- Home

- »

- Medical Devices

- »

-

BRIC Breast Pump Market Size & Share, Report, 2030GVR Report cover

![BRIC Breast Pump Market Size, Share & Trends Report]()

BRIC Breast Pump Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Open System, Closed System), By Technology (Manual, Battery Powered, Electric), By Application, By Countries, And Segment Forecasts

- Report ID: GVR-2-68038-554-0

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

BRIC Breast Pump Market Size & Trends

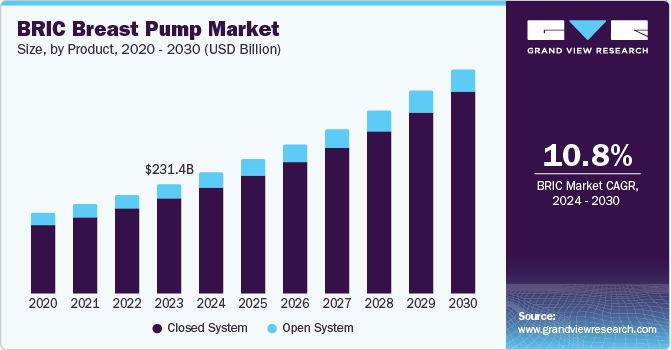

The BRIC breast pump market size was valued at USD 231.4 million in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030. The rising number of working women in BRIC countries is also contributing to the demand for convenient breastfeeding solutions. Government initiatives promoting maternal and child health, along with technological advancements in breast pump designs, are further fueling market expansion. In addition, economic growth in these countries is enhancing disposable incomes, making breast pumps more accessible to a broader consumer base.

The increasing challenges for women to breastfeed their children are expected to drive the demand for breast pumps in the future. Complications such as improper positioning, breast fullness, and sore nipples can hinder breastfeeding and negatively impact children’s health, leading to issues such as undernutrition. According to the latest WHO reports, 45% of deaths among children under age five are linked to undernutrition.

Innovations in milk storage have significantly shaped the market in recent years. The rise of milk banks in BRIC countries has had a substantial impact, enabling working mothers to support their professional careers while ensuring their children’s health. In addition, shifting trends toward breastfeeding culture and educational programs have encouraged mothers to donate milk to banks, thus expanding the market. According to the International Milk Genomics Consortium, Brazil has 217 milk banks and 126 milk collection points, with each state having at least one bank. In the previous year, 166,848 women donated breast milk.

Furthermore, technological advancements are major drivers of market growth. These advancements have led to the development of hygienic, user-friendly breast pumps that transform the breastfeeding process and support mothers. Features such as electric and battery-powered pumps, closed system technologies, portable and compact designs, noise reduction, and smart technology integration for monitoring and tracking pumping sessions have made breast pumps more appealing. These innovations ensure the safety of children, thereby increasing the demand for breast pumps and significantly propelling the market.

Product Insights

The closed-system segment accounted for the largest market revenue share of 86.8% in 2023 primarily due to the superior hygiene and safety features offered by closed-system breast pumps. These pumps are designed to prevent milk from coming into contact with the pump’s motor and tubing, thereby reducing the risk of contamination and ensuring the milk remains pure and safe for the baby. This feature is particularly appealing to health-conscious mothers and healthcare providers who prioritize the safety and well-being of infants.

The open-system segment is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. This growth is largely driven by the affordability and accessibility of open-system breast pumps. Unlike closed-system pumps, open-system pumps allow milk to flow through the tubing and into the pump’s motor, which can make them less expensive to produce and purchase. This cost advantage makes open-system pumps an attractive option for budget-conscious consumers. Additionally, the simplicity and ease of use of open-system pumps appeal to many new mothers who may be looking for a straightforward and effective solution for milk expression.

Technology Insights

The battery-powered segment dominated the market with a revenue share of 62.1% in 2023 attributed to the unparalleled convenience and portability that battery-powered breast pumps offer, making them highly attractive to working mothers who need to express milk on the go. The flexibility to use these pumps without being tethered to an electrical outlet allows mothers to maintain their routines seamlessly, whether at work, traveling, or at home. Additionally, advancements in battery technology have led to longer-lasting and more efficient batteries, enhancing the overall user experience. The growing awareness of the importance of breastfeeding and the increasing number of working mothers in BRIC nations have further fueled the demand for battery-powered breast pumps.

The electric segment is expected to grow at the fastest CAGR of 14.0% over the forecast period driven by the superior efficiency and performance of electric breast pumps compared to their battery-powered counterparts. Electric pumps typically offer stronger suction and more customizable settings, allowing mothers to express milk more quickly and comfortably. These features are particularly appealing to mothers who need to pump frequently or have specific breastfeeding challenges. Moreover, the increasing availability of advanced electric breast pumps with smart features, such as app connectivity and automated pumping schedules, is expected to attract tech-savvy consumers. The rising disposable incomes and improving healthcare infrastructure in BRIC nations also contribute to the segment’s growth, as more families can afford and access these high-quality products.

