- Home

- »

- Electronic & Electrical

- »

-

Built-In Kitchen Appliances Market Size & Share Report 2030GVR Report cover

![Built-In Kitchen Appliances Market Size, Share, & Trends Report]()

Built-In Kitchen Appliances Market (2023 - 2030) Size, Share, & Trends Analysis Report By Product Type, By Application (Residential, Commercial), By Distribution Channel (Contract Sales, Exclusive Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-132-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Built-In Kitchen Appliances Market Size & Trends

The global built-in kitchen appliances market size was estimated at USD 13.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The increasing demand for built-in kitchen appliances is driven by a range of factors, including aesthetics, modular kitchen improvements, space-saving solutions, eco-friendliness, and smart home technology. The increasing adoption of smart home devices also drives the demand for built-in kitchen appliances. These appliances allow homeowners to control their appliances remotely through their smartphones or voice-activated assistants, enhancing the convenience and efficiency of their kitchen experience. Such features attract several groups of consumers including the working population who are all tech savvy and have busy working schedules. As per an article published in July 2022, the connected economy survey report on the U.S. stated that 32% of consumers, an estimated 83 million individuals used smart home or automated chore technology in May 2022.

In addition, the rise in demand for optimal space utilization is likely to fuel the demand for built-in kitchen appliances. One of the primary advantages of built-in appliances is the ability to save space Built-in kitchen appliances include anything from a built-in hob to a built-in hood and are especially useful in smaller kitchens with limited foundation and surface area,

The growing trend of remodelling traditional kitchens to modular kitchens with integrated energy-efficient appliances such as built-in kitchen appliances due to the increasing consumer spending and growing middle-class income is also expected to derive the market. For instance, according to the National Kitchen & Bath Association (NKBA) report, residential kitchen spending in the U.S. increased by 20.5% in 2022 valued at USD 95.4 billion including remodeling and new home spending. Built-in appliances in a modular kitchen offer a clean and modern appearance since they are flush against the wall which is becoming an increasingly popular in-home design. Built-in appliances can blend seamlessly with cabinetry, creating a cohesive and streamlined look.

The COVID-19 pandemic had a significant impact on many industries, including the built-in kitchen market. With the implementation of lockdowns and social distancing measures, people were spending more time at home, which led to an increased demand for home improvement projects, including kitchen renovations. In addition, people globally were taking safety measures and cooking and eating at home, which increased sales of kitchen cabinets, countertops, and other kitchen fixtures.

The pandemic also disrupted supply chains and caused shortages of raw materials and products, which has led to delays in construction and increased costs. Additionally, the economic downturn caused by the pandemic has led to decreased consumer confidence and spending, which affected the demand for higher-end kitchen products.

Product Type Insights

Based on product type, the market has been segmented into built-in ovens & microwaves, built-in hobs, built-in hoods, built-in dishwashers, built-in refrigerators, and others. The built-in refrigerator segment held the largest market share of 27.5% in 2022. Refrigerators are a necessity in most households, and a built-in refrigerator can save space in the kitchen by integrating the fridge into the cabinetry, it can create a seamless look and free up floor space. Built-in refrigerators typically offer a larger storage capacity compared to other built-in appliances, such as ovens or dishwashers. They also often have more features, such as humidity controls and adjustable shelves. Moreover, technological advancements in built-in refrigerators also drive its demand over the forecast year. In March 2023, Samsung launched its new range of Bespoke refrigerators with a side-by-side model. By introducing a range of refrigerator models that can be tailored to fit the specific design and functionality requirements of consumers.

Application Insights

Based on application, the market has been segmented into residential and commercial. The residential segment held the largest market share of 82.3% in 2022. This can be attributed to the increasing trend of home remodeling and renovation projects that have boosted the demand for built-in kitchen appliances. In addition, the rise of smart homes and connected appliances has also contributed to the growth of this segment. Consumers are increasingly looking for appliances that offer advanced features and connectivity options that can be controlled remotely. The residential segment is expected to grow at the fastest CAGR of 7.7% over the forecast period 2022-2030.

