- Home

- »

- Biotechnology

- »

-

Cancer Biomarkers Market Size And Share Report, 2030GVR Report cover

![Cancer Biomarkers Market Size, Share & Trends Report]()

Cancer Biomarkers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Breast Cancer, Prostate Cancer), By Biomolecule (Genetic, Epigenetic, Metabolic, Proteomic), By Application, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-862-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cancer Biomarkers Market Summary

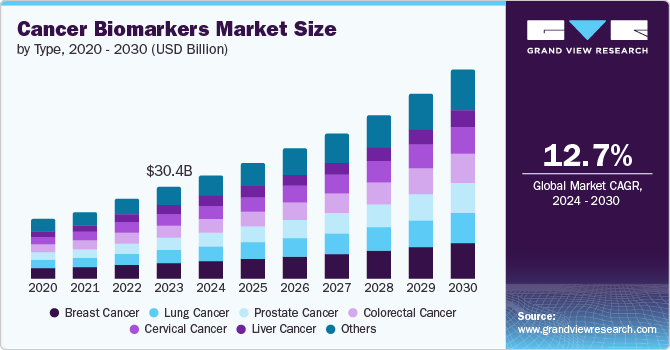

The cancer biomarkers market size was valued at USD 30.35 billion in 2023 and is projected to reach USD 69.76 billion by 2030, growing at a CAGR of 12.7% from 2024 to 2030. Biomarkers can help determine the prognosis of cancer patients and play a significant role in the diagnosis and treatment of nearly every patient.

Key Market Trends & Insights

- North America dominated the cancer biomarkers market with revenue share of 43.84% in 2023.

- The cancer biomarkers market in the U.S. dominated with a share of 85.8% in 2023

- By type, the breast cancer segment held a significant market share in terms of revenue in 2023

- By biomolecule, the genetic biomarkers segment dominated the market in terms of revenue share in 2023.

- By application, the diagnostics segment dominated the market in terms of revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.35 Billion

- 2030 Projected Market Size: USD 69.76 Billion

- CAGR (2024-2030): 12.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The main drivers of growth in this market are the increasing incidence of cancer worldwide, growing research on cancer biomarkers, growing use of biomarkers in drug discovery and development, and individualized treatment approaches and technical developments. The rising global incidence of cancer is fueling the growth of the cancer biomarkers market as the demand for early detection and personalized treatment options increases. This trend underscores the crucial role of biomarkers in improving cancer diagnosis and therapy. For instance, in 2022, around 20 million people were diagnosed. While many (53.5 million) survived for at least 5 years, nearly 10 million people died from cancer in 2022. Furthermore, a World Health Organization (WHO) survey identified a critical gap in healthcare access, with less than 40% of countries providing basic cancer care and palliative services.

The expanding research on cancer biomarkers is propelling the cancer biomarkers market forward as advancements in this field enhance early detection, diagnosis, and personalized cancer treatment. This growing focus underscores the vital role of biomarkers in improving cancer care outcomes. For instance, a clinical trial, OPTIC RCC, was testing a way to personalize treatment for kidney cancer. Doctors were expected to analyze the patient's tumor genes to see which treatment is likely to work best. This builds on the knowledge from past studies and aims to improve patient outcomes.

The increasing use of biomarkers in drug discovery and development is driving the growth of the cancer biomarkers market. These biomarkers enhance the precision and effectiveness of cancer treatments, highlighting their critical role in advancing personalized medicine and improving patient outcomes.

The increasing use of biomarkers in drug discovery and development drives the growth of the cancer biomarkers market. These biomarkers enhance the precision and effectiveness of cancer treatments, highlighting their critical role in advancing personalized medicine and improving patient outcomes. According to the Alliance for Patient Access, Biomarkers are genetic indicators that predict which medications will be effective for individual patients, making them essential for personalized cancer treatment. For cancer patients, biomarker testing is a crucial initial step toward customized therapy.

