- Home

- »

- Medical Devices

- »

-

Bone Allografts Market Size, Share And Trends Report, 2030GVR Report cover

![Bone Allografts Market Size, Share & Trends Report]()

Bone Allografts Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Cortical Bone Allografts, Cancellous Bone Allografts), By Application (Dental, Spine) By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-968-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bone Allografts Market Size & Trends

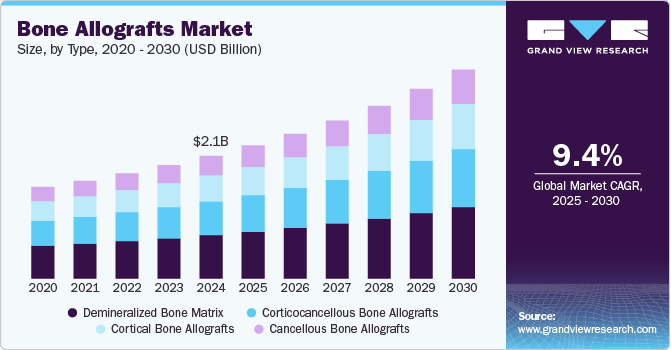

The global bone allografts market size was estimated at USD 1.90 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The growing geriatric population, rising healthcare costs, and increasing healthcare provider adherence to allograft are some factors propelling the industry's growth. Other factors include the rising number of surgical procedures, such as joint reconstruction and spinal fusion surgeries.

In addition, during the forecast period, the development of sophisticated bone graft procedures and an increase in the frequency of bone fractures are anticipated to propel the market growth. For instance, according to the World Osteoporosis Day Survey 2023 conducted by the International Osteoporosis Foundation, 43% of the women surveyed reported that they had broken a bone following a minor fall after age 50.

A growing number of product approvals by regulatory authorities and rising demand for synthetic substitutes are expected to propel market growth over the forecast period. For instance, in May 2023, Locate Bio, a UK-based company, obtained a U.S. FDA clearance for its LDGraft. It is designed to provide more effective treatment or diagnosis for life-threatening or irreversibly debilitating diseases or conditions, especially degenerative disc disease. Moreover, various advantages and benefits of bone grafts, such as osteoconductivity, biocompatibility, and safety for fractured bones, have driven the adoption of these products, further boosting market growth.

Moreover, increasing cases of road accidents are expected to drive the demand for bone allografts. For instance, according to the Road Accidents in India 2022 Report published by the Ministry of Road Transport and Highways, 4,61,312 accidents were reported by union territories (UTs) and states, resulting in injuries to 443,366 individuals. This showcases the 11.9% increase in accidents and a 15.3% increase in injuries compared to 2021.

Furthermore, factors such as the rising demand for minimally invasive surgeries, the growing incidence of facial fractures due to falls, and sports injuries are projected to drive the demand for bone allografts during the forecast period. For instance, according to The Johns Hopkins University, approximately 30 million children participate in sports each year in the U.S., and more than 3.5 million sports injuries are registered annually. Similarly, according to the Centers for Disease Prevention and Control (CDC), more than 14 million adults aged 65 and older report injuries due to falls annually.

Some key drivers impacting the industry include the aging population and the growing adoption of allografts due to their properties, such as immediate structural support and osteoconductivity. These are commonly used in spine, dental, and hip areas. Furthermore, demineralized bone matrices are easily available in various sizes and shapes, such as chips, pellets, and granules. Moreover, they demonstrate both osteoinductive and osteoconductive properties, increasing their popularity and boosting industry growth.

Market Concentration & Characteristics

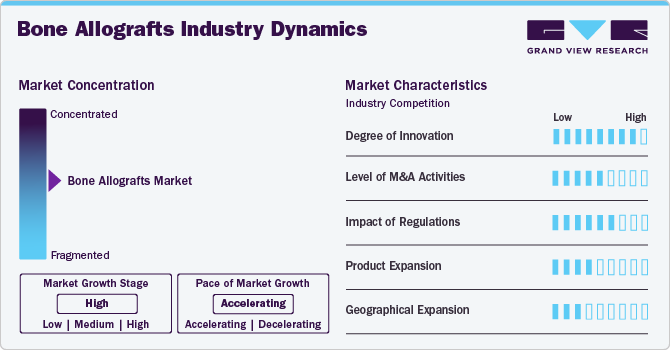

The market has been characterized by a high degree of innovation due to increased funding and significant R&D activities. For instance, in 2021, MTF Biologics granted over USD 1 million to fund research on allografts through research grants.

