- Home

- »

- Medical Devices

- »

-

Blood Warmer Market Size And Share, Industry Report, 2030GVR Report cover

![Blood Warmer Market Size, Share & Trends Report]()

Blood Warmer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Hardware, Consumables), By Product (Portable Blood Warmer, Non-portable Blood Warmer), By Flow Rate, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-141-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Warmer Market Summary

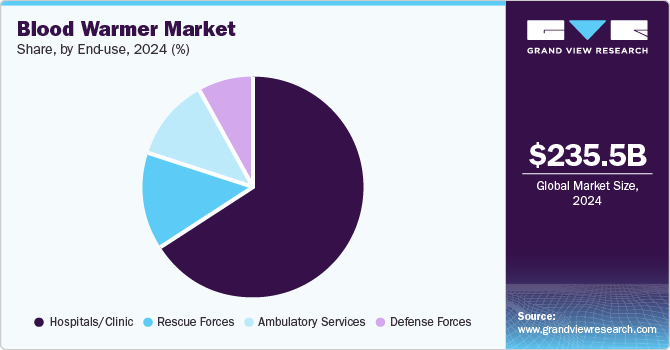

The global blood warmer market size was estimated at USD 235.5 million in 2024 and is projected to reach USD 383.4 million by 2030, growing at a CAGR of 8.61% from 2025 to 2030. The demand for blood warmer products is rising owing to the growing number of surgical cases and the rising cases of cold weather injuries such as hypothermia.

Key Market Trends & Insights

- North America blood warmer market held the largest revenue share globally of more than 45.47% in 2024.

- The Asia Pacific blood warmer market is anticipated to witness the fastest CAGR of 9.98% during the forecast period.

- Based on flow rate, the rapid/fast flow warmers segment dominated the market and is expected to grow at the fastest CAGR of 9.31% over the forecast period.

- In terms of end use, the hospitals/ clinics segment held the largest share of 66.44% in 2024.

- Based on application, the surgery segment held the largest share of 36.69% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 235.5 Million

- 2030 Projected Market Size: USD 383.4 Million

- CAGR (2025-2030): 8.61%

- North America: Largest market in 2024

For instance, statistics from the Military Health System published in November 2024 indicate that the incidence rate of cold weather injuries among active U.S. military employees was 31.1 per 100,000 individual years during the 2023-2024 season. This highlights an 8.4% growth from the 28.7 per 100,000 individual years registered in the earlier season (2022-2023).

In addition, the increasing number of surgeries and trauma cases is anticipated to propel the demand for blood-warming devices. These instruments are typically used during fluid administration in surgeries to mitigate a reduction in mean body temperature. A study published by the National Library of Medicine in April 2023 registered a 13% growth in trauma patients at a trauma center in Marin County between 2019 and 2020. In addition, according to an article published by Medindia in July 2023, the total number of surgeries performed across the globe is projected to be 310 million per year. Thus, the high surgical volume is expected to propel the demand for blood warmer in the coming years.

Furthermore, the increasing incidences and mortality related to hypothermia are expected to boost the market growth in the coming years. For instance, according to data issued by the National Library of Medicine in January 2024, between 700 and 1,500 hypothermia-related casualties occur in the U.S. yearly. Thus, the rising cases of cold weather injuries are anticipated to propel the demand for blood warmers over the forecast period.

In addition, the growing demand for blood warmers from ambulance services, military & defense sectors is expected to drive the market growth in the coming years. Several initiatives are being implemented to address this increasing demand in the defense and military sectors. For example, in December 2022, the Ministry of Defence and Air Ambulances UK collaborated with NHS Blood and Transplant (NHSBT) for a clinical trial, SWIFT, in which Air Ambulance crews carried ‘whole blood’ instead of separate plasma and red blood cells to treat severely injured patients at risk of bleeding to death. This trial benefits both civilian and military trauma care. Such supportive initiatives undertaken by government authorities are expected to boost the demand for blood warmers over the forecast period.