Type Insights

The breast cancer segment held a significant market share in terms of revenue in 2023 and it is also expected to be the witness the fastest CAGR over the forecast period. The driving factors for breast cancer in the cancer biomarkers market include the disease's high prevalence, advancements in genomic and proteomic technologies, increased funding for breast cancer research, and the growing emphasis on personalized medicine. These factors contribute to developing more precise diagnostic tools and targeted therapies, improving patient outcomes. For instance, in 2022, breast cancer caused 670,000 deaths worldwide, with about half of all cases occurring in women without specific risk factors beyond sex and age. It was the most common cancer among women in 157 out of 185 countries.

The others segment held a notable share in 2023 pertaining to the increased research on rare cancers, advancements in genomics and proteomics, the rising incidence of cancers such as pancreatic and ovarian, and the growing demand for personalized medicine. These developments enhance early diagnosis, improve treatment strategies, and improve patient outcomes for various cancers. For instance, the incidence rate of pancreatic cancer was 13.5 per 100,000 men and women annually, with a death rate of 11.2 per 100,000. In 2021, an estimated 100,669 people were living with pancreatic cancer in the U.S.

Biomolecule Insights

The genetic biomarkers segment dominated the market in terms of revenue share in 2023. Genetic biomarkers are crucial in the cancer biomarkers market due to several driving factors. These include advancements in genomic technologies allowing for more precise identification of genetic mutations linked to cancer susceptibility and progression. In addition, the growing adoption of personalized medicine emphasizes the need for biomarkers to guide treatment decisions based on individual genetic profiles.

The increasing prevalence of cancer and the quest for early detection methods also fuel the demand for genetic biomarkers, enhancing their role in improving patient outcomes through targeted therapies and tailored treatment approaches. For instance, in April 2024, the California Institute for Regenerative Medicine (CIRM) granted USD 11.8 million to Denovo Biopharma LLC (Denovo) to advance DB107, Denovo's DGM7 biomarker-guided gene therapy for high-grade glioma (HGG), including glioblastoma (GBM), a severe form of brain cancer. Was expected to support a Phase 1/2 clinical trial investigating DB107 in newly diagnosed HGG patients.

The epigenetics segment is expected to be the fastest growing segment over the forecast period. One of the key drivers boosting the growth of the segment is the growing research for the development of novel biomarkers. Furthermore, market players are collaborating with pharmaceutical companies, which is contributing to the segment growth. For instance, in February 2024, C-Biomex Ltd. and the University of Texas MD Anderson Cancer Center announced a strategic research collaboration to jointly develop CBT-001, a radioligand targeting the CA9 cancer biomarker. This partnership leverages MD Anderson’s expertise in translational radiopharmaceutical research alongside C-Biomex’s unique radioligand. The collaboration was expected to involve conducting preclinical evaluations of CBT-001, advancing it toward early-phase clinical trials, and supporting an anticipated Investigational New Drug (IND) application to the FDA.

Application Insights

The diagnostics segment dominated the market in terms of revenue share in 2023. Factors such as the growing development of cancer biomarkers based on oncology tests that are highly efficient and effective and growing government initiatives may drive the segment's growth. For instance, in July 2024, Genoks GDHM and healthcare technology firm Velsera formed a strategic partnership to advance cancer diagnostics and treatment across Turkey and neighboring regions. This collaboration was expected to integrate Velsera’s Clinical Genomics Workspace (CGW) with Genoks’s expertise in genomics, enhancing the detection and characterization of various cancer types. Velsera’s CGW platform supports comprehensive analysis of solid tissue, liquid tumors, and hematological cancer samples, specifically designed for oncologists and specialists in inherited diseases to foster the expansion of next-generation sequencing (NGS) testing initiatives. Genoks aims to utilize Velsera’s genomic analysis and data interpretation capabilities to bolster its oncology diagnostic capabilities within Turkey.