The market is characterized by a medium level of merger and acquisition (M&A) activity. This strategy enables companies to enhance their capabilities, improve competency, and expand their product portfolios. For instance, in May 2022, Envista Holdings Corporation, a dental equipment company, entered into a definitive agreement to acquire Allotech LLC and OBI Biologics, Inc., Osteogenics Biomedical Inc., collectively known as "Osteogenics". Osteogenics offers a range of bone grafting products.

The U.S. FDA strictly regulates bone grafts. Bone grafting materials that include therapeutic biologicals, such as bone morphogenic proteins (BMPs) and other biological response modifiers, are regulated under the product codes NPZ and NQA. FDA's Office of Combination Products determines the jurisdiction of these products. Such products within the Center for Devices and Radiological Health (CDRH) jurisdiction are classified as Class III devices and must submit a premarket approval application.

Several market players are expanding their business by launching new products in the market. For instance, in September 2024, LifeNet Health, in collaboration with Johnson & Johnson, introduced the PliaFX Pak bone allografting solution for spine procedures and orthopedic trauma, such as fracture fixations, fusions, and osteotomies.

Several market players are expanding their business by entering new geographical regions to expand their footprints in global markets. For instance, in August 2022, Orthofix Medical Inc., a medical device company, partnered with CGBio, a developer of synthetic bone grafts, for the commercialization and clinical development of Novosis recombinant human bone morphogenetic protein-2 (rhBMP-2) for the Canadia and U.S. markets.

Type Insights

In terms of type, the demineralized bone matrix segment dominated the market in 2024 and held the largest revenue share of 35.3%. A demineralized bone matrix is a bone allograft utilized in bone defects and spinal fusion. The segment is anticipated to grow throughout the forecast period due to factors such as the rising number of dental surgery and spinal fusion cases, the growing patient base due to population growth, the adoption of various strategic initiatives by market players, and the increasing frequency of orthopedic ailments. For instance, in July 2021, RTI Surgical, a surgical implant company, acquired Exactech’s Optecure, a 510(k)- cleared demineralized bone matrix to use as a bone graft extender in the pelvis, spine, and extremities.

The cancellous bone allografts segment in the market is anticipated to witness the fastest CAGR over the forecast period. Cancellous bone allografts are bone grafts made from cancellous bone, a type of bone tissue known as trabecular or spongy bone. They are often used to fill bone defects and are available as small granules or chips. Moreover, the segment is anticipated to be driven by the growing burden of orthopedic disorders and the rise in product launches. For instance, in April 2023, ZimVie Inc., a life science company, introduced two biomaterials such as the RegenerOss Bone Graft Plug, a grafting solution for filling periodontal defects and extraction sockets, and the RegenerOss CC Allograft Particulate, which is a combination of natural cancellous and cortical bone particles designed to fill bone gaps in various dental procedures.

Application Insights

The dental application segment dominated the market in 2024 and held the largest revenue share of 33.9%. The primary driver fueling the segment expansion is the rising use of bone grafts in dental implant procedures. In addition, there is a growing frequency of root caries, periodontal disorders, and edentulous fueling market growth. Moreover, the ongoing commercialization of products, the growing healthcare industry, and high-quality services are increasing consumer awareness and are anticipated to support market expansion. Furthermore, the rising success rate of these operations is expected to support segment growth. The expanding dental tourism industry in developing nations is also anticipated to drive industry expansion.

The reconstruction & traumatology segment in the market is anticipated to witness the fastest CAGR over the forecast period. Growing demand for reconstructive surgery due to an aging population and increased bone fracture cases due to falls and road accidents fosters segment growth. For instance, according to an article published by Annals of International Medical and Dental Research in February 2023, the majority of severe orthopedic injuries are often the result of road traffic accidents, which account for a prevalence rate of 63.6%.

