- Home

- »

- Pharmaceuticals

- »

-

Global Cannabis Extract Market Size & Share Report, 2030GVR Report cover

![Cannabis Extract Market Size, Share & Trends Report]()

Cannabis Extract Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Oil, Tinctures), By Extract Type (Full Spectrum Extracts, Cannabis Isolates), By Sources (Hemp. Marijuana), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-100-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Extract Market Summary

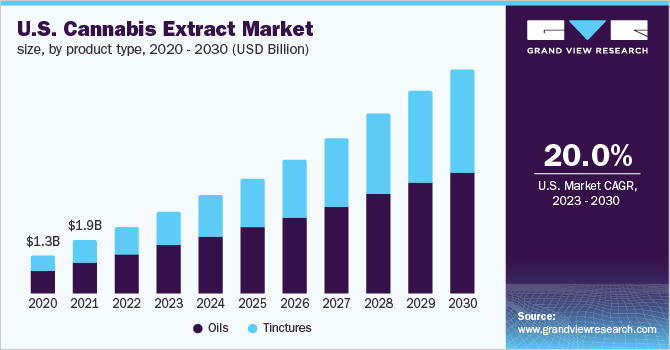

The global cannabis extract market size was valued at USD 3.5 billion in 2022 and is expected to reach USD 15.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 20.0% from 2023 to 2030. Growing demand for cannabis extracts, including oils and tinctures, and the increased legalization of marijuana for the treatment of different chronic ailments like arthritis, Alzheimer's, anxiety, and cancer are driving the expansion of the industry.

Key Market Trends & Insights

- North America accounted for a high revenue share of 78.5% in 2022.

- By product type, the oil sector held the largest revenue share of 62.8% in 2022.

- By source, marijuana held the highest revenue share of 83.5% in 2022.

- By extract type, the full spectrum segment held the leading revenue share of 70.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.5 Billion

- 2030 Projected Market Size: USD 15.5 Billion

- CAGR (2023-2030): 20.0%

- North America: Largest market in 2022

- Middle East and Africa: Fastest growing market

The marijuana industry is flourishing due to a greater understanding of its various medical benefits. In several countries, decriminalization and/or legalization of medical cannabis has resulted in a drop in the black market since people choose to buy it legally for medical usage. Other than smoking, tinctures & oil can be utilized to make topical and edibles. These are highly considered in treating ailments including nausea, cancer, and mental illness as well as for recreational purposes like vaping. The laws governing medical marijuana extracts are far more permissive in terms of legality are far more permissive than those governing dried buds, which include smoking, thereby supporting the industry’s growth.

In several countries, decriminalization and/or legalization of medical cannabis has resulted in a drop in the black market since people choose to buy it legally for medical usage. Other than smoking, tinctures & oil can be utilized to make topical and edibles. These are highly considered in treating ailments including nausea, cancer, and mental illness as well as for recreational purposes like vaping. The laws governing medical marijuana extracts are far more permissive in terms of legality are far more permissive than those governing dried buds, which include smoking, thereby supporting the industry’s growth.

The cannabis extract market is predicted to witness growth due to the rising prevalence of chronic diseases such as cancer, diabetes, and others. As per the report of the American Cancer Society, in 2022, about 1.9 million cancers cases are projected to be diagnosed in the U.S. Furthermore, the World Health Organization (WHO) estimates that 2.5 % of the global population uses cannabis in some form or another each year, leading to increased demand for CBD.

CBD extract is also utilized to treat 62% of the world's population suffering from chronic disease, according to the National Center for Biotechnology Information (NCBI). Depression, on the other hand, is a prevalent mental illness. It is approximated that 5.0 % of adults in the world suffer from depression. Depression is the greatest cause of disability in the world, and it contributes significantly to the global illness burden.

The rising prevalence of chronic conditions and studies signifying positive effects of cannabis extracts on these conditions is expected to boost the market growth. However, the worldwide market is hampered by a lack of information and understanding about the numerous benefits in rising countries of the world and a strong regulatory presence regulating CBD usage.

