- Home

- »

- Communication Services

- »

-

Broadband Services Market Size, Industry Report, 2030GVR Report cover

![Broadband Services Market Size, Share & Trends Report]()

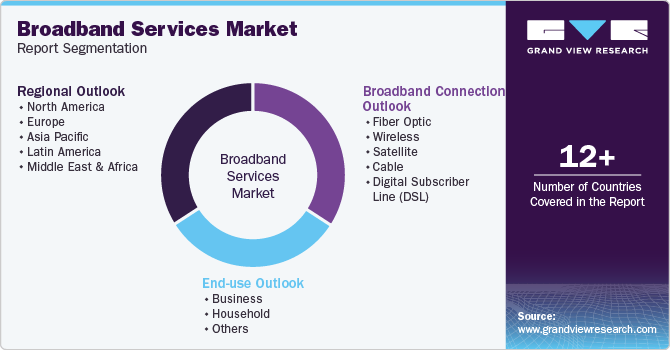

Broadband Services Market (2025 - 2030) Size, Share & Trends Analysis By Broadband Connection (Fiber Optic, Wireless, Satellite, Cable, Digital Subscriber Line), By End Use (Business, Household), By Region, and Segment Forecasts

- Report ID: GVR-4-68038-542-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Broadband Services Market Summary

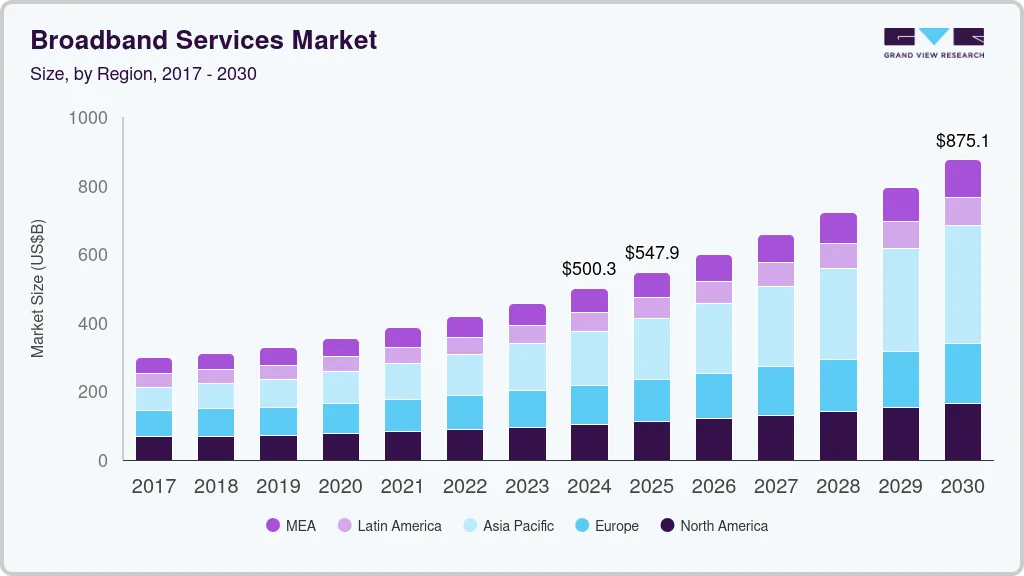

The global broadband services market size was estimated at USD 500.30 billion in 2024 and is projected to reach USD 875.06 billion by 2030, growing at a CAGR of 9.8% from 2025 to 2030. Digital transformation of several industry verticals requires broadband services, thereby promoting market growth.

Key Market Trends & Insights

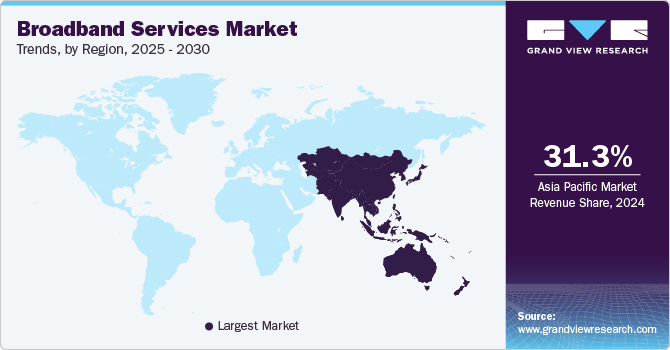

- Asia Pacific broadband services market dominated globally with a revenue share of 31.31% in 2024.

