- Home

- »

- Communication Services

- »

-

Broadcasting And Cable TV Market, Industry Report, 2030GVR Report cover

![Broadcasting And Cable TV Market Size, Share & Trends Report]()

Broadcasting And Cable TV Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Cable TV, Satellite TV, IPTV, DTT), By Revenue Channel (Advertising, Subscription), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-514-4

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Broadcasting And Cable TV Market Summary

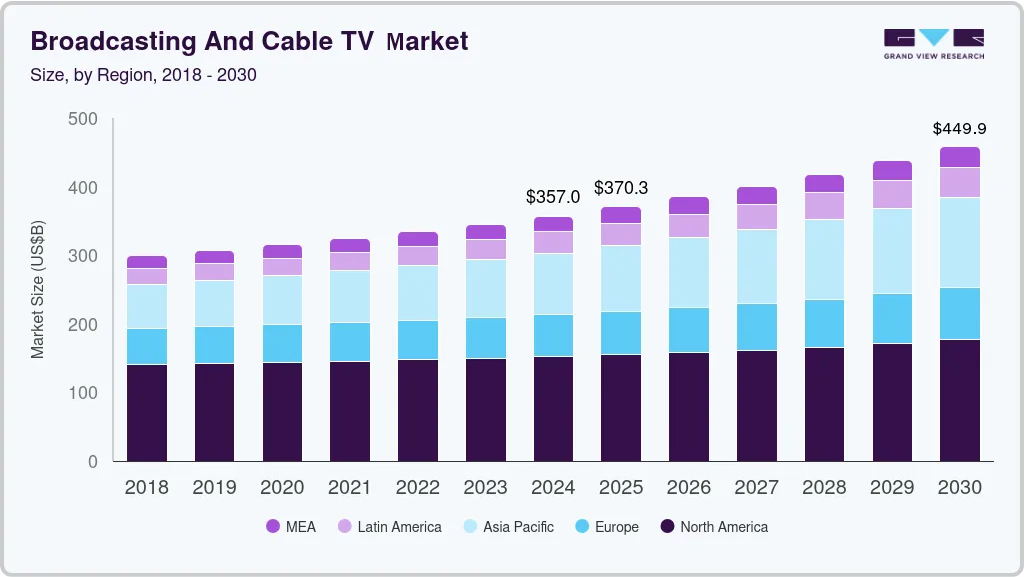

The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024 and is projected to reach USD 449.91 billion by 2030, growing at a CAGR of 4.0% from 2025 to 2030. The market is experiencing growth due to the increasing demand for on-demand and live content, driven by the rise in digital consumption and expanding global connectivity.

Key Market Trends & Insights

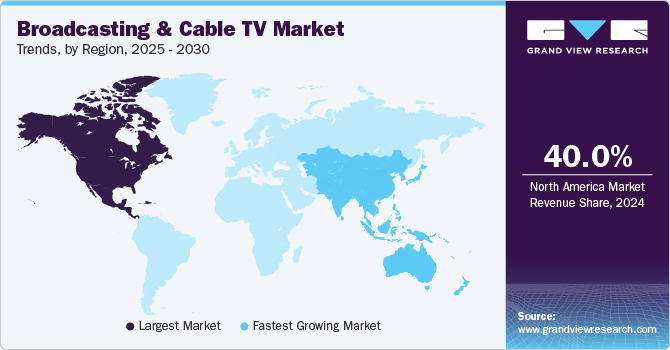

- The North American broadcasting & cable TV market holds a substantial share of nearly 40% in 2024 due to high digital adoption, a well-established infrastructure, and strong demand for diverse content.

- Based on technology, the satellite TV segment seized the highest revenue share of approximately 42.7% in 2024.

