- Home

- »

- Advanced Interior Materials

- »

-

Butterfly Valve Market Size And Share, Industry Report, 2030GVR Report cover

![Butterfly Valve Market Size, Share & Trends Report]()

Butterfly Valve Market (2025 - 2030 ) Size, Share & Trends Analysis Report, By Function (Manual, Electric-actuated), By End Use (Oil & Gas, Water & Wastewater Treatment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-557-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Butterfly Valve Market Summary

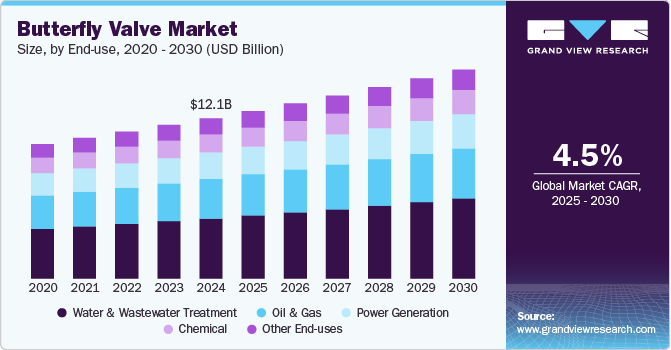

The global butterfly valve market size was estimated at USD 12.12 billion in 2024 and is projected to reach USD 15.78 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. driven by the robust demand from the oil and gas sector. Butterfly valves are extensively used in upstream, midstream, and downstream operations for isolating and regulating flow.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of about 44.8% in 2024.

- In the United States, the butterfly valve market benefits from substantial investments in shale gas exploration and petrochemical processing facilities.

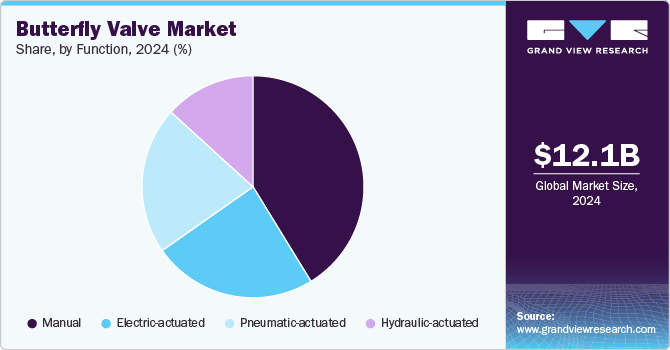

- By function, the manual segment led the market and accounted for the largest revenue share of 41.2% in 2024, driven by its cost-effectiveness and simplicity of operation.

- By end use, the water & wastewater treatment segment dominated the market and accounted for the largest revenue share of 37.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.12 Billion

- 2030 Projected Market Size: USD 15.78 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

As global energy demand continues to rise, especially in emerging economies, oil and gas exploration and production activities are witnessing considerable expansion. This, in turn, is propelling the requirement for reliable, compact, and cost-efficient flow control devices such as butterfly valves. In addition, the push for modernization and the integration of automated valves in oil and gas infrastructures are further boosting market growth. An increase in global investments in water treatment and wastewater management is acting as a major driver for the butterfly valve market. Governments and private stakeholders are increasingly focusing on upgrading water infrastructure to meet the needs of growing urban populations and comply with stringent environmental regulations. Butterfly valves, due to their durability, low-pressure drop, and ease of operation, are widely adopted in water treatment plants for flow isolation and control. The increased deployment of desalination plants in arid regions and the retrofitting of aging municipal water systems are also contributing to the upward trend in demand.

The butterfly valve market is experiencing strong momentum from the chemical and power generation industries. In chemical manufacturing, where corrosive fluids and harsh operating conditions are common, butterfly valves offer an effective solution due to their resistance to a wide range of chemicals and their ability to handle high temperatures and pressures. Similarly, in power generation, particularly thermal and nuclear plants, these valves are essential for controlling steam and cooling water flow. As the global power demand escalates and new plants are established to diversify energy portfolios, the adoption of butterfly valves is expected to increase proportionally.

