- Home

- »

- Renewable Energy

- »

-

Carbon Credit Market Size, Share, Industry Report, 2033GVR Report cover

![Carbon Credit Market Size, Share & Trends Report]()

Carbon Credit Market (2026 - 2033) Size, Share & Trends Analysis Report By Type, Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects), By End Use, By Region (North America, Europe, APAC, Latin America, MEA) And Segment Forecasts

- Report ID: GVR-4-68040-080-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Credit Market Summary

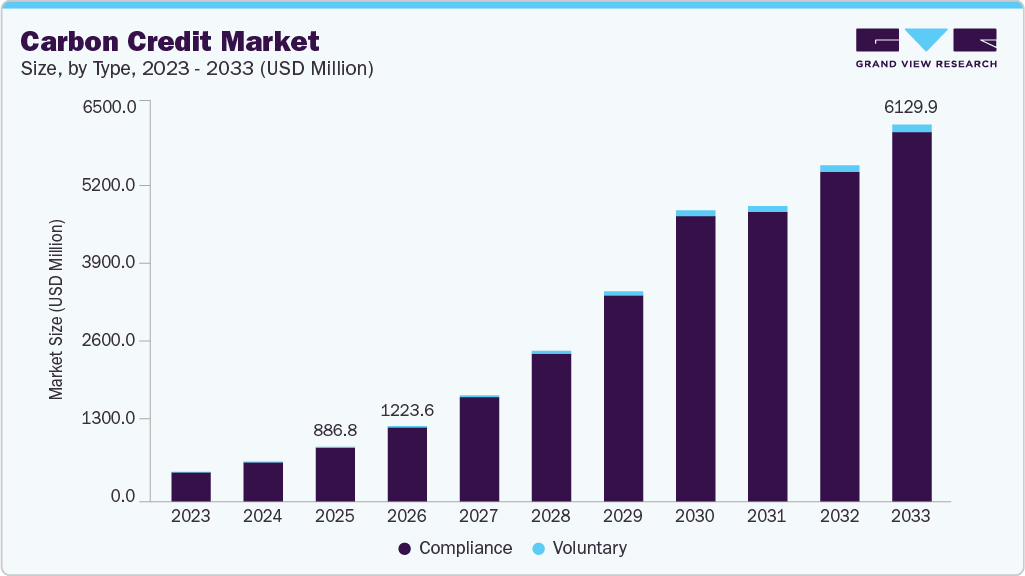

The global carbon credit market size was estimated at USD 886.77 billion in 2025 and is projected to reach USD 6,129.87 billion by 2033, growing at a CAGR of 25.9% from 2026 to 2033. The demand for carbon credits has been increasing in recent years due to factors such as various government-introduced policies & regulations aimed at reducing greenhouse gas (GHG) emissions.

Key Market Trends & Insights

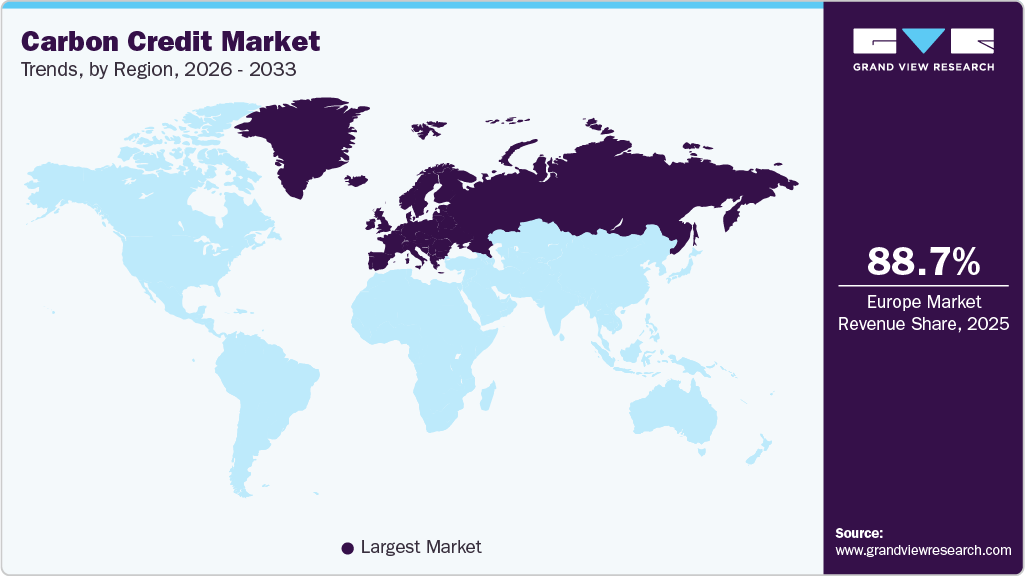

- The Europe carbon credit market held the largest share of 88.68% of the global market in 2025.

