- Home

- »

- Medical Devices

- »

-

Blood Ketone Meter Market Size, Industry Report, 2030GVR Report cover

![Blood Ketone Meter Market Size, Share & Trends Report]()

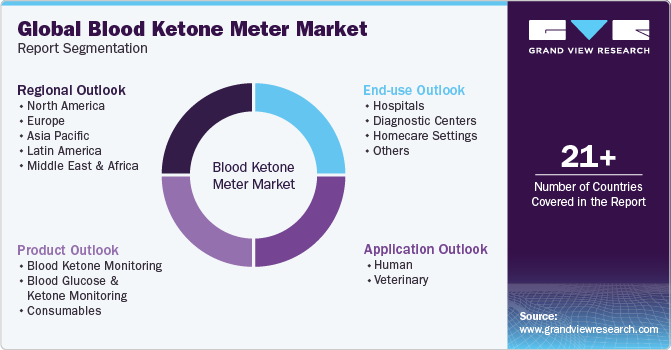

Blood Ketone Meter Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ketone Monitoring, Glucose & Ketone Monitoring), By Application (Human, Veterinary), By End-use (Hospitals, Home Care Settings), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-617-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Ketone Meter Market Summary

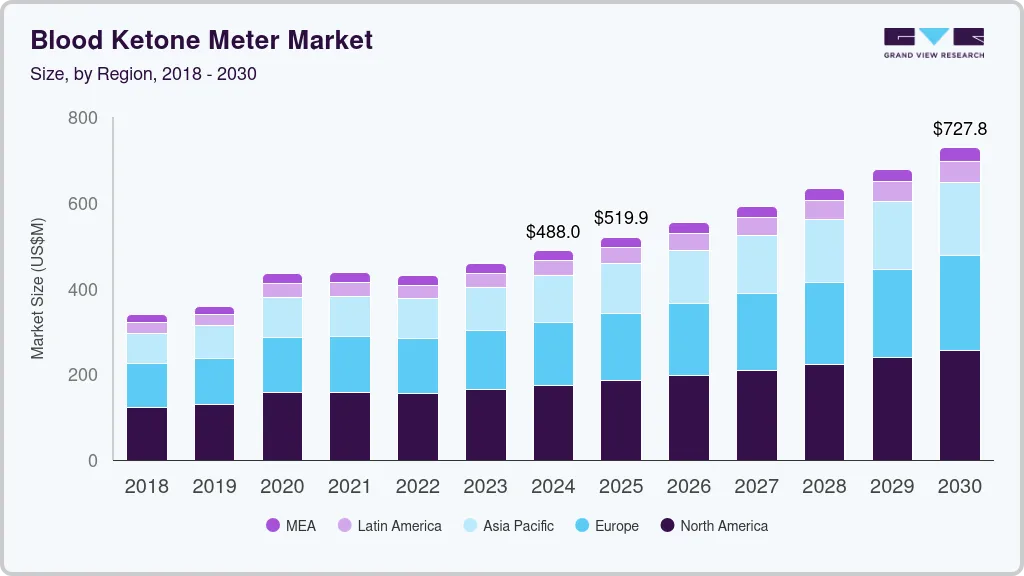

The global blood ketone meter market size was estimated at USD 488.0 million in 2024 and is projected to reach USD 727.8 million by 2030, growing at a CAGR of 6.96% from 2025 to 2030. Major factors driving the growth of the industry include the increasing prevalence of diabetes, rising adoption of ketogenic and low-carbohydrate diets, and growing health awareness among consumers.