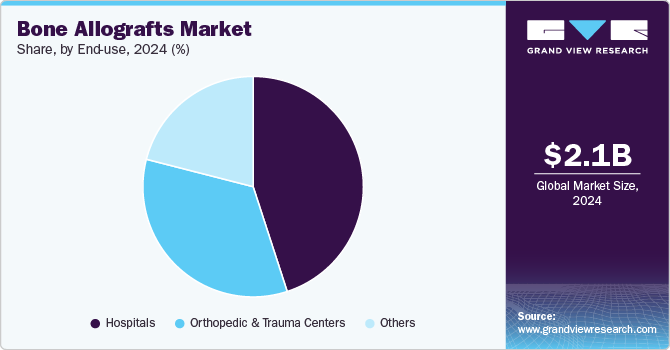

End Use Insights

The hospitals segment dominated the market in 2024 with a revenue share of 44.6%. The large share of this segment is attributed to the fact that most facilities and technologically advanced implants are available in hospitals for treating and diagnosing spine disorders. The segment is estimated to witness significant growth with the growing demand for bone grafts for patients with spine disorders and dental pain. According to the University of Aberdeen, annually, up to 1.6 million individuals undergo spinal fusion surgery needing a bone graft substitute.

The orthopedic & trauma centers segment in the market is anticipated to register the fastest CAGR over the forecast period. These centers provide end-to-end care and management for all types of bone and joint disorders. Factors such as reduced wait times, personalized care, and shorter stay duration have increased the demand for these clinics. Furthermore, orthopedic & trauma centers provide cost-effective services and treatments due to their low-cost structure compared to hospitals. Such factors are anticipated to drive segment growth over the forecast period. Since the number of patients preferring orthopedic clinicians has increased, there has been a significant rise in the number of such clinics.

Regional Insights

The North America bone allografts market dominated globally in 2024 with the largest global revenue share of 40.0%. The presence of well-established healthcare infrastructure, supportive reimbursement policies, and widespread adoption of bone grafts in orthopedic surgeries is further fueling the adoption of such products in the region. Moreover, a rise in sports-related injuries is anticipated to fuel the market growth during the forecast period.

U.S. Bone Allografts Market Trends

The bone allografts market in the U.S. held the largest revenue share in 2024. The country's emphasis on technological innovation and research results in the continuous development of improved bone allograft products. For instance, in July 2021, Dr Scott A. Rodeo from the Hospital for Special Surgery received USD 50,000 in funding from the Orthopedic Research and Education Foundation to research an injectable biologic for knees.

Europe Bone Allografts Market Trends

The Europe bone allografts market is anticipated to register a significant CAGR during the forecast period. The region's strong focus on research and development fosters continuous innovation in bone graft technologies, improving product efficacy and enhancing patient outcomes. Furthermore, favorable healthcare policies and robust regulatory frameworks ensure the quality and safety of the product, thereby increasing their demand amongst the population.

Germany bone allografts market is anticipated to register the fastest CAGR during the forecast period. The rising incidence of road accidents in the country contributes to increased demand for bone allografts. For instance, in February 2023, according to the Statistisches Bundesamt, approximately 21,600 people were injured in road accidents in Germany.

Bone allografts market in UK is anticipated to register a considerable growth rate during the forecast period. The UK's National Health Service (NHS) provides universal healthcare coverage, ensuring seamless access to orthopedic procedures for all residents, which stimulates market growth. In addition, the growing aging population is expected to escalate market growth.

Asia Pacific Bone Allografts Market Trends

The Asia Pacific bone allografts market is anticipated to register the fastest CAGR during the forecast period. The presence of a large number of patient pools with a range of orthopedic conditions and growing investments by market players to expand their presence in the region are anticipated to propel the market growth. For instance, in October 2021, CoreBone raised USD 3.7 million in funding to commercialize bioactive bone graft material for dental and orthopedic treatments and expand its activity in China.