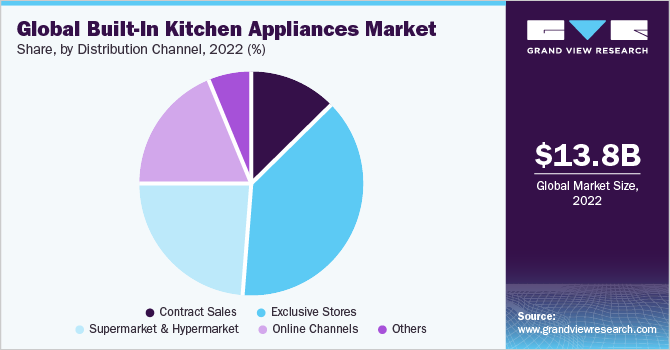

Distribution Channel Insights

Based on the distribution channel, the market has been segmented into contract sales, exclusive stores, supermarkets & hypermarkets, and online channels. The exclusive store segment held the largest market share of 38.5% in 2022. Exclusive stores handled by the sales representatives have better product knowledge and provide superior customer service, which helps to create a loyal customer base. Therefore, manufacturers of built-in kitchen appliances are increasingly relying on exclusive stores as an important distribution channel to reach their target consumers and grow their market share.

The online channels segment is expected to grow at the fastest CAGR of 9.0% over the forecast period 2023-2030. This can be attributed to the increasing popularity of online channels and the availability of a wide range of product portfolios.

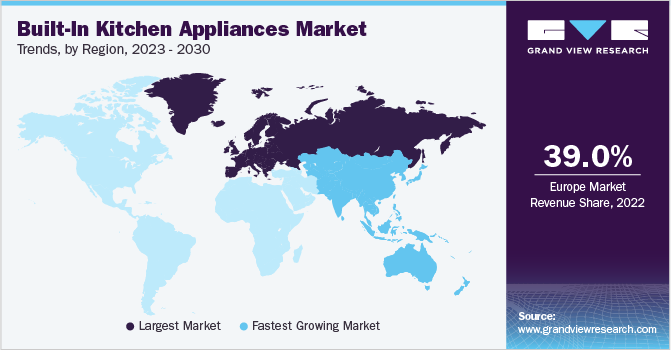

Regional Insights

Europe dominate the market in 2022 due to the increasing demand for modern and efficient kitchen appliances. Consumers in Europe are becoming more conscious of the convenience, functionality, and aesthetics of their kitchen spaces adopting built-in appliances, such as ovens, cooktops, refrigerators, and dishwashers, which offer sleek and integrated solutions and fit seamlessly into kitchen designs. In addition, rising construction activities along with rising living standards among middle-class groups create the demand for built-in appliances, leading to market growth.

Asia Pacific is expected to grow at the fastest CAGR of 8.8%, over the forecast period 2023-20230 due to the increasing popularity of built-in kitchen appliances, the increasing purchasing power of consumers, and the growing working women population.

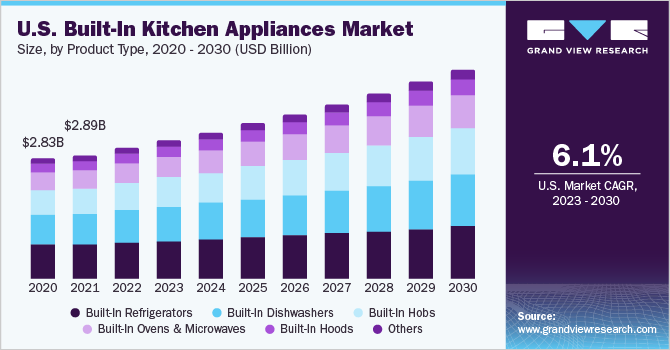

The U.S. market for built-in kitchen appliances has been growing in recent years, driven by a variety of factors such as the growing trend of home renovation and the increasing demand for smart and energy-efficient appliances. Additionally, the rising adoption of luxury appliances and the popularity of open-concept kitchen designs are also contributing to the growth of the market. Major players operating in the U.S. built-in kitchen appliances industry include Whirlpool Corporation, General Electric Company, LG Electronics, and Samsung Electronics, among others. These companies are focusing on product innovation and technological advancements to cater to changing consumer preferences.