Key Market Trends & Insights

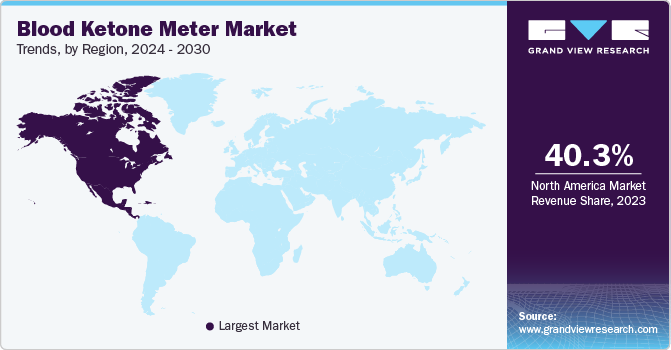

- North America blood ketone meter market held the largest share of 35.68% in 2024.

- The blood ketone meter market in U.S. held the largest market share in 2024 in the North America region.

- By product, the blood glucose and ketone monitoring segment dominated the industry and accounted for the largest revenue share of 51.65% in 2024.

- By application, the human segment dominated the industry and accounted for the largest revenue share of 79.08% in 2024.

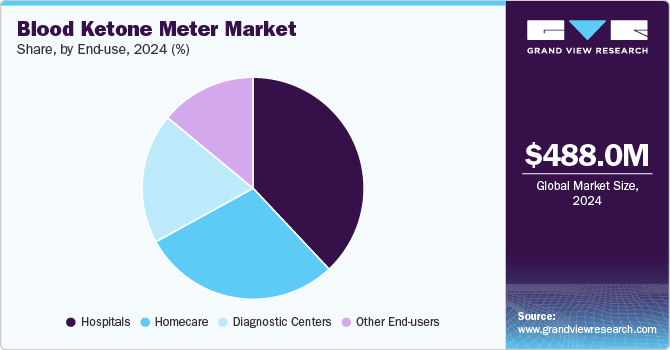

- By end use, the hospital segment held the largest revenue share of 38.44% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 488.0 Million

- 2030 Projected Market Size: USD 727.8 Million

- CAGR (2025-2030): 6.96%

- North America: Largest market in 2024

For instance, according to the International Diabetes Federation, approximately 536 million diabetes cases were reported globally in 2020-expected to rise to 642 million by 2030. The need for ketone monitoring is becoming more critical, especially for individuals managing diabetes-related complications like diabetic ketoacidosis (DKA). Additionally, the popularity of ketogenic diets for weight loss, metabolic health, and therapeutic benefits has fueled demand for ketone meters among health-conscious individuals. Advances in digital health technology have further boosted market growth by enabling real-time monitoring through mobile applications, making ketone tracking more accessible and convenient.Blood ketone monitoring is gaining popularity due to its effectiveness in tracking metabolic health and its alignment with evolving lifestyle trends focused on proactive health management. As more individuals adopt health-conscious habits, such as ketogenic and low-carbohydrate diets, for weight loss and metabolic optimization, the demand for accurate ketone measurement tools has increased. These devices provide real-time insights into the body’s ketone levels, helping users make informed dietary and lifestyle choices. Additionally, with the rising prevalence of diabetes, particularly type 1 diabetes, blood ketone meters play a crucial role in preventing complications like diabetic ketoacidosis (DKA).

The integration of digital health technologies and mobile applications has further enhanced the usability of blood ketone meters, enabling seamless tracking and personalized health management. This growing emphasis on self-monitoring, combined with the efficiency and convenience of modern ketone meters, continues to drive their widespread adoption across various consumer segments. Furthermore, the availability of dual-function devices capable of measuring both ketone and glucose levels in a single unit is contributing to the market growth. These multifunctional meters offer greater convenience for individuals managing diabetes or following ketogenic diets, eliminating the need for separate devices and streamlining metabolic health monitoring. As a result, the adoption of such advanced solutions is increasing, further propelling the growth of the blood ketone meter industry.