- The U.S. broadband services market is expected to grow at a significant CAGR from 2025 to 2030.

- Based on broadband connection, in terms of revenue, fiber optics segment dominated the market with a share of 36.06% in 2024.

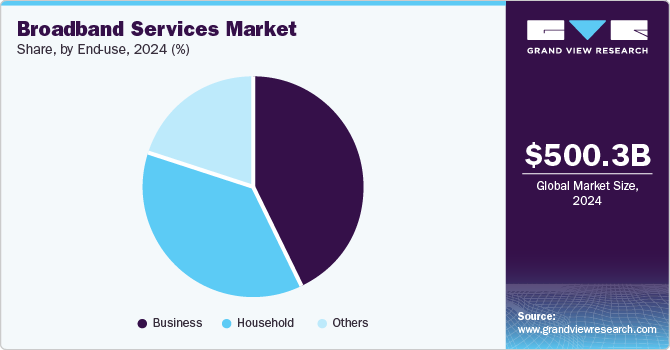

- Based on end-use, in terms of revenue and market share, the business segment captured the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 500.30 Billion

- 2030 Projected Market Size: USD 875.06 Billion

- CAGR (2025-2030): 9.8%

- Asia Pacific: Largest market in 2024

For instance, increasing online commerce for retail goods & services, digitalization of hospital records, e-government initiatives, and rapidly rising platforms for media and entertainment content are notably augmenting the market growth. Wireless technology holds immense potential to accelerate the global digital revolution across verticals through productivity enhancements and economic reductions.

According to the Organization for Economic Co-operation and Development (OECD), surge in the number of wireless subscribers has been a major growth driver for the market. Besides digital transformation in businesses, increased adoption of online learning has not only augmented the need for digital education but also reflects a strong requirement for uninterrupted broadband connectivity.

The market continues to expand at a steady pace, driven by the increasing application of broadband in global communication. With the rising trend of global digitalization, governments, businesses, and individuals are increasingly depending on high-speed seamless internet connections for purposes of information, education, interaction, and entertainment.

The broadband services industry is experiencing significant trends that are reshaping the industry landscape. The integration of 5G technology is revolutionizing broadband services by providing higher speeds, lower latency, and more reliable connections, particularly in urban areas where 5G fixed wireless access offers a viable alternative to traditional wired broadband. In addition, the rise of satellite broadband services, led by companies like SpaceX's Starlink, is expanding high-speed internet access to remote and underserved regions, aiming to bridge the digital divide. Furthermore, service providers are increasingly offering bundled packages that combine internet, television, phone, and even home security systems, enhancing customer value and satisfaction.

Several factors are driving the growth of the broadband services industry. The proliferation of social networking platforms, which require higher bandwidth and faster internet speeds to support content-rich features like live streaming and video sharing, is also contributing to this demand. Moreover, the rising adoption of Internet of Things (IoT) devices in households and businesses necessitates robust and dependable Internet connections, further driving the expansion of broadband services.

Broadband Connection Insights

In terms of revenue, fiber optics dominated the market with a share of 36.06% in 2024. This high share is attributable to the capacity of fiber optics to carry superior-quality network signals from the operator's equipment directly to an enterprise, business, or household. Fiber networks have been called "futureproof" due to their continuously improving technologies to increase bandwidth according to business needs without the deployment of novel networks. However, the emergence of wireless broadband services poses a strong threat to the fiber optics broadband market.

