- Home

- »

- Biotechnology

- »

-

Cancer Gene Therapy Market Size, Industry Report, 2030GVR Report cover

![Cancer Gene Therapy Market Size, Share & Trends Report]()

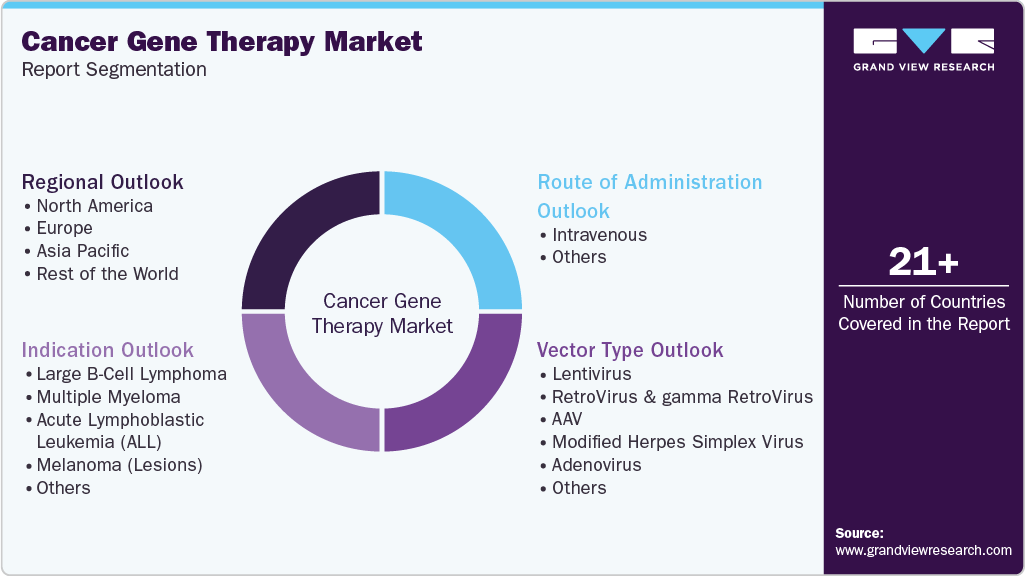

Cancer Gene Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication (Large B-Cell Lymphoma, Multiple Myeloma), By Vector Type (Lentivirus, RetroVirus & Gamma RetroVirus, AAV), By Route Of Administration, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-984-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cancer Gene Therapy Market Summary

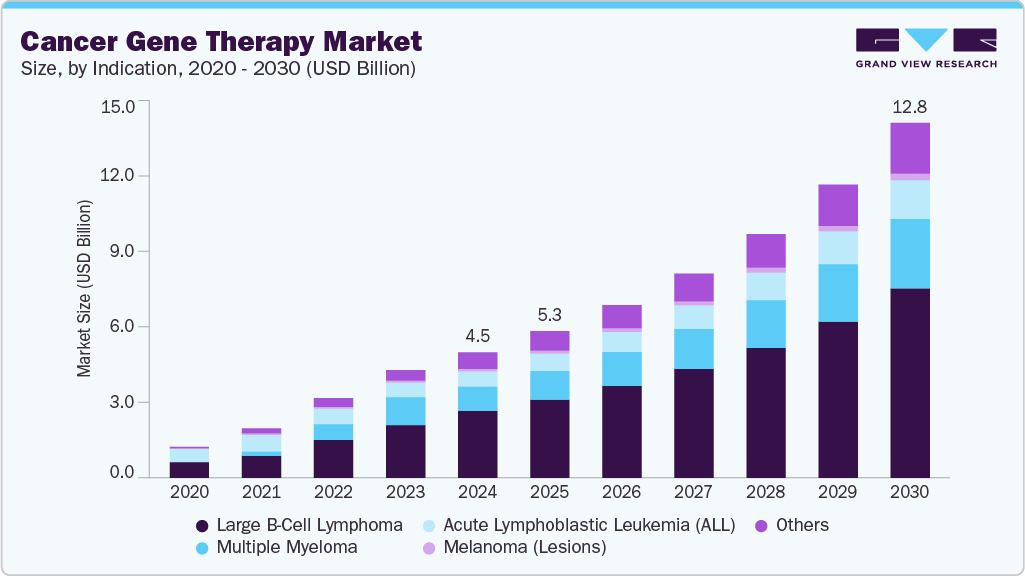

The global cancer gene therapy market size was estimated at USD 4.51 billion in 2024 and is anticipated to reach USD 12.76 billion in 2030, growing at a CAGR of 19.34% from 2025 to 2030. The significant growth can primarily be attributed to the rising demand for gene therapy and the increasing global incidence of cancer.