The coronavirus (COVID-19) pandemic and shutdown in several nations throughout the world have had an impact on enterprises of all kinds. The COVID-19 pandemic is having a significant impact on the private healthcare industry. The coronavirus outbreak has had a detrimental influence on raw material development, manufacturing, and supply, particularly in the private sector.

The existence of tight regulatory bodies' restrictions and the fluctuating costs of cannabidiol products are two main issues restricting the growth of the industry. Furthermore, the lack of legalization efforts in many Asian and African nations is a major stumbling block to the market's expansion.

Product Type Insights

The market is divided into tincture and oil segments based on product type. The oil sector held the largest revenue share of 62.8% in 2022 and is anticipated to register the fastest growth rate of 20.3%. Furthermore, the benefits of cannabis and its derivatives are widely perceived. For instance, individuals in Canada are educated about the benefits and bad effects of smoking marijuana and the human body's reasonable limits by the drug stores themselves. Cannabis-derived oils are used to relieve nausea and vomiting brought on by cancer.

Cannabis oil aids in the treatment of sleep disorders and the reduction of stress and anxiety. The market for cannabis oils is expected to rise over the forecast period owing to a significant increase in the number of patients who prefer oil to flowers. The cannabinoids in isolates collected through isolation and extracts are the most reliable. Furthermore, these isolates have a number of benefits that have led to their growing adoption throughout time. Their truest expression tests negative for THC and has no psychoactive impact because of the low/no THC level.

Cannabis tinctures are made by dissolving the substance in alcohol and are taken sublingually. Tinctures can begin functioning in as little as 15 minutes, whereas oils can take up to 45 minutes to begin working. As a result, tincture demand is predicted to increase significantly over the projection period. The tinctures category is expected to grow at the highest rate. The product demand is expected to be driven by healthcare practitioners’ changing perspectives on safer ingesting approaches such as oral intake, beverages, or gummies.

Due to rapid growth in end-use industries such as medicines, nutraceuticals, cosmetics, drinks, and consumables, the majority of companies have begun to increase their extract portfolios. These items are advertised with detailed details on them. For medical purposes, these products are offered with particular information on the content of THC and CBD, or solely CBD.

Source Insights

Based on source, the market is segmented into marijuana and hemp. Among them, marijuana held the highest revenue share of 83.5% in 2022 and is also expected to grow with the fastest CAGR value of 20.1% in the forecast period. The growth of this segment is attributed to its medicinal value. Marijuana contains more than 100 active compounds out of which THC chemical causes the high, whereas, the CBD-dominant strain has little or no amount of THC and thus, has little or no effect on the consciousness of the user.

Marijuana is highly used for treating anxiety, stress, and depression and is majorly used as a pain reliever. Growing acceptance of marijuana for medical and recreational activities are positively impacting the market growth. Factors such as the growing awareness about cannabis products and increasing R&D activities in cannabis extract are further driving the growth.

Childhood epilepsy known as Dravet syndrome is difficult to control but responds intensely well to the CBD-dominant strain of cannabis. For instance, Charlotte’s Web, effective in Dravet’s syndrome, was developed by the Stanley brothers by crossing industrial hemp with a strain of marijuana. This variety produces more amount of CBD and less THC.

Hemp is also expected to showcase lucrative growth over the forecast period as it is highly used for high cholesterol, constipation, arthritis, and others. Hemp contains a small amount of THC of less than 0.3%, even the 2018’s Farm Bill contains a specific definition of hemp versus cannabis where the THC content is limited to 0.3%. Growing usage of hemp by industries is expected to drive the market in the forecast period.

Extract Type Insights

The global market is divided into two types of extracts, namely, full-spectrum and isolates. The full-spectrum extract contains the entire range of cannabinoids taken from a cannabis plant. The segment held the largest share of 70.7% in 2022 and is anticipated to register the fastest growth rate of 21.0%. Apart from CBD, there are over 100 additional cannabinoids that exist in their natural forms. Full-spectrum extracts provide an entourage effect, which is a collaborative link between terpenes and cannabinoids that enhances the therapeutic qualities of cannabinoids due to their availability.