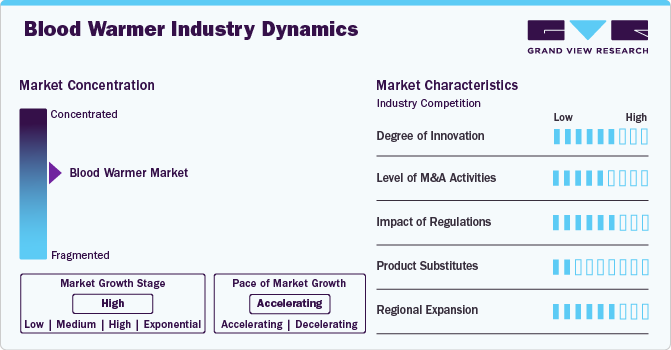

Market Characteristics

The market growth stage is high, and the pace of growth is accelerating. The blood warmer industry is characterized by growth owing to the rising number of surgical procedures and trauma cases, along with advancements in blood warmers.

Players in the industry and researchers are focusing on developing innovative and advanced blood warmer products. For instance, in July 2022, the Combat Readiness Medical Research Program (CRRP), the U.S. Army Institute of Surgical Research, and MaxQ Research, LLC announced the development of the MaxExo blood warmer, a smaller, more user-friendly, and durable device that does not require electricity. Such developments are anticipated to drive innovation in the blood warmer industry.

Regulatory agencies such as the Food and Drug Administration (FDA), the European Union, Health Canada, and other bodies oversee medical device regulations, including blood warmer products. These devices are categorized into various classes based on the associated risk levels. For instance, the U.S. FDA classifies blood warmers into Class III or II. Such regulatory classification helps manufacturers enter the blood warmer industry.

Several industry players operating in the blood warmer industry are undergoing mergers and acquisitions to strengthen their industry position and expand their product portfolio. Some players adopting this initiative include TSC Life, ICU Medical, Inc., Stryker, and GENTHERM.

Players in the blood warmer industry are strategically focusing on provincial expansion to capitalize on emerging prospects and broaden their market presence. Numerous industry players are forming distribution partnerships to increase their product reach in various geographies. For instance, in June 2023, QinFlow and Life-Assist completed onboarding for their distribution partnership, focusing on the Warrior line of blood and IV fluid warmers. This collaboration enhances access to QinFlow's advanced fluid-warming solutions, providing first responders and emergency medical services with critical tools for managing hypothermia in pre-hospital and acute care settings.

Product Insights

The non-portable blood-IV fluid warmers segment held the largest market share in 2024. The growing incidence of road accidents, gunshot wounds, and mishaps is expected to drive segment growth. In addition, the increasing rate of hospitalization due to various medical disorders, the rising aging population, and improving financing for healthcare infrastructure in developing economies are all expected to propel the segment growth over the forecast period.

The portable blood warmers segment is expected to grow at the fastest CAGR of 9.45% from 2025 to 2030. The demand is expected to remain slightly higher than for non-portable devices in the coming years. A majority of the demand comes from ambulatory/paramedic services, rescue forces, and defense sectors. In addition, growing demand from remote clinics and emergency centers is also expected to drive the segment growth.

Application Insights

The surgery segment held the largest share of 36.69% in 2024. It is anticipated to grow fastest in the coming years. The rising number of surgical procedures, such as prolonged surgeries & other major surgeries, drive the segment growth over the forecast period. Prolonged surgical procedures, particularly those involving substantial blood loss or exposure to cold environments, can result in hypothermia. Blood warmers help maintain optimal blood temperature during these procedures, reducing the risk of hypothermia-related complications. According to the data published by Smart Surgeons in July 2024, approximately 30 million surgeries are conducted annually in India. Thus, the increasing number of surgical procedures is expected to propel the segment growth in the coming years.

The pediatric segment is expected to grow significantly during the forecast period. Premature birth is a significant driver in the pediatrics application segment. For instance, as per a report by Artemis Hospitals in November 2024, an estimated 15 million babies are born prematurely globally each year. Premature babies are vulnerable to hypothermia as they have limited ability to regulate their body temperature. Blood warmers are crucial for ensuring that fluids and blood products administered to premature babies are warmed to the correct temperature, preventing further health complications. Thus, the increase in premature births is anticipated to support the segment growth in the coming years.

