- Home

- »

- Healthcare IT

- »

-

Biosimulation Market Size & Share, Industry Report, 2030GVR Report cover

![Biosimulation Market Size, Share & Trends Report]()

Biosimulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Software, Services), By Application, Therapeutic Area, By Deployment Model, By Pricing Model, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-051-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biosimulation Market Summary

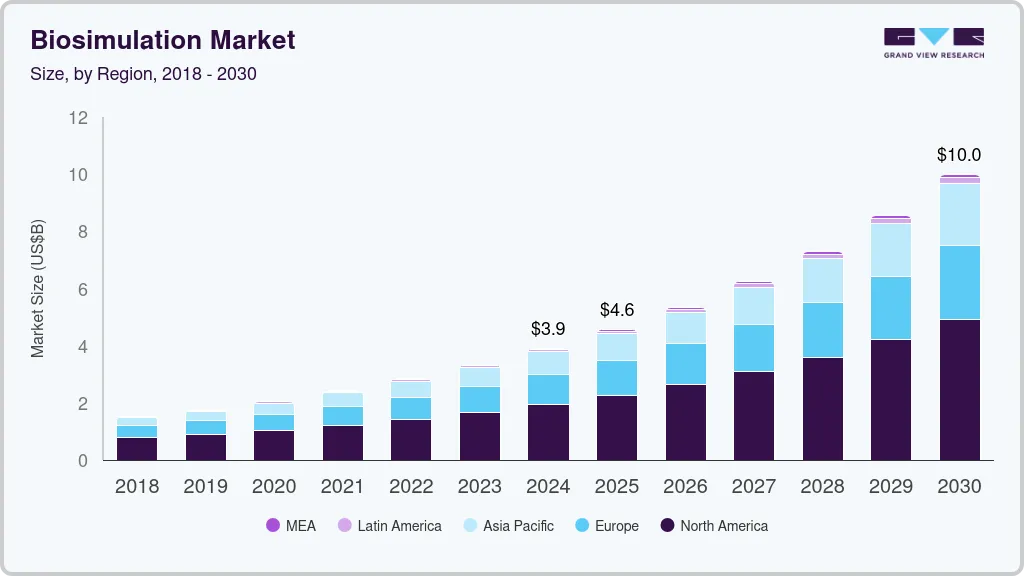

The global biosimulation market size was estimated at USD 3.91 billion in 2024 and is projected to reach USD 10.00 billion by 2030, growing at a CAGR of 17.0% from 2025 to 2030. This growth is largely driven by the increasing incidence of drug relapse cases due to drug resistance in diseases such as cancer, tuberculosis, and other bacterial infections.

Key Market Trends & Insights

- The Biosimulation market in North America dominated the industry with a revenue share of 49.90% in 2024.

- Based on product, the software dominated the market, with a revenue share of 62.02% in 2024.

- Based on application, the drug development segment held the largest market share of 55.43% in 2024

- Based on pricing model, the license-based model segment held the largest revenue share in 2024.

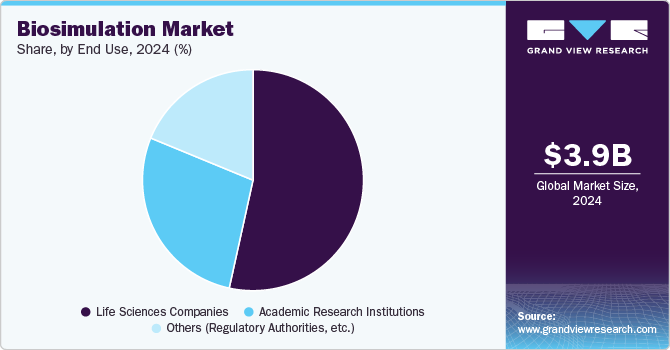

- Based on end use, the life science companies segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.91 Billion

- 2030 Projected Market USD 10.00 Billion

- CAGR (2025-2030): 17.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These trends are key factors stimulating market growth, creating a critical need to integrate biosimulation into the initial development of a new generation of drugs. In addition, the rising demand for biosimulation tools among researchers, fueled by technological advancements and software upgrades, is expected to further enhance market growth.

Moreover, the growing emphasis on personalized medicine further drives market growth. As healthcare shifts towards more individualized treatment approaches, tools are increasingly needed to model patient-specific responses to therapies. Biosimulation allows researchers to create detailed models for genetic variations among individuals, enabling them to predict how different patients are likely to respond to specific drugs or treatment regimens. This capability enhances therapeutic efficacy and minimizes adverse effects by tailoring treatments to individual profiles. However, the rise of pharmacogenomics further underscores the need for advanced biosimulation tools to integrate genetic information into predictive models.

