Brazil Rigid PU Foam Market Size & Trends

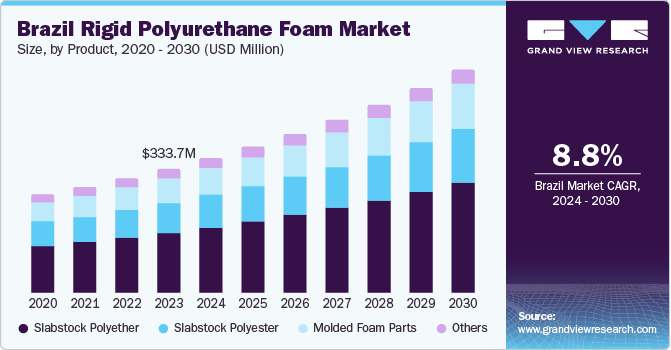

The Brazil rigid polyurethane foam market size was valued at USD 333.7 million in 2023 and is projected to grow at a CAGR of 8.8% from 2024 to 2030. Increasing demand in building insulation for energy conservation purposes, growing automotive industry, and increasing construction activities are the factors driving the Brazil rigid polyurethane (PU) foam market.

The growing focus on energy conservation and thermal performance in buildings is fueling the need for rigid polyurethane foam as an insulating material. The Brazilian government’s initiatives to reduce energy consumption and improve infrastructure development are also contributing to this trend. Moreover, the increasing adoption of rigid polyurethane foam in appliances is expected to further boost demand, as consumers seek energy-efficient solutions.

The automotive industry is another key driver of the market, with the growing demand for lightweight components and sustainable practices pushing the adoption of rigid polyurethane foam. The use of flexible polyurethane in cars is expected to increase, leading to a corresponding rise in demand for rigid polyurethane foam for sound insulation and vibration dampening. Furthermore, the increasing construction activities across Brazil, particularly in residential and commercial projects, are creating a significant demand for rigid polyurethane foam.

Regulatory frameworks promoting sustainable materials and practices are also playing a crucial role in driving the market growth. Manufacturers are increasingly adopting rigid polyurethane foam as a viable alternative to traditional insulation materials, given its excellent thermal and acoustic insulation properties. As a result, the demand for rigid polyurethane foam is expected to continue to grow, driven by a combination of factors including energy efficiency, sustainability, and regulatory pressures. This presents opportunities for innovation and sustainability in the industry, as manufacturers seek to develop new applications and products that meet these demands.

Product Insights

Slabstock polyether led the market and accounted for a share of 48.7% in 2023. Slabstock polyether is a premium insulation material utilized in the construction industry to enhance energy efficiency and reduce heating and cooling costs. Its exceptional thermal insulation properties make it an ideal solution for applications requiring energy efficiency, while its durability withstands frequent usage and varying environmental conditions.

Molded foam parts are expected to grow significantly with a CAGR of 8.9% during the forecast period. The foam molding process, including injection molding and reaction injection molding, enables the production of high-quality molded foam parts with intricate shapes and details. Recent advancements in molded foam technology have improved its performance and expanded its applications. In the automotive industry, polyurethane foam is used in interior components, driving demand in Brazil’s growing market.

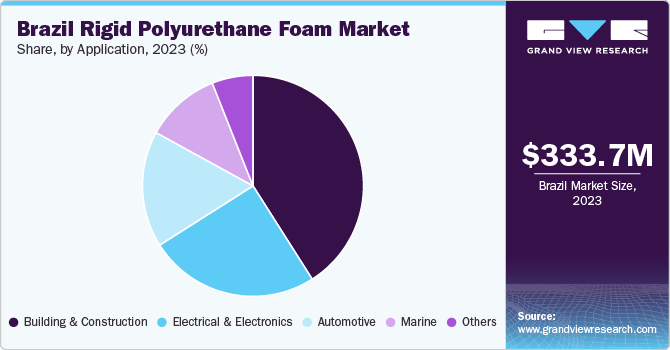

Application Insights

Building & construction accounted for the largest market share of 41.2% in 2023. Rigid polyurethane foam has become a crucial material in construction for its exceptional thermal insulation properties, conserving heat and energy. Its lightness and strength also make it an ideal component for structural building elements, ensuring solid and efficient structures. Moreover, polyurethane coatings and adhesives provide protection and durability, while withstanding various environmental conditions.

Automotive applications are projected to grow at the fastest CAGR of 6.6% over the forecast period. Brazil’s thriving automotive sector, catering to both domestic and international markets, drives demand for rigid polyurethane foam. Foreign car manufacturers have made significant investments in Brazil, establishing production facilities and expanding their presence. This growth in vehicle production has created a substantial need for stiff polyurethane foam, fueling market demand.

Key Brazil Rigid Polyurethane Foam Company Insights

Some key companies in the Brazil polyurethane foam market include Covestro AG; Dow; Honeywell International Inc.; Evonik Industries AG; and others. Companies are leveraging organic and inorganic growth strategies, including capacity expansions, mergers, acquisitions, and joint ventures, to sustain and enhance their market share.

-

Recticel S.A. manufactures a broad range of foams and synthetic compounds, serving the automotive, bedding, construction, and industrial sectors. With a majority of research focused on the automotive industry, the company’s products cater to various applications, including insulation materials and equipment.

-

Trelleborg AB (publ) offers engineering polymer solutions, specializing in sealing, bearings, damping, and protection for critical applications in harsh environments. The company’s portfolio includes polymer-based solutions, antivibration solutions, control system seals, and coated fabrics, catering to demanding industrial and commercial sectors.

Key Brazil Rigid Polyurethane Foam Companies:

The following are the leading companies in the Brazil rigid polyurethane foam market. These companies collectively hold the largest market share and dictate industry trends.

- Covestro AG

- Dow

- Honeywell International Inc.

- Evonik Industries AG

- BASF

- Trelleborg AB (publ)

- SEKISUI CHEMICAL CO., LTD.

- Saint-Gobain S.A.

- Rogers Corporation

- Recticel S.A.

Recent Developments

-

In April 2024, BASF launched a novel polyurethane foam technology called ‘Design-for-recycling’, enabling the easier and more scalable recycling of PU foam. The recycled material was subsequently incorporated into foam formulations designed for easy recycling.

Brazil Rigid Polyurethane Foam Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 361.9 million

|

|

Revenue forecast in 2030

|

USD 601.4 million

|

|

Growth rate

|

CAGR of 8.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million/billion, CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application

|

|

Country scope

|

Brazil

|

|

Key companies profiled

|

Covestro AG; Dow; Honeywell International Inc.; Evonik Industries AG; BASF; Trelleborg AB (publ); SEKISUI CHEMICAL CO., LTD.; Saint-Gobain S.A.; Rogers Corporation; Recticel S.A.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Brazil Rigid Polyurethane Foam Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil polyurethane foam market report based on product, and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Slabstock Polyether

-

Slabstock Polyester

-

Molded Foam Parts

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics

-

Building & Construction

-

Automotive

-

Marine

-

Others