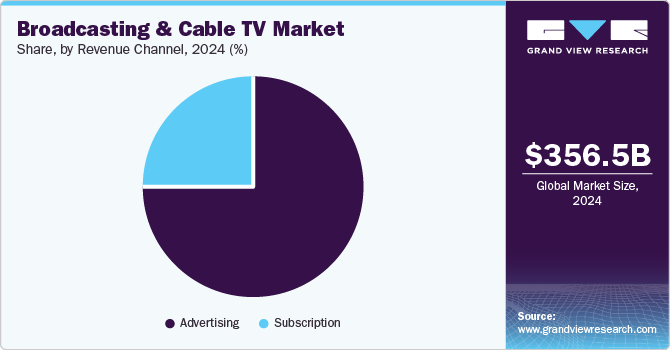

- Based on revenue channel, the advertising segment dominated the market with a revenue share of more than 74.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 356.45 Billion

- 2030 Projected Market Size: USD 449.91 Billion

- CAGR (2025-2030): 4.0%

- North America: Largest market in 2024

Viewers seek diverse content, including news, sports, and entertainment, available in high-definition formats. In addition, rising income levels and increased television ownership in emerging markets fuel demand for cable TV services. Broadcasters and cable TV providers capitalize on these trends by offering flexible subscription models and specialized content, catering to a broader audience base and spurring market growth.

Governments in several countries actively support the broadcasting & cable TV industry through policies to expand digital infrastructure and promote local content. Initiatives such as subsidies for digital broadcasting equipment and investments in high-speed internet infrastructure make broadcasting services more accessible, especially in rural and underserved areas. In countries like India, regulatory bodies encourage local language programming, which helps diversify content offerings and increases audience reach. Governments aim to boost the adoption of broadcasting services by facilitating access to digital content, thereby contributing to market growth.

The broadcasting & cable TV industry presents significant growth opportunities with the expansion of digital and mobile platforms, which allow broadcasters to reach audiences through multiple devices. The shift toward streaming and hybrid models offers a chance for cable providers to retain customers by incorporating streaming services into their offerings. Furthermore, emerging markets in Asia Pacific, Africa, and Latin America represent untapped potential, with rising disposable incomes and growing interest in digital content. Moreover, the demand for niche content in sports, lifestyle, and regional programming creates new avenues for broadcasters to engage viewers and generate additional revenue streams.

Manufacturers and service providers in the broadcasting and cable TV industry increasingly focus on growth strategies, such as enhancing content delivery infrastructure and adopting advanced broadcasting technologies. By investing in fiber-optic networks, 5G, and cloud-based platforms, companies are improving the quality and reliability of broadcast services. In addition, partnerships with content creators and technology firms allow for diversified content offerings and interactive features, enhancing viewer engagement. Many companies also target specific regional markets with tailored content and subscription models to cater to local audiences, supporting sustained market growth.

Technological innovation is a key driver in the market, as advancements in broadcasting technology enhance content quality, accessibility, and user experience. High definition (HD), 4K, and even 8K broadcasts are now widely available, while virtual and augmented reality innovations create immersive viewing experiences. Furthermore, integrating artificial intelligence and data analytics allows broadcasters to personalize content recommendations, catering to viewers’ individual preferences. Cloud-based broadcasting and 5G networks are also transforming content delivery, enabling low-latency, high-speed streaming on multiple devices, which is vital in today’s multi-screen environment. These innovations help companies attract and retain subscribers while meeting the evolving demands of modern audiences.

Technology Insights

The satellite TV segment seized the highest revenue share of approximately 42.7% in 2024 due to its ability to deliver content to remote and underserved regions where traditional cable infrastructure is less feasible. Satellite TV offers a vast array of channels and content options, including high-definition and international programming, making it appealing to diverse viewer segments. Furthermore, the segment benefits from advancements in satellite technology, such as improved signal quality and increased capacity, which enhance viewer experience. As satellite TV continues to expand its reach and provide a variety of channel packages at competitive prices, it remains a key component of the broadcasting market, particularly in areas with limited cable access.

The IPTV segment is expected to witness the highest CAGR of around 6.7%, owing to the rising demand for on-demand and personalized viewing experiences. IPTV delivers content over the internet, allowing for interactive features, multi-device compatibility, and high-quality streaming, which appeal to today’s tech-savvy viewers. As broadband penetration and internet speeds improve globally, more consumers are turning to IPTV for its flexibility, especially as viewers increasingly prefer to watch content on mobile devices and smart TVs. This segment also benefits from bundling options offered by telecom operators, combining IPTV with internet and phone services, making it a convenient and popular choice.