Key Market Trends & Insights

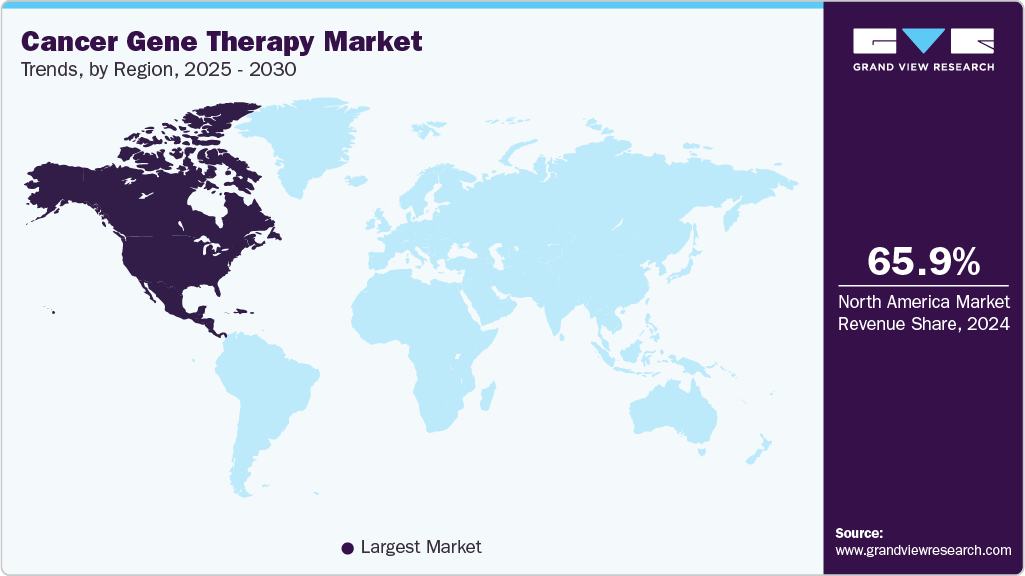

- The North America cancer gene therapy market held the largest share of 65.90% of the global market in 2024.

- The cancer gene therapy market in the U.S. is expected to grow significantly over the forecast period.

- By indication, the large B-Cell lymphoma segment held the highest market share of 53.32% in 2024.

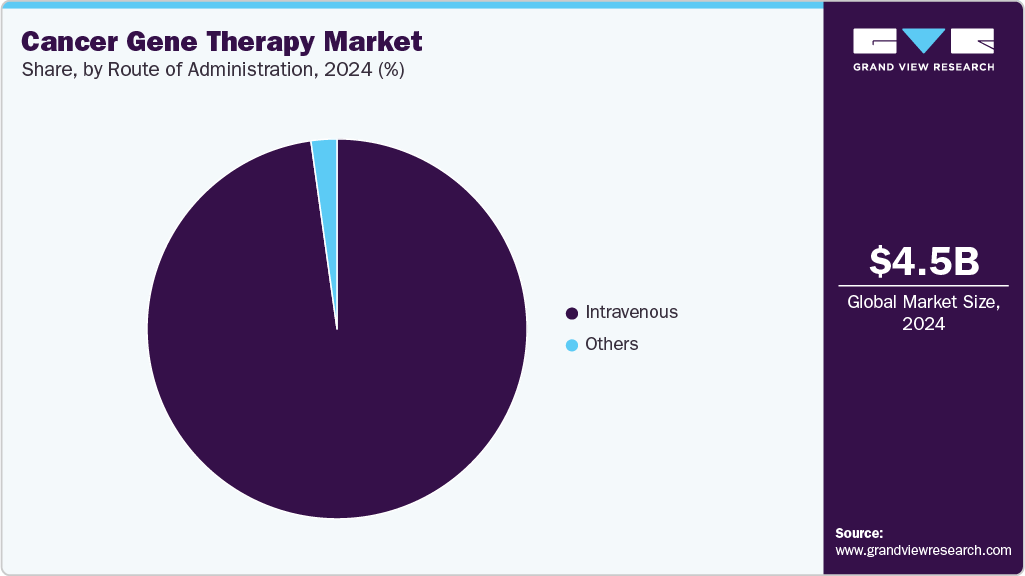

- By route of administration, the intravenous segment held the highest market share in 2024.

