- Home

- »

- Advanced Interior Materials

- »

-

Kaolin Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Kaolin Market Size, Share & Trends Report]()

Kaolin Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Paper, Ceramics, Paints & Coatings, Fiber Glass, Plastic, Rubber, Cosmetics, Pharmaceuticals & Medical), By Region (North America, EU, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-337-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kaolin Market Summary

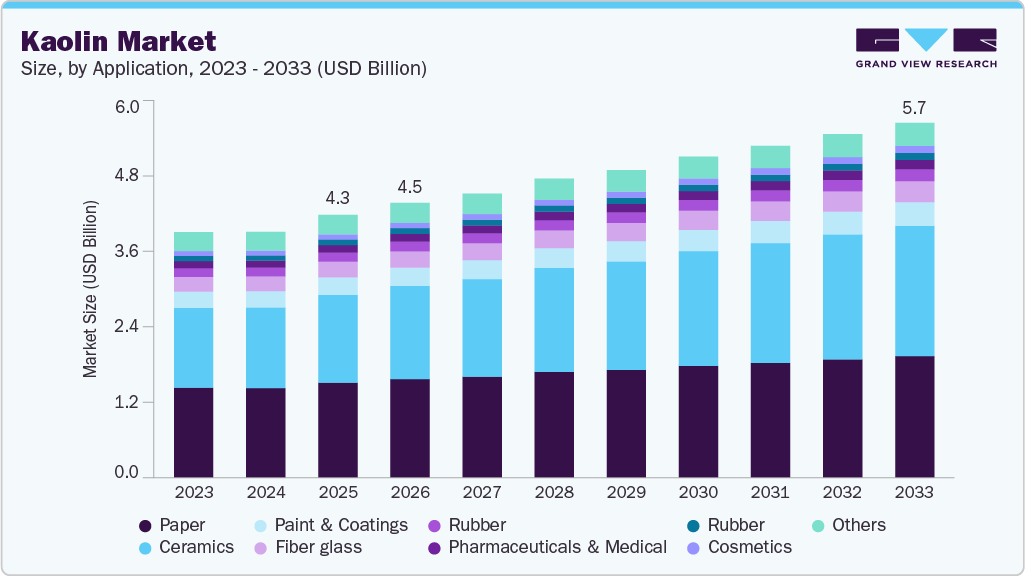

The global kaolin market size was estimated at USD 4.26 billion in 2025 and is expected to reach USD 5.75 billion by 2033, growing at a CAGR of 3.7% from 2026 to 2033. The growth of the kaolin market is strongly supported by rising demand from the paper industry, where kaolin is widely used as a filler and coating material.

Key Market Trends & Insights

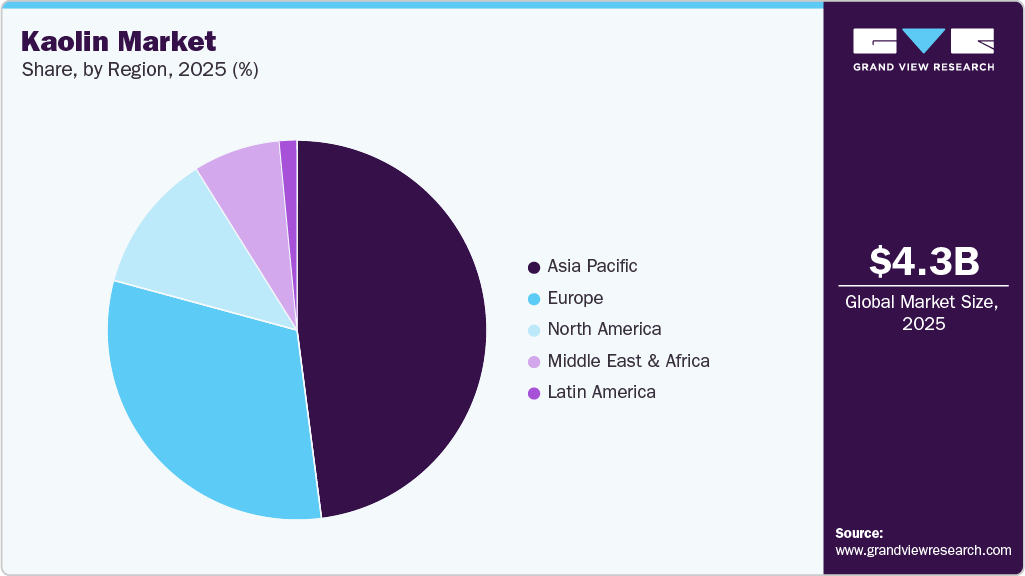

- Asia Pacific dominated the kaolin market with the largest market revenue share of over 48.0% in 2025.

- The kaolin market in China is expected to grow at a significant CAGR over the forecast period.