Japan bone allografts market is anticipated to grow lucratively during the forecast period. Advanced healthcare systems, with a strong focus on innovation and technological advancements, are boosting market growth. For instance, in May 2019, Medtronic launched Grafton Demineralized Bone Matrix (DBM) for orthopedic and spine procedures in Japan.

Latin America Bone Allografts Market Trends

The bone allografts market in Latin America is witnessing considerable CAGR in the market due to the increasing awareness regarding the availability and benefits of bone allografts among healthcare professionals and patients. Moreover, the region's growing geriatric population and a rise in orthopedic conditions, which can lead to complications needing orthopedic interventions, are further propelling the market growth.

MEA Bone Allografts Market Trends

The MEA bone allografts market is experiencing lucrative growth due to several factors, including the rising prevalence of orthopedic conditions, product launches, and favorable reimbursement for orthopedic procedures. Moreover, governments and healthcare organizations are undertaking initiatives to improve healthcare facilities in the MEA region, which is boosting the market growth.

Key Bone Allografts Company Insights

Key participants in the bone allografts industry are involved in deploying strategic initiatives that include product launches, service expansion, competitive pricing strategies, sales & marketing initiatives, partnerships, and mergers & acquisitions.

Key Bone Allografts Companies:

The following are the leading companies in the bone allografts market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- Medtronic

- Stryker

- Smith+Nephew

- Lynch Biologics, LLC.

- Biomatlante

- Johnson & Johnson Services, Inc.

- Royal Biologics

- Baxter

- Xtant Medical

Recent Developments

- In February 2024, TETROUS, INC., a regenerative medicine company, launched EnFix TAC to its product portfolio of EnFix demineralized bone allograft implants designed specifically for rotator cuff repair surgeries

Bone Allografts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.99 billion

Revenue forecast in 2030

USD 2.62 billion

Growth Rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Zimmer Biomet; Medtronic; Stryker; Smith+Nephew; Lynch Biologics, LLC.; Biomatlante; Johnson & Johnson Services, Inc.; Royal Biologics; Baxter; Xtant Medical

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

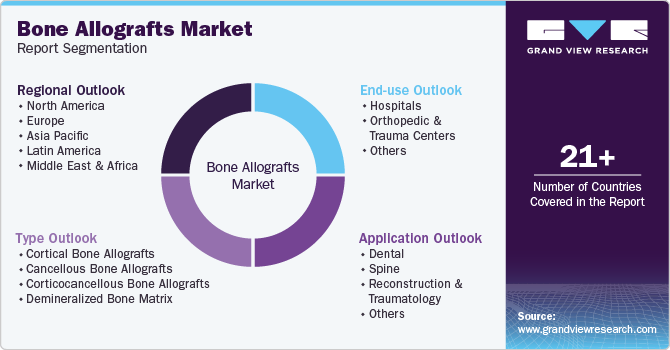

Global Bone Allografts Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global bone allografts market report based on type, application, end use, and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Cortical Bone Allografts

-

Cancellous Bone Allografts

-

Corticocancellous Bone Allografts

-

Demineralized Bone Matrix

-

-

Application Outlook (Revenue USD Million, 2018 - 2030)

-

Dental

-

Spine

-

Reconstruction & Traumatology

-

Others

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Orthopedic & Trauma Centers

-

Others

-

-

Regional Outlook (Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bone allograft market size was estimated at USD 1.9 billion in 2024 and is expected to reach USD 1.99 billion in 2025.

b. The global bone allograft market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 2.62 billion by 2030.

b. North America dominated the bone allograft market with a share of 40.0% in 2024. Growing awareness related to the commercially accessible innovative products, accessibility of a well-developed healthcare structure, and higher healthcare expenditure is the major aspects contributing to the regional market growth.

b. Some key players operating in the bone allograft market include Zimmer Biomet, Medtronic, Lynch Biologics, LLC, Biomatlante, Stryker, Royal Biologics, Johnsons & Johnsons, Smith & Nephew, Baxter

b. Some of the key drivers impacting the bone allograft market include an aging population, and the growing adoption of an allograft increasing due to their properties, such as immediate structural support and osteoconductivity. Additionally, they do not require another surgery bone, which triggers fast wound healing and decreases the surgery time. These are commonly used in dental, spine, and hip areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.