The personalized medicine segment is the fastest growing segment during the forecast period. Personalized medicine in the market is advancing due to breakthroughs in genomic and proteomic technologies, pinpointing biomarkers that forecast how patients will respond to treatments, thereby enhancing treatment precision and outcomes. With cancer rates rising globally, the demand for therapies that offer targeted effectiveness is growing, emphasizing the significance of personalized approaches.

Technology Insights

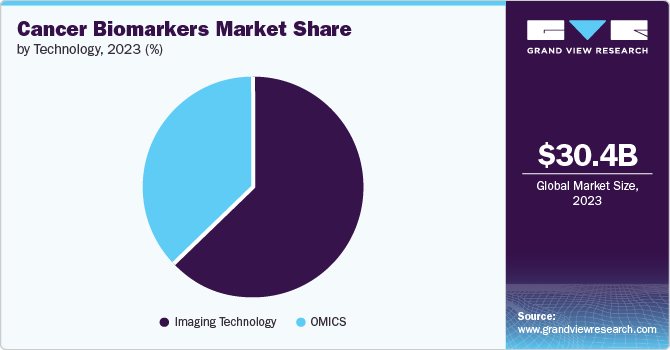

The imaging technologies segment dominated the market share in 2023 due to its high-throughput nature, accuracy, and broad applicability in biomarker discovery and diagnosis. For instance, in October 2023, Koninklijke Philips N.V. and Quibim partnered to integrate artificial intelligence (AI), which has enabled MR imaging and image analysis software to facilitate quicker and more efficient prostate cancer diagnosis and treatment. This collaboration addresses challenges such as staffing shortages and cost reduction in healthcare delivery.

The OMICS segment is expected to grow at the fastest CAGR over the forecast period. OMICS technologies are pivotal in the cancer biomarkers market because they provide comprehensive molecular insights into tumors through genomics, proteomics, and metabolomics. These advancements facilitate the discovery of novel biomarkers essential for early diagnosis, prognosis, and personalized treatment selection. In addition, the increasing sophistication of bioinformatics tools enhances the interpretation and application of OMICS data, driving their integration into clinical practice and accelerating advancements in cancer research and therapy.

Region Insights

North America dominated the cancer biomarkers market with revenue share of 43.84% in 2023. This dominance is due to the presence of numerous market players dedicated to cancer biomarkers and substantial investments by the U.S. government in research and development efforts, which foster innovation. Moreover, the implementation of advanced technologies further propels market expansion in North America. For instance, in June 2024, Cizzle Biotechnology Holdings plc, a UK-based diagnostics developer, announced its collaboration with its licensing partner, Cizzle Bio Inc., in the U.S. Their proprietary test for the CIZ1B biomarker was chosen for inclusion in a major study at a prominent cancer center in the U.S.

U.S. Cancer Biomarkers Market Trends

The cancer biomarkers market in the U.S. dominated with a share of 85.8% in 2023 due to the market growth is largely driven by factors such as the availability of new drugs, the presence of a strong pipeline, and the rise in the incidence of renal cancer due to the growing geriatric population and more prominent smoking habits. For instance, in August 2023, Quest partnered with Envision Sciences to introduce a new prostate cancer biomarker test aimed at identifying patients with aggressive forms of the disease. This innovative test incorporates biomarkers Appl1, Sortilin, and Syndecan-1, which were researched by investigators at the University of South Australia, Adelaide, and subsequently developed and validated for commercial use.

Asia Pacific Cancer Biomarkers Market Trends

Asia Pacific cancer biomarkers market is anticipated to witness the fastest growth at a CAGR of 14.3% over the forecast period. The growth in the prevalence of cancer is driving the market in the region. Furthermore, the government is constantly funding development activities to develop new products. Thus, rising awareness of cancer biomarkers is also boosting the market's growth in the region. For instance, in 2023, Asia Pacific accounted for 45% of global breast cancer cases and 58% of cervical cancer deaths worldwide. Investments toward achieving cervical cancer elimination goals could generate a return of over USD 3 to the economy for every dollar spent. Regional governments in the Asia Pacific could implement various actionable measures to mitigate the impact of cancer on women, fostering significant improvements in public health outcomes.