Market Concentration & Characteristics

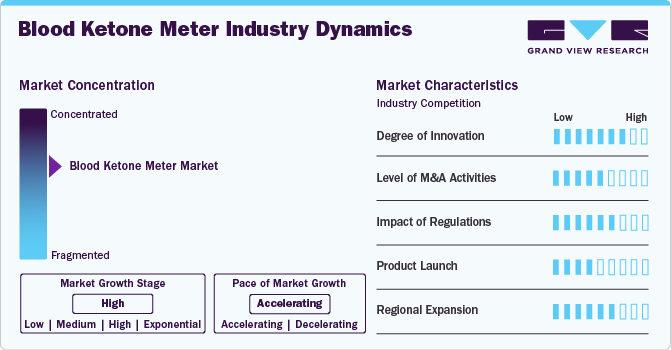

The industry is accelerating at a significant rate, driven by the rising prevalence of diabetes, the increasing adoption of ketogenic and low-carbohydrate diets, and the growing trend of proactive health monitoring. With a surge in diabetes cases worldwide, particularly type 1 diabetes, there is an increasing need for ketone monitoring to prevent complications such as diabetic ketoacidosis (DKA). Additionally, the popularity of ketogenic diets for weight management, athletic performance, and metabolic health has fueled the demand for accurate and convenient ketone measurement tools.

Companies are actively innovating by introducing new products and upgrading their existing solutions to address the increasing demand for blood ketone meters. For instance, in September 2023, SIBIONICS, a prominent player in bio-wearable consumer electronics, unveiled the SIBIO KS1 Continuous Ketone Monitoring (CKM) System. This advanced biometric wearable device enables users to track their ketone levels continuously for 14 days, offering a seamless and real-time monitoring experience. Designed for individuals following ketogenic diets or engaging in intensive physical activities, the CKM system enhances convenience and accuracy, reflecting the industry's push towards more sophisticated and user-friendly health monitoring solutions.

The degree of innovation in the blood ketone meter industry is high, driven by continuous technological advancements aimed at improving accuracy, convenience, and real-time monitoring capabilities. Companies are increasingly integrating digital health features, such as Bluetooth connectivity and mobile app synchronization, to provide seamless tracking and personalized health insights

Industry players are actively pursuing mergers and acquisitions as a strategic approach to enhance their market position, expand their product portfolios, and drive growth. For instance, in September 2023, Abbott announced the completion of its acquisition of Bigfoot Biomedical, known for developing smart insulin management systems for people with diabetes.

Regulations have a significant impact on blood ketone meter devices by ensuring safety, accuracy, and reliability through compliance with safety and performance standards. While the regulatory process can delay product launches and increase costs, it helps foster trust and long-term growth in the healthcare market.

Manufacturers are actively launching new products to expand their offerings. For instance, in March 2021, EKF Diagnostics Holdings plc. announced the launch of its STAT-Site WB handheld analyzer, which provides rapid β-ketone and glucose measurements from whole blood in seconds. This launch follows the attainment of CE mark certification and an FDA CLIA-waiver, making the portable, dual-purpose analyzer an ideal tool for healthcare professionals managing diabetes patients.

The geographical reach of the blood ketone meter industry is expanding, driven by strong demand in emerging markets, technological advancements, and increasing healthcare investments. Developing regions, particularly in Asia-Pacific and Latin America, are witnessing significant growth due to the rising prevalence of diabetes, greater awareness of metabolic health, and improved healthcare infrastructure. Additionally, government initiatives promoting diabetes management and digital health adoption are further accelerating market penetration.

Product Insights

The blood glucose and ketone monitoring segment dominated the industry and accounted for the largest revenue share of 51.65% in 2024. This can be attributed to the increasing prevalence of diabetes, which has increased the demand for dual-function monitoring devices that measure both glucose and ketone levels. These multifunctional meters provide greater convenience for diabetes patients, particularly those at risk of diabetic ketoacidosis (DKA), by enabling comprehensive metabolic monitoring with a single device. Additionally, advancements in portable and digital health technologies, such as Bluetooth-enabled connectivity and mobile app integration, have further enhanced the usability and accessibility of these devices.

