- Home

- »

- Petrochemicals

- »

-

Bromobenzene Market Size, Share And Growth Report, 2030GVR Report cover

![Bromobenzene Market Size, Share & Trends Report]()

Bromobenzene Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Pharmaceutical Grade, Industrial Grade), By Application (Solvent, Grignard Reagent, Tapes & Labels), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-424-2

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bromobenzene Market Summary

The global bromobenzene market size was estimated at USD 1,228.8 million in 2023 and is projected to reach USD 1,692.5 million by 2030, growing at a CAGR of 4.7% from 2024 to 2030. The market is driven by increasing demand for specialty chemicals across various industries, particularly pharmaceuticals and agrochemicals.

Key Market Trends & Insights

- The Asia Pacific dominated the market and accounted for a 83.2% share in 2023.

- The North America emerged as the fastest growing market with a CAGR of 6.1% from 2024-2030

- Based on type, the pharmaceutical grade segment dominated the market and accounted for a revenue share of approximately 42.3% in 2023.

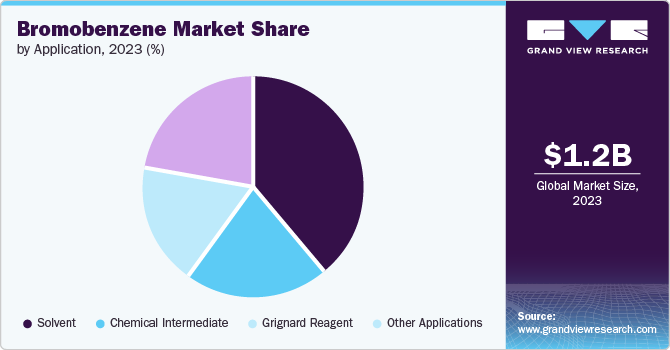

- Based on application, the solvent segment dominated the market and accounted for a revenue share of 39.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,228.8 Million

- 2030 Projected Market Size: USD 1,692.5 Million

- CAGR (2024-2030): 4.7%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

As a crucial chemical intermediate, bromobenzene is essential in the synthesis of active pharmaceutical ingredients (APIs) and Grignard reagents, which are vital for organic synthesis.

The growth of the pharmaceutical sector, especially in emerging markets, significantly contributes to the rising consumption of bromobenzene.

Drivers, Opportunities & Restraints

The global bromobenzene market is significantly driven by the expanding pharmaceutical industry, which utilizes bromobenzene as a crucial intermediate in the synthesis of various drugs. Bromobenzene is particularly important in the production of Grignard reagents, which are essential for creating a wide range of organic compounds used in pharmaceuticals. As the demand for innovative and effective medications continues to rise, especially in emerging markets, the need for bromobenzene is expected to grow.

Another significant driver is the growing agrochemical sector, where bromobenzene is employed in the formulation of pesticides and herbicides. The need for enhanced agricultural productivity to meet the demands of a growing global population is pushing farmers to adopt more effective chemical solutions. As agricultural practices evolve, the demand for agrochemicals that utilize bromobenzene is likely to increase. For example, in regions like Asia Pacific, where agriculture plays a vital role in the economy, the rising adoption of modern farming techniques and chemical inputs is expected to drive the bromobenzene market forward.

Despite the positive growth drivers, the bromobenzene market faces several restraints, particularly concerning environmental and health regulations. Bromobenzene is classified as a hazardous substance, and its production and use are subject to stringent regulations in many countries. These regulations aim to mitigate the environmental impact and health risks associated with bromobenzene exposure. For example, in the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes strict guidelines on the use of hazardous chemicals, which can limit the market for bromobenzene.

The growing focus on research and development in chemical synthesis is creating new applications for bromobenzene. As researchers explore innovative uses for bromobenzene in fields such as materials science and nanotechnology, the potential for new market segments emerges. For example, bromobenzene's unique properties may be harnessed in the development of advanced materials or specialty chemicals, opening up new avenues for growth. This ongoing innovation is expected to create additional demand for bromobenzene, further solidifying its position in the global market.