Revenue Channel Insights

The advertising revenue channel dominated the market with a revenue share of more than 74.8% in 2024, driven by the consistent demand for targeted advertising opportunities. Television remains one of the most influential media channels, providing advertisers access to diverse audiences. Moreover, the rise of digital advertising within broadcast platforms has allowed for more precise ad targeting, enabling broadcasters to deliver tailored content to specific demographics. Innovations such as addressable TV ads, which target households based on viewing habits, have further increased the appeal of TV advertising. This segment’s growth is supported by sustained investment from businesses seeking broad exposure and engagement with potential consumers.

Subscription is witnessing strong growth in the broadcasting & cable TV industry, fueled by the growing popularity of premium content and ad-free viewing experiences. Consumers are increasingly willing to pay for exclusive, high-quality content offered through subscription models, including live sports, original series, and on-demand movies. The shift toward personalized, on-demand viewing has driven the growth of subscriptions for traditional TV and streaming platforms. Furthermore, broadcasters are leveraging flexible subscription packages and bundling options to attract and retain customers, further boosting this segment’s appeal as viewers prioritize customizable and immersive content experiences over free, ad-supported models.

Regional Insights

The North American broadcasting & cable TV market holds a substantial share of nearly 40% in 2024 due to high digital adoption, a well-established infrastructure, and strong demand for diverse content. The region’s mature broadcasting industry benefits from significant investments in HD and 4K broadcasting technologies and the continued expansion of on-demand and streaming services. North American viewers show strong interest in live sports, news, and entertainment, and many providers cater to these preferences through subscription-based and ad-supported content models. In addition, the region’s high internet penetration and household income levels support sustained spending on both cable TV and digital streaming, making North America a key market for broadcasting.

U.S. Broadcasting & Cable TV Market Trends

The broadcasting & cable TV market in the U.S. is the largest in North America, driven by robust consumer demand for premium, localized, and on-demand content. The market benefits from a strong competitive landscape, with established players like Comcast, AT&T, Fox Corporation, and emerging streaming giants. High disposable income, widespread internet access, and evolving content preferences have spurred a shift toward hybrid broadcasting models that combine traditional TV with digital streaming. Furthermore, major investments in new technologies, such as 5G and cloud-based content delivery, enhance user experience and solidify the U.S.’s leading role in the global broadcasting & cable TV industry.

Europe Broadcasting & Cable TV Market Trends

The broadcasting & cable TV market in Europe is experiencing growth due to high consumer demand for high-quality, diverse content and increasing adoption of digital and OTT (over-the-top) platforms. European countries are known for their rich cultural content, leading to strong viewership in segments like sports, films, and regional programming. Strict government regulations promoting content quality and data privacy drive the adoption of secure, premium broadcasting services. Moreover, expanding fiber-optic and high-speed internet infrastructure in Europe has made it easier for broadcasters to deliver HD and 4K content, catering to evolving viewer expectations and driving market growth.

Asia Pacific Broadcasting & Cable TV Market Trends

The broadcasting & cable TV market in Asia Pacific has significant growth in CAGR in 2024, population, rising urbanization, and growing middle class in countries like China, India, and Japan. The region’s diverse and rapidly expanding demand for local and international content, including sports, drama, and news, creates opportunities for broadcasting companies. In addition, the shift from analog to digital broadcasting and government support for digital infrastructure development have increased viewership. The growing adoption of smart TVs and mobile devices further enhances content accessibility, positioning Asia-Pacific as a key driver in the global broadcasting landscape.

China broadcasting & cable TV market holds a significant share due to its vast population, strong domestic entertainment industry, and government support for digital transformation. The rapid growth of digital platforms and mobile usage has encouraged the expansion of broadcasting networks, particularly in urban areas where high-speed internet and 5G are widely available. Chinese consumers have a strong appetite for a mix of local content, news, entertainment, and premium content from abroad. Government regulations that promote digital content production and curb unauthorized streaming further strengthen the market, making China a major player in the broadcasting and cable TV sector.

