- Home

- »

- Alcohol & Tobacco

- »

-

Canned Alcoholic Beverages Market Size, Share Report 2030GVR Report cover

![Canned Alcoholic Beverages Market Size, Share & Trends Report]()

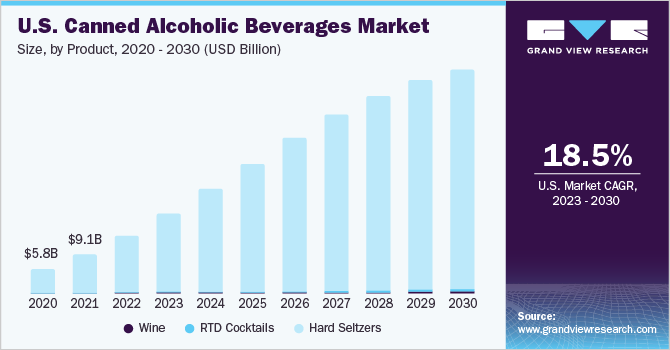

Canned Alcoholic Beverages Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Wine, RTD Cocktails, Hard Seltzers), By Distribution Channel (On-Trade, Liquor Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-258-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canned Alcoholic Beverages Market Summary

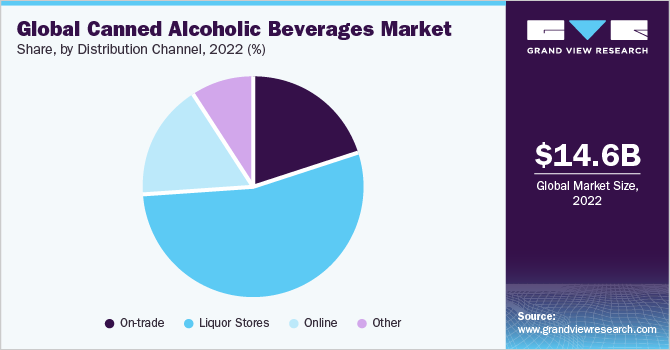

The global canned alcoholic beverages market size was estimated at USD 14.62 billion in 2022 and is projected to reach USD 59.37 billion by 2030, growing at a CAGR of 19.1% from 2023 to 2030. Canned alcoholic beverages are gaining popularity among consumers since cans are more convenient, portable, and travel-friendly.

Key Market Trends & Insights

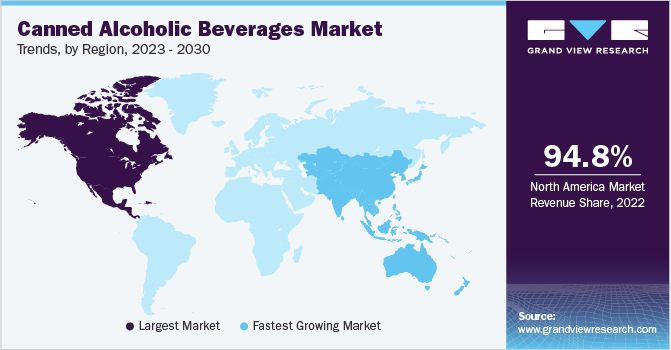

- North America dominated the global immersive virtual reality market with the largest revenue share of 94.8% in 2022.

- By product, the hard seltzers segment led the market, holding the largest revenue share of 91.7% in 2022.

- By distribution channel, the online segment is expected to grow at the fastest CAGR of 20.0% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 14.62 Billion

- 2030 Projected Market Size: USD 59.37 Billion

- CAGR (2023-2030): 19.1%

- North America: Largest market in 2022

Moreover, these metal cans are less expensive as compared to glass bottles and have a considerably higher recycling rate than glass. This is expected to fuel the growth of the industry during the forecast period. The COVID-19 pandemic has encouraged consumers to shift to on-the-go alcoholic beverages. According to a report published by Wine Industry Network LLC in August 2020, canned alcoholic drinks have gained tremendous traction among consumers during the lockdown period. Compared to 2019, the off-premises sales of canned beer/flavored malt beverage (FMB)/cider increased by 25% in 2020.

With a history of over thousands of years, wine has evolved in all its aspects, including its ingredients, methods of preparation, packaging, and consumption. With significant progress in the ingredients and methods of preparation, a large variety of wines have come into existence and are being rigorously marketed.