Application Insights

The hospital-grade segment dominated the market in 2023. This segment’s prominence is largely due to the high demand for reliable and efficient breast pumps in medical settings. Hospital-grade breast pumps are known for their robust performance, durability, and ability to handle frequent, intensive use. These pumps are designed to support mothers who may have difficulty breastfeeding directly, such as those with premature infants or medical complications. The superior suction power and advanced features of hospital-grade pumps ensure effective milk expression, which is crucial for maintaining milk supply and supporting infant health. In addition, hospitals and healthcare facilities in BRIC nations are increasingly investing in high-quality breastfeeding equipment to improve maternal and infant care standards.

The personal use segment is anticipated to witness the fastest growth from 2024 to 2030. his segment’s rapid expansion can be attributed to the increasing number of working mothers in BRIC nations is driving the demand for convenient and efficient breast pumps that can be used at home or on the go. Personal-use breast pumps offer the flexibility and portability that many mothers need to balance their professional and personal lives. Advances in technology have also made personal use pumps more affordable, user-friendly, and effective, making them accessible to a broader range of consumers. Features such as quiet operation, compact design, and customizable settings enhance the appeal of these products. Furthermore, the rising awareness of the health benefits of breastfeeding and the support from government and healthcare initiatives promoting breastfeeding practices are encouraging more mothers to invest in the personal use of breast pumps.

Countries Insights

Russia Breast Pump Market Trends

Russia breast pump market dominated the BRIC market with a share of 29.8% in 2023. This dominance is attributed to rising employment rates among women, which has increased the demand for solutions such as breast pumps that help balance professional life with breastfeeding. In addition, growing awareness of the health benefits of breastfeeding has consistently driven the demand for these products in the country.

China Breast Pump Market Trends

China breast pump market is anticipated to witness the fastest growth from 2024 to 2030. This growth is influenced by the challenges women in China face while breastfeeding, leading to complications such as nipple pain and breast engorgement, thereby increasing the demand for breast pumps. Moreover, the growing female workforce in China is driving the reliance on breast pumps among new mothers. Supportive policies aimed at encouraging breastfeeding in the workplace to support working mothers are also positively impacting product sales.

India Breast Pump Market Trends

India breast pump market was identified as a lucrative sector in 2023 owing to cultural shifts towards using technology in childcare, which has increased the demand for breast pumps. In addition, growing urbanization and rising family incomes have made it easier for mothers to afford quality and suitable breast pumps.

Key BRIC Breast Pump Company Insights

Some of the key companies in the BRIC breast pump market include Philips, Medela, Ameda, Inc., Willow, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Philips is a technology company operating globally and offers a line of high-performance breast pumps intended for supporting breastfeeding mothers with additional tools that improve comfort and effectiveness, characterized by both electric and manual models, developed to conform to the needs of consumers in these rapidly growing economies.

-

Medela is manufactures breast pumps and breastfeeding items. The company provides a broad range of quality breast pumps capable of satisfying consumer needs, including the electric and manual ones that are appropriate for both hospital usage and home application, aiming at improving the condition of moms and the nutritive value of their babies in these emergent countries.

Key BRIC Breast Pump Companies:

- Newell Brands

- Pigeon Corporation

- Koninklijke Philips N.V.

- Medela

- Mayborn Group Limited

- Ameda, Inc.

- Freemie

- Willow

- BabyBuddha Products.

Recent Developments

-

In May 2024, BabyBuddha introduced the BabyBuddha 2.0 Breast Pump. This new product was developed in response to direct feedback from mothers and incorporates their insights to enhance the pumping experience.

-

In February 2024, Madela introduced a pioneering family smartwatch application featuring advanced tracking capabilities and dedicated monitoring functions for breastfeeding and pumping sessions.

BRIC Breast Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 256.4 million

Revenue forecast in 2030

USD 474.4 million

Growth Rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Technology, Application, Countries

Regional scope

BRIC

Country scope

Brazil, Russia, India, China

Key companies profiled

Newell Brands; Pigeon Corporation; Koninklijke Philips N.V.; Medela; Mayborn Group Limited; Ameda, Inc.; Freemie; Willow; BabyBuddha Products.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

BRIC Breast Pump Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the BRIC breast pump market report based on product, technology, application, and countries.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Open System

-

Closed System

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Battery Powered

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Use

-

Hospital Grade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Russia

-

India

-

China

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.