Type Insights & Trends

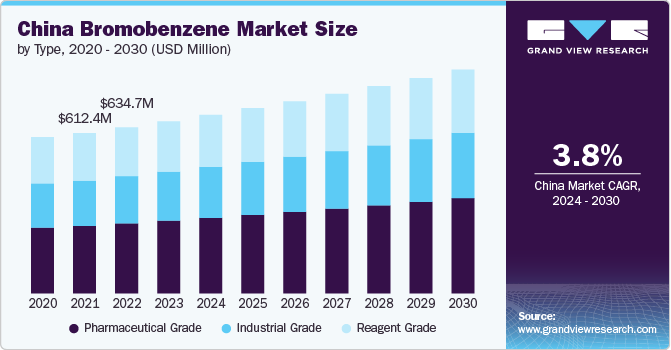

“Industrial grade emerged as the fastest growing product with a CAGR of 5.1%”

Pharmaceutical grade dominated the market and accounted for a revenue share of approximately 42.3% in 2023. Pharmaceutical grade bromobenzene is a highly purified form of bromobenzene that meets stringent quality standards for use in the pharmaceutical industry. This grade is primarily utilized as a key intermediate in the synthesis of various pharmaceutical compounds, particularly in the production of Grignard reagents, such as phenyl magnesium bromide. These reagents are essential for creating a wide range of organic compounds, including active pharmaceutical ingredients (APIs) used in medications for treating various health conditions.

Industrial grade bromobenzene is used in various industrial applications, including as a solvent and chemical intermediate in the production of motor oils, flame retardants, and other chemical products. This grade of bromobenzene is characterized by its ability to dissolve a wide range of organic compounds, making it a valuable solvent in manufacturing processes. The industrial sector's growth, particularly in emerging economies, is driving the demand for industrial grade bromobenzene.

Reagent grade bromobenzene is specifically designed for use in laboratory settings and is characterized by its high purity and reliability in chemical reactions. This grade is commonly employed in organic synthesis, particularly in the preparation of various chemical compounds, including dyes, perfumes, and pharmaceuticals. The versatility of reagent grade bromobenzene makes it an essential component in research and development activities across multiple scientific disciplines.

Application Insights & Trends

“Chemical intermediate emerged as the fastest growing end use with a CAGR of 5.0%”

Solvent dominated the market and accounted for a revenue share of 39.1% in 2023.Bromobenzene is widely utilized as a solvent in various industrial applications due to its unique properties, including its ability to dissolve a wide range of organic compounds. As a solvent, bromobenzene is particularly valuable in the chemical synthesis of organic compounds, where it serves as a medium for reactions that require a non-polar environment. For instance, in the production of specialty chemicals and pharmaceuticals, it is often employed to dissolve reactants and facilitate chemical reactions.

Bromobenzene is a crucial precursor for the preparation of Grignard reagents, specifically phenyl magnesium bromide. Grignard reagents are organometallic compounds that play a significant role in organic synthesis, enabling chemists to form new carbon-carbon bonds and create complex organic structures. The reactivity of Grignard reagents allows them to participate in various reactions, such as nucleophilic additions to carbonyl compounds, which are fundamental in the synthesis of alcohols, acids, and other functional groups.

Bromobenzene is used in the production of flame retardants, where its bromine content contributes to the fire-resistant properties of the final products. Additionally, bromobenzene is employed in the formulation of additives for motor oils, enhancing their performance and stability under high temperatures. Its ability to improve the viscosity and lubricating properties of oils makes it a valuable component in automotive applications. Furthermore, it is utilized in the manufacturing of various specialty chemicals, including dyes and pigments, where its unique chemical properties contribute to the desired characteristics of the final products.

Regional Insights & Trends

“North America emerged as the fastest growing market with a CAGR of 6.1% from 2024-2030”

North American market is characterized by a well-established chemical manufacturing industry and a strong focus on research and development. Bromobenzene is widely used in the production of specialty chemicals, pharmaceuticals, and agrochemicals, making it an essential component in various applications. The demand for bromobenzene in North America is driven by the growing pharmaceutical sector, where it serves as a key intermediate in drug synthesis.