Cannabis isolates obtained through isolation and extraction are the most dependable forms of their cannabinoids. They offer fewer health advantages than full-spectrum cannabis extracts. Furthermore, these isolates have several advantages that have led to their increased acceptance throughout time. Because of the low/no THC content, their truest expression tests negative for THC and has no psychoactive effect.

Regional Insights

North America accounted for a high revenue share of 78.5% in 2022. According to recent statistics, around 57.0% of adults in the United States support the use of marijuana for medical purposes such as pain, inflammation, and cancer therapy. As a result, factors such as cannabis legalization, greater citizen acceptance, and rising product use for therapeutic purposes are promoting regional market growth.

Middle East and Africa is anticipated to register the fastest growth rate of 37.8%. Cannabis has been used in the pharmaceutical business in a few European countries. This is especially true in Spain, the U.K., Germany, and other countries. Europe was the second-largest revenue contributor. However, legalization in European countries, coupled with strict laws and regulations governing sales and cultivation, could limit overall growth in Europe and hence the worldwide industry. Australia, Germany, Poland, Colombia, Uruguay, and Israel are potential marijuana markets, signifying growth potential in the upcoming years.

Key Companies & Market Share Insights

Cannabis products give a variety of medical benefits to consumers, which has led to a surge in the treatment of a variety of chronic illnesses. As a result, they are quickly gaining traction. Furthermore, the global rivalry is fierce since corporations are focusing on expanding their product offerings, entering new markets, and attracting new customers.

As a vast amount of European and Asian nations have legalized cannabis for medical purposes, the industry is rapidly rising. The early adopters are expected to reap the benefits by expanding their presence in the countries and strengthening their dominance. For instance, TerraTech Corp and Unrivaled Brands have merged to form a vertically integrated cannabis powerhouse. Together they are building the next generation of unrivaled cannabis products and experiences. Some prominent participants in the global cannabis extract market include:

-

Tikun Olam

-

CANOPY GROWTH CORPORATION

-

Tilray

-

Aurora Cannabis

-

The Cronos Group

-

Maricann Inc

-

Organigram Holdings Inc.

-

The Cronos Group

-

Aphria Inc

Cannabis Extract Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.3 billion

Revenue forecast in 2030

USD 15.5 billion

Growth rate

CAGR of 20.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, extract type, sources, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; Poland; Czech Republic; Switzerland; Croatia; Netherlands; Australia; China, India; New Zealand; Japan; Mexico; Colombia; Chile; Israel; South Africa, Brazil

Key companies profiled

Tikun Olam; CANOPY GROWTH CORPORATION; Tilray; Aurora Cannabis; The Cronos Group; Maricann Inc.; Organigram Holdings Inc.; Aphria Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Extract Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global cannabis extract market report based on product type, extract type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Oils

-

Tinctures

-

-

Extract Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Full Spectrum Extracts

-

Cannabis Isolates

-

-

Sources Outlook (Revenue, USD Million, 2016 - 2030)

-

Hemp

-

Marijuana

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Medical Use

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Recreational Use

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K

-

Germany

-

Netherlands

-

Switzerland

-

Italy

-

Poland

-

Czech Republics

-

Croatia

-

-

Asia Pacific

-

China

-

India

-

New Zealand

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Colombia

-

Chile

-

-

Middle East and Africa

-

Israel

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cannabis extract market size was estimated at USD 3.5 billion in 2022 and is expected to reach USD 4.3 billion in 2023 .

b. The global cannabis extract market is expected to grow at a compound annual growth rate of 20.0% from 2023 to 2030 to reach USD 15.5 billion by 2030

b. Oil segment dominated the cannabis extract market with a share of 62.8% in 2022. This is attributable to ease of availability and low price of the product.

b. Some key players operating in the cannabis extract market include Canopy Growth Corporation; Aphria Inc.; Aurora Cannabis; Maricann Inc.; Tilray; Organigram Holdings Inc.; Tikun Olam, Ltd.; and The Cronos Group.

b. Key factors that are driving the cannabis extract market growth include the growing legalization of cannabis in various countries, preference for cannabis oil and tinctures, and adoption of medical marijuana for treating chronic diseases like arthritis, anxiety, and Alzheimer’s.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.