- Home

- »

- Disinfectants & Preservatives

- »

-

Bleaching Clay Market Size & Share Report, 2020-2027GVR Report cover

![Bleaching Clay Market Size, Share & Trends Report]()

Bleaching Clay Market Size, Share & Trends Analysis Report By Product (Activated, Natural), By Application (Refining Of Vegetable Oils & Fats, Refining Of Mineral Oils & Lubricants), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-1-68038-274-7

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The global bleaching clay market size was valued at USD 1.2 billion in 2019 and is expected to register a compound annual growth rate (CAGR) of 5.5% from 2020 to 2027. The increasing use of biofuel as a sustainable energy resource and growing consumption of vegetable oils are expected to drive the market over the forecast period. The bleaching earth is a type of clay, which is rich in minerals. It is mined in countries, such as U.S., U.K., and India. It is processed after sourcing from the earth's surface and is then used for refining due to its filtering, bleaching, and absorbing properties. The product is primarily manufactured from several raw materials including bentonite, fuller’s earth, kaolin, and sulfuric acid among others.

The key manufacturers cautiously procure raw clay and monitor it through several quality procedures and control checks. At production facilities, manufacturers use advanced state-of-the-art machinery and technology to manufacture and monitor high-quality bleaching clay. Clay rich in bentonite is preferred for manufacturing acid-activated bleaching earth.

Apart from this, montmorillonite and attapulgite clays are also preferred owing to their high bleaching power. The activation process is undertaken to improve the bleaching and decolorization properties of the clay. Acid activation is undertaken by using sulfuric acid or hydrogen chloride to eliminate calcium and alkali present in it.

The market is fragmented with the presence of a large number of companies coupled with high demand from various applications. Key companies are concentrating on bulk production by using advanced technology and adopting new strategic initiatives, such as long-term agreements and mergers, to strengthen their base and generate more revenue.

Product Insights

The natural bleaching of earth is estimated to register the fastest CAGR of 4.9% from 2020 to 2027. It includes various mineral clays, such as attapulgite, bentonite, and sepiolite. It is primarily used for removing multiple contaminants, including soluble components of organic & chemical compounds. The selection depends on the quality and type of feedstock, as well as the refining process.

The product is widely used across several industries, such as biofuel, mineral oils & lubricants, paints, varnishes & soaps, and wastewater treatment industries. Growing demand for refined & processed products from the above-mentioned industries is expected to drive market growth during the forecast period.

The activated bleaching earth is produced by acidification of bentonite clay with sulfuric or hydrochloric acids. The bleaching power depends on the activation procedure (acid concentration, temperature, pressure, and time). The product is used to decolorize and refine edible and non-edible oils. Rising consumption of edible oils & fats, along with increased demand for mineral oil, is driving the growth of this segment.

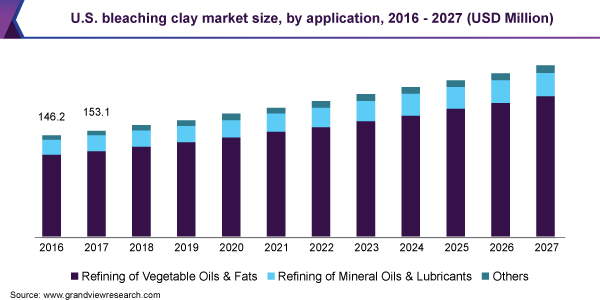

Application Insights

The refining of vegetable oils and fats segment is expected to register the fastest CAGR of 5.6% from 2020 to 2027. Vegetable oils, including soybean, palm, rapeseed, soybean edible lard, and beef tallow, when extracted, contain impurities, which need to be removed to achieve high-quality products. The bleaching earth is used in the refining process for edible oils & fats to remove contaminants that may affect the taste as well as the appearance of these oils. In addition, it plays an essential role in reducing the level of phosphatides, pigments, trace metals, residual soaps, and oxidation products.

One of the significant factors contributing to the high consumption of vegetable oil is the increased demand from the food industry. It is used as an ingredient in margarine formulation as well as in non-dairy creamers and ice cream preparations. Moreover, several cosmetic formulations include vegetable oil as it functions as a skin and hair conditioning agent. Thus, the rising demand for vegetable oil from several application industries, including cosmetics, food processing, and biofuel generation, is expected to boost the segment growth.