- The carbon credit market in the U.S. is expected to grow significantly over the forecast period.

- By type, the compliance segment accounted for the largest share of 98.6% in 2025.

- By project type, the avoidance/reduction projects segment accounted for a largest share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 886.77 Billion

- 2033 Projected Market Size: USD 6,129.87 Billion

- CAGR (2026-2033): 25.9%

- Europe: Largest market in 2025

Companies that are subject to these regulations may need to purchase carbon credits to offset their emissions and comply with the rules. The Indian Government has passed the Energy Conservation Bill, 2022, which clears the way for establishing carbon credit markets. A combination of state-level programs and voluntary markets primarily drives the global market growth.

There are also voluntary markets in the U.S. where companies can purchase carbon credits to offset their emissions. These voluntary markets are often used by companies that want to reduce their carbon footprint but are not required to do so by regulation. Overall, the U.S. market is relatively small compared to the markets in other regions, such as Europe, but it is growing and could play a larger role in reducing GHG emissions in the future. Companies are increasingly recognizing the importance of sustainability and reducing their carbon footprint as part of their corporate social responsibility initiatives.

Drivers, Opportunities & Restraints

The carbon credit market is driven by rising regulatory pressure to reduce emissions, the expansion of carbon pricing mechanisms, and stronger corporate sustainability and net-zero commitments. Increasing investor scrutiny is driving demand across various industrial sectors, while advancements in emissions monitoring, verification, and blockchain-based traceability are enhancing transparency and facilitating broader market adoption.

Significant opportunities arise from the emergence of high-quality, nature-based, and technology-driven carbon removal projects, including afforestation, blue carbon, biochar, and direct air capture, which are attracting strong investor interest. Developing economies with substantial land resources can benefit through project partnerships and new revenue streams from carbon sequestration.

The carbon credit market is restrained by inconsistent global regulations, fragmented standards, and unclear credit quality definitions that weaken buyer confidence and restrict cross-border trading. Ongoing concerns around greenwashing, limited project transparency, and issues of permanence and additionality also affect credibility. Additionally, price volatility, slow MRV processes, and high project development costs continue to limit large-scale adoption, particularly in emerging markets.

Type Insights

Compliance segment held the largest revenue share of over 98% in 2025. Based on type, the market is further categorized into compliance and voluntary. In terms of revenue, the compliance segment accounted for the largest share of 98.6% in 2025. The compliance carbon credit market is a market where companies and organizations that are regulated by a government or a specific authority are required to offset their carbon emissions by purchasing carbon credits. These credits represent a reduction in GHG emissions from an approved project, such as renewable energy or energy efficiency initiatives.

The voluntary segment is projected to register the fastest CAGR of 30.9% over the forecast period, driven by increasing corporate net-zero commitments, rising demand for high-quality offset projects, and greater participation from businesses seeking flexible, non-regulated pathways to reduce their carbon footprint.

Project Type Insights

Avoidance / Reduction projects turbines held the largest revenue share of over 65% in 2025. Based on project type, the market is divided into removal/sequestration projects and avoidance/reduction projects. The removal/sequestration projects segment is further sub-segmented into technology-based and nature-based projects. In terms of revenue, the avoidance/reduction projects segment dominated the market in 2025, accounting for 65.73% share of the overall revenue. Avoidance/reduction projects involve the implementation of various strategies to avoid or reduce carbon emissions by undertaking measures for improving the energy efficiency of the system and initiating renewable energy projects.

The removal/sequestration projects segment is projected to register the highest CAGR of 26.4% over the assessment period, driven by rising demand for high-integrity carbon removal solutions, increased investment in nature-based and engineered sequestration technologies, and growing corporate preference for credits that deliver measurable and long-term climate impact.