- Based on vector type, the lentivirus segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.51 Billion

- 2030 Projected Market Size: USD 12.76 Billion

- CAGR (2025-2030): 19.34%

- North America: Largest market in 2024

Furthermore, ongoing advancements in gene therapy are expected to make it a promising alternative for treating various types of cancers and neoplastic disorders. The increasing prevalence of cancer cases is expected to create a high demand for novel therapeutic drugs that could be effective for cancer treatment. According to the WHO, cancer affects 1 in 5 people, 1 in 12 women, and 1 in 9 men. In 2022, 20 million new cancer cases and 9.7 million deaths were reported, with 53.5 million people alive within 5 years of diagnosis.Furthermore, the market is experiencing significant growth due to increased research and development activities, advancements in product technologies, and the introduction of new products by key industry players. This progress is propelling the healthcare infrastructure to unprecedented levels. For instance, in April 2023, an improved gene editing method was introduced based on special cell-penetrating peptides, representing a significant advancement in cell and gene therapies. This technique offers distinct advantages over current methods for editing the genomes of primary cells, particularly patients’ T-cells.

The growing strategic investments and expansion by major players have been actively developing gene therapies for various types of cancer, leveraging its expertise in genetic engineering and delivery systems. For instance, in August 2023, Astellas and Poseida Therapeutics announced a strategic investment to support Poseida’s commitment to redefining cancer cell therapy. This partnership aims to advance the development of innovative cell therapies for cancer treatment. This strategic investment implies a significant financial commitment towards advancing the field of cancer cell therapy. This infusion of capital is likely to enable Poseida to further develop its cutting-edge technologies and accelerate the progress of its pipeline of novel cell therapies.

Moreover, the rising prevalence rates of lifestyle disorders, including diabetes and obesity, rising health-care spending, and the fast-growing diagnostic industry are driving the market expansion. For instance, according to the American Diabetes Association, around 1.2 million Americans are diagnosed with diabetes annually. In 2021, diabetes affected about 11.6% of the American population, which is equivalent to 38.4 million people. Of these, around 2 million people have type 1 diabetes, with around 304,000 of them being children and adolescents. In addition, the growing elderly population, increased demand for laboratory automation, and more awareness of preventative healthcare are driving the market growth.