- By application, ceramics is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 4.26 Billion

- 2033 Projected Market Size: USD 5.75 Billion

- CAGR (2026-2033): 3.7%

- Asia Pacific: Largest market in 2025

Its ability to improve brightness, smoothness, opacity, and printability makes it essential for high-quality paper and packaging products. With increasing consumption of packaging paper driven by e-commerce, food delivery, and consumer goods, kaolin demand continues to expand even as certain regions witness slower growth in traditional printing paper. Increasing investment in the construction and infrastructure industry is propelling demand for paints & coatings, ceramic-based products, and cement, which is driving market growth. The global construction industry is expected to witness lucrative growth over a shifting inclination towards green construction, which in turn is expected to provide a significant growth opportunity for the kaolin market. For instance, according to the World Bank’s new IFC report, green construction is anticipated to make investment opportunities worth USD 1.5 trillion for emerging markets.Investments in construction, infrastructure development, and automotive production are expected to contribute to market growth over the forecast period. The growth of the construction industry in the U.S. is a key factor contributing to the demand for kaolin in the country. According to the U.S. Census Bureau, total construction spending (residential and non-residential) grew by 3.5% in June 2023 on a year-over-year basis. The spending on single-family housing increased by 2.1% and on multi-family housing by 1.5%.

Growing demand for painting due to rising investments in construction is leading companies to engage in strategic measures such as mergers & acquisitions, which are expected to influence the market demand positively. For instance, in December 2025, JSW Paints Limited completed the acquisition of a 60.76% majority stake in Akzo Nobel India Limited (ANIL) from Akzo Nobel N.V. and its affiliates, taking its total holding to 61.2% after also acquiring 0.44% from public shareholders via an open offer, thereby marking one of the largest deals in India’s paints and coatings sector and positioning JSW Paints as a major player in the fast-growing Indian decorative and industrial paints market with access to premium brands like Dulux.

Further investments in the medical industry are another driving factor for the market. For instance, in December 2021, Pfizer announced that it would acquire Arena Pharmaceuticals for about USD 6.70 billion. This deal was completed in March 2022 and is expected to help advance its presence in the treatment of several immunodeficiency diseases. Such developments indicate healthy growth for the country’s pharmaceutical and medical industries. This is anticipated to have a positive impact on demand for kaolin in the pharmaceuticals and medical application segments.

Drivers, Opportunities & Restraints

The kaolin market is driven by strong demand from end-use industries such as paper, ceramics, paints and coatings, rubber, and plastics. Growth in packaging consumption due to retail expansion, food delivery, and consumer goods manufacturing continues to support kaolin usage in paper coating and filling applications. Rapid urbanization and infrastructure development are also increasing ceramic tile and sanitaryware production, where kaolin plays a critical role due to its strength, whiteness, and thermal stability. Rising awareness around functional minerals that improve product performance while maintaining cost efficiency further reinforces market growth.

The market offers several opportunities linked to the diversification of applications and evolving consumer preferences. Increasing use of kaolin in pharmaceuticals, cosmetics, and personal care products presents a high-value growth avenue, supported by demand for natural and mineral-based ingredients. Technological advancements in kaolin processing, including calcined and surface-treated grades, are expanding its suitability for high-performance coatings, polymers, and specialty applications. Growth in emerging economies across Asia Pacific, the Middle East, and Africa is also creating new opportunities as industrial output, construction activity, and consumer spending continue to rise.

Despite these positives, the kaolin market faces certain restraints that may limit growth potential. Environmental regulations related to mining activities and land rehabilitation increase operational costs and can delay project approvals. Availability of substitutes such as calcium carbonate in paper and plastics applications also creates pricing pressure and limits volume growth in some regions.

Application Insights

The paper segment held the revenue share of over 36% in 2025, driven by rising demand for higher-quality printing and packaging papers that require superior brightness, opacity, and surface smoothness, attributes that kaolin reliably provides when used as a filler and coating pigment. Coated and specialty papers used in labels, flexible packaging, and high-end print media need improved printability and ink holdout, which increases consumption of both coated and calcined kaolin.

The ceramics application is driven by strong demand for ceramic tiles, sanitaryware, and tableware across residential and commercial construction. Kaolin plays a critical role in improving plasticity, green strength, and firing behavior, which is essential for achieving uniform shapes and smooth surface finishes in ceramic products. Rapid urbanization, housing development, and renovation activities in emerging economies are increasing the consumption of tiles and sanitary ceramics, directly supporting higher kaolin usage in ceramic bodies and glazes.

Regional Insights

Asia Pacific kaolin market held over 48% revenue share of the global kaolin industry, driven by strong demand from construction-related industries where kaolin is essential for ceramics, sanitaryware, refractories and certain cement applications. Rapid urbanization and infrastructure investment across China, India and Southeast Asia have pushed tile and sanitaryware production higher, increasing the need for both washed and calcined kaolin grades used to improve whiteness, plasticity and firing performance.

North America Kaolin Market Trends

In North America, the kaolin market is expanding as industrial sectors with heavy mineral usage heighten their consumption of this clay mineral. Demand in the paper industry continues to be significant because kaolin improves surface smoothness, brightness, and ink receptivity in coated papers used for packaging and printing, which sustains baseline market volumes. Growth in construction-linked ceramics and sanitaryware production adds further pull since kaolin enhances plasticity and firing characteristics in ceramic bodies.