Lubricant refining is gaining popularity in the waste oil regeneration process. Waste lubricant oil contains several contaminants, such as chlorinated hydrocarbon, polycyclic aromatic hydrocarbon, and heavy metals, which are considered to be hazardous wastes that can have an adverse effect on the environment. To remove these contaminants, the adsorption process is carried out by using bleaching earth as a natural adsorbent.

Regional Insights

Asia Pacific is anticipated to register the largest market share expanding at the fastest CAGR of 5.3% from 2020 to 2027. The growth in the region can be attributed to the rising consumption of vegetable oils. Moreover, increasing crop acreage yields in countries, such as Malaysia and Indonesia, is driving vegetable oil production in this region, which has led to the augmented product demand for purification and refining purposes.

North America is projected to be the second-largest regional market. This growth can be attributed to the increasing demand for processed edible as well as industrial oils. Large-scale production of raw material, bentonite, coupled with a strong presence of well-established domestic as well as international market players, such as Oil-Dri Corporation of America and Clariant, in the region is also expected to foster the market growth over the forecast period.

The region is one of the major producers and exporters of crude as well as refined edible oils. Production of refined edible oil involves the use of bleaching earth for the removal of contaminants and other components. Thus, increased production of refined oils is further expected to fuel the demand for bleaching earth products, thereby propelling the growth of the regional market over the forecast period.

Key Companies & Market Share Insights

The market is highly competitive and may witness an increase in mergers, acquisitions, and strategic alliances over the next seven years. These companies have a strong product portfolio and are engaged in several research & development activities. Furthermore, most of the key players are focusing on in-house bleaching clay production. Some of the prominent players in the global bleaching clay market include:

-

Taiko Group of Companies

-

Clariant AG

-

Ashapura Perfoclay Ltd. (APL)

-

Oil Dri Corporation of America

-

Korvi Activated Earth

Bleaching Clay Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.3 billion

Revenue forecast in 2027

USD 1.9 billion

Growth Rate

CAGR of 5.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Malaysia; Indonesia; Brazil; Argentina; South Africa

Key companies profiled

Taiko Group of Companies; Clariant AG; Ashapura Perfoclay Ltd. (APL); Oil Dri Corporation of America; Korvi Activated Earth

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2027. For the purpose of this study, Grand View Research has segmented the global bleaching clay market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Natural

-

Activated

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Refining of Vegetable Oils & Fats

-

Refining of Mineral Oils & Lubricants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bleaching clay market size was estimated at USD 1.2 billion in 2019 and is expected to reach USD 1.3 billion in 2020.

b. The global bleaching clay market is expected to grow at a compound annual growth rate of 5.5% from 2020 to 2027 to reach USD 1.9 billion by 2027.

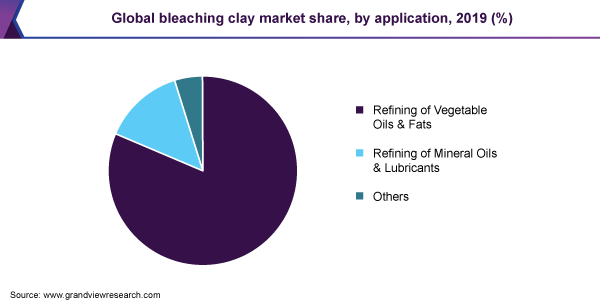

b. Edible oils & fats dominated the bleaching clay market with a share of 81.2% in 2019. This is attributable to the rising production of vegetable oil due to higher oilseed crop yield and technological developments.

b. Some key players operating in the bleaching clay market include Taiko Group of Companies, Clariant, Ashapura Perfoclay Limited (APL), Musim Mas Holdings Pte. Ltd., The W Clay Industries Sdn. Bhd., and MANEK ACTIVE CLAY PVT. LTD.

b. Key factors that are driving the bleaching clay market growth include increasing use of bleaching clay for vegetable oil refining for removal of phospholipids, sulfuric acid, sludge, sulfonic acid, free fatty acids, and traces of metal in the oil.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."