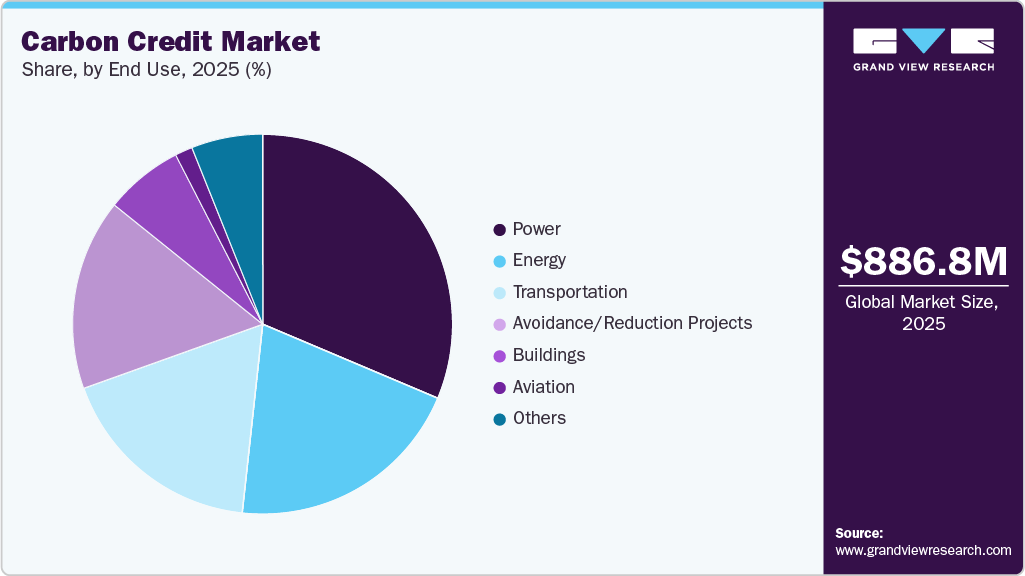

End Use Insights

Power segment held the revenue share of over 31% in 2025. The power segment emerged as the largest segment in 2025 with a revenue share of 31.36%. The other segment includes agriculture, forestry, and waste. The power end use segment is a large emitting sector that utilizes low-GHG technologies to adopt carbon-offsetting projects and schemes. Companies worldwide are making efforts to adopt renewable energy sources, such as solar energy, wind energy, and geothermal energy, to reduce their carbon emissions and generate carbon credits. These credits can be further sold to other companies or the open market for additional revenue generation. Carbon offsets are a market-based mechanism used to mitigate GHG emissions, including those in the energy sector.

The energy segment is projected to register the fastest CAGR of 27.5% over the forecast period, supported by accelerated clean energy transitions, expanding renewable project pipelines, and rising demand for credits generated from sustainable power generation initiatives.

Regional Insights

Europe held over 88.68% revenue share of the global carbon credit market. The market is based on the EU’s Emissions Trading System (ETS), which is the largest carbon market in the world. The ETS was established in 2005 and covers more than 11,000 installations in the power and industrial sectors in 31 European countries. These installations are responsible for around 45% of the EU's GHG emissions. The price of carbon offsets in the EU ETS is largely determined by supply and demand. The total supply of allowances is capped by the EU, and the price of carbon credits can fluctuate based on factors, such as economic conditions, energy prices, and climate policies. The demand for carbon credits can also be influenced by factors, such as the price of fossil fuels, the availability of renewable energy, and adoption of low-carbon technologies.

North America Carbon Credit Market Trends

The North American carbon credit market growth is driven by a combination of government programs and voluntary markets. At the state level, several cap-and-trade programs have been introduced to cap the total amount of greenhouse gas emissions allowed within the state; this requires companies to purchase carbon credits to offset their emissions.

Asia Pacific Carbon Credit Market Trends

The Asia Pacific has most of the countries, such as China and India, with rapidly growing economies. Moreover, the demand for fossil fuels for energy generation is increasing owing to their increased consumption in these countries. It is anticipated to result in increased carbon emissions in the region, which is expected to boost market growth.

Latin America Carbon Credit Market Trends

The Latin America carbon credit market is growing rapidly, supported by abundant natural resources, strong potential for nature-based projects, and rising participation in compliance and voluntary markets. Countries such as Brazil, Colombia, and Peru are becoming key suppliers of high-quality credits through large-scale forestry and REDD+ initiatives. Strengthening climate policies, increasing foreign investment, and growing corporate sustainability commitments are further driving market expansion across the region.

Middle East & Africa Carbon Credit Market Trends

Countries in the region, such as UAE and Saudi Arabia, have signed international GHGs and global thermal maintenance treaties such as the Paris Agreement. These agreements made it mandatory for the countries to reduce their GHG emissions. Furthermore, companies in the region have adopted sustainability measures to reduce their carbon footprint. Hence, due to the international collaboration & agreements and these countries’ active involvement & investment in the implementation of carbon removal projects boosts the market demand.