Asia Pacific Bromobenzene Market Trends

Asia Pacific dominated the market and accounted for a 83.2% share in 2023. It is driven by the increasing demand for bromobenzene in the pharmaceutical industry which is primarily attributed to its use as a chemical intermediate in the synthesis of various drugs and active ingredients. For instance, the production of Grignard reagents, which are essential for organic synthesis, heavily relies on bromobenzene. Additionally, the region's expanding automotive and agrochemical industries further bolster the demand for bromobenzene, as it is used in coatings and as a solvent in various applications.

China bromobenzene market plays a pivotal role in the global market, being one of the largest producers and consumers of this chemical. The country's rapid industrial growth, coupled with its dominance in the pharmaceutical sector, significantly drives the demand for bromobenzene. As a leading manufacturer of APIs, China relies heavily on these products as a chemical intermediate in drug synthesis. The Chinese government's initiatives to enhance the pharmaceutical industry, including investments in research and development, are expected to further boost the demand for bromobenzene.

Europe Bromobenzene Market Trends

Europe is another important region for the bromobenzene market, characterized by a strong emphasis on sustainability and innovation in chemical production. The region's chemical industry is highly regulated, with strict environmental standards that influence the production and use of bromobenzene. Countries such as Germany, France, and the United Kingdom are key players in this market, utilizing bromobenzene in various applications, including pharmaceuticals, coatings, and specialty chemicals. The growing demand for eco-friendly products drives manufacturers to explore alternative synthesis methods and develop sustainable bromobenzene derivatives.

Key Bromobenzene Company Insights

The global bromobenzene market is characterized by a competitive landscape with several key players, each employing various strategies to enhance their market presence and drive growth. Additionally, partnerships with research institutions and universities are becoming increasingly common, as companies seek to leverage cutting-edge research to develop new applications for bromobenzene. Such collaborations not only foster innovation but also help companies stay ahead of regulatory changes and market trends. Companies are investing heavily in research and development to create new and improved products that cater to the evolving needs of their customers. For instance, the development of pharmaceutical-grade bromobenzene with enhanced purity levels is a response to the growing demand for high-quality intermediates in drug synthesis.

Some of the key players operating in the global bromobenzene market include

-

Heranba Industries Ltd. is an Indian chemical manufacturing company specializing in the production of agrochemicals, pharmaceuticals, and specialty chemicals. The company is involved in the manufacturing and marketing of a wide range of chemicals, including agrochemicals, pharmaceuticals, and specialty chemicals. Heranba Industries Ltd. has established robust production capabilities for Bromobenzene, ensuring high-quality output to meet industry standards. The company adheres to stringent quality control processes to ensure the reliability and consistency of its products. Heranba Industries Ltd. continually invests in research and development to enhance its product offerings and improve production efficiencies. The company is focused on expanding its product portfolio and exploring new market opportunities to drive growth.

-

Chemcon Speciality Chemicals Limited is engaged in the manufacture and supply of specialty chemicals and pharmaceutical intermediates. The company is known for its expertise in producing high-quality chemicals for various industrial applications. Chemcon Speciality Chemicals Limited has established advanced manufacturing facilities for Bromobenzene, ensuring high-quality production standards. The company leverages state-of-the-art technology and processes to deliver reliable and consistent products. Chemcon Speciality Chemicals Limited is committed to environmental sustainability and regulatory compliance. The company implements practices designed to minimize environmental impact and ensure the safe handling of chemicals throughout the production process. The company serves a broad range of industries, including pharmaceuticals, agrochemicals, and specialty chemicals. Chemcon’s Bromobenzene products are recognized for their quality and reliability, contributing to its strong position in the global market.