Key Companies & Market Share Insights

The built-in kitchen appliances market features various global, regional, and local players which makes it a competitive market. The world’s leading companies including BSH Hausgeräte GmbH, Haier Group, LG Electronics, Electrolux, and others are undertaking strategies such as partnerships, collaborations, new product launches, technological innovation, and joint ventures to withstand the intense competition and increase their market share. For instance, in December 2022, LG Electronics launched its advanced kitchen appliances including QuadWash Pro built-in dishwasher, LG InstaView Combination Double Wall Oven, and Over-the-Range Microwave Oven. The objective of the strategy is to position the company's premium appliances as a hassle-free solution for consumers in the kitchen, by emphasizing the benefits of advanced cooking and cleaning technologies. Some of the prominent players operating in the global built-in kitchen appliances market include:

-

BSH Hausgeräte GmbH

-

Electrolux

-

Haier Group

-

Whirlpool Corporation

-

Panasonic Holdings Corporation

-

LG Electronics

-

Elica S.p.A.

-

Samsung

-

Gorenje

-

Arcelik

Built-In Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.84 billion

Revenue forecast in 2030

USD 24.9 billion

Growth Rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; France; Germany; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

BSH Hausgeräte GmbH; Electrolux; Haier Group; Whirlpool Corporation; Panasonic Holdings Corporation; LG Electronics; Elica S.p.A.; Samsung; Gorenje; Arcelik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

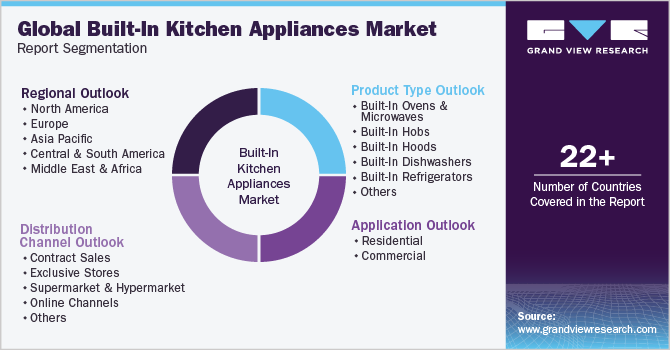

Global Built-In Kitchen Appliances Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global built-in kitchen appliances market report based on product type, application, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Built-in Ovens & Microwaves

-

Built-in Hobs

-

Built-in Hoods

-

Built-in Dishwashers

-

Built-in Refrigerators

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Contract Sales

-

Exclusive Stores

-

Supermarket & Hypermarket

-

Online Channels

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

France

-

Germany

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global built-in kitchen appliances market size accounted for USD 13.8 billion in 2022 and is expected to reach USD 14.84 million in 2023

b. The global built-in kitchen market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 24.9 billion by 2030

b. Europe dominated the built-in kitchen appliances market with a revenue share of 39.0% in 2022. This can be attributed to the strong economic performance, presence of large key market players, increasing percentage of homeownership, and increasing spending on high-end appliances such as kitchen fixtures, including built-in appliances.

b. Some of the key players operating in the built-in kitchen appliances market include BSH Hausgeräte GmbH, Electrolux, Haier Group, Whirlpool Corporation, Panasonic Holdings Corporation, LG Electronics, Elica S.p.A., Samsung, Gorenje, Arcelik among others

b. The key factors driving the global built-in kitchen appliances market are the increasing demand for smart home appliances, growing preference for modular kitchens, increasing disposable income, and changing consumer lifestyle and preference

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.