The blood ketone monitoring segment is expected to grow at the fastest CAGR of 7.40% over the forecast period. This growth is driven by the rising prevalence of diabetes, particularly type 1 diabetes, which has increased the demand for ketone monitoring to prevent complications such as diabetic ketoacidosis (DKA). Additionally, the growing adoption of ketogenic and low-carbohydrate diets for weight management, metabolic health, and athletic performance has fueled interest in ketone tracking among health-conscious consumers.

Application Insights

The human segment dominated the industry and accounted for the largest revenue share of 79.08% in 2024. and is also expected to grow at the fastest CAGR over the forecast period. This is due to the increasing prevalence of diabetes, particularly type 1 diabetes, where ketone monitoring is crucial for preventing diabetic ketoacidosis (DKA). Additionally, the rising adoption of ketogenic and low-carbohydrate diets for weight management, metabolic health, and athletic performance has contributed to higher demand for blood ketone meters among health-conscious individuals. Technological advancements, such as the development of dual-function devices that measure both glucose and ketone levels, as well as the integration of digital health features like Bluetooth connectivity and mobile app synchronization, have further enhanced accessibility and convenience for users.

The veterinary segment is expected to grow over the forecast period. This is due to the increasing awareness of metabolic disorders in animals and the rising adoption of ketone monitoring for veterinary applications. Conditions such as bovine ketosis in dairy cattle and diabetic ketoacidosis (DKA) in companion animals, including dogs and cats, are fueling the demand for blood ketone meters in veterinary care. Advancements in portable and easy-to-use veterinary-specific ketone meters have made monitoring more accessible for veterinarians and pet owners. Additionally, growing investments in animal healthcare increasing pet ownership, are further contributing to the market expansion.

End-use Insights

The hospital segment held the largest revenue share of 38.44% in 2024, owing to the growing prevalence of diabetes and the critical need for ketone monitoring in hospitalized patients, particularly those at risk of diabetic ketoacidosis (DKA). Hospitals rely on blood ketone meters for rapid and accurate diagnosis, enabling timely intervention and improved patient outcomes. Additionally, the increasing adoption of dual-function devices that measure both glucose and ketone levels has enhanced efficiency in hospital settings, reducing the need for multiple tests.

The home care settings segment is expected to witness the fastest CAGR of 7.68% during the forecast period. This growth is driven by the increasing shift toward self-monitoring and personalized health management. The rising prevalence of diabetes, particularly among aging populations and individuals at risk of diabetic ketoacidosis (DKA), has fueled demand for portable and user-friendly blood ketone meters that enable convenient at-home monitoring. Additionally, the growing adoption of ketogenic and low-carbohydrate diets for weight management, metabolic health, and athletic performance has further increased the need for accurate ketone measurement devices among health-conscious consumers.

Regional Insights

North America blood ketone meter market held the largest share of 35.68% in 2024, driven by the high prevalence of diabetes, increasing adoption of ketogenic diets, and strong healthcare infrastructure. The region has a large population of individuals with type 1 and type 2 diabetes, where ketone monitoring is essential for managing diabetic ketoacidosis (DKA). Additionally, the growing trend of ketogenic and low-carb diets for weight loss, metabolic health, and athletic performance has boosted the demand for blood ketone meters among health-conscious consumers. Technological advancements, such as dual-function glucose and ketone meters, Bluetooth connectivity, and mobile app integration, have further enhanced market growth by providing convenient self-monitoring options

U.S. Blood Ketone Meter Market Trends

The blood ketone meter market in U.S. held the largest market share in 2024 in the North America region. This is attributed to the country's advanced healthcare infrastructure, high healthcare spending, and widespread adoption of self-monitoring devices. The increasing incidence of diabetes and obesity has driven the demand for blood ketone meters, particularly among individuals managing diabetic ketoacidosis (DKA) and those following ketogenic diets for metabolic health. Additionally, strong regulatory support, including FDA approvals for innovative ketone monitoring devices, has facilitated market expansion.