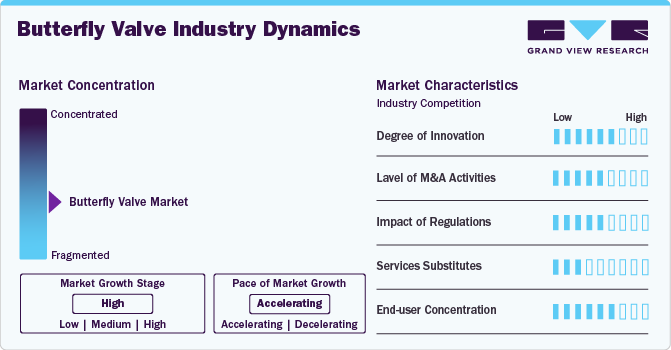

Market Concentration & Characteristics

The global butterfly valve market exhibits moderate to high market concentration, characterized by the presence of several large multinational corporations alongside numerous regional players. Market leaders such as Emerson Electric Co., Flowserve Corporation, and AVK Group dominate through extensive distribution networks, strong R&D capabilities, and diversified product portfolios. The degree of innovation in the industry remains significant, driven by the need for enhanced performance, energy efficiency, and automation compatibility. Innovations include the integration of smart valve technologies, corrosion-resistant materials, and advanced sealing mechanisms, particularly in applications requiring high reliability such as oil & gas, water treatment, and chemical processing. These technological developments are pivotal in maintaining competitive advantage and catering to the evolving demands of end users.

The market has seen a moderate level of mergers and acquisitions in recent years, aimed at geographic expansion, product diversification, and consolidation of technological expertise. Regulatory frameworks also play a considerable role in shaping the market, particularly concerning emissions, environmental safety, and industrial safety standards—especially in sectors such as water management and energy. Substitutes for butterfly valves, such as ball valves and gate valves, pose limited threat due to application-specific advantages that butterfly valves offer, including compact design and quick operation. Furthermore, end use concentration is moderately high, with sectors such as water & wastewater, oil & gas, and power generation constituting the majority of demand, thus influencing the market dynamics and product development priorities of key manufacturers.

Function Insights

The manual segment led the market and accounted for the largest revenue share of 41.2% in 2024, driven by its cost-effectiveness and simplicity of operation. Manual butterfly valves require no external power source, making them an ideal choice in locations with limited access to electricity or in applications where automation is not necessary. This attribute significantly reduces both installation and operational costs, making manual valves an economical option for small- and medium-scale industries and water management facilities.

The electric-actuated segment is expected to grow at fastest CAGR of 5.0% over the forecast period, driven by the increasing demand for automation across various industrial sectors. Industries such as oil and gas, water and wastewater treatment, power generation, and chemical processing are increasingly adopting electric-actuated butterfly valves to improve operational efficiency and process control. These valves offer precise modulation capabilities and remote operability, which enhance system responsiveness and reduce human intervention. The transition toward Industry 4.0 and the integration of smart technologies further support the deployment of electric-actuated valves, as they are well-suited for digital monitoring and automated control systems.

End Use Insights

The water & wastewater treatment segment dominated the market and accounted for the largest revenue share of 37.5% in 2024. Governments and municipal authorities across developed and developing countries are heavily investing in water treatment facilities, sewage systems, and desalination plants. Butterfly valves are widely used in these applications owing to their cost-effectiveness, compact design, and ability to regulate high-volume flow, making them ideal for managing large-scale water distribution and treatment systems.

