- Home

- »

- Animal Health

- »

-

Bovine Mastitis Market Size & Share, Industry Report, 2030GVR Report cover

![Bovine Mastitis Market Size, Share & Trends Report]()

Bovine Mastitis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pharmaceuticals, Diagnostics), By Route Of Administration (Intra-Mammary, Systemic), By Therapy, By Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-507-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bovine Mastitis Market Summary

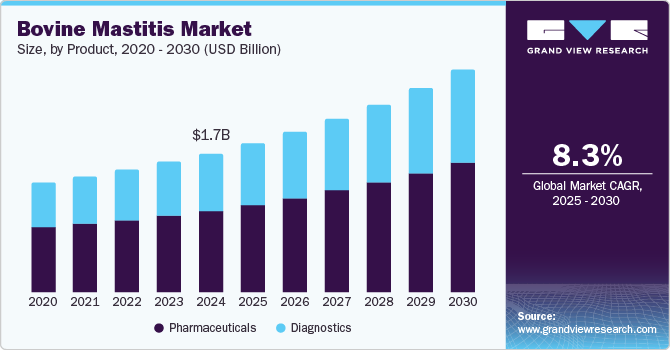

The global bovine mastitis market size was estimated at USD 1.67 billion in 2024 and is projected to reach USD 2.66 billion by 2030, growing at a CAGR of 8.26% from 2025 to 2030. The market is expanding rapidly due to the rising incidence of udder infection, and the growing awareness of the condition is anticipated to play a significant role in the expansion of the bovine mastitis industry.

Key Market Trends & Insights

- North America bovine mastitis market held the largest revenue share of 37.74% in 2024.

- The Asia Pacific bovine mastitis industry is anticipated to grow at the fastest CAGR of 10.22% during the forecast period.

- In terms of product, the pharmaceuticals segment accounted for more than 59% of revenue share in 2024.

- In terms of type, clinical mastitis held the largest market share in 2024 and sub-clinical is expected to grow at the fastest CAGR of 8.64% during the forecast period

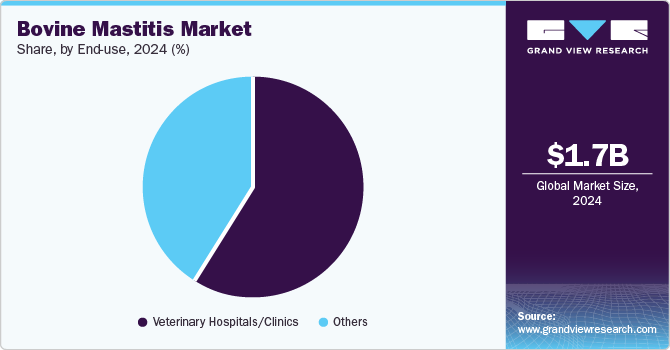

- In terms of end use, The veterinary hospitals/clinics segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.67 Billion

- 2030 Projected Market Size: USD 2.66 Billion

- CAGR (2025-2030): 8.26%

- North America: Largest market in 2024

Another factor driving market growth is the introduction of novel products. Udder infection is one of the most significant conditions affecting dairy animals, with subclinical mastitis accounting for the majority of cases, according to a September 2024 article in the Indian Journal of Veterinary Sciences and Biotechnology.

Approximately 9.93% and 30.83% of the population had clinical and subclinical mastitis, respectively.

The COVID-19 pandemic has significantly influenced various markets globally, including the bovine mastitis industry. Lockdowns and restrictions disrupted the supply of key raw materials required for manufacturing bovine mastitis treatments. Farmers and livestock owners avoided routine veterinary visits due to COVID-19-related restrictions and fear of infection. Moreover, the pandemic-induced economic downturn reduced farmers' purchasing power, affecting their ability to invest in high-cost treatments or preventive measures for bovine udder infection.

In addition, one of the main factors propelling the bovine mastitis industry is the rising demand for dairy products. The demand for milk and dairy products like cheese, yogurt, and butter is increasing due to a growing population and increased disposable income. Dairy producers are under pressure to guarantee a high-quality and healthy dairy supply due to the spike in demand. Therefore, controlling udder infection becomes increasingly important to preserving the quantity and quality of milk. A greater emphasis on efficient treatment and preventative strategies is the result of producers investing in ways to reduce udder infection-related losses. This pattern suggests that the importance of treating bovine udder infection would increase along with the dairy market, which will ultimately lead to expansion in the bovine mastitis industry.