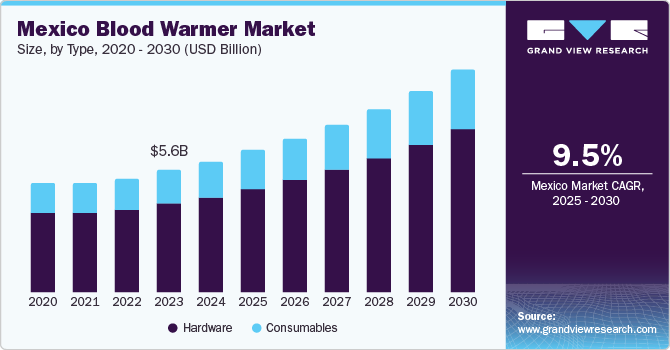

Type Insights

The hardware segment held the largest share in 2024. It is also anticipated to grow fastest at a CAGR of 8.88% in the coming years. This segment growth can be attributed to several factors, such as the increasing need for blood transfusions, technological advancements in warming devices, and growing awareness of hypothermia risks. Furthermore, expanding healthcare facilities and the rising demand for portable solutions in military settings are further expected to support the segment's growth.

The consumables segment is expected to grow significantly during the forecast period. The consumables segment includes various disposable and single-use products crucial for effectively functioning blood-warming devices. The rising number of surgical procedures and growing focus on patient safety is anticipated to propel the segment growth in the coming years. Furthermore, the increasing aging population and a rise in chronic diseases have significantly increased the demand for surgeries. This, in turn, leads to greater use of blood-warming devices and higher consumption of disposables such as warming sets, tubing, and filters.

Flow Rate Insights

The rapid/fast flow warmers segment dominated the market and is expected to grow at the fastest CAGR of 9.31% over the forecast period. This growth is driven by the increasing demand for efficient blood temperature management in clinical settings. These devices are specifically designed to quickly warm blood and intravenous fluids, ensuring that patients receive safe, warm blood products during critical medical interventions.

The routine/standard flow warmers segment is anticipated to experience significant growth during the forecast period. These warmers are designed for lower flow rates, typically a few hundred milliliters per minute, making them ideal for standard transfusion rates in non-emergency situations. They are commonly used in routine clinical settings, such as scheduled surgeries and procedures, where slower, more controlled infusions are feasible. Compared to rapid/fast flow warmers, routine/standard flow warmers are generally simple and more cost-effective, enhancing their accessibility for regular use across various healthcare environments.

End Use Insights

The hospitals/ clinics segment held the largest share of 66.44% in 2024. Hospitals and clinics are the primary end users of blood warmers. The growth of this segment can be attributed to the increasing rate of hospitalization due to the rise in trauma cases and the growing number of well-furnished, well-equipped, & advanced hospitals. Furthermore, favorable policies and increasing funding and investment for developing hospitals and clinics are anticipated to support the segment's growth.

The ambulatory services segment is expected to experience the fastest CAGR during the forecast period. This growth is primarily driven by the rising trend toward outpatient procedures and minimally invasive surgeries, which increase the demand for portable blood warmers. Due to their compact design and ease of transport, these devices are well-suited for use in ambulatory surgical centers and clinics. In addition, the expansion of emergency medical services (EMS) and the increasing incidence of accidents and trauma cases further contribute to the growing need for portable blood-warming solutions in ambulatory settings.

Regional Insights

North America blood warmer market held the largest revenue share globally of more than 45.47% in 2024. The key drivers of growth in the region are increasing hypothermia rate, rising number of trauma cases, surgical procedures, and medical conditions that necessitate large-scale blood transfusions. In November 2024, KUNM , University of New Mexico, reported that nearly 100 people in New Mexico had visited the emergency room for weather-related conditions since the start of October 2024. These cases include frostbite, hypothermia, and other cold-related issues. Such rising incidences of cold weather injuries are anticipated to boost the market growth over the forecast period.