Europe Blood Ketone Meter Market Trends

The blood ketone meter market in Europe held a significant market share in 2024. This is owing to the rising prevalence of diabetes, increasing focus on metabolic health, and growing adoption of home healthcare solutions. Many European countries have well-established healthcare systems that support the use of advanced monitoring devices, including blood ketone meters, for diabetes management and early detection of diabetic ketoacidosis (DKA). Additionally, the increasing popularity of ketogenic and low-carbohydrate diets has driven demand for ketone monitoring among health-conscious consumers.

The UK blood ketone meter market is experiencing significant growth, driven by factors such as increasing awareness of diabetes management, rising adoption of self-monitoring devices, and a strong focus on preventive healthcare. The National Health Service (NHS) has been actively promoting advanced monitoring solutions to improve patient outcomes, leading to greater accessibility and adoption of blood ketone meters. Additionally, the growing popularity of ketogenic diets for weight management and metabolic health has fueled the demand for ketone monitoring devices among health-conscious individuals.

The blood ketone meter market in France is expected to grow over the forecast period, driven by the increasing prevalence of diabetes, growing awareness of metabolic health, and the rising adoption of ketogenic diets. With a large number of individuals managing diabetes in the country, the demand for accurate and efficient blood ketone monitoring devices is on the rise. Additionally, France's healthcare system is placing greater emphasis on preventive care and digital health technologies, which has supported the integration of advanced monitoring solutions, including blood ketone meters, into both clinical and home care settings.

Germany blood ketone meter market is experiencing significant growth, driven by the increasing prevalence of diabetes, strong healthcare infrastructure, and rising adoption of digital health solutions. Germany has a well-developed medical technology sector, enabling rapid innovation and widespread availability of advanced blood ketone monitoring devices. The growing awareness of diabetic ketoacidosis (DKA) prevention and metabolic health management has further fueled the demand for ketone meters among both healthcare professionals and individuals practicing self-monitoring.

Asia Pacific Blood Ketone Meter Market Trends

The blood ketone meter market in Asia Pacific is expected to witness the fastest growth of CAGR 7.91% over the forecast period. This growth is driven by the rising incidence of diabetes, increasing health awareness, and improving healthcare infrastructure. Rapid urbanization and lifestyle changes have contributed to a growing prevalence of metabolic disorders, leading to higher demand for ketone monitoring solutions. Additionally, the expansion of healthcare access in emerging economies, such as China and India, has facilitated greater adoption of self-monitoring devices. Technological advancements, including affordable and portable ketone meters, along with the integration of digital health solutions, have further supported market growth.

China blood ketone meter market is expected to grow at a significant rate over the forecast period, driven by the rising burden of diabetes, increasing consumer focus on health monitoring, and expanding access to medical technologies. The country has one of the highest diabetes populations globally, leading to a growing need for ketone monitoring to prevent complications such as diabetic ketoacidosis (DKA). Additionally, the increasing adoption of wearable and digital health devices has made self-monitoring more accessible and convenient for consumers. Government initiatives aimed at strengthening healthcare infrastructure and promoting preventive care further support market expansion.

The blood ketone meter market in Japan is significantly driven by the country’s aging population, increasing prevalence of diabetes, and strong emphasis on preventive healthcare. With one of the highest proportions of elderly individuals globally, Japan faces a rising incidence of diabetes-related complications, necessitating advanced monitoring solutions such as blood ketone meters. The country’s highly developed healthcare infrastructure and widespread adoption of digital health technologies have further facilitated market growth.

Latin America Blood Ketone Meter Market Trends

The blood ketone meter market in Latin America is expected to grow steadily, over the forecast period, driven by the rising prevalence of diabetes, increasing healthcare investments, and growing awareness of metabolic health. Many countries in the region are experiencing a surge in diabetes cases due to lifestyle changes, urbanization, and dietary habits, fueling the demand for blood ketone monitoring to prevent complications like diabetic ketoacidosis (DKA). Additionally, improving access to healthcare services and the expansion of telemedicine are enhancing the adoption of self-monitoring devices.