Key Cancer Biomarkers Company Insights

Some of the key companies in the Cancer Biomarkers market include Abbott Laboratories QIAGEN;Thermo Fisher Scientific Inc;Affymetrix Inc;Illumina, Inc.;Agilent Technologies;F. Hoffmann-La Roche AG;Merck & Co. Inc;Hologic, Inc and Sino Biological Inc. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Abbott offers a wide variety of assays to test for many types of cancer, including breast and colon. It also offer personalized oncology testing solutions for early detection, diagnosis, and monitoring needs.

-

QIAGEN offers services for sample collection and data interpretation, utilizing robust technologies and resources to assist in detecting, analyzing, and validating relevant biomarkers. It continues to innovate and expand its range of solutions.

Key Cancer Biomarkers Companies:

The following are the leading companies in the cancer biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- QIAGEN

- Thermo Fisher Scientific Inc

- Affymetrix Inc

- Illumina, Inc.

- Agilent Technologies

- F. Hoffmann-La Roche AG

- Merck & Co. Inc

- Hologic, Inc

- Sino Biological Inc

Recent Developments

-

In March of 2023, LES LABORATOIRES SERVIER partnered with QIAGEN to create a novel mIDH1 companion diagnostic test to advance their Hemato-Oncology Portfolio. This collaboration focuses on developing a test to identify acute myeloid leukemia patients.

-

In April 2021, Roche launched the Elecsys Anti-p53 immunoassay for diagnosing various cancers, available in CE mark-accepting markets. This test quantifies anti-p53 antibodies in serum and plasma, aiding physicians in diagnosing throat, bowel, and breast cancers when used with other diagnostics.

-

In December 2020, the U.S. FDA approved Thermo Fisher Scientific Inc’s Oncomine Dx Target Test to identify EGFR Exon20 insertion mutation-positive metastatic non-small cell lung cancer (mNSCLC) patients eligible for Takeda's targeted therapy, EXKIVITY (mobocertinib).

Cancer Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.10 billion

Revenue forecast in 2030

USD 69.76 billion

Growth Rate

CAGR of 12.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, biomolecule, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; India; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; QIAGEN; Thermo Fisher Scientific Inc; Affymetrix Inc; Illumina, Inc.; Agilent Technologies; F. Hoffmann-La Roche AG; Merck & Co. Inc; Hologic, Inc., and Sino Biological Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cancer Biomarkers Market Report Segmentation

This report forecasts revenue growth Country, Type, Biomolecule, Application Technology, and Region and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cancer biomarkers market report based on type, biomolecule, application, technology, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Breast cancer

-

Prostate cancer

-

Colorectal cancer

-

Cervical cancer

-

Liver cancer

-

Lung cancer

-

Others

-

-

Biomolecule Outlook (Revenue, USD Million; 2018 - 2030)

-

Genetic Biomarkers

-

Epigenetic Biomarkers

-

Metabolic Biomarkers

-

Proteomic Biomarkers

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Drug discovery and Development

-

Diagnostics

-

Personalized medicine

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Imaging Technology

-

OMICS

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cancer biomarkers market size was estimated at USD 30.35 billion in 2023 and is expected to reach USD 34.10 billion in 2024.

b. The global cancer biomarkers market is expected to grow at a compound annual growth rate of 13.9% from 2024 to 2030 to reach USD 69.76 billion by 2030.

b. North America dominated the global cancer biomarkers market and accounted for largest market share of 43.84% in 2023, attributable to high rate of cancer diagnostics adoption in the region along with favorable cancer diagnostics reimbursement scenario.

b. Some key players operating in the cancer biomarker market include Abbott, Illumina, Inc., F. Hoffmann-La Roche Ltd., QIAGEN, Affymetrix Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Sino Biological, Inc., Merck & Co., Inc., Hologic, Inc., BD (Becton, Dickinson and Company)

b. Key factors that are driving the market growth include the growing geriatric population base, growing prevalence of cancer, increasing government funding for cancer research, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.