Advancements in diagnostic approaches and therapeutic management in udder infection led to market growth. For example, a July 2023 article in the National Library of Medicine states that advanced diagnostic tools like polymerase chain reactions, acute phase protein detection, protein-based ELISA techniques, quantitative PCR, MALDI-TOF, etc., offer many benefits, including the ability to detect udder infection-causing pathogens with high accuracy and specificity, even at the subspecies level, and an effective treatment approach.

Product Insights

The pharmaceuticals segment accounted for more than 59% of revenue share in 2024, driven by the availability of a wide range of antibiotics and NSAIDs. Pharmaceuticals, such as antibiotics, anti-inflammatories, and hormonal therapies, are highly effective in treating and managing bovine udder infection. Their ability to address both clinical and subclinical infections contributes to their dominant position in the market. Moreover, according to the Cornell University College of Veterinary Medicine, antibiotics are used as a primary therapy for bovine udder infection, which contributes significantly to the growth of the bovine mastitis industry. Since effective antibiotic treatments are crucial for managing infections, lowering inflammation, and averting problems in afflicted cattle, there is a greater need for these prescription medications.

The diagnostics segment is expected to grow at a CAGR of 8.49% from 2025 to 2030. This growth is associated with the presence of prominent market competitors that provide diagnostic tools. For example, VetMAX MastiType multiplex qPCR kits from Thermo Fisher Scientific Inc. are made to deliver same-day results, even for Mycoplasma species, allowing veterinarians and farmers to act quickly and effectively. This solution has a number of benefits, including quicker results and the elimination of the requirement for bacterial culture.

Type Insights

Clinical mastitis held the largest market share in 2024. According to Merck & Co., Inc., clinical mastitis is an inflammatory reaction to illness that results in obviously abnormal milk (for example, color or fibrin clots). Changes in the udder, such as swelling, heat produced, soreness, and redness, may also become noticeable as the inflammation worsens. Products such as antibiotics, anti-inflammatory drugs, and supportive therapies are extensively used in managing clinical mastitis. This creates a robust market for treatment options tailored specifically to this condition.

Moreover, the sub-clinical segment is expected to grow at the fastest CAGR of 8.64% during the forecast period, as subclinical mastitis is more prevalent and can cause long-term losses due to chronic inflammation and reduced milk quality. Subclinical mastitis is asymptomatic and often identified only through diagnostic screening (e.g., somatic cell count tests). This lower detection rate translates to less urgency and market demand compared to clinical mastitis. Moreover, the existence of an infection without obvious local inflammation or systemic involvement is recognized as sub-clinical mastitis, although temporary episodes of abnormal milk production may occur. An infection is considered chronic if it lasts for two months or more.

Therapy Insights

The dry period segment held the largest market share in 2024. The dry period is when cows are most susceptible to subclinical mastitis, which often progresses to clinical mastitis during the next lactation. Antibiotic treatments during the dry period are a standard practice to prevent infections. Increased regulatory focus on antibiotic stewardship has led to the growth of selective dry cow therapy (SDCT), where antibiotics are used only for cows with a confirmed infection, which further contributes to segment growth.

The lactating period segment is anticipated to grow at the fastest CAGR, driven by the high prevalence of udder infection in lactating cows. For instance, according to an article published by Awassa College of Agriculture, Debub University, Awassa, Ethiopia, 34.9% of lactating cows suffer from udder infections. Hence, as the incidence of udder infection continues to rise in lactating cows, the demand for effective diagnostic tools, preventive measures, and treatment solutions increases, driving the market growth.

End-use Insights

The veterinary hospitals/clinics segment accounted for the largest revenue share in 2024 due to their pivotal role in the diagnosis, treatment, and prevention of udder infection. Veterinary clinics and hospitals often have access to advanced diagnostic tools, such as somatic cell counters, PCR tests, and bacterial culture facilities. This allows for accurate detection of mastitis-causing pathogens, enabling targeted treatment strategies. These facilities provide comprehensive treatment plans, including antimicrobial therapies, anti-inflammatory drugs, and supportive care. The availability of high-quality treatment services increases the demand for veterinary hospitals and clinics.

The others segment is projected to grow at the fastest CAGR over the forecast period. On-site treatments, such as antibiotic therapy, anti-inflammatory medications, and other veterinary interventions, allow farmers to address mastitis quickly without needing to send cows to a clinic. These treatments not only help reduce the duration and severity of the condition but also minimize the risk of contamination of milk, which can lead to financial losses. The convenience and effectiveness of on-site treatments drive adoption, encouraging farmers to invest in products and technologies that enable quicker, more efficient treatment of mastitis on their farms.

Route Of Administration Insights

The intra-mammary segment dominated the market in 2024 due to its effectiveness in directly targeting the infection within the udder. The intra-mammary route allows for the direct delivery of therapeutic agents into the affected mammary gland, ensuring high concentrations of the medication at the site of infection. This targeted approach improves treatment outcomes, particularly for bacterial infections like Staphylococcus aureus and Escherichia coli. Unlike systemic administration, intra-mammary treatments minimize drug exposure to the rest of the animal's body, reducing side effects and withdrawal periods for milk, which is a crucial factor for dairy farmers.

Moreover, the segment is anticipated to grow at the fastest CAGR over the forecast period due to the abundance of available products. For example, Boehringer Ingelheim Animal Health provides solutions like PolyMast, ToDAY, Dry-Clox, and Lockout that are used intra-mammary to treat udder infections which contain antibiotics.

Regional Insights

North America bovine mastitis market held the largest revenue share of 37.74% in 2024, due to the increasing requirement to meet consumer needs for sustainable animal protein sources, as well as the growing cattle population. Mastitis has a major impact on milk quality and output. Maintaining productivity and satisfying the growing demand for animal protein worldwide while upholding environmental objectives depend on preventing or successfully managing this illness. Over 90% of dairy cattle in the United States are Holstein cows, and over 70% of cows in the nation are kept on factory farms, according to data from the Holstein Association of the USA for 2024.

U.S. Bovine Mastitis Market Trends

The U.S. bovine mastitis industry is anticipated to grow owing to an increase in the number of animal healthcare facilities and practitioners. In the United States, for example, there are approximately 126,138 active veterinarians. According to research by the American Veterinary Medical Association, 75,349 people were employed in private practice in 2024. Furthermore, it is anticipated that a rise in the number of veterinary healthcare organizations will accelerate market expansion. As a result, the increasing number of veterinary clinics broadens the geographic scope of healthcare services, increasing access to advanced diagnostics and treatments in isolated and rural dairy farming regions. This expands the market for medicinal remedies, diagnostic tools, and preventative measures.

Europe Bovine Mastitis Market Trends

The bovine mastitis industry in Europe is anticipated to grow at a lucrative rate over the forecast period. According to an article published by the European Commission, Bovine mastitis is a major issue in the dairy industry, incurring losses of around €1.5 billion in Europe each year. The region's market is growing owing to the introduction of new technologies. PanaMast, for example, is a newly developed, innovative, non-antibiotic antimicrobial technology. It responds well against every type of bacteria that has been tested in the lab, including forms that are resistant to antibiotics like MRSA. in order to provide an efficient treatment regimen, this non-antibiotic method seeks to become the first zero-withdrawal product in the world, enabling farmers to sell milk both during and after treatment. In initial field studies against udder infection caused by Staph. aureus, researchers discovered a 70% cure rate, compared to a 5-15% cure rate utilizing traditional treatments.

The Germany bovine mastitis industry growth is attributed to factors such as the presence of local companies and supportive government measures to reduce the incidence of udder infection. Companies that sell a diverse range of products, such as antibiotics, teat sealants, and anti-inflammatory medications, offer individualized solutions for controlling and preventing mastitis, which contributes to market growth. For instance, J-VAC, ToMORROW, and other intra-mammary antibiotics are offered by Boehringer Ingelheim Animal Health to treat udder infections in lactating cows.

Asia Pacific Bovine Mastitis Market Trends

The Asia Pacific bovine mastitis industry is anticipated to grow at the fastest CAGR of 10.22% during the forecast period. The growing demand for dairy products in developing economies is expected to drive the market. Asia is the world's greatest milk-producing region, with an output of around 419 million tons in 2023, according to the FAO. Compared to the previous year, this represented a 2.1% increase. The Asian dairy market is expected to expand in countries including China, Japan, and India. Additionally, the USDA claims that the increase in bovine production and milk/beef consumption was mostly caused by the growing populations, rising incomes, and urbanization of Southeast Asian nations.

The bovine mastitis industry in China is expanding significantly over the forecast period. The increasing number of dairy cows in the country propels the market growth. For example, the dairy sector in China has flourished in response to the increase in earnings and living standards observed in recent decades, according to a February 2024 publication by Dezan Shira & Associates. After the US, China has the second-largest dairy product market in the world. Between 2001 and 2023, China's dairy cow population grew from 5.7 million to 7.1 million.

Latin America Bovine Mastitis Market Trends

The bovine mastitis industry in Latin America is experiencing growth driven by the growing consumer demand for dairy products which has resulted in a steady increase in dairy production throughout Latin America. The risk of udder infection outbreaks is increased by this expansion, which frequently makes it difficult to maintain appropriate sanitation and hygiene standards on farms. Research and development to produce novel treatments and prophylactics for bovine udder infection is becoming more and more important. To improve illness management and control, innovations like new vaccinations, medicines, and diagnostic instruments are being developed, further supporting the market growth.

The Brazil bovine mastitis market is driven by the increasing prevalence of mastitis in dairy cows. Mastitis is widely recognized as one of the most expensive diseases in dairy herds. One of the biggest problems facing the Brazilian dairy sector has been determined to be the high prevalence of clinical mastitis across the country. The country's implementation of disease awareness initiatives further supports the expansion of the market. Mastitis control programs have been developed in Brazil, and the demand for research on mastitis risk factors is increasing as these programs are implemented.

MEA Bovine Mastitis Market Trends

The bovine mastitis industry in the Middle East and Africa (MEA) region is being driven by the growing awareness of animal health and welfare. Concerns about the quality of dairy products and the welfare of animals have led to a greater focus on animal health and welfare. Farmers are being encouraged by this understanding to spend money on mastitis prevention strategies and efficient treatments. Furthermore, inadequate cleansing and disinfection of the genitals is one example of poor hygiene practices that might promote the spread of bacteria that cause mastitis. Improving these practices is critical for reducing the incidence of illness.

The market for bovine mastitis in South Africa is driven by increased livestock production, accelerated genetic improvements, and increasing concerns about animal health. South Africa holds a special place on the African continent in terms of vegetation, climate zones, and livestock resources. Furthermore, the cow sector is one of the biggest in South Africa, with over 40,000 workers. The growing demand for dairy cows, as purchasing pregnant cows benefits dairy farmers, is one of the factors propelling the country's market growth.

Key Bovine Mastitis Company Insights

The market is fairly competitive due to the presence of numerous small and major businesses. To increase their market share, businesses are increasingly using various tactics, including product launches, geographic expansions, and mergers and acquisitions. Because of ongoing research projects, this sector can be seen as having a medium-to-high level of development.

Key Bovine Mastitis Companies:

The following are the leading companies in the bovine mastitis market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer

- Zoetis

- Merck

- Ceva

- Elanco

- HIPRA

- Heilsaa

- Immucell Corporation

- Forte Healthcare Ltd

- Virbac

Recent Developments

-

In August 2023, Zoetis launched Vetscan Mastigram, a quick on-farm mastitis test that can identify Gram-positive mastitis in just eight hours using a standard flow dipstick test, allowing for results prior to the next milking in a number of European markets.

-

In September 2022, The Clinical and Laboratory Standards Institute approved the updated interpretation criteria for the susceptibility testing of Ubrolexin, according to Boehringer Ingelheim, a world leader in animal health.

Bovine Mastitis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.79 billion

Revenue forecast in 2030

USD 2.66 billion

Growth Rate

CAGR of 8.26% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, therapy, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa and Kuwait

Key companies profiled

Boehringer Ingelheim Animal Health, Zoetis, Merck & Co., Inc., Ceva, Elanco, HIPRA, Immucell Corporation, Forte Healthcare Ltd, Virbac, Heilsaa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bovine Mastitis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bovine mastitis market report based on product, type, therapy, route of administration, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Antibiotics

-

Vaccines

-

Others

-

Diagnostics

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Mastitis

-

Sub-Clinical Mastitis

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Period

-

Lactating Period

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intra-Mammary

-

Systemic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global bovine mastitis market size was estimated at USD 1.67 billion in 2024 and is expected to reach USD 1.79 billion in 2025.

b. The global bovine mastitis market is expected to grow at a compound annual growth rate of 8.26% from 2025 to 2030 to reach USD 2.66 billion by 2030.

b. North America dominated the bovine mastitis market with a share of 37.74% in 2024. This is attributable to the increasing requirement to meet consumer needs for sustainable animal protein sources, as well as the growing cattle population

b. Some key players operating in the bovine mastitis market include Boehringer Ingelheim Animal Health, Zoetis, Merck & Co., Inc., Ceva, Elanco, HIPRA, Immucell Corporation, Forte Healthcare Ltd, Virbac, Heilsaa

b. Key factors that are driving the market growth include rising incidence of bovine mastitis, technological advancements in diagnosis, and rising demand for dairy products

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.