U.S. Blood Warmer Market Trends

The blood warmer market in the U.S. is expected to dominate the North American region over the forecast period due to the presence of key players and the increasing launches of products. Some players operating in the U.S. market include GENTHERM, 3M, ICU Medical, Inc., Estill Medical Technologies, Inc., Quality In Flow Ltd (QinFlow), and North American Rescue, LLC.

Europe Blood Warmer Market Trends

The blood warmer market in Europe is projected to experience significant growth in the coming years, driven by an increase in surgical procedures, rising prevalence of trauma cases, and advancements in medical technology. In addition, the growing aging population is anticipated to drive market expansion further. According to data from Eurostat published in February 2024, as of January 2023, the estimated EU population was 448.8 million, with over one-fifth (21.3%) aged 65 and older.

The blood warmer market in the UK is projected to grow moderately during the forecast period. This growth is driven by an aging population and a rising incidence of hypothermia, which has increased the demand for effective blood-warming systems. For instance, the data published by the Royal College of Emergency Medicine and Creative Commons in December 2022 estimate that the incidence of hypothermia in Great Britain ranges from 6 to 8 cases per 1,000 patients.

France's blood warmer market is projected to grow during the forecast period, driven by the increasing number of surgical procedures and the rising prevalence of conditions requiring blood transfusions. The Arago Clinic report published in April 2024 indicates that in France, over 4,700 organ transplants are performed annually, benefiting nearly 40,000 individuals who rely on transplanted organs.

Asia Pacific Blood Warmer Market Trends

The Asia Pacific blood warmer market is anticipated to witness the fastest CAGR of 9.98% during the forecast period, fueled by a rise in surgical procedures, an increasing prevalence of trauma cases, and growing awareness of patient safety. Countries like China and India are experiencing a significant increase in surgical interventions, an expanding healthcare infrastructure, and rising healthcare expenditures. As a result, hospitals and surgical centers are increasingly adopting advanced blood-warming technologies to improve patient care and safety.

China's blood warmer market is expected to grow throughout the forecast period, driven by increasing awareness of patient safety, rising government initiatives to control and prevent cold weather injuries, and advancements in medical technology.

The blood warmer market in Japan is expected to experience substantial growth during the forecast period, driven by several key factors. These include rising surgical procedures nationwide and increasing the demand for blood warmer solutions. In addition, Japan's rapidly aging population is a significant driver, as elderly individuals are at higher risk of cold weather injuries.

Middle East and Africa Blood Warmer Market Trends

The blood warmer market in the Middle East and Africa is projected to experience significant growth in the coming years, driven by an increasing number of surgical operations. Countries like the UAE, Saudi Arabia, and South Africa are making substantial investments in their healthcare systems, improving hospital capabilities and expanding surgical services.

The blood warmer market in Saudi Arabia is anticipated to grow over the forecast period. Supportive government initiatives are expected to support market growth. For instance, as part of Vision 2030, the Saudi Arabian government has outlined plans to allocate over USD 65 billion to improve the country's healthcare infrastructure.

The blood warmer market in Kuwait is expected to grow over the forecast period due to the growing demand for improved patient care, advancements in medical technology, and an increase in surgical procedures. Rising healthcare expenditures also propel country market growth.

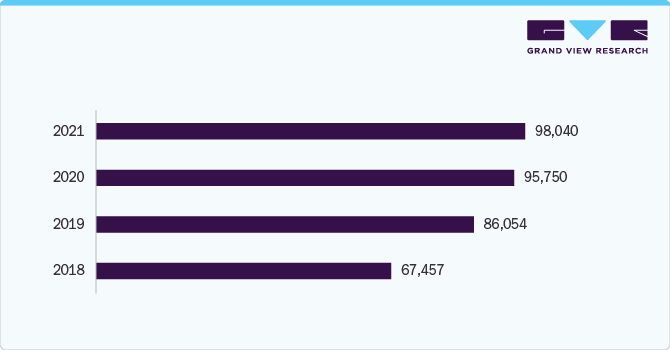

The number of penetrating trauma cases in the U.S. from 2018 to 2021 is illustrated in the graph below:

Medical procedures, particularly trauma treatments, often require blood transfusions. Blood warmer devices are crucial for patients who need rapid blood transfusions to maintain homeostasis. Blood warmers allow for the quick replacement of blood without causing harm. As a result, the growing number of trauma cases and associated blood transfusions is expected to drive the demand for blood warmer devices in the coming years.