Middle East & Africa Blood Ketone Meter Market Trends

The blood ketone meter market in the Middle East & Africa is experiencing notable growth, driven by the rising prevalence of diabetes, increasing healthcare awareness, and expanding access to medical technologies. With a growing burden of diabetes-related complications, particularly in Gulf Cooperation Council (GCC) countries, there is an increasing demand for ketone monitoring to prevent conditions such as diabetic ketoacidosis (DKA). Additionally, government initiatives aimed at strengthening healthcare infrastructure and promoting preventive care are supporting market expansion.

Key Blood Ketone Meter Company Insights

Key players in the blood ketone meter industry are continuously enhancing their product offerings through technological advancements, strategic acquisitions, and the introduction of advanced monitoring solutions. They are prioritizing the integration of artificial intelligence (AI), developing high-precision and portable devices, and securing regulatory approvals to cater to the rising demand for accurate and non-invasive diagnostics. Additionally, these companies are actively engaging in partnerships and collaborations to drive innovation, expand their global reach, and reinforce their competitive position in the market.

Key Blood Ketone Meter Companies:

The following are the leading companies in the blood ketone meter market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Apex Biotechnology Corp.

- TaiDoc Technology Corporation

- EKF Diagnostics Holdings plc.

- Nova Biomedical

- Keto-Mojo

- ForaCare, Inc.

- Nipro

- i-SENS, Inc

Recent Developments

-

In July 2024, Nipro announced a major expansion in the U.S. with the establishment of its first North American manufacturing facility in Greenville, North Carolina. This strategic development marks a significant step in Nipro’s continued growth.

-

In March 2024, Nova Biomedical announced the U.S. launch of its New Generation StatStrip Glucose Hospital Meter System. This advanced meter introduces enhanced features that improve hospital glucose testing efficiency and cybersecurity while maintaining accuracy, interference-free performance, and FDA clearance for use with critically ill patients that StatStrip has delivered for over a decade.

-

In November 2024, Abbott announced the opening of its state-of-the-art manufacturing facility in Kilkenny, Ireland. This site serves as a global manufacturing center of excellence for Abbott’s diabetes care business and is expected to employ more than 800 people.

Blood Ketone Meter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 519.9 million

Revenue forecast in 2030

USD 727.8 million

Growth rate

CAGR of 6.96% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Apex Biotechnology Corp.; TaiDoc Technology Corporation; EKF Diagnostics Holdings plc.; Nova Biomedical; Keto-Mojo; ForaCare, Inc.; Nipro; i-SENS, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Ketone Meter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood ketone meter market report on the basis of product type, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Ketone Monitoring

-

Blood Glucose and Ketone Monitoring

-

Consumables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Human

-

Veterinary

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare Settings

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood ketone meter market size was estimated at USD 488.0 million in 2024 and is expected to reach USD 519.9 million in 2025.

b. The global blood ketone meter market is expected to grow at a compound annual growth rate of 6.96% from 2025 to 2030 to reach USD 727.8 million by 2030.

b. The blood glucose and ketone monitoring segment dominated the global blood ketone meter market and accounted for the largest revenue share of over 51.65% in 2024.

b. Some key players operating in the blood ketone meter market include Abbott; Apex Biotechnology Corp.; TaiDoc Technology Corporation; EKF Diagnostics Holdings plc.; Nova Biomedical; Keto-Mojo; ForaCare, Inc.; Nipro; i-SENS, Inc

b. Key factors that are driving the blood ketone meter market growth include awareness regarding the benefits of blood ketone meters, technological advancements, developing healthcare infrastructure, increasing hospital admissions, and rising diabetes-related complications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.