Wireless broadband service is positioned to demonstrate the fastest CAGR through the forecast period to become the largest segment among all broadband connections by 2030. The rapid growth is supported by technological advancements and user convenience. Unlike other broadband connections, wireless services use radio waves or Wireless Fidelity (Wi-Fi) instead of cables. The fast-paced evolution of mobile wireless services from 3G to 4G and now, the nascent 5G technology has further ramped up the demand and application of wireless broadband services.

End Use Insight

In terms of revenue and market share, the business end use segment captured the largest market share in 2024. Most businesses require a fast and consistent internet connection to communicate internally with employees and externally with business partners and customers. Nearly all aspects of new age business models-including marketing and sales, client engagement, and profits analysis, resonate with the demand for broadband service. Furthermore, digital channelization of most business models in tandem with the global digital revolution has further enhanced the application of broadband services across all industry verticals.

The trend of online learning is speedily gaining momentum as schools, colleges, and universities promptly adopt digital education, thereby requiring a reliable internet connection. Furthermore, the increasing trend of work-from-home practices-that registered a steep incline due to the lockdowns forced by COVID-19 curbing activities-and surge in entertainment & other media content online has enabled large-scale installation of internet services in the household sector. We anticipate the household sub-segment to register a double-digit growth through the forecast period.

Regional Insights

The North America broadband services market growth is driven by extensive government initiatives, such as the U.S. Broadband Equity, Access, and Deployment (BEAD) program, aiming to bridge the digital divide in underserved areas. In Canada, increased demand for remote work and e-learning tools has spurred investment in high-speed internet infrastructure, especially in rural regions. In addition, the region's emphasis on next-generation technologies, such as 5G and cloud computing, further drives broadband adoption.

U.S. Broadband Services Market Trends

The U.S. broadband services market is expected to grow at a significant CAGR from 2025 to 2030. The market's growth is driven by the rapid adoption of smart home technologies and IoT devices, creating a surge in demand for reliable and high-speed broadband connections. Competitive pricing and innovative service bundles offered by major telecom providers are attracting a broader customer base. In addition, the increasing focus on edge computing and cloud services accelerates the need for robust broadband infrastructure in the country.

Asia Pacific Broadband Services Market Trends

Asia Pacific broadband services market dominated globally with a revenue share of 31.31% in 2024, driven by broad accessibility, technological advancements, and proactive government initiatives. Asia Pacific countries-forerun by China and Japan-spontaneously embrace ultra-fast broadband, thereby propelling the usage rates and enlarging the consumer pool over the next few years. Furthermore, internet services providers continue to offer add-on services at economic rates to attract the middle- and low-income sections of consumers. In addition, the large consumer base in this region and the rise in disposable income are notable growth contributors to the broadband services industry.

Japan broadband services industry is expected to grow at a moderate growth rate during the forecast period. The growth of the market in Japan is driven by the country's advanced fiber-optic infrastructure, with a significant penetration of FTTH (Fiber to the Home) connections providing ultra-high-speed internet. Japan's rising demand for digital entertainment, including 4K and 8K streaming, online gaming, and immersive technologies, is boosting broadband usage. In addition, the adoption of IoT devices and smart home technologies is fueling broadband subscriptions. Government initiatives, such as expanding rural connectivity, further support market expansion.

The China broadband services market held a substantial market share in 2024, driven by the country's rapid urbanization and extensive investments in 5G infrastructure, enabling faster and more reliable internet connectivity. China's booming e-commerce sector and widespread adoption of cloud services are driving demand for high-speed broadband. In addition, government policies such as the "Broadband China" initiative aim to enhance internet accessibility across rural and underserved areas. The proliferation of online education, telemedicine, and digital payments further accelerates broadband adoption in the country.

Europe Broadband Services Market Trends

Europe broadband services market is poised to witness significant growth over the forecast period. According to the European Commission (EC), nearly 96.7% of households in Europe have access to fixed broadband services. The EC intends to transform the region into a Gigabit Society by 2025. In addition, the Broadband Coverage in Europe study has been designed to track the progress of the specified broadband coverage objectives Digital Agenda of Europe-‘Broadband take-up of 50% of households with speeds at least 100 Mbps by 2020’ and ‘Universal Broadband Coverage with speeds at least 30 Mbps by 2020’.