Chemical segment is expected to grow significantly at CAGR of 4.7% over the forecast period, driven by stringent environmental and safety regulations across various regions which are compelling chemical companies to upgrade their infrastructure with high-performance and leak-proof valve systems. Butterfly valves, known for their compact design and reliable sealing capabilities, are increasingly preferred for use in critical processes to ensure compliance with regulatory standards and to mitigate the risk of chemical leaks or spills.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of about 44.8% in 2024. The Asia Pacific butterfly valve market is experiencing robust growth due to rapid industrialization, urbanization, and increasing infrastructure development. Government-led initiatives focusing on expanding water treatment facilities and boosting energy production are significant contributors. The region’s strong manufacturing base, combined with rising investments in power and chemical sectors, is creating substantial demand for cost-effective and reliable valve solutions across emerging economies.

China Butterfly Valve Market Trends

In China, the butterfly valve market is driven by the country’s aggressive push towards infrastructure development and urban expansion. Major investments in power generation, especially renewable energy projects, and the continued growth of the chemical and petrochemical industries fuel the demand for high-performance butterfly valves. In addition, stringent government regulations aimed at improving environmental compliance and industrial safety standards are encouraging the adoption of advanced flow control technologies.

North America Butterfly Valve Market Trends

The butterfly valve market in North America is primarily driven by the modernization and expansion of water and wastewater infrastructure. Significant investments in industrial automation, especially within the oil & gas and power generation sectors, also contribute to market growth. In addition, growing environmental regulations necessitate the use of efficient flow control solutions, further supporting demand. The adoption of advanced valve technologies integrated with smart monitoring systems is accelerating in the region, enhancing operational efficiency and reliability across critical industries.

In the United States, the butterfly valve market benefits from substantial investments in shale gas exploration and petrochemical processing facilities. The country’s emphasis on upgrading aging infrastructure, including pipelines and water systems, has led to increased demand for durable and cost-efficient flow control products. Furthermore, the strong presence of key market players and consistent advancements in automation and industrial IoT (IIoT) solutions are fostering the adoption of smart butterfly valves across diverse end-use industries.

Europe Butterfly Valve Market Trends

The European butterfly valve market is supported by stringent environmental regulations and the widespread adoption of renewable energy systems. Demand is also rising due to ongoing upgrades in water management and wastewater treatment infrastructure. The region's emphasis on energy efficiency and sustainable industrial practices promotes the use of high-efficiency and low-leakage valve technologies. Moreover, the growth of the pharmaceutical and food & beverage sectors further strengthens market demand across key European countries.

In Germany, strong demand for butterfly valves stems from the country’s well-established engineering and manufacturing sectors. The ongoing energy transition, known as Energiewende, is driving investments in both renewable and conventional power generation facilities. In addition, Germany’s commitment to environmental sustainability and industrial innovation encourages the adoption of technologically advanced and environmentally compliant valve solutions in key process industries.

Latin America Butterfly Valve Market Trends

The butterfly valve market in Latin America is largely driven by expanding oil & gas exploration activities and the growth of water treatment infrastructure. Countries such as Brazil and Mexico are investing in energy and industrial projects that require reliable and economical flow control equipment. Despite economic fluctuations, increased foreign investment in the region’s industrial sectors and improving regulatory frameworks contribute to a favorable market environment.

Middle East & Africa Butterfly Valve Market Trends

In the Middle East & Africa, the butterfly valve market is influenced by extensive investments in oil & gas infrastructure, desalination plants, and power generation projects. The region's strategic focus on diversifying energy sources and improving water supply infrastructure supports market growth. In addition, the demand for valves resistant to extreme environmental conditions and corrosion is driving innovation and adoption of high-performance butterfly valves in this region.

Key Butterfly Valve Company Insights

Some of the key players operating in market include Alfa Laval Corporate AB, Curtiss-Wright Corporation

-

Alfa Laval Corporate ABoffers a wide range of hygienic and industrial butterfly valves designed for use in the food and beverage, pharmaceutical, and marine industries. Its valve solutions are known for reliability, ease of maintenance, and compatibility with automated control systems.

-

Curtiss-Wright Corporation in the butterfly valve segment provides engineered valve solutions primarily for critical service environments such as nuclear power plants and defense systems. Their product portfolio includes high-performance and triple offset butterfly valves designed for high-pressure, high-temperature, and severe service applications, ensuring safety and performance under demanding conditions.

