- Home

- »

- Clinical Diagnostics

- »

-

Canada In Vitro Diagnostics Market Size, Share Report, 2030GVR Report cover

![Canada In Vitro Diagnostics Market Size, Share & Trends Report]()

Canada In Vitro Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Services), By Technique, By Application, By End Use, By Test Location, By Province, And Segment Forecasts

- Report ID: GVR-4-68040-084-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada In Vitro Diagnostics Market Trends

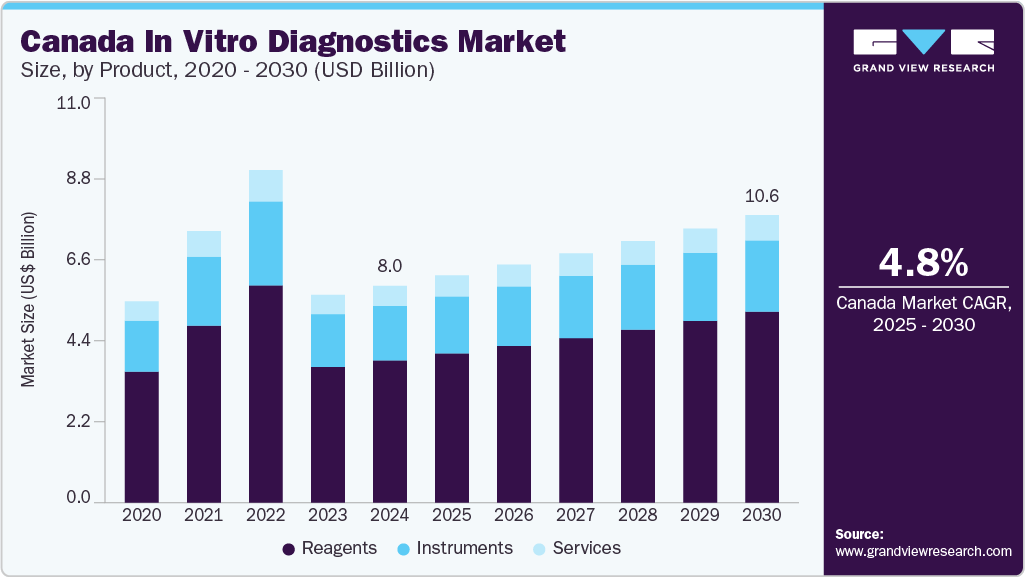

The Canada in vitro diagnostics market size was valued at USD 8.05 billion in 2024 and is projected to witness a CAGR of 4.8% from 2025 to 2030. The increasing prevalence of chronic diseases such as cancer, inflammatory conditions, autoimmune disorders, and infectious diseases is one of the major factors expected to drive growth. Moreover, the rise in the geriatric population and technological advancements in In-vitro diagnostics (IVD) devices are also expected to drive the market.

The prevalence of various diseases, such as cancer, autoimmune diseases, and inflammatory conditions, is increasing in Canada, which is expected to drive the demand for IVD testing. For instance, according to the Canadian Cancer Society, approximately 239,100 Canadians were expected to be diagnosed with cancer in 2023, and about 86,700 deaths were anticipated to be reported from cancer.

Moreover, according to the Canadian Congenital Heart Alliance, about 1 in 80-100 children in Canada is born with congenital heart disease (CHD). It is estimated that approximately 257,000 Canadians are living with CHD. The increasing prevalence of chronic diseases and growing awareness about the early diagnosis of diseases are expected to further drive the demand for in vitro diagnostic services in the country.

Canada’s geriatric population is gradually increasing. The number of people aged 65 and older is expected to grow by 68%, reaching 10.4 million by 2037. This growth is reported across all provinces and territories in Canada. As people age, their immune systems weaken, increasing their susceptibility to various diseases. Hence, a growing geriatric population requires improved healthcare services, particularly for chronic conditions.

As the population ages, the need for frequent and accurate diagnostic tests to manage age-related health conditions increases. Technological advancements have improved the precision, efficiency, and accessibility of these tests, enabling better health monitoring and early disease detection.

Product Insights

The reagents segment dominated the market with the largest revenue share of 65.5% in 2024, owing totheir crucial role in diagnostic tests. Reagents are essential for disease detection, resulting in high demand across laboratories and diagnostic centers. This widespread usage has led to significant revenue growth, solidifying the segment’s prominence. The growth of the reagent segment is attributed to factors such as the rising R&D initiatives by the market players to develop novel biomarker kits, along with the increasing commercialization of reagents, which is expected to spur the demand for reagents during the forecast period.

The instruments segment is projected to grow at a significant CAGR of 4.5% from 2025 to 2030. This growth is augmented by technological advancements in products and high demand for advanced in vitro diagnostic devices. For instance, the introduction of portable instruments such as Cobas 4800, developed by Roche Diagnostics, and GeneXpert by Cepheid may fuel the Canadian IVD market's growth over the forecast period.