The growing clinical need for the development of high-potency and advanced drugs is expected to drive market growth. Biosimulation is increasingly being used in the simulation modeling of diseases such as diabetes mellitus. It integrates with proteomic and genomic technologies to create models for advanced therapeutics. In addition, regulatory support and guidance are anticipated to further stimulate market expansion. Regulatory agencies, including the U.S. FDA and the EMA, endorse the use of biosimulation in regulatory submissions, particularly in the areas of pharmacokinetics and pharmacodynamics modeling. Moreover, collaborations among academic institutions, industry players, and regulatory agencies promote innovation in the field. These partnerships often facilitate shared resources and knowledge transfer, enhancing the development of robust biosimulation platforms that meet both scientific and regulatory requirements.

The COVID-19 pandemic significantly impacted the healthcare industry, including the biosimulation industry. The need to rapidly test and develop COVID-19 vaccine candidates harnessed the demand for biosimulation software and services. For instance, in August 2020, Certara, a key market player, collaborated with several pharmaceutical companies. This collaboration was intended to support the development of a new biosimulation tool to make it easier to develop vaccine candidates across multiple types of patient populations by using virtual patients and trials. In addition, it was also intended to provide insights before conducting any real-life studies. This new module was a part of the company’s Quantitative Systems Pharmacology (QSP) platform.

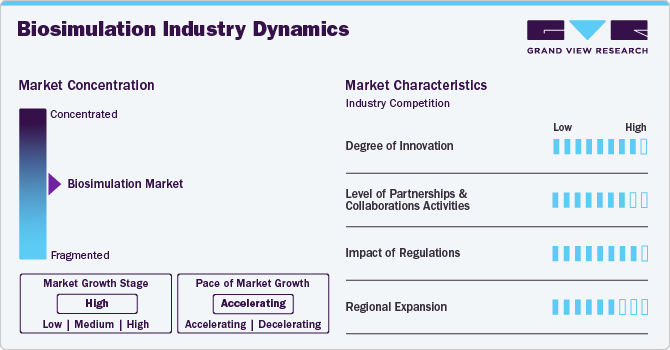

Market Concentration & Characteristics

The biosimulation industry experiences a high degree of innovation driven by technological advancements. Incorporating artificial intelligence (AI) and machine learning (ML) into biosimulation platforms allows for more sophisticated data analysis and pattern recognition. For instance, in October 2024, Simulations Plus and the University of Southern California secured an NIH grant to enhance AI-driven drug discovery. The funding is likely to support the development of innovative tools and methodologies, aiming to accelerate the drug discovery process and improve therapeutic outcomes through advanced artificial intelligence applications in pharmaceutical research.

The biosimulation industry is currently witnessing a significant increase in partnership and collaboration activities among several key players. This trend is driven by the desire to gain a competitive edge, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in August 2022, GNS-now rebranded as Aitia in 2023-partnered with LES LABORATOIRES SERVIER to enhance drug discovery and clinical development for Multiple Myeloma (MM) using AI and biosimulation. This collaboration aims to utilize GNS's Digital Twin technology to better understand disease progression and improve therapeutic strategies for MM patients.

Health authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) govern the regulatory landscape for the biosimulation industry. These organizations set stringent guidelines to ensure that biosimulation is safe and effective for patient use. These agencies have issued specific guidelines regarding the use of biosimulation in drug discovery and development. However, due to technological advancements, regulatory bodies are continuously updating their policies to incorporate new scientific knowledge and methodologies related to biosimulation.

The regional expansion of the biosimulation industry is notable, largely due to the increasing demand for biosimulation tools in emerging nations. For instance, in October 2021, 4baseCare, a precision oncology company based in India, partnered with Cellworks Group, Inc., a U.S.-based company, to improve personalized cancer treatment. This collaboration is likely to focus on providing advanced clinical insights through genomics-based molecular profiling and biosimulation to predict patient therapy responses and optimize treatment strategies.

Product Insights

Software dominated the market, with a revenue share of 62.02% in 2024. This can be attributed to the availability of application-specific software catering to specific research and development requirements. For instance, Rhenovia Pharma provides software that specializes in simulating the mechanism of CNS-specific drugs.

Services is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to the increasingly complex and multi-layered systems involved in drug development, where biosimulation services are likely to play a crucial role. This progress is anticipated to be driven by the creation of new and more precise combination therapies.

Application Insights

The drug development segment held the largest market share of 55.43% in 2024, driven by the increasing number of drug development processes. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), more than 8,000 medicines are in development. Biosimulation software is vital in drug development, allowing researchers to create detailed models of biological systems. In addition, the rising adoption of biosimulation in fields such as pharmacogenomics and pharmacogenetics contributes to the segment's growth. In February 2020, Certara acquired a modeling and simulation technology platform designed to study neurodegenerative conditions from In Silico Biosciences, Inc. This acquisition enhanced the company's quantitative systems pharmacology (QSP) business model, particularly in its research focused on neurodegenerative diseases.

