing the importance of sustainable practices, further expanding the market's potential. Overall, these factors collectively present substantial opportunities for growth and innovation in the carbon footprint management sector.

Cost of carbon footprint management varies widely. It depends on deployment technology whether it is to be added to an existing plant as a on premise or cloud, on type of power plant (such as a "supercritical" or "ultra-supercritical" coal plant or an "integrated gas combined cycle" plant), and on type of fuel (coal or natural gas). Cost of carbon footprint management technology along with new plant setup is very high, which may not prove to be a viable solution for many industry players as well as countries globally. Therefore, high cost of CCS is expected to restrain growth of the carbon footprint management market in near future.

Deployment Insights

Cloud held the largest revenue share of over 42.0% in 2024. Demand for cloud based carbon footprint management solutions is rising rapidly as adoption of cloud based software is trending across industries. Growth in demand is attributed to various benefits offered by cloud-based carbon management solutions which includes accessibility, scalability, and cost-effectiveness. Moreover, cloud based solutions offers remote access to real time critical environmental data, accessibility and convenience are the major factors responsible for wide adoption of remote carbon footprint management solutions around the world across various industries.

An on-premise carbon footprint management system refers to a software solution for tracking, reporting, and managing carbon emissions and sustainability data that is installed and operated within an organization's own physical infrastructure. With increasing adoption of cloud based carbon footprint management software solutions across various industries on premise segment is expected have lower market share over forecast period.

End-use Insights

Energy and utilities held the largest revenue share of over 31.0% in 2024. On basis of end use, global carbon footprint market is further divided into energy and utilities, manufacturing, transportation, it and telecommunication, residential and commercial buildings. Power sector accounted for two-thirds of emissions growth from previous year. Due to high emission rates, carbon capture & storage potential is extremely high in coal-fired power plants. Coal-fired power plants are the most dominant emitters of carbon dioxide. Due to imposed restrictions on power plants, utilization of CCS facilities has become mandatory to reduce carbon emissions up to required standards which pose as a lucrative opportunity for growth of carbon footprint management solutions. Adoption of these technologies is necessary to potentially permit continued use of coal resources for power generation, whilst reducing CO2 emissions. Moreover, CCS facilities can be retrofitted to existing power plants without hampering their efficiency. Due to these factors, adoption of CCS and carbon footprint management technologies in Energy and Utilities industry is anticipated to grow over forecast period.

Manufacturing industry accounted for a significant market share in 2024 owing to involvement of huge amount CO2 emissions in metal & cement manufacturing. Moreover, iron and steel industry accounted for 7% of all industrial CO2 emissions in 2021, according to the International Energy Agency (IEA) and the United Nations Industrial Development Organization (UNIDO). Following the recent trend, immense research & development is being conducted to reduce emissions, especially CO2, captured in the blast furnace. Post-combustion technologies are easily implemented to capture CO2 from flue gases escaping from sinter plants, and flue gas exiting the lime kiln, stove, coke oven plant, basic oxygen furnace, and blast furnace. On account of a wide range of CCS applications at various stages in the metal production industry, the market is expected to grow at a significant pace over forecast period.

Type Insights

Enterprise tier held the largest revenue share of over 39.0% in 2024. On the basis of type, the global carbon footprint market is further divided into basic-tier, mid-tier, and enterprise-tier. An Enterprise-tier carbon management system is a highly sophisticated and comprehensive software solution designed to cater to needs of large organizations with complex operations, extensive emissions profiles, and stringent reporting requirements. These systems provide advanced features and capabilities for tracking, measuring, and managing carbon emissions and sustainability data. Rising awareness for CO2 reduction in various industries at large scale pose lucrative demand for Enterprise-tier carbon footprint management.

A mid-tier carbon footprint management system refers to a software solution that offers more comprehensive features and capabilities for tracking, measuring, and managing carbon emissions and sustainability data. Mid-tier carbon footprint management software is generally adopted by medium scale organizations with less geographical presence and less emission capacity as compared to large scale organizations.

Regional Insights

North American market is expected to grow at a significant pace in forecast period. North America is the largest market for CCS around globe. U.S. is front runner in technology implementation for CCS globally as the first CCS project in the world was started in 1978 by Searles Valley Minerals in a coal-based power plant located in the state of California. In August 2023, the U.S. Department of Energy (DOE) announced an investment of USD 1.2 billion to launch two new CCS facilities in Texas and Louisiana to reduce carbon emissions from the atmosphere using the direct air capture (DAC) process. DOE further aims to launch four DAC hubs in the country to reduce approx. 1 million tons of carbon emissions from the atmosphere. Rapid growth of CCS technology and favorable government initiative is expected propel market in the region.

U.S. Carbon Footprint Management Market Trends

The U.S. carbon footprint management market is gaining momentum as federal and state policies focus on reducing greenhouse gas emissions. The Biden administration's push for cleaner energy sources and corporate sustainability commitments are accelerating the adoption of carbon management solutions. Industries like transportation, manufacturing, and energy are increasingly adopting digital tools to monitor and reduce their carbon footprints. Moreover, regional initiatives, such as California's carbon market, are setting precedents for other states to follow.

Asia Pacific Carbon Footprint Management Market Trends

Asia Pacific held the largest revenue share of over 56.0% in 2024. Asia Pacific has suitable geological conditions for carbon sequestration. The National University of Japan and ExxonMobil conducted a geological condition feasibility test in Asia Pacific for carrying out carbon sequestration. ExxonMobil has set up a low-carbon solutions division in Asia. It is further planning to start a carbon capture and storage business in the region. The company estimates that approximately 300 billion tons of carbon storage capacity is available in Southeast Asia.