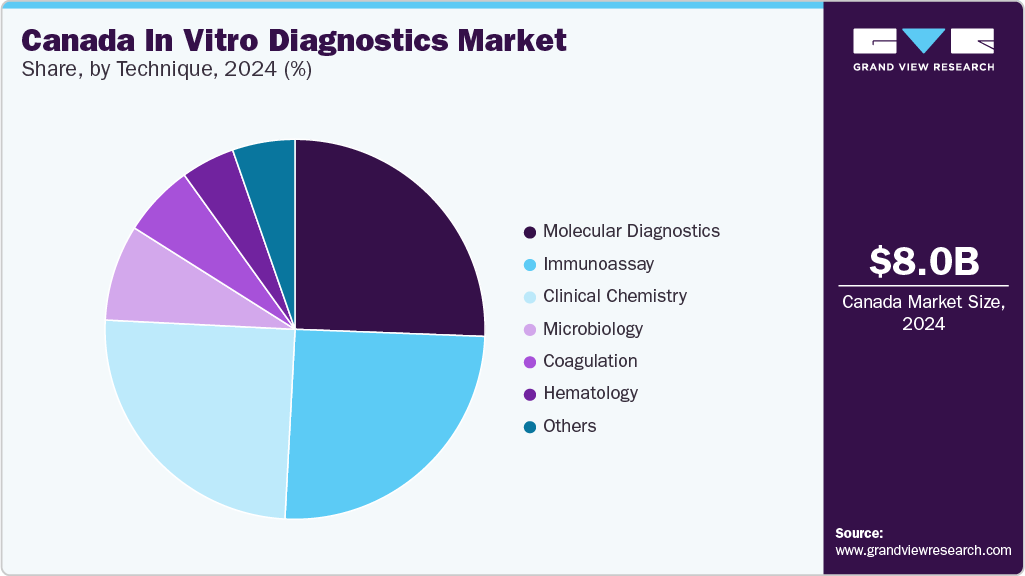

Technique Insights

The molecular diagnostics segment held the largest market share in 2024, attributed to its crucial role in accurately diagnosing a wide range of diseases. This growth is fueled by advancements in technologies like PCR and next-generation sequencing, along with the rising prevalence of infectious diseases, genetic disorders, and cancer. Increased product approvals, launches, and R&D by key players have further strengthened the segment.

The coagulation segment is expected to be the fastest-growing segment over the forecast period. The increasing prevalence of cardiovascular diseases, blood-related disorders, and autoimmune diseases is expected to boost the demand for coagulation testing, using IVD instruments. Moreover, instruments are getting updated and handheld coagulation analyzers, such as the Xprecia stride coagulation analyzer, such instruments are anticipated to enhance the overall workflow of detection.

Application Insights

The infectious disease segment accounted for the largest market share in 2024, attributed to the high prevalence of infectious diseases and the need for accurate and timely diagnostics. The demand for rapid testing and early detection has increased, particularly during public health emergencies. Continuous advancements in diagnostic technologies have further propelled the growth of this segment. The widespread application of infectious disease diagnostics in hospitals, clinics, and laboratories has cemented its dominance.

The oncology segment is anticipated to be the fastest-growing segment over the forecast period, driven by the rising incidence of cancer and the demand for early and accurate diagnostics. Technological innovations, particularly liquid biopsies and molecular testing, are improving cancer detection and monitoring. In addition, awareness campaigns and government initiatives promoting cancer screening are boosting this growth.

End Use Insights

The hospital segment held the largest share in 2024, owing to its pivotal role in patient care and diagnostics. Hospitals are major healthcare providers, conducting a wide range of diagnostic tests for various conditions. The high volume of patients, coupled with the availability of advanced diagnostic technologies, contributes to the dominance of this segment. In January 2022, Yourgene announced the launch of expanded facilities under Yourgene Health Canada Inc. The new facilities are expected to be well suited for the company’s consumable shipping requirements and instrument manufacturing.

The home care segment is projected to be the fastest-growing segment over the forecast period, propelled by the shift towards personalized healthcare and convenience. With the rise of chronic diseases and an aging population, more individuals are seeking at-home diagnostic solutions for early detection and ongoing monitoring.

Test Location Insights

The "others" test location segment, including outpatient clinics and private laboratories, garnered the largest share in 2024, due to the broad range of diagnostic settings these locations offer, providing diverse and convenient testing options for patients. The shift towards specialized testing services outside of traditional hospital environments has substantially contributed to the growth of this segment. Moreover, advancements in technology and a focus on patient-centric care have strengthened the expansion of this segment, securing its dominant position in the Canada in vitro diagnostics industry.

The home care segment is anticipated to be the fastest-growing segment over the forecast period. Government initiatives and increasing adoption of self-tests are some of the key factors anticipated to boost the segment’s growth over the forecast period. Regulatory authorities rigorously evaluate the performance of diagnostic tests to meet global standards of safety, performance, and quality.