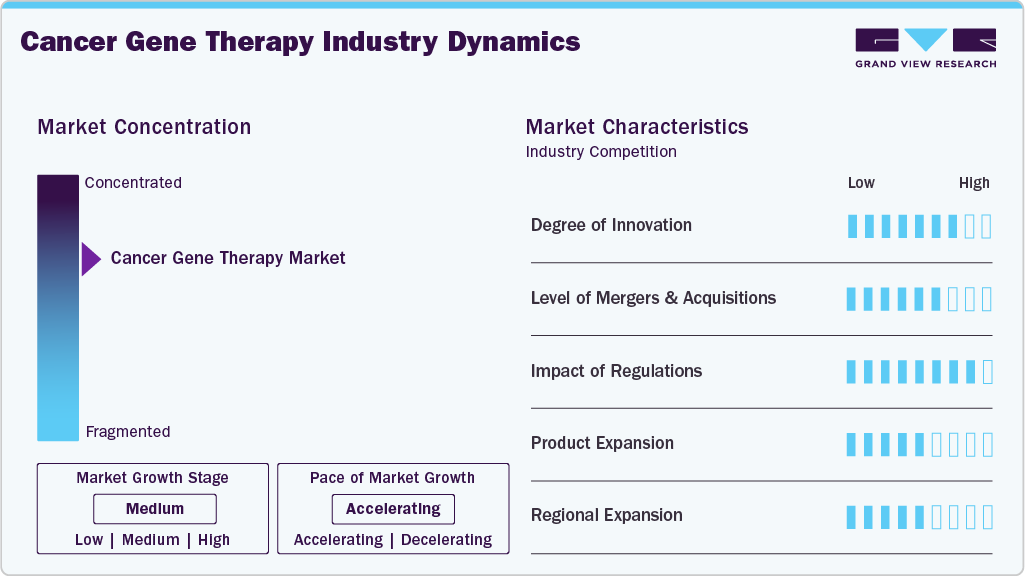

Market Concentration & Characteristics

The cancer gene therapy industry growth stage is high, and the pace of market growth is accelerating. The market is characterized by a degree of innovation, a Level of M&A activities, the impact of regulations, service expansions, and regional expansions. The market fortifies a high degree of innovation. Breakthrough technology is CAR-T cell therapy, which involves genetically modifying a patient’s T-cells to express chimeric antigen receptors (CARs) that recognize and attack cancer cells. These innovative approaches highlight the growing potential of gene-based therapies in reshaping how we combat cancer.

The level of M&A (mergers and acquisitions) activities in the market is high. Several companies are undertaking mergers and acquisitions strategies to expand biologics regulatory affairs portfolios, gain access to advanced technologies, and enhance their market presence. For instance, in November 2023, AstraZeneca announced its acquisition of Gracell Biotechnologies Inc. This strategic move by AstraZeneca is aimed at expanding its presence in the field of cell therapy, particularly in oncology and autoimmune diseases.

Regulations have a high impact on the market by shaping gene therapies' development, approval, and commercialization for cancer treatment. Regulatory frameworks set by health authorities such as the FDA in the U.S. and the EMA in Europe are designed to ensure patient safety, efficacy of treatments, and ethical standards are met. These bodies require extensive preclinical and clinical trials to demonstrate the safety and effectiveness of gene therapy products before they can be approved for use in patients. Additionally, regulatory requirements often necessitate substantial investments in compliance measures, quality control systems, and manufacturing standards to meet strict guidelines. Companies operating in this space must navigate complex regulatory landscapes that vary across regions, adding another challenge to bringing innovative gene therapies to needy patients.

The cancer gene therapy industry has experienced exponential growth, driven by the increasing demand for more effective treatments. Rising cancer prevalence, particularly among aging populations, has highlighted the need for advanced therapies. Gene therapies like CAR-T cell treatments have shown promising results in cancers such as leukemia and lymphoma. Advances in gene delivery technologies, along with improved safety profiles, have boosted confidence in their effectiveness. Additionally, the shift towards personalized medicine, targeting specific genetic profiles, is fueling market demand. With ongoing innovation and regulatory support, the market for cancer gene therapies is expected to expand rapidly.

The market is experiencing significant regional expansion, with service providers strategically expanding their presence to new geographic areas. Biologics companies are expanding into emerging markets in Asia-Pacific owing to growing healthcare needs and favorable regulatory environments. Thus, growing outsourcing trend for regulatory affairs due to the rising need to navigate country-specific regulatory requirements and skilled expertise.

Indication Insights

On the basis of indication, the market is segmented into large B-cell lymphoma, multiple myeloma, acute lymphoblastic leukemia (ALL), melanoma (lesions), and others. The large B-cell lymphoma segment dominated the market and accounted for the largest revenue share of 53.32% in 2024. This is primarily due to the high prevalence of LBCL, which is one of the most common types of non-Hodgkin lymphoma. The availability of advanced gene therapies, such as CAR-T cell therapies, has shown significant success in treating LBCL, making it a key focus area for clinical development. The strong response rates and improvements in patient outcomes have led to increased adoption of these therapies.

Additionally, ongoing research and regulatory approvals are further expanding treatment options for LBCL, boosting its market share. The combination of unmet medical needs, effective therapies, and continued innovation in gene therapy for LBCL has positioned this segment as a market leader. In August 2024, JW Therapeutics has announced the NMPA approval of the supplemental biological license application for Carteyva, a CAR-T cell therapy, for adult patients with relapsed or refractory mantle cell lymphoma. This approval expands the use of Carteyva to a new patient population, offering a targeted treatment option for individuals who have not responded to previous therapies. With this approval, Carteyva demonstrates its potential to address a significant unmet need in the treatment of mantle cell lymphoma, showcasing the continued advancements in gene therapy for hematologic cancers.

