- Home

- »

- Food Additives & Nutricosmetics

- »

-

Caprylyl Glycol Market Size, Share & Growth Report, 2030GVR Report cover

![Caprylyl Glycol Market Size, Share & Trends Report]()

Caprylyl Glycol Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Personal Care & Cosmetics, Chemical Intermediate), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-185-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caprylyl Glycol Market Size & Trends

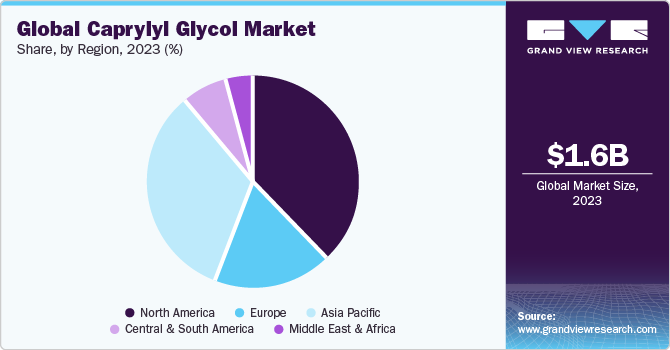

The global caprylyl glycol market size was estimated at USD 1.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030. This growth is attributed to its extensive usage in various industries such as cosmetics, personal care, and pharmaceuticals. It offers moisturizing, emollient, and antimicrobial properties, making it a popular choice in these sectors. The rising awareness regarding personal hygiene and grooming is a significant driver for the market growth.

The availability of various brands and products in the market, such as oral hygiene products, shower and bath products, and beard maintenance products, is contributing to the growth of the personal hygiene market. This, in turn, leads to increased consumption of ingredients in the hygiene products’ manufacturing processes.

The trend of personal care and grooming has been growing in the United States. Consumers are becoming more conscious of their appearance and are seeking products that enhance their personal care routines. The clean beauty movement, which emphasizes the use of safe and non-toxic ingredients in personal care products, has gained momentum in the United States. Caprylyl glycol, with its antimicrobial properties, is used by the cosmetics firm to preserve clean beauty formulations to ensure product safety without compromising on performance.

Caprylyl glycol kills or inhibits the growth of microorganisms, including bacteria, viruses, protozoans, and fungi, making it a valuable ingredient in cosmetic and personal care products, as well as in pharmaceutical formulations. Caprylyl glycol is often used as a preservative in cosmetic and personal care products, extending the shelf life of these products and ensures their safety and efficacy.

Regulatory compliance and safety are crucial factors driving the caprylyl glycol industry. Compliance with regulations ensures that caprylyl glycol and products containing it meet safety standards and legal requirements. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States and the European Union's REACH regulations set standards for the use of preservatives in cosmetics. Compliance with these regulations ensures that the ingredients meet safety requirements and are suitable for use in cosmetic formulations.

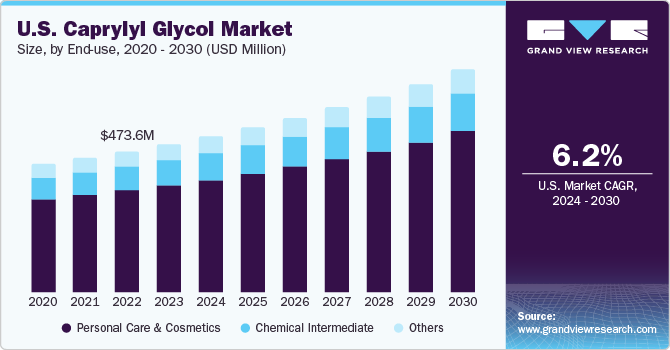

End-use Insights

The personal care & cosmetics segment held the largest revenue share of 71.5% in 2023, which is attributed to its extensive use of personal care & cosmetics products.Caprylyl glycol is a versatile ingredient and works as a humectant, emollient, and skin conditioning agent that offers multiple benefits for various skincare and haircare products. It is commonly used as a preservative booster, emollient, and moisturizing agent due to its excellent skin compatibility and antimicrobial properties.

In the personal care industry, caprylyl glycol is often used as a multifunctional ingredient in formulations such as lotions, creams, serums, cleansers, shampoos, and conditioners. Its hydrating properties help attract and retain moisture in the skin and hair, providing a smoother and softer feel. It also acts as a stabilizer, enhancing the efficacy and shelf life of formulations by inhibiting the growth of microorganisms. Caprylyl glycol is often combined with other preservatives to create a synergistic effect, allowing for lower levels of traditional preservatives while maintaining product integrity.