Disease modeling is anticipated to grow fastest during the forecast period. The increasing prevalence of infectious diseases globally necessitates robust modeling frameworks to predict outbreaks and assess their potential impacts on healthcare systems. Moreover, integrating big data analytics and artificial intelligence into disease modeling has further accelerated its growth, enabling more accurate predictions and real-time analysis.

Therapeutic Area Insights

Oncology held the largest revenue share in 2024. In oncology, biosimulation is crucial in understanding tumor dynamics, treatment responses, and patient-specific factors influencing cancer outcomes. By combining data from multiple sources, such as genomic information, clinical trials, and pharmacokinetics, researchers can develop advanced models that predict how tumors will respond to various therapies. For instance, in September 2024, Cellworks Group, Inc. announced advancements in its biosimulation technology that enhances predictions of immunotherapy responses in non-small cell lung cancer (NSCLC) patients. Integrating genomic and transcriptomic data with personalized tumor microenvironment modeling significantly improves treatment outcome predictions beyond traditional biomarkers like PD-L1 and TMB.

The infectious diseases segment is anticipated to grow at the fastest CAGR during the forecast period. Biosimulation models can integrate biological data, including pathogen behavior, host responses, and treatment effects, allowing researchers and clinicians to predict how infectious diseases progress and respond to different therapeutic interventions. Moreover, biosimulation can help assess the impact of drug resistance on treatment efficacy by modeling different cases where pathogens evolve resistance mechanisms.

Deployment Model Insights

Cloud-based deployment model dominated the market and held the largest revenue share of over 43.00% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to the multiple advantages offered by the cloud-based deployment models. Traditional on-premises systems often require significant investments in hardware and software, which can limit the ability to expand computational resources as needed. Conversely, cloud platforms offer biosimulation companies the flexibility to adapt their resources up or down as required, facilitating a more responsive approach to their operational requirements.

Pricing Model Insights

License-based model held the largest revenue share in 2024. The advantage of this model is that it provides users with access to sophisticated tools without the need for substantial investments in infrastructure or development. Moreover, as these models offer flexibility and scalability, companies can choose from various licensing options, including single-user licenses, multi-user licenses, or enterprise-wide agreements, depending on their specific needs and budget constraints. Such factors are expected to drive the segment growth over the forecast period.

Subscription-based pricing model is anticipated to grow at the fastest CAGR over the forecast period. Organizations can manage their budgets and allocate resources more effectively by adopting a subscription model. Moreover, the subscription model encourages collaboration among researchers and institutions by lowering barriers to entry for accessing sophisticated biosimulation tools.

End Use Insights

Life science companies accounted for the largest revenue share in 2024. These companies are increasingly adopting biosimulation software as a critical tool in drug development and research. This software enables companies to create detailed models of biological systems, which can simulate the effects of drugs on various physiological processes. Moreover, biosimulation software plays a crucial role in regulatory submissions and compliance for pharmaceutical companies. Tools such as PK-Sim and MoBi provide robust frameworks for modeling complex biological interactions essential for understanding how drugs behave in the body.

The academic and research institutes segment is expected to grow at the fastest CAGR during the forecast period. Biosimulation models facilitate the modeling of biological systems to predict their behavior under various conditions. This software allows researchers to create virtual representations of complex biological processes, such as drug interactions, metabolic pathways, and cellular responses.

Regional Insights

Biosimulation market in North America dominated the industry with a revenue share of 49.90% in 2024. This growth can be attributed to the presence of key players, growing investment in drug discovery and development, and the rising prevalence of chronic diseases. Moreover, adopting in-silico models while enforcing regulatory policies to ensure high patient safety and treatment standards further contributes to regional market growth.

U.S. Biosimulation Market Trends

The biosimulation market in the U.S. held the largest revenue share in 2024 due to the rising prevalence of chronic diseases and increased investments in drug discovery and development. In addition, the strong presence of pharmaceutical and biotechnology companies, the increasing adoption of artificial intelligence and machine learning in healthcare, and the growing focus on personalized medicine further fuel the growth of the biosimulation industry.

Europe Biosimulation Market Trends

The biosimulation market in Europe experienced lucrative growth in 2024. The strong presence of pharmaceutical companies and biotechnology research centers, coupled with increasing R&D investments, are factors contributing to market growth. Moreover, technological advancements such as drug development expedite market growth further. In addition, events such as the European Drug Discovery Innovation & Outsourcing Programme serve as a platform for knowledge exchange between companies and professionals engaged in drug discovery and development.