U.S. Kaolin Market Trends

In the U.S., the kaolin market is expanding as key industrial sectors increase their uptake of this versatile clay mineral. Industries such as paper, ceramics, paints and coatings, rubber, and plastics are major contributors to demand because kaolin improves brightness, surface smoothness, opacity, and mechanical properties in these products. Growth in packaging, publishing, construction, and automotive production supports sustained consumption since kaolin acts as an effective filler and functional additive across these applications.

Europe Kaolin Market Trends

The growth of the kaolin market in Europe is primarily driven by its indispensable role in the ceramics and paper industries, which are major consumers of high-quality clay. In ceramics, kaolin is a fundamental component for producing porcelain, sanitaryware, and tiles, providing whiteness, strength, and plasticity. The robust construction and renovation activities across the continent, particularly in nations like Germany, Italy, and Spain, fuel demand for these ceramic products.

Latin America Kaolin Market Trends

In Latin America, the kaolin market is being shaped by steady demand from core industrial sectors such as ceramics, paper, and construction-related manufacturing. Countries such as Brazil and Mexico feature established ceramics industries where kaolin enhances plasticity, whiteness, and strength in tiles, sanitaryware, and other clay products. This traditional ceramics consumption underpins a reliable base of regional demand. The paper segment also contributes to growth because kaolin improves brightness, smoothness, and printability in coated and packaging papers. This factor retains relevance with expanding packaging activity across the region.

Key Kaolin Company Insights

Some of the key players operating in the market include BASF SE, EICL Ltd, among others.

-

BASF SE is a German multinational chemical company headquartered in Ludwigshafen and is widely regarded as one of the largest chemical producers worldwide. Its extensive portfolio spans chemicals, plastics, performance products, coatings, crop protection solutions and more, serving customers in over 190 countries across industries such as automotive, construction, agriculture, electronics and personal care.

-

EICL Ltd (English Indian Clays) is an Indian clay specialist founded in 1963, with headquarters in New Delhi and manufacturing operations in Kerala and other regional sites. The company focuses on mining and processing high-end kaolin and related clay products under its Clay Division, alongside a Starch Division producing maize-based products. EICL’s clay business draws on decades of experience with processed clays that serve a range of industrial customers. EICL’s kaolin portfolio includes processed china clay, calcined clay, delaminated clay, metakaolin and nano clay grades tailored to diverse applications.

Key Kaolin Companies:

The following are the leading companies in the kaolin market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- EICL Ltd.

- Imerys S.A.

- I-Minerals Inc.

- KaMin LLC

- LB Minerals Ltd.

- Maoming Xingli Kaolin Co. Ltd.

- Quazwerke GmbH

- Sibelco

- Thiele Kaolin Company

Recent Developments

-

In December 2025, Andromeda Metals ramped up early site work at its Great White kaolin project in South Australia, having made the required USD 4.45 million in rehabilitation and environmental compliance payments to the South Australian government, enabling the start of pre-construction activities such as site preparation, construction of the mine access road, bulk earthworks for the Stage 1A+ processing plant, and grade control and geotechnical drilling, while also advancing detailed engineering design and scheduling the freight of key long-lead equipment items to site in preparation for a final investment decision.

Kaolin Market Report Scope

Report Attribute

Details

Market definition

The market represents total consumption of kaolin in various applications.

Market size value in 2026

USD 4.46 billion

Revenue forecast in 2033

USD 5.75 billion

Growth rate

CAGR of 3.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, flit factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; Turkey; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

LB Minerals Ltd.; BASF SE; Sibelco; KaMin LLC; Thiele Kaolin Company; Imerys S.A.; I-Minerals; Quazwerke GmbH; EICL Ltd.; Maoming Xingli Kaolin Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kaolin Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global kaolin market report on the basis of application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Paper

-

Ceramics

-

Paint & Coatings

-

Fiberglass

-

Plastic

-

Rubber

-

Pharmaceuticals & Medical

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The paper segment dominated the kaolin market with a revenue share of nearly 37.0% in 2025, owing to its extensive use of the product as a filler in paper manufacturing.

b. Some of the key vendors of the global kaolin market are LB Minerals Ltd., BASF SE, Sibelco, KaMin LLC, Thiele Kaolin Company, Imerys S.A., I-Minerals Inc., Quazwerke GmbH, Maoming Xingli Kaolin Co. Ltd., and EICL Ltd

b. The key factors that are driving the kaolin market include growing grade demand from the ceramics industry and the rising prominence of kaolin in cosmetics manufacturing.

b. The global kaolin market size was estimated at USD 4.26 billion in 2025 and is expected to reach USD 4.46 billion in 2026.

b. The global kaolin market is expected to grow at a compound annual growth rate of 3.7% from 2026 to 2033 to reach USD 5.75 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.