Caprylyl glycol, also known as 1,2-Octanediol, is a versatile compound widely used in the chemical industry as a chemical intermediate for its various properties and applications. It is a colorless liquid with a faint odor and is soluble in water and most organic solvents. Caprylyl glycol has gained popularity in recent years due to its multifunctional nature and its ability to enhance the performance of many products.

Caprylyl glycol is used in the pharmaceutical industry as an ingredient in ointment bases, vehicles for drugs in suppositories, capsules, tablet binders, and liquid prescriptions. It is also used in veterinary drugs for various preparations. Industries such as leather, plastics, resins, paper, ceramics, glass, rubber, petroleum, and metal find applications for caprylyl glycol.

Regional Insights

North America dominated the global market with the largest revenue share of 38.3% in 2023. This is attributed to the wide usage of personal care and cosmetic products in North America as humectants, emollients, and preservatives. It helps to retain moisture, improve texture, and extend the shelf life of these products. In addition, it finds applications in the large North America pharmaceutical industry as an ingredient in ointments, capsules, tablets, and liquid prescriptions.

In North America, the demand is driven by the growing consumer preference for natural and organic personal care products. Manufacturers are focusing on developing formulations that are free from harmful chemicals, and caprylyl glycol, being a safe and effective ingredient, is gaining popularity in this context. The region also witnesses a high demand for disinfectant sprays and wipes, especially in the wake of the COVID-19 pandemic, where antimicrobial properties are valued.

The Asia Pacific region is another significant market with diverse end-user industries and consumption trends. Consumption in the Asia Pacific region is influenced by several factors. The region has a large population, which drives the demand for personal care and cosmetic products. In addition, the rising disposable income and changing lifestyles of consumers contribute to the growth of the market.

Apart from personal care, caprylyl glycol finds applications in other industries in the Asia Pacific region. For instance, it is used in the production of textiles, plastics, resins, and paper. Caprylyl glycol's properties, such as compatibility with surfactants and the ability to form substantive films on surfaces, make it suitable for various industrial applications. Moreover, the presence of major manufacturing hubs and availability of raw materials in the region further support the production and consumption of glycol-based products.

Caprylyl glycol is extensively used in the personal care and cosmetic industry in Europe. The presence of major cosmetic manufacturers and suppliers in Europe contributes to the growth of the caprylyl glycol industry. These companies ensure the availability and distribution of ingredients to meet the demands of the industry. In addition, advancements in research and development activities in Europe drive innovation in the market.

Key Companies & Market Share Insights

The market is characterized by the presence of a limited number of market players vying for a majority share. The firms have been indulging in research and development to offer new products. In addition, caprylyl glycol is used as an ingredient in the production of various beauty products by key cosmetics manufacturers. For instance, in August 2023, Evonik Industries AG announced the launch of a new line of fermented actives, which addresses the issues of skin aging. The products enhance skin resurfacing and enable a healthy balance of the skin microbiota.

Key Caprylyl Glycol Companies:

- Ashland

- BASF SE

- Symrise

- Inolex, Inc.

- Lonza Group Ltd.

- Evonik Industries AG

- Dow

- Clariant AG

- Lotioncrafter

- Thor Personal Care

Caprylyl Glycol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.66 billion

Revenue forecast in 2030

USD 2.42 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume, Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume, and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ashland; BASF SE; Symrise; Inolex, Inc.; Lonza Group Ltd.; Evonik Industries AG; Dow; Clariant AG; Lotioncrafter; Thor Personal Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caprylyl Glycol Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caprylyl glycol market report based on end-use, and region:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Chemical Intermediate

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global caprylyl glycol market size was estimated at USD 1.57 billion in 2023 and is expected to reach USD 1.66 billion in 2024.

b. The global caprylyl glycol market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 2.42 billion by 2030.

b. North America dominated the caprylyl glycol market with a share of 38.3% in 2023. This is attributable to its wide usage in personal care and cosmetic products in North America as a humectant, emollient, and preservative.

b. Some key players operating in the caprylyl glycol market include Ashland, BASF SE, Symrise, Inolex, Inc., Lonza Group Ltd., Evonik Industries AG, Dow, Clariant AG, Lotioncrafter, and Thor Personal Care, to name a few.

b. Key factors that are driving the market growth include extensive usage in various industries such as cosmetics, personal care, and pharmaceuticals. The rising awareness regarding personal hygiene and grooming is a significant driver of the caprylyl glycol market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.