The broadcasting & cable TV market in India is seeing rapid growth, fueled by increasing disposable income, high demand for regional and local language content, and government support for digitalization. The ongoing transition from analog to digital broadcasting and the widespread adoption of smartphones has expanded the reach of TV and streaming content in urban and rural areas. India’s large and culturally diverse audience base has created demand for a wide variety of content genres, including news, sports, movies, and serials, which drive viewership. In addition, government initiatives supporting the rollout of digital broadcasting infrastructure enhance accessibility and fuel the continued growth of India’s broadcasting market.

Key Broadcasting And Cable TV Company Insights

AT&T Inc., Discovery Communication, Inc., FOX, and DISH Network L.L.C. are some of the key market players. Broadcasting and cable TV service providers are focusing on strategic partnerships and collaborations to enable continuous business growth and explore new revenue channels.

-

AT&T Inc. is a prominent player in the market, primarily through its subsidiary WarnerMedia, which includes HBO, CNN, and TNT. AT&T has leveraged its extensive telecommunications infrastructure to provide high-quality broadcast content, combining traditional cable TV with digital streaming services like HBO Max. The company delivers a diverse range of entertainment, news, and sports programming while expanding its reach through broadband and wireless services.

-

Fox Corporation is a leading media company in the market, known for its diverse portfolio, which includes Fox News, Fox Sports, and the Fox Broadcasting Company. Specializing in news, sports, and entertainment, Fox delivers content across traditional cable TV and digital platforms, ensuring a wide audience reach. The company emphasizes live programming and high-impact sports coverage, appealing to viewers seeking real-time content.

Key Broadcasting And Cable TV Companies:

The following are the leading companies in the broadcasting and cable TV market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T Inc.

- Canadian Broadcasting Corporation

- DISH Network L.L.C.

- Discovery Communication Inc.,

- Warner Bros. Discovery, Inc.

- Fox Corporation

- Tata Play Limited

- The Walt Disney Company

- Hathway Digital

- Siti Network

Recent Development

-

In August 2024, Scripps Co revamped Tablo, a device that receives and records free over-the-air TV channels and integrates with streaming services. E.W. Scripps is now developing a solution to bring this functionality to small and mid-sized cable operators.

-

In May 2024, Nielsen Company LLC launched the Media Distributor Gauge, a unique cross-platform tool providing an integrated view of total TV consumption across broadcast, cable, and streaming. This new metric breaks down traditional silos between TV and streaming, giving an equal perspective on how viewers engage with all types of content.

-

In December 2023, EchoStar Corporation acquired DISH Network Corporation. The merger is expected to offer ubiquitous connectivity to people, things, enterprises, and everywhere.

Broadcasting And Cable TV Market Report Scope

Report Attribute

Details

Market size in 2025

USD 369.52 billion

Revenue forecast in 2030

USD 449.91 billion

Growth rate

CAGR of 4.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, revenue channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

AT&T Inc.; Canadian Broadcasting Corporation; Comcast Corporation; DISH Network L.L.C.; Warner Bros. Discovery, Inc.; Fox Corporation; Hatchway Digital; Siti Network

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Broadcasting And Cable TV Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global broadcasting and cable TV market report based on technology, revenue channel, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cable TV

-

Satellite TV

-

Internet Protocol TV (IPTV)

-

Digital Terrain TV (DTT)

-

-

Revenue Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advertising

-

Subscription

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global broadcasting and cable TV market was estimated at USD 356.45 billion in 2024 and is expected to reach USD 369.52 billion in 2025.

b. The global broadcasting & cable TV market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030 to reach USD 449.91 billion by 2030.

b. North America dominated the global broadcasting & cable TV market with a share of over 40% in 2024. This is attributable to the rising trend of subscription video-on-demand (SVOD).

b. Some key players operating in the global broadcasting and cable TV market include AT&T Inc., Canadian Broadcasting Corporation, Comcast Corporation, DISH Network L.L.C., Warner Bros. Discovery, Inc., Fox Corporation.

b. Key factors that are driving the market growth include advent of 5G delivery model and digitization of video and content distribution process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.