The others segment is estimated to grow at the fastest CAGR of 21.27% during the forecast period. It encompasses cancers like ovarian cancer, lung cancer, pancreatic cancer, and solid tumors, which are increasingly being targeted by gene therapies. The growth in this segment is attributed to ongoing research and the development of innovative gene therapies aimed at treating these challenging and often hard-to-treat cancers. As advancements in gene delivery methods and personalized medicine continue, more treatment options are becoming available for these cancers, driving significant market growth in the others segment.

Vector Type Insights

Based on vector type, cancer gene therapy industry is segmented into lentivirus, retrovirus & gamma retrovirus, AAV, modified herpes simplex virus, adenovirus, and others. The lentivirus segment dominated the market with the largest revenue share of 47.30% in 2024. This is primarily due to lentiviral vectors' ability to efficiently deliver genetic material into both dividing and non-dividing cells, making them suitable for a wide range of cancers. Lentiviruses can integrate into the host genome, ensuring stable and long-term expression of therapeutic genes, which is crucial for successful cancer treatments. They are also preferred in developing advanced therapies like CAR-T cell treatments, which have shown promising results in blood cancers. Additionally, lentiviral vectors are versatile and can be engineered to target specific cancer cells, further boosting their market growth. These advantages position lentivirus-based gene therapies as one of the most effective and widely used options in the field of cancer gene industry.

In July 2023, Innovent and IASO Bio have announced the NMPA (National Medical Products Administration) approval of FUCASO, marking it as the first fully human BCMA (B-cell maturation antigen) CAR-T therapy. This approval is a significant milestone in the treatment of relapsed or refractory multiple myeloma. FUCASO offers a new and promising therapeutic option for patients who have not responded to prior treatments. As a fully human CAR-T therapy, it aims to reduce the risk of adverse immune reactions, improving the safety and effectiveness of the treatment. This approval highlights the growing potential of gene therapies in addressing challenging cancers like multiple myeloma. Thus, indicating the demand of the segment over the forecast period.

Route Of Administartion Insights

On the basis of route of administration, the market is segmented into intravenous and others. The intravenous segment dominated the market with the largest revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This dominance is due to the IV route's ability to deliver gene therapies directly into the bloodstream, allowing for quick and widespread distribution of therapeutic agents throughout the body. IV administration is well-established in clinical settings, offering ease of use and a reliable method for gene delivery. It is also preferred in many cancer treatments as it allows for precise control over dosing and treatment scheduling. Additionally, many gene therapy treatments are designed for intravenous infusion, making this method highly efficient for cancer patients. The growing use of IV-based gene therapies in clinical trials and successful treatments further strengthens its position in the market, driving continued growth in this segment. In June 2024, Sarepta Therapeutics announced FDA approval of ELEVIDYS for DMD patients aged 4 and older with a confirmed gene mutation. Full approval was given for ambulatory patients, and accelerated approval was given for nonambulatory patients, pending further trials, thereby propelling the growth of the segment.

The AAV (adeno-associated virus) segment is expected to grow at the fastest CAGR of 44.87% over the forecast period. This growth is mainly due to AAV vectors’ strong safety profile and low risk of causing immune reactions, making them a popular choice for gene therapies, including cancer treatments. AAVs can effectively deliver genes to a wide range of tissues and ensure long-lasting results, which is important for treating cancers. Their ability to target specific areas with minimal side effects boosts their appeal in clinical applications. As research and development in AAV-based therapies continue to advance, this segment is expected to see strong demand in the cancer gene therapy industry.

The others segment is expected to grow at a significant CAGR from 2025 to 2030, driven by the development of alternative gene delivery methods, such as oral and topical delivery systems. These methods are being researched for their potential to improve patient convenience and expand the accessibility of gene therapies. Additionally, innovations in non-viral vectors and nanotechnology are creating new opportunities for safer, more targeted treatments. As these alternative approaches show promise in clinical trials, they are expected to contribute significantly to the growth of this segment in the coming years.

Regional Insights

North America held the largest market share of 65.90% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The regional growth is attributable to the conducive environment facilitated by the government and the National Cancer Institute that supports research and development activities to enhance cancer therapeutics. Further, the presence of key market players in the region, their research efforts in devising gene therapy for cancer treatment, and collaborative efforts among market players to enhance research are boosting the market growth in the region. For instance, in January 2024, the CoGenT Global program, initiated by the U.S. FDA is a pioneering pilot project aimed at fostering collaboration among global regulatory bodies for the concurrent review of gene therapy applications. This innovative initiative draws inspiration from the success of the Center for Oncology Excellence (OCE)’s Project Orbis and seeks to leverage the expertise and resources of regulatory partners worldwide to streamline the evaluation process for gene therapy products.