The UK biosimulation market is expected to grow over the forecast period. This growth can be attributed to the robust R&D infrastructure and strong presence of pharmaceutical companies, CROs, and CDMOs. Pharmaceutical companies are partnering and collaborating with biosimulation software providers to enhance their drug development process. For instance, in March 2024, Exploristics collaborated with Exonate to utilize Exploristics’ KerusCloud platform for Exonate’s Phase IIb study for diabetic eye disease.

The biosimulation market in Germany held the largest market share in 2024 in the European market. This growth can be attributed to the presence of key market players, increasing healthcare spending, and strong R&D infrastructure. In addition, increasing investments in drug discovery and development and a growing focus on personalized medicine are other factors propelling market growth.

Asia Pacific Biosimulation Market Trends

The biosimulation market in Asia Pacific is anticipated to grow at the fastest CAGR from 2025 to 2030. Technological advancements, a strong presence of pharmaceutical and biopharmaceutical companies, CROs, and CDMOs, and increasing funding in biotechnology research and development contribute to market growth. For instance, in September 2024, Certara, Inc. a lmodel-informed drug development company, is expanding its Certainty client event with one-day conferences in China, South Korea, and Japan this September. With a $210 billion pharmaceutical market in 2023, the APAC region is a hub for drug discovery and development. Certara’s Certainty fosters innovation through collaboration, offering attendees insights from experts in biosimulation, data analytics, and regulatory science.

Japan biosimulation market held the largest revenue share in the Asia Pacific market, owing to technological advancements and strategic initiatives by industry players tofoster innovation by developing innovative biosimulation tools. For instance, in June 2021, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) Renews Certara Biosimulation Software Licenses for Regulatory Evaluations.

The biosimulation market in China is expected to grow over the forecast period, owing to the growing emphasis on personalized medicine and the rising number of partnerships and collaborations to implement biosimulation technologies. For instance, Certara, Inc., a global biosimulation company, announced a $310 million cash-and-stock acquisition of Pinnacle 21. Pinnacle 21 provides software for validating compliance with Clinical Data Interchange Standards Consortium (CDISC) standards, required by Japan's Pharmaceuticals and Medical Devices Agency (PMDA) and FDA, and preferred by China's National Medical Products Administration (NMPA) for drug submissions.

Latin America Biosimulation Market Trends

The biosimulation market in Latin America is anticipated to grow at a significant CAGR over the forecast period. This can be attributed to the increasing adoption of technology in healthcare and biotechnology, coupled with growing awareness about AI technologies and increasing government spending.

Middle East and Africa Biosimulation Market Trends

The biosimulation market in the Middle East and Africa is expected to grow at a significant CAGR over the forecast period. Rising healthcare expenditures, drug development initiatives, and favorable government policies are contributing factors.

Key Biosimulation Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Biosimulation Companies:

The following are the leading companies in the biosimulation market. These companies collectively hold the largest market share and dictate industry trends.

- Certara, USA.

- Dassault Systèmes

- Advanced Chemistry Development

- Simulation Plus

- Schrodinger, Inc.

- Chemical Computing Group ULC

- Physiomics Plc

- Rosa & Co. LLC

- BioSimulation Consulting Inc.

- Genedata AG

- Instem Group of Companies

- PPD, Inc.

- Yokogawa Insilico Biotechnology GmbH

Recent Developments

-

In October 2024, Certara acquired ChemAxon, a leading provider of cheminformatics software. This acquisition helped Certara enhance its drug discovery and development capabilities by integrating ChemAxon's advanced molecular modeling and data analysis tools.

-

In September 2024, Certara partnered with Ichnos Glenmark Innovation (IGI) to optimize the dosing strategy for a potential first-in-class cancer drug. This collaboration leverages Certara's modeling and simulation expertise to enhance the drug's development process, aiming to improve patient outcomes and streamline clinical trials.

-

In August 2024, Certara launched Phoenix version 8.5, a software for pharmacokinetic/pharmacodynamic (PK/PD) and toxicokinetic modeling.

-

In June 2024, Simulations Plus acquired Pro-ficiency. By this acquisition, Simulation Plus is likely to integrate Pro-ficiency's innovative software solutions with its existing capabilities, creating a novel platform designed to streamline and optimize the drug development process.

-

In December 2023, Certara acquired Applied Biomath, a leader in model-informed drug discovery, aiding Certara to expand its biosimulation portfolio.

-

In November 2023, Certara launched Simcyp Biopharmaceutics software to enhance the efficiency of novel and generic drug formulation development.

-

In June 2023, Simulations Plus, Inc. acquired Immunetrics, Inc., a company offering modeling and simulation for drug development in oncology, immunology, and autoimmune diseases.

-

In January 2023, Cellworks, a biosimulation company, announced the launch of a new business unit dedicated to precision oncology drug development. This initiative aims to leverage advanced computational models to enhance the understanding of cancer biology and improve therapeutic strategies.

-

In January 2022, Simulation Plus partnered with a pharmaceutical company for modifying the GