- Home

- »

- Medical Devices

- »

-

Bone Wax Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Bone Wax Market Size, Share & Trends Report]()

Bone Wax Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Absorbable, Non-absorbable), By Application (Orthopedic Surgery, Thoracic Surgery), By Material, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-197-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bone Wax Market Size & Trends

The global bone wax market size was estimated at USD 52.7 million in 2023 and is projected to grow at a compounded annual growth rate (CAGR) of 3.1% from 2024 to 2030. The increasing cases of fractures across the globe play a crucial role in driving the use of bone wax. For instance, as per the 2022 Osteoporosis Canada Facts and Stats, one in three women and one in five men will experience an osteoporotic fracture in their lifetime. Similarly, according to the INTERNATIONAL Osteoporosis Foundation report, every year, more than 8.9 million fractures occur globally due to osteoporosis. This means that an osteoporosis fracture happens every three seconds. Thus, rising cases of fractures will boost product demand.

The rising number of cases of sports and recreation-related injuries is driving the market growth. According to the National Safety Council's report, in 2022, approximately 3.6 million emergency department visits were caused by sports and recreational equipment. The most common activities associated with injuries were exercise, cycling, and basketball. In addition, there was a 12% increase in sports and recreational injuries in 2022, following a 20% increase in 2021. Similarly, according to a report by Johns Hopkins University, in the U.S., more than 3.5 million injuries occur each year among over 30 million children and teenagers who participate in organized sports.

Due to the rising prevalence of orthopedic conditions, such as osteoarthritis and osteoporosis, the number of orthopedic surgeries is increasing. For instance, according to a report from the Centers for Disease Control and Prevention (CDC), around 53.2 million people, or 21.2% of U.S. adults were diagnosed with arthritis between 2019 and 2021. Similarly, as per the 2023 article from the Bone Health and Osteoporosis Foundation (BHOF), around 10 million Americans are affected by osteoporosis, whereas another 44 million people suffer from low bone density, which increases their chances of bone fractures. These factors are likely to contribute to industry growth.

A study conducted in 2022, titled "Efficacy of Bone Wax in Total Hip Arthroplasty (THA) via Direct Anterior Approach," has concluded that bone wax can be safely used as a part of the surgical technique in THA through the direct anterior approach without any complications. As a result, research and development studies focusing on bone wax's effectiveness in arthroplasty procedures are expected to drive market growth during the study period. Moreover, increasing awareness among healthcare professionals regarding the benefits of using bone wax in surgical procedures is likely to contribute to market growth.

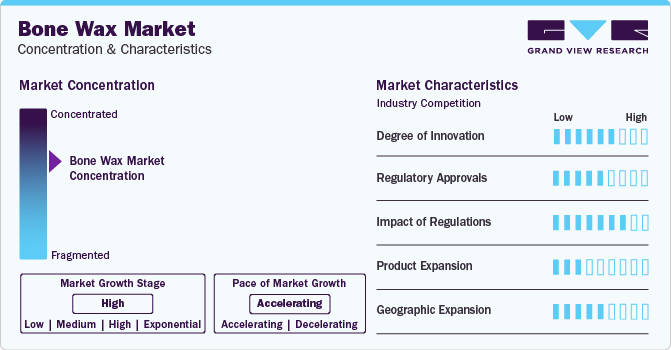

Market Concentration & Characteristics

The market growth stage is steady and its growth pace is accelerating. The product applications are constantly emerging, leading to the creation of new opportunities for market players. The market is characterized by a low to moderate degree of growth owing to increasing incidence of falls & injuries, high product adoption, and introduction of advanced products by market players.

The market is characterized by a high degree of innovation due to rapid technological advancements. New and improved formulations of bone wax, as well as innovative delivery systems, may enhance the overall efficacy and safety of surgeries. For instance, Future Surgicare Pvt. Ltd. launched an innovative product, Hemostax, for absorbable hemostasis

The market is characterized by a high level of merger and acquisition (M&A) activity by leading players to gain higher market share and cater to the growing demand. For instance, in April 2022, Medline International B.V. announced the acquisition of Asid Bonz from Medi-Globe Group

Well-developed regulatory framework and a rising number of product approvals from government regulatory bodies positively impact market growth. The certifications and standards provided by government authorities for bone wax in their production, deployment, and use would enhance their adoption at the workplace

Several companies are embracing the product expansion strategy to stay competitive and ahead in the dynamically evolving market landscape

Several players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising R&D activities create more opportunities for players to enter new regions

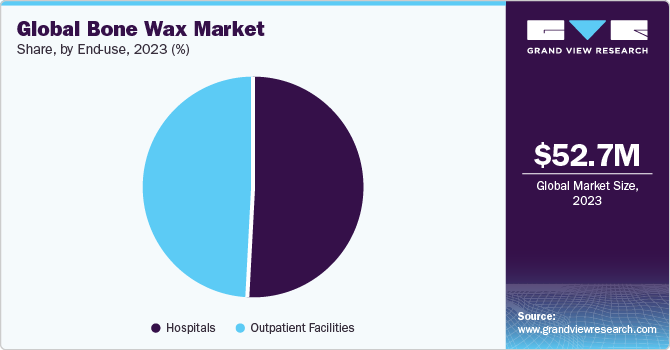

End-use Insights

The hospitals end-use segment dominated the market in terms of revenue share in 2023 owing to their central role in the delivery of comprehensive healthcare services. Large-scale hospitals are equipped to handle various surgical procedures, including orthopedic, thoracic, and neurosurgical interventions. In these procedures, bone wax plays a crucial role in achieving hemostasis and ensuring favorable surgical outcomes. In addition, hospitals are increasingly adopting orthopedic programs to improve patient care. For instance, Becker's Hospital report has highlighted the orthopedic programs of 100 hospitals and health systems across the U.S.

These programs are dedicated to providing exceptional orthopedic care for patients with musculoskeletal conditions or injuries. The outpatient facilities segment is anticipated to register the fastest CAGR of 3.3% from 2024 to 2030 owing to the increasing demand for outpatient surgeries. According to ScienceDirect, the proportion of total knee arthroplasty (TKA) performed in ambulatory surgery centers (ASCs) rose from 5% in 2020 to 8% in Q1 2021. Moreover, outpatient facilities, including ASCs and clinics, offer a convenient and cost-effective alternative for certain surgical interventions, thereby supporting market growth.

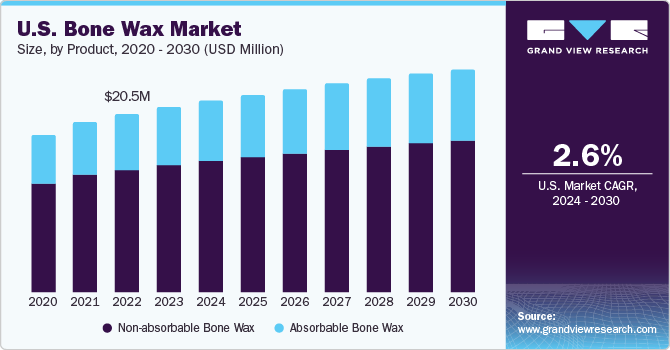

Product Insights

By product, the market is divided into absorbable and non-absorbable bone wax. In 2023, the non-absorbable product segment dominated the market and accounted for the largest revenue share of 68.4%. The non-absorbable product segment is anticipated to witness a steady CAGR from 2024 to 2030. Non-absorbable bone wax is a valuable resource in surgical procedures involving orthopedics and craniofacial surgeries, where persistent hemostasis is essential. Its durability and long-lasting hemostatic effects make it a preferred choice for medical professionals, contributing to a consistent demand for this product. The product's ability to provide a reliable solution to control bleeding has helped improve patient outcomes and made surgical procedures safer and more effective.

The absorbable product segment is anticipated to witness the fastest CAGR from 2024 to 2030. A steep rise in the adoption of absorbable products, particularly in arthroplasty procedures is driving segmental growth. According to a study, "The Efficacy of Tableau Wax (Water-Soluble Bone Wax) in Spinal Fusion Surgery: A Randomized Controlled Trial", published in 2023, tableau wax demonstrated effective bleeding control ability when compared to conventional bone. Moreover, compared to traditional non-absorbable options, absorbable bone wax eliminates the need for secondary surgery, reducing patient discomfort and complications.

Application Insights

The orthopedic surgery segment held the largest revenue share of 30.4% in 2023 owing to the rising geriatric population susceptible to orthopedic disorders and fractures. According to a report by the World Health Organization (WHO), by 2030, one out of every six individuals in the world will be aged 60 years or above. This implies that the share of the population aged 60 years and above will increase from 1 billion in 2020 to 1.4 billion in 2030. By 2050, the global population of people aged 60 years and older will double to 2.1 billion. Furthermore, the number of individuals aged 80 years or older is projected to triple between 2020 and 2050, reaching 426 million. With the rising geriatric population, there has been a significant increase in the prevalence of orthopedic disorders.

These conditions often require surgical interventions, where bone wax plays a crucial role in achieving hemostasis and providing structural support, thereby fostering market growth. The dental/oral surgery segment is anticipated to register a considerable growth rate from 2024 to 2030. Increasing awareness of dental health, coupled with a rising number of reconstructive and implant surgeries, fuels the product demand in dental/oral surgery applications. According to Forbes, the number of Americans with implants will grow from 6% in 2023 to 23% in 2026. In addition, due to advancements in dental procedures and the need for effective solutions to address bleeding concerns, bone wax has become increasingly popular in this field.

Material Insights

The natural martial segment dominated the market in terms of revenue share owing to the increasing preference for biocompatible and natural materials in surgical applications. Natural bone wax, which is usually derived from beeswax, has emerged as a viable option for surgical materials due to its compatibility with the body's natural healing mechanisms. Its inherent biocompatibility minimizes the risk of adverse reactions, inflammation, and foreign body responses, thus aligning with the patient-centric approach to healthcare. Thus, with the rising awareness of the advantages of natural materials, the natural material segment is expected to register the fastest CAGR of 3.3% from 2024 to 2030.

The synthetic product segment is anticipated to register a steady growth rate over the forecast period due to the continual advancements in material science and the demand for precision in surgical applications. Synthetic bone wax formulations, which are often composed of biocompatible polymers, provide a controlled and tailored method for achieving hemostasis and structural support during surgical procedures. The ability to customize these formulations to meet different surgical requirements is contributing to the growing acceptance of synthetic bone wax.

Regional Insights

North America dominated the market in 2023 and accounted for the largest revenue share of 51.1% owing to the growing participation of the population in sports and recreational activities. According to the Children's Safety Network, each year, more than 38 million children and adolescents participate in sports in the U.S.; of which, over 3.5 million children under the age of 15 years require medical treatment for sports-related injuries.Advanced healthcare infrastructure in North America, characterized by state-of-the-art hospitals and outpatient facilities, further fuels the demand for bone wax. In addition, the region experiences continual advancements in medical technologies and surgical techniques, fostering innovation for enhanced product utilization in diverse surgical applications.

Asia Pacific is anticipated to register the fastest CAGR from 2024 to 2030 owing to the increasing geriatric population. For instance, According to the WHO, China has one of the world's fastest-growing populations. It is estimated that by 2040, around 28% of the country's population will be over 60 years old due to an increase in life expectancy and decreasing fertility rates. Thus, with the growing aging population, the demand for orthopedic surgeries will rise, augmenting product demand. Furthermore, growing cases of orthopedic conditions are expected to boost regional market growth. According to the Global Data report, in 2022, 5,675,561 orthopedic procedures were performed in India.

Key Bone Wax Company Insights

Key participants in the bone wax market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Bone Wax Companies:

The following are the leading companies in the bone wax market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these bone wax companies are analyzed to map the supply network.

- Pfizer, Inc.

- Zimmer Biomet Holdings, Inc.

- Medline Industries, Inc.

- Medtronic

- B Braun Melsungen AG

- Baxter International, Inc.

- Johnson & Johnson

- Dolphin Sutures

- SMI AG

- Orion Sutures India Pvt. Ltd.

- Universal Suture

Recent Developments

-

In November 2022, Ur24Technology Inc., a medical device company, partnered with DemeTECH Corporation

-

In February 2022, Futura Surgicare Pvt. Ltd. launched a new brand, Dolphin Hemostats, for its absorbable hemostat, Hemostax. The product is designed to help surgeons control bleeding

-

In February 2019, Terumo Cardiovascular Group, a major player in the market for cardiovascular surgery technologies, announced a three-year distribution partnership aimed at introducing the BoneSeal bone hemostat to the cardiac surgery market in the U.S.

Bone Wax Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 54.82 million

Revenue forecast in 2030

USD 66.00 million

Growth rate

CAGR of 3.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Braun Melsungen AG; Baxter International Inc.; Johnson & Johnson; Medtronic Plc; GPC Medical Ltd.; Medline Industries Inc.; Dolphin Sutures; SMI AG; Orion Sutures India Pvt. Ltd.; Universal Sutures

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bone Wax Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the bone wax market report on the basis of product, application, material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Absorbable Bone Wax

-

Non-absorbable Bone Wax

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

Thoracic Surgery

-

Neurosurgery

-

Dental/Oral Surgery

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Bone Wax

-

Synthetic Bone Wax

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bone wax market size was estimated at USD 52.7 million in 2023 and is expected to reach USD 54.82 million in 2024.

b. The global bone wax market is expected to grow at a compound annual growth rate of 3.1% from 2024 to 2030 to reach USD 66.0 million by 2030.

b. North America dominated the bone wax market with a share of 51.1% in 2023. Owing to the growing participation of the population in sports and recreational activities. The availability of advanced healthcare infrastructure in North America, further fuels the demand for bone wax.

b. Some key players operating in the bone wax market include B Braun Melsungen AG, Baxter International Inc, Johnson & Johnson, and Medtronic plc. Dolphin Sutures, SMI AG, ORION SUTURES INDIA PVT LTD, and Universal Sutures

b. Key factors that are driving the market growth include increasing cases of fractures across the globe play a crucial role in driving the use of bone wax. For instance, as per the 2022 Osteoporosis Canada Facts and Stats, one in three women and one in five men will experience an osteoporotic fracture in their lifetime.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.