The UK broadband services market growth is driven by the government's "Project Gigabit," which focuses on expanding gigabit-capable broadband to rural and underserved areas. The increasing shift towards hybrid work models has amplified the demand for reliable, high-speed internet connections. Furthermore, the UK's competitive telecom market, with providers investing in fiber-optic infrastructure, has enhanced broadband accessibility and affordability.

The Germany broadband services market held a substantial market share in 2024. Significant investments in fiber-optic networks and the modernization of digital infrastructure by both public and private sectors are accelerating market development. In addition, Germany’s thriving industrial base is driving demand for high-speed internet to support advanced technologies such as IoT and Industry 4.0.

Key Broadband Services Company Insights

Some of the key companies in the broadband services industry include AT&T, Verizon, SK broadband CO.LTD., T‑Mobile USA, Inc., and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

- AT&T is a leading telecommunications company and a major player in the global broadband services industry, offering high-speed internet solutions, fiber-optic connectivity, and innovative digital services. Its advanced network infrastructure and extensive customer base position it as a key driver of broadband expansion worldwide.

- SK Broadband Co., Ltd., a subsidiary of SK Telecom Co., Ltd., is a prominent provider in the global broadband services industry, offering high-speed internet, IPTV, and enterprise solutions. Renowned for its advanced fiber-optic network in South Korea, the company drives innovation and connectivity across diverse customer segments.

Key Broadband Services Companies:

The following are the leading companies in the broadband services market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T

- BCE Inc

- Charter Communications

- Hughes Network Systems, LLC

- Comcast

- CenturyLink

- KT Corp.

- LG Uplus Corp.

- Singtel

- SK broadband CO.LTD.

- T‑Mobile USA, Inc.

- Verizon

- Viasat, Inc.

Recent Developments

-

In October 2024, AT&T launched an industry-first integrated gateway that combines Business Fiber and 5G wireless connectivity in a single device, providing businesses with seamless, reliable internet access. This solution ensures automatic failover to 5G in case of fiber outages and offers Wi-Fi 6E technology for improved speed and reliability.

-

In May 2024, Comcast launched NOW Internet and NOW Mobile services across the U.S., offering affordable, flexible prepaid options with no contracts or credit checks. These services, backed by the Xfinity network, provide reliable connectivity and competitive pricing, with the added benefit of nationwide Wi-Fi hotspots for mobile users.

Broadband Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 547.89 billion

Revenue forecast in 2030

USD 875.06 billion

Growth Rate

CAGR of 9.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Broadband connection, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

AT&T, BCE Inc, Charter Communications, Hughes Network Systems, LLC, Comcast, CenturyLink, KT Corp., LG Uplus Corp., Singtel, SK broadband CO.LTD., T‑Mobile USA, Inc., Verizon, Viasat, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Broadband Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global broadband services market report based on broadband connection, end use, and region:

-

Broadband ConnectionOutlook (Revenue, USD Billion, 2018 - 2030)

-

Fiber Optic

-

Wireless

-

Satellite

-

Cable

-

Digital Subscriber Line (DSL)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business

-

Household

-

Others

-

-

Regional Outlook (Revenue, USD Billion. 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global broadband services market size was estimated at USD 500.30 billion in 2024 and is expected to reach USD 547.89 billion in 2025.

b. The global broadband services market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 875.06 billion by 2030.

b. The Asia Pacific dominated the broadband services market with a share of 31.31% in 2024. This is attributable to broad accessibility, technological advancements, and proactive government initiatives in the region.

b. Some key players operating in the broadband services market include AT&T, BCE Inc, Charter Communications, Hughes Network Systems, LLC, Comcast, CenturyLink, KT Corp., LG Uplus Corp., Singtel, SK broadband CO.LTD., T‑Mobile USA, Inc., Verizon, Viasat, Inc.

b. Key factors driving the broadband services market growth include digital transformation in businesses, increased adoption of online learning, and a rise in disposable income.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.