Key Blood Warmer Company Insights

GENTHERM, Belmont Medical Technologies, 3M, ICU Medical, Inc., TSC Life, MEQU, Estill Medical Technologies, Inc, Quality In Flow Ltd (QinFlow), Biegler GmbH, Labtron Equipment Ltd., and North American Rescue, LLC are some of the major players in the global blood warmer industry. Organizations are expanding their product portfolios to gain a competitive advantage in the coming years. Moreover, industry players are also undergoing distribution partnerships to meet the growing demand for blood warmers.

Key Blood Warmer Companies:

The following are the leading companies in the blood warmer market. These companies collectively hold the largest market share and dictate industry trends.

- GENTHERM

- Belmont Medical Technologies

- 3M

- ICU Medical, Inc.

- TSC Life

- MEQU

- Estill Medical Technologies, Inc

- Quality In Flow Ltd (QinFlow)

- Biegler GmbH

- Labtron Equipment Ltd.

- North American Rescue, LLC

Recent Developments

- In April 2024, TSC Life launched its direct sales operations in the UK, a significant milestone for the company. Establishing a direct sales presence suggests a strategic focus on increasing customer engagement and offering more personalized support.

- In June 2024, MEQU received 510(k) clearance from the U.S. FDA for its °M Warmer System, a portable blood and IV fluid warming device designed for military and civilian applications. This regulatory milestone enables MEQU to expand into the U.S. market, providing a critical solution for effective fluid warming in emergency and pre-hospital care settings.

Blood Warmer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 253.74 Million

Revenue forecast in 2030

USD 383.43 Million

Growth Rate

CAGR of 8.61% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end use, flow rate, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA)

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

GENTHERM, Belmont Medical Technologies, 3M, ICU Medical, Inc., TSC Life, MEQU, Estill Medical Technologies, Inc, Quality In Flow Ltd (QinFlow), Biegler GmbH, Labtron Equipment Ltd., North American Rescue, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Blood Warmer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood warmer market report based on product, application, end use, type, flow rate, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Blood/IV warmers

-

Non-portable Blood/IV warmers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Pediatrics

-

Acute Care

-

Homecare

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals/Clinic

-

Ambulatory Services

-

Defense Forces

-

Rescue Forces

-

-

Flow Rate Outlook (Revenue, USD Million, 2018 - 2030)

-

Rapid/Fast Flow Warmers

-

Routine/Standard Flow Warmers

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Consumables

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood warmer market size was estimated at USD 235.49 million in 2024 and is expected to reach USD 253.74 million in 2025.

b. The global blood warmer market is expected to grow at a compound annual growth rate of 8.61% from 2025 to 2030 to reach USD 383.43 million by 2030.

b. North America dominated the blood warmer market, with a share of 39.57% in 2024. This is attributable to increasing healthcare expenditures, extreme climate conditions, the increasing incidence of surgical procedures/hospital visits, and high defense/rescue forces spending.

b. Some key players operating in the blood warmers market include GENTHERM, Belmont Medical Technologies, 3M, ICU Medical, Inc., TSC Life, MEQU, Estill Medical Technologies, Inc, Quality In Flow Ltd (QinFlow), Biegler GmbH, Labtron Equipment Ltd., and North American Rescue, LLC.

b. Key factors that are driving the blood warmers market growth include increasing demand from ambulatory services and military/defense sectors, growth in the number of surgical procedures performed globally, and increasing incidence of road accidents and mishaps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.