In addition, according to the Japan Energy Center, Southeast Asia can reserve 300 billion tons of carbon dioxide. China, one of the largest carbon dioxide emitters in the world, is planning to double its capacity to capture and store carbon dioxide to reduce its contribution to global warming in coming years. The country has 14 carbon capture, utilization, and storage (CCUS) facilities with an annual capacity of 2.1 million tons. It aims to initiate eight large-scale CCUS projects by 2025. Huge adoption of carbon capture and storage systems is expected to drive carbon footprint management market over forecast period.

China is increasingly focusing on carbon footprint management as part of its long-term climate strategy. The government has introduced new policies to reduce carbon emissions, including mandatory carbon accounting for key industries. Efforts to enhance energy efficiency and integrate renewable energy are being actively pursued, with support from both public and private sectors. As a major global emitter, China's commitment to reducing its carbon footprint is critical for global sustainability goals.

India carbon footprint management market is growing and it is increasing its practices as part of its broader climate strategy. The government is promoting carbon management initiatives across industries through regulatory frameworks and incentive programs. Significant focus is placed on energy-intensive sectors, including cement, steel, and power generation, where emissions reduction can have the most impact. Corporate responsibility initiatives are also on the rise, encouraging businesses to adopt sustainable practices and reduce their carbon footprints.

Europe Carbon Footprint Management Market Trends

Europe is a global leader in carbon footprint management, driven by robust environmental regulations and ambitious climate targets. The European Union’s Green Deal and initiatives like the Carbon Border Adjustment Mechanism (CBAM) are pushing industries to adopt comprehensive carbon management strategies. Countries like Germany and France are particularly proactive, implementing advanced carbon tracking and reporting systems to meet net-zero goals. The focus on reducing emissions from industrial and transport sectors continues to shape the market landscape.

Germany carbon footprint management market is expected to grow significantly due to its commitment to achieving climate neutrality. The country has implemented policies aimed at reducing carbon emissions, including expanding its Emissions Trading System to cover more sectors. This strategic focus is encouraging companies to invest in carbon management technologies, particularly within the automotive and manufacturing industries. Moreover, public awareness and corporate responsibility initiatives are further driving the adoption of carbon management practices.

The carbon footprint management market in UK is progressing as it is supported by government policies aimed at reducing emissions from transportation and energy production. Recent regulatory updates, including potential integration with the EU carbon trading system, are expected to streamline carbon pricing and reporting. Companies are increasingly adopting carbon management solutions to comply with national and regional regulations, while public and private sector partnerships are fostering innovation in emissions reduction strategies.

Middle East & Africa Carbon Footprint Management Market Trends

The Middle East and Africa region is gradually adopting carbon footprint management practices, primarily driven by the global transition to sustainable energy. Countries like Saudi Arabia and the UAE are making strides in integrating carbon management into their industrial operations. However, balancing economic development with environmental sustainability remains a challenge. Governments are increasingly recognizing the need to align their energy strategies with carbon reduction commitments, fostering new opportunities for carbon management solutions.

Key Carbon Footprint Management Company Insights

Some of prominent players operating in global carbon footprint management market include Wolters Kluwer, IBM Corporation and Schneider Electric.

-

Wolters Kluwer is a global leader in professional information, software solutions, and services, actively involved in the carbon footprint management market. The company offers digital tools that enable businesses to streamline carbon reporting, compliance, and sustainability management.

-

IBM Corporation is a pioneer in digital transformation and data analytics, playing a vital role in the carbon footprint management market. IBM’s Environmental Intelligence Suite leverages AI and IoT to monitor emissions, optimize resource use, and generate real-time insights for carbon management. The platform helps businesses track their carbon footprints, reduce energy consumption, and align with global sustainability standards.

Key Carbon Footprint Management Companies:

The following are the leading companies in the carbon footprint management market. These companies collectively hold the largest market share and dictate industry trends.

- Wolters Kluwer

- IBM Corporation

- Schneider Electric

- Dakota Software

- ENGIE

- IsoMetrix

- ProcessMAP

- Schneider Electric

- SAP

- Ecova

Recent Developments

-

In January 2024, the United Nations finalized an agreement at COP29 to launch a global carbon trading market, enabling countries and companies to trade credits for carbon emission reductions. This initiative aims to provide financial support for climate projects in developing nations and offers a mechanism for organizations to offset their carbon footprints. However, concerns have been raised about the potential for greenwashing and the effectiveness of the system in achieving actual emission reductions.

Carbon Footprint Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.12 billion

Revenue forecast in 2030

USD 20.44 billion

Growth rate

CAGR of 9.3%from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, type, end-use, region

Region scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; Netherlands; Norway; Denmark;China; India; Japan; Australia; South Korea; Singapore; Malaysia; Saudi Arabia; UAE; South Africa; Brazil; Argentina

Key companies profiled

Wolters Kluwer; IBM Corporation; Schneider Electric; Dakota Software; ENGIE; IsoMetrix; ProcessMAP; Schneider Electric; SAP; Ecova

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Footprint Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global carbon footprint management market report based on deployment, type, end-use, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On Premise

-

Cloud

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Basic Tier

-

Mid-Tier

-

Enterprise Tier

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy and Utilities

-

Manufacturing

-

Transportation

-

IT and Telecommunication

-

Residential and Commercial Buildings

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Netherlands

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.