Flowserve Corporation, Emerson Electric Co. are some of the emerging market participants in butterfly valve market.

- Flowserve Corporation is U.S.-based provider of fluid motion and control products and services. The company’s butterfly valve offerings encompass resilient-seated, high-performance, and triple-offset designs that cater to a wide range of industries, including oil & gas, power, water, and chemicals. Flowserve’s butterfly valves are recognized for their robust engineering, long service life, and operational efficiency.

- Emerson provides a broad selection of resilient-seated, high-performance, and triple offset butterfly valves designed for precision flow control in industries such as oil & gas, power generation, and water treatment. These valves are integrated with smart technologies to enable predictive maintenance and operational efficiency.

Key Butterfly Valve Companies:

The following are the leading companies in the butterfly valve market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval Corporate AB

- Curtiss-Wright Corporation

- Flowserve Corporation

- Emerson Electric Co.

- Pentair PLC

- Weir Group PLC

- AVK Group A/S

- Crane Company

- Schlumberger Limited

- Velan, Inc.

- KSB SE & Co. KGaA

- Honeywell International Inc.

Recent Developments

-

In September 2024, Flomatic announced the expansion of its Sylax 3 Butterfly Valve series with the addition of a new 1 1/2 lug style model. Designed to deliver reliable and efficient flow control in compact systems, the newly introduced valve features a durable ductile iron body, a 316 stainless steel disc, and a stainless-steel stem. Engineered for bi-directional flow and dead-end service, it upholds the robust performance standards of the Sylax line.

Butterfly Valve Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.67 billion

Revenue forecast in 2030

USD 15.78 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

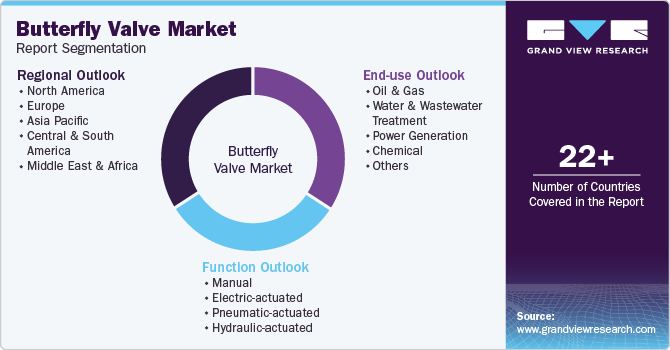

Segments covered

Function, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Alfa Laval Corporate AB; Curtiss-Wright Corporation; Flowserve Corporation; Emerson Electric Co.; Pentair PLC; Weir Group PLC; AVK Group A/S; Crane Company; Schlumberger Limited; Velan, Inc.; KSB SE & Co. KGaA; Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Butterfly Valve Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global butterfly valve market report based on function, vehicle type and region.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric-actuated

-

Pneumatic-actuated

-

Hydraulic-actuated

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Water & Wastewater Treatment

-

Power Generation

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global butterfly valve market size was estimated at USD 12.12 billion in 2024 and is expected to reach USD 12.67 billion in 2025.

b. The global butterfly valve market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 15.78 billion by 2030.

b. The manual segment led the market and accounted for the largest revenue share of 41.2% in 2024, driven by its cost-effectiveness and simplicity of operation.

b. Some of the key players operating in the butterfly valve market include. Alfa Laval Corporate AB, Curtiss-Wright Corporation, Flowserve Corporation, Emerson Electric Co., Pentair PLC, Weir Group PLC, AVK Group A/S, Crane Company, Schlumberger Limited, Velan, Inc., KSB SE & Co. KGaA, and Honeywell International Inc.

b. The key factors that are driving the butterfly valve market include growing demand for industrial automation, rising infrastructure development, increased usage in water and wastewater treatment, and the need for cost-effective flow control solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.