Moreover, according to Greenberg Trauig article published in January 2024, the FDA predicts that by 2025, it is likely to approve 10 to 20 cell and gene therapy products annually. This forecast underscores the agency’s recognition of the potential of these therapies to address unmet medical needs and revolutionize the treatment landscape. These initiatives together propel the overall market growth.

U.S. Cancer Gene Therapy Market Trends

The market in the U.S. held the largest share in North America in 2024. This growth is owed to the growing innovation in the field of cancer gene therapy and expands the range of therapies available to oncologists and patients in the U.S. Strong demand for cost-effective generic and biosimilar products in the U.S. contributes to the overall market demand. For instance, in January 2024, Ferring Pharmaceuticals announced the full availability of ADSTILADRIN (nadofaragene firadenovec-vncg) in the U.S. This announcement marks a significant milestone in the treatment options available for patients with high-grade Bacillus Calmette-Guérin (BCG)-unresponsive non-muscle invasive bladder cancer (NMIBC).

Europe Cancer Gene Therapy Market Trends

The market in Europe is expected to grow significantly due to the presence of the EIC (European Innovation Council) Cell and Gene Therapy Symposium. This cell plays a crucial role in driving the market in Europe by facilitating collaboration, knowledge sharing, innovation showcase, networking opportunities, and international partnerships that collectively contribute to advancing research, development, and commercialization of novel therapies for cancer treatment. In October 2023, the EIC Cell and Gene Therapy Symposium was organized in the context of the 30th Annual ESGCT Congress in Brussels. This symposium is a significant event that brings together key stakeholders in cell and gene therapy to discuss the latest advancements, challenges, and opportunities in this rapidly evolving sector. It serves as a platform for researchers, clinicians, industry leaders, investors, and policymakers to exchange ideas, collaborate on innovative projects, and drive forward the development of cutting-edge therapies.

The cancer gene therapy market in the UK is anticipated to grow significantly over the forecast period. The growing advancements in biotechnology and a growing understanding of genetic mutations associated with cancer are propelling the market growth. Moreover, the key factors contributing to this growth include increased investment in research and development, favorable regulatory frameworks, and the rising prevalence of cancer cases. Additionally, collaborations between academic institutions and biotech companies are accelerating the development of innovative therapies. The adoption of personalized medicine, which tailors treatments based on individual genetic profiles, further enhances the potential of gene therapies to improve patient outcomes and offers a promising avenue for the future of cancer treatment in the UK.

The cancer gene therapy market in Germany is expected to boost exponentially, owing to the strong presence of a skilled & experienced workforce, which is also one of the primary factors expected to drive the market in Germany. For instance, in September 2023, the scientists from the German Cancer Research Center (DKFZ), University Medical Center Mannheim (UMM), and German Cancer Consortium (DKTK) conducted a groundbreaking study where they tested a new form of cellular immunotherapy against brain tumors in mice. This study marked the first successful application of this therapy in a preclinical model for brain tumors.

Asia Pacific Cancer Gene Therapy Market Trends

The Asia Pacific cancer gene therapy market is expected to grow at a lucrative rate over the forecast period. The opening of an expanded cell and gene therapy manufacturing facility at Peter Mac in July 2023 has significant implications for the market in the region. This development is poised to drive advancements in cancer treatment by enhancing the availability, accessibility, and affordability of cutting-edge gene therapies for patients across the Asia Pacific. Moreover, the growing achievement of Cell & Gene Therapy is poised to positively influence the landscape of cancer gene therapy in the Asia-Pacific region by bolstering credibility, fostering collaborations, attracting investments, promoting innovation, and expanding market opportunities. For instance, in September 2023, Novotech was awarded the Cell & Gene Therapy CRO Excellence Award. This recognition highlights Novotech’s expertise and capabilities in supporting cell and gene therapy research and development projects.

The cancer gene therapy market in China held a significant share in 2024. The advancement in gene therapy for deafness in China can have a profound impact on the market in the country. For instance, in November 2023, China made a significant breakthrough in gene therapy for deafness. Researchers successfully used a CRISPR-based gene editing technique to restore hearing in mice with genetic deafness. This groundbreaking achievement has opened new possibilities for treating genetic hearing loss in humans.