Province Insights

Ontario's in vitro diagnostics market captured the largest revenue share of 31.1% in 2024, fueled by the advanced healthcare infrastructure of the province and the high prevalence of chronic diseases such as cancer and diabetes. Numerous specialized laboratories and diagnostic centers in Ontario have also contributed to this growth. Furthermore, the aging population in the province has increased the demand for diagnostic services, further positioning Ontario as the leading region in the market.

East Canada is anticipated to be the fastest-growing region with a CAGR of 6.1% over the forecast period.The expanding healthcare infrastructure of the region and increasing focus on personalized medicine are significant factors in this upward trajectory. In addition, the rising prevalence of chronic diseases and the aging population are fueling the demand for advanced diagnostic solutions. Technological innovations and the emphasis on early disease detection further contribute to the region's growth. With these favorable conditions, East Canada is set to become a prominent and thriving region in the Canada in vitro diagnostics industry.

Key Canada In Vitro Diagnostics Company Insights

Some of the key companies in the Canada in vitro diagnostics industry include Abbott; bioMérieux SA; Bio-Rad Laboratories, Inc.; Siemens Healthcare GmbH; QIAGEN; Quidel Corporation; F. Hoffmann-La Roche Ltd; BD; Danaher; Agilent Technologies, Inc.

-

Abbott offers a diverse range of healthcare solutions, including medical devices, diagnostics, nutrition, and pharmaceuticals. It focuses on improving patient care and health outcomes through innovations in areas such as diabetes management and cardiovascular health.

-

bioMérieux SA offers in vitro diagnostic solutions for clinical laboratories, hospitals, and industry. Its products include systems, reagents, and software for diagnosing infectious diseases, cancer, and cardiovascular conditions, as well as microorganism identification.

Key Canada In Vitro Diagnostics Companies:

- Abbott

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- QIAGEN

- QuidelOrtho Corporation

- F. Hoffmann-La Roche Ltd

- BD

- Danaher

- Agilent Technologies, Inc.

Recent Developments

-

In March 2024, QuidelOrtho Corporation received approval from Health Canada for its Triage PLGF test for laboratory use. This fluorescence immunoassay, used with the compact Triage MeterPro Instrument, quantitatively measures placental growth factor (PLGF ) in maternal plasma specimens.

-

In August 2023, bioMérieux Canada received Health Canada approval for its BIOFIRE Joint Infection (JI) Panel. This panel can quickly test for 31 pathogens linked to joint infections and 8 antimicrobial resistance (AMR) genes, enhancing timely antibiotic therapy and stewardship.

Canada In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.44 billion

Revenue forecast in 2030

USD 10.68 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, application, end use, test location, province

Province scope

Ontario; Quebec; West Canada; East Canada

Key companies profiled

Abbott; bioMérieux SA; Bio-Rad Laboratories, Inc.; Siemens Healthcare GmbH; QIAGEN; Quidel Corporation; F. Hoffmann-La Roche Ltd; BD; Danaher; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Canada in vitro diagnostics market report on the basis of product, technique, application, end use, test location, and province:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Instruments

-

Reagents

-

Services

-

-

Hematology

-

Instruments

-

Reagents

-

Services

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Services

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Services

-

-

Coagulation

-

Instruments

-

Reagents

-

Services

-

-

Microbiology

-

Instruments

-

Reagents

-

Services

-

-

Others

-

Instruments

-

Reagents

-

Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Primary Care

-

Laboratories

-

Home Care

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Point of Care

-

Home Care

-

Others

-

-

Province Outlook (Revenue, USD Million, 2018 - 2030)

-

Ontario

-

Quebec

-

West Canada

-

Alberta

-

Saskatchewan

-

Manitoba

-

British Columbia

-

-

East Canada

-

Nova Scotia

-

Prince Edward Island

-

New Brunswick

-

Newfoundland and Labrador

-

-

Frequently Asked Questions About This Report

b. The Canada in vitro diagnostics market size was estimated at USD 3.58 billion in 2022 and is expected to reach USD 3.64 billion in 2023.

b. The Canada in vitro diagnostics market is expected to grow at a compound annual growth rate of 2.6% from 2023 to 2030 and is expected to reach USD 4.36 billion by 2030.

b. The reagents segment is expected to dominate the Canada in vitro diagnostics market with a share of 63.07% in 2022 due to the introduction of novel reagents and increasing R&D initiatives undertaken by major market players.

b. Some key players operating in the Canada in vitro diagnostics market include Abbott, Bio-Rad Laboratories, Inc, F. Hoffmann-La Roche Ltd, BD, and bioMérieux SA among others.

b. Increasing prevalence of chronic & infectious diseases, increasing geriatric population, and development of novel products for IVD testing are the major factors driving the Canada in vitro diagnostics market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.