The growing demand for low-content alcohol-based flavored drinks due to rising health concerns is anticipated to drive the market during the forecast period. These drinks are available in a variety of flavors, such as ready-to-drink (RTD) cocktails infused with ginger, rose, and lavender, which makes them the most preferred alcoholic beverage among consumers.

The key players are capitalizing on the growing demand for low alcoholic beverages owing to rising health concerns. For instance, in August 2021, Shima Drinks, a Japanese startup, launched an RTD cocktail, canned ake, in the hard seltzer category in the U.K. industry.

The growing demand for convenience and rising health consciousness among consumers are the major factors driving the demand for hard seltzers. Nowadays, low-calorie drinks with natural ingredients appeal the most to consumers, thus, manufacturers are focusing on launching products with natural ingredients to capture a wider market share.

For instance, in September 2021, Coca-Cola Australia announced the launch of its new canned beverage, Topo Chico, in the hard seltzer category. The new beverage is a blend of sparkling water with alcohol and is available in three flavors - Pineapple Twist, Tangy Lemon Lime, and Strawberry Guava.

Moreover, consumers have been showing a preference for beverages in convenient packaging formats, which is expected to promote the scope of growth for the market over the next few years. The growing preference for containers that are more portable and less fragile than glass is boosting the growth.

Product Insights

Hard seltzers held the largest revenue share of 91.7% in 2022 and are expected to maintain dominance during the forecast period. Hard seltzers are carbonated water-based drinks, which are usually infused with fruits and spirits. These have become quite popular among millennials due to their low alcohol content. Low prices of hard seltzer and easy availability across supermarkets and convenience stores are factors anticipated to boost their sales during the forecast period.

New product launches by beverage companies to cater to the growing demand for hard seltzers will further fuel the segment growth. For instance, in April 2020, Molson Coors, launched new hard seltzer, Vizzy, and in four different flavors-Strawberry Kiwi, Black Cheery Lime, Pineapple Mango, and Blueberry Pomegranate in the U.S. Each 12-ounce serving contains 5% alcohol by volume.

Ready-to-drink (RTD) cocktails are anticipated to register a CAGR of 14.0% over the forecast timeline. The growing popularity of at-home cocktail culture and rising demand for flavored drinks with low alcohol content owing to the rising health concerns are some of the factors expected to drive the segment growth.

Premiumization of the product with enhanced quality, taste, flavors, and creative packaging will further drive the demand for RTD cocktails. The key players are emphasizing aggressive advertisement and product launches to capture a high market share. For instance, in March 2022, Pernod Ricard launched RTD cocktail, ginger & lime canned premix under its brand Jameson brand in the U.S. The RTD cocktail is a blend of Jameson Irish whiskey and natural lime & ginger flavors.

However, the wine segment is projected to register high growth during the forecast period with a CAGR of 14.4% from 2023 to 2030. The rising awareness among consumers for eco-friendlier alternatives to plastic bottles coupled with the growing preference for convenient products is propelling the demand for canned wine.

Aluminum cans eliminate the efforts required for opening corks in wine bottles. Market players are emphasizing new launches of canned wines in different variations to attract and retain new customers. For instance, in November 2019, Constellation Brands launched a new canned wine brand, Crafters Union, in three variations, a Pinot Grigio, rosé, and a red blend. Such factors are likely to bode well for market growth.

Distribution Channel Insights

The liquor stores segment contributed a share of more than 54.4% of the global revenue in 2022. These stores have been a widespread and well-established distribution channel for in the industry. The wide availability of both premium and private label brands at these stores attract consumers to purchase products through these channels. The liquor stores provide enhanced in-store experience along with wider availability of products.

According to the National Association of Convenience Stores 2021 report, 53% of shoppers enjoy seeing their alcoholic beverage options in-store, while 41% find it easier to discover new brands in-store. In liquor stores, and other retail stores such as Walmart, Costco, and Target consumers get to learn more about the product, verify the product, discover new brands, as well as get assistance from store employees who knows more about the product, and suggest products as per shopper’s taste and preferences. However, the overall in-store sales of several-liquor and offline retail stores significantly declined during the pandemic.

The online segment is expected to register the fastest growth during the forecast period with a CAGR of 20.0% from 2023 to 2030. The hassle-free shopping experience such as pickup and home delivery, offered by various online platforms is expected to drive the growth of the segment. Easy payment methods that fit into the regulatory standards of different countries have made transactions a lot easier. The overall online sales increased significantly during the pandemic.