-

Sandoo Pharmaceuticals and Chemicals Co., Ltd. is involved in the production and supply of pharmaceutical intermediates, specialty chemicals, and fine chemicals. The company serves various industries including pharmaceuticals, agrochemicals, and other chemical sectors. Sandoo Pharmaceuticals and Chemicals Co., Ltd. operates advanced production facilities with a focus on high-quality manufacturing. The company utilizes modern technology and stringent quality control measures to produce Bromobenzene that meets industry standards. Sandoo is dedicated to environmental sustainability and compliance with regulatory standards. The company implements practices aimed at reducing environmental impact and ensuring the safe handling and disposal of chemicals. Sandoo continues to invest in research and development to enhance its product offerings and improve manufacturing processes. The company is focused on expanding its product range and exploring new opportunities in the chemical and pharmaceutical sectors.

Key Bromobenzene Companies:

The following are the leading companies in the bromobenzene market. These companies collectively hold the largest market share and dictate industry trends.

- Chemcon Speciality Chemicals Limited

- Pragna Group

- Heranba Industries Ltd.

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Yurui (shanghai) chemical Co., Ltd

- Yogi Intermediates PVT. LTD.

- Aarnee International

Recent Developments

-

In September 2020, Cambridge Isotope Laboratories, Inc. (CIL), a global leader in stable isotopes and stable isotope-labeled compounds, has recently announced an expansion of its production capacity for deuterated benzene at Cambridge Isotope Separations, LLC (CIS), situated on a 33-acre site in Xenia, Ohio.

Bromobenzene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,284.8 million

Revenue forecast in 2030

USD 1,692.5 million

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Chemcon Speciality Chemicals Limited; Pragna Group;

Heranba Industries Ltd.; Sandoo Pharmaceuticals and Chemicals Co., Ltd.; Yurui (shanghai) chemical Co., Ltd;

Yogi Intermediates PVT. LTD.; Aarnee International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

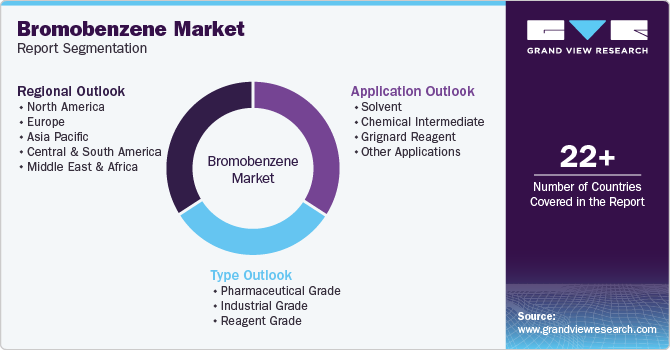

Global Bromobenzene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bromobenzene market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Grade

-

Industrial Grade

-

Reagent Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solvent

-

Chemical Intermediate

-

Grignard Reagent

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bromobenzene market is valued at USD 1228.80 million in 2023 and is expected to reach USD 1284.83 million in 2024.

b. The global bromobenzene market is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to reach USD 1692.49 million by 2030.

b. Asia Pacific dominated the market and accounted for a 83.2% share in 2023. It is driven by the increasing demand for bromobenzene in the pharmaceutical industry which is primarily attributed to its use as a chemical intermediate in the synthesis of various drugs and active ingredients.

b. The global bromobenzene market is characterized by a competitive landscape that includes several key players, each employing various strategies to enhance their market presence and drive growth. Companies such as Heranba Industries Ltd., Chemcon Specialty Chemicals Limited, Sandoo Pharmaceutical and Chemicals Co., Ltd., and Pragna Group are among the leading companies.

b. The global bromobenzene market is driven by increasing demand for specialty chemicals across various industries, particularly pharmaceuticals and agrochemicals. As a crucial chemical intermediate, bromobenzene is essential in the synthesis of active pharmaceutical ingredients (APIs) and Grignard reagents, which are vital for organic synthesis. The growth of the pharmaceutical sector, especially in emerging markets, is significantly contributing to the rising consumption of bromobenzene.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.