Key Carbon Credit Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to expand & maintain their market share. Key companies in the carbon credit market include WGL Holdings Inc, EKI Energy Services Ltd., NativeEnergy, ClearSky Climate Solutions, and 3Degrees Group, Inc., among others.

Key Carbon Credit Companies:

The following are the leading companies in the carbon credit market. These companies collectively hold the largest market share and dictate industry trends.

- 3Degrees Group, Inc.

- Carbon Care Asia Ltd.

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Ltd.

- Finite Carbon

- NativeEnergy

- South Pole Group

- Torrent Power Ltd.

- WGL Holdings Inc.

Recent Developments

- In March 2024, Toucan launched the world’s first String PV inverter market for biochar carbon credits as a response to increasing carbon credit demand.

Carbon Credit Report Scope

Report Attribute

Details

Market Definition

The carbon credit market size represents the total global revenue generated from the creation, trading, and purchase of verified emission reduction credits across compliance and voluntary markets.

Market size value in 2026

USD 1,223.65 billion

Revenue forecast in 2033

USD 6,129.87 billion

Growth rate

CAGR of 25.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026-2033

Quantitative Units

Revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, project type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

3Degrees Group, Inc.; Carbon Care Asia Ltd.; CarbonBetter; ClearSky Climate Solutions; EKI Energy Services Ltd.; Finite Carbon; NativeEnergy; South Pole Group; Torrent Power Ltd.; WGL Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

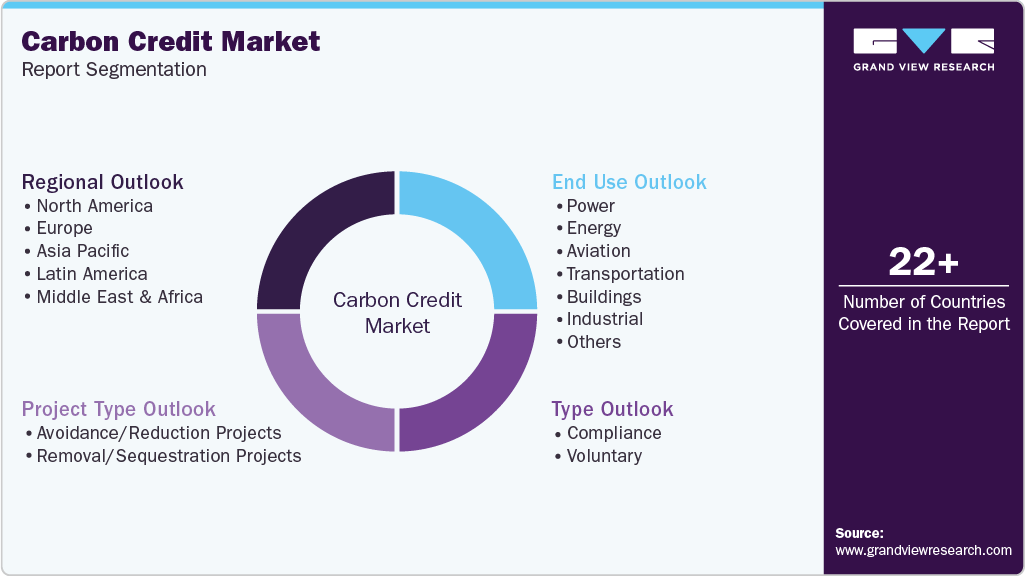

Global Carbon Credit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global carbon credit market report on the basis of type, project type, end use and region.

-

Type (Revenue, USD Million, 2021 - 2033)

-

Compliance

-

Voluntary

-

-

Project Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Avoidance/Reduction Projects

-

Removal/Sequestration Projects

-

Nature based

-

Technology based

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Power

-

Energy

-

Aviation

-

Transportation

-

Buildings

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global carbon credit market size was estimated at USD 886.77 billion in 2025 and is expected to reach USD 1223.65 billion in 2026.

b. The global carbon credit market is expected to grow at a compound annual growth rate of 25.9% from 2026 to 2033 to reach USD 6129.87 billion by 2033.

b. Based on the end-use segment, Power held the largest revenue share of more than 31.36% in 2025.

b. Some of the key vendors operating in the global carbon credit market include 3Degrees Group, Inc. Carbon Care Asia Ltd. CarbonBetter. ClearSky Climate Solutions. EKI Energy Services Ltd. Finite Carbon. NativeEnergy. South Pole Group. Torrent Power Ltd. WGL Holdings Inc., among others.

b. The key factors driving the carbon credit market include the rapid expansion of renewable energy projects such as solar and wind, coupled with rising corporate and governmental commitments to reduce greenhouse gas emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.