According to OECD 2021 report, alcoholic beverages sales increased by 3% to 5% in U.K., Germany, and the U.S in 2020 compared to 2019. Sales of alcohol in restaurants, and bars plummeted, while online sales, grew significantly. For instance, online sales of alcohol increased by 262% compared to 2019 sales in the U.S. during the pandemic, as per the National Institutes of Health (NIH) 2020 report..

Regional Insights

North America made the largest contribution to the global market with a revenue share of over 94.8% in 2022. The growing per capita expenditure on alcohol coupled with the increasing availability of alcoholic beverages is expected to drive the regional market growth.

As per the Bureau of Labor Statistics Consumer Expenditure Survey 2019 data, the average consumer in the U.S. spends USD 579 on alcohol annually. Furthermore, an increase in binge drinking and heavy alcohol consumption among people aged 18 and above is expected to drive regional growth. According to the National Institutes of Health (NIH), 25.8 percent of people aged 18 and older were engaged in binge drinking in 2019.

Asia Pacific is the fastest-growing region and is expected to witness a CAGR of 29.9% from 2023 to 2030. The rapid expansion of the alcohol industry along with fast-growing economies are the major factors propelling the market demand for alcoholic beverages in the Asia Pacific...

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players and several small and medium players. Mergers and acquisitions are one of the key strategic initiatives in the industry. For instance:

-

In July 2022, Diageo and The Vita Coco Company have joined forces to introduce a new collection of top-tier canned cocktails. This exciting collaboration brings together the rich taste of Captain Morgan rum with the invigorating and refreshing flavor of Vita Coco coconut water.

-

In March 2021, Koninklijke Grolsch, a Dutch brewery and a subsidiary of Asahi Group, launched hard seltzer in cans and bottles under the brand name “Viper”. This is the first hard seltzer in the Netherlands that is available in cans and bottles

-

In May 2021, Bacardi expanded its range of canned cocktails, in different flavors BACARDÍ Sunset Punch BACARDÍ Bahama Mama, and BACARDÍ Mojito. This gluten-free are made with real ingredients, natural flavors, and no artificial sweeteners

Some prominent players in the global canned alcoholic beverages market include:

-

Bacardi Limited

-

Diageo

-

Brown-Forman

-

Anheuser-Busch InBev

-

Treasury Wine Estates

-

Union Wine Company

-

E. & J. Gallo Winery

-

Asahi Group Holdings, Ltd.

-

Pernod Ricard

-

Integrated Beverage Group LLC (IBG)

-

Sula Vineyards

-

Kona Brewing Co.

-

Suntory Holdings Limited

-

Barefoot Cellars

-

Constellation Brands

Canned Alcoholic Beverages Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.19 billion

Revenue forecast in 2030

USD 59.37 billion

Growth rate

CAGR of 19.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD Million/Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Bacardi Limited; Diageo; Brown-Forman Corporation; Anheuser-Busch InBev; Treasury Wine Estates; Union Wine Company; E. & J. Gallo Winery; Asahi Group Holdings, Ltd.; Pernod Ricard; Integrated Beverage Group LLC (IBG); Sula Vineyards; Kona Brewing Co., Suntory Holdings Limited; Barefoot Cellars; Constellation Brands.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Canned Alcoholic Beverages Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global canned alcoholic beverages market on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Wine

-

Still

-

Fortified

-

Low-alcohol

-

Sparkling

-

-

RTD Cocktails

-

Malt based

-

Spirit based

-

Wine based

-

-

Hard Seltzers

-

Malt based

-

Spirit based

-

Wine based

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

On-trade

-

Liquor Stores

-

Online

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global canned alcoholic beverages market size was estimated at USD 14.62 billion in 2022 and is expected to reach USD 20.19 billion in 2023.

b. The global canned alcoholic beverages market is expected to witness a compound annual growth rate of 19.1% from 2023 to 2030 to reach USD 59.37 billion by 2030.

b. The hand seltzers segment dominated the market for canned alcoholic beverages and held the largest revenue share of 89.0% in 2022 and is expected to maintain dominance over the forecast period.

b. The liquor stores segment dominated the market for canned alcoholic beverages and accounted for the largest revenue share of more than 54% in 2022.

b. North America dominated the canned alcoholic beverages market and accounted for the largest revenue share of 92.5% in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.