Japan cancer gene therapy market is expected to grow over the forecast period due to the rising genomic sequencing project implications for the market in Japan. For instance, in January 2023, the National Cancer Center Japan launched a project to sequence the genomes of 10,000 cancer patients to evaluate the risk of recurrence. This initiative aims to identify genetic mutations associated with cancer and predict the likelihood of cancer recurrence in individual patients. By understanding the genetic makeup of tumors, doctors can tailor treatment plans to target specific mutations, leading to more personalized and effective therapies.

Key Cancer Gene Therapy Company Insights

The market players operating in the cancer gene therapy industry are adopting product approval to increase the reach of their products in the market and improve their availability in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Cancer Gene Therapy Companies:

The following are the leading companies in the cancer gene therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Amgen Inc.

- Novartis AG

- Gilead Sciences, Inc.

- bluebird bio, Inc.

- Bristol-Myers Squibb Company

- Legend Biotech.

- JW Therapeutics

- CARsgen Therapeutics

- Nanjing IASO Biotechnology

- Krystal Biotech, Inc.

Recent Development

-

In June 2024, The FDA granted accelerated approval to the combination of adagrasib and cetuximab for the treatment of patients with KRAS G12C-mutated colorectal cancer. This decision marks a significant advancement in precision medicine for colorectal cancer patients with this specific genetic mutation.

-

In April 2024, India witnessed the launch of its first homegrown CAR T-cell therapy. This groundbreaking therapy was unveiled by the President of India, who hailed it as a beacon of “new hope” in the fight against cancer. CAR T-cell therapy is a form of immunotherapy that involves modifying a patient’s own immune cells to better recognize and attack cancer cells.

-

In April 2024, Pfizer Inc. received approval from the U.S. FDA for BEQVEZ to treat adults with moderate to severe hemophilia B who are currently using factor IX (FIX) prophylaxis therapy, have experienced life-threatening hemorrhage in the past, or have had repeated serious spontaneous bleeding episodes. Additionally, these individuals must not have neutralizing antibodies to adeno-associated virus serotype Rh74var (AAVRh74var) capsid as confirmed by an FDA-approved test.

Cancer Gene Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.27 billion

Revenue forecast in 2030

USD 12.76 billion

Growth rate

CAGR of 19.34% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

June 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, Route of Administration, Vector Type, Region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; Mexico; UK; Germany; Switzerland; Japan; China; Australia; South Korea

Key companies profiled

Amgen Inc., Novartis AG, Gilead Sciences, Inc., bluebird bio, Inc., Bristol-Myers Squibb Company, Legend Biotech, JW Therapeutics, CARsgen Therapeutics, Nanjing IASO Biotechnology, Krystal Biotech, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cancer Gene Therapy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cancer gene therapy market based on indication, route of administration, vector type, and region.

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Large B-Cell Lymphoma

-

Multiple Myeloma

-

Acute Lymphoblastic Leukemia (ALL)

-

Melanoma (lesions)

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Others

-

-

Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lentivirus

-

RetroVirus & gamma RetroVirus

-

AAV

-

Modified Herpes Simplex Virus

-

Adenovirus

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

South Korea

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. North America dominated the cancer gene therapy market with a share of 65.90% in 2024. This is attributable to the presence of key market players in the region, and their research efforts in devising gene therapy for cancer treatment.

b. Some key players operating in the cancer gene therapy market include Abeona Therapeutics Inc., Asklepios BioPharmaceutical Inc., Altor Bioscience Inc., Bluebird bio Inc., BioCancell Inc., Celgene Inc., Elevate Bio Inc., GlaxoSmithKline Inc., Genelux Corporation, GenVec, Introgen Therapeutics Inc., Merck KGaA, OncoGenex Pharmaceuticals Inc.

b. Key factors that are driving the market growth include the increasing prevalence of cancer cases, the growing demand for cancer gene therapy, and the emergence of advancements in gene therapy.

b. The global cancer gene therapy market size was estimated at USD 4.51 billion in 2024 and is expected to reach USD 5.27 billion in 2025.

b. The global cancer gene therapy market is expected to grow at a compound annual growth rate of 19.34% from 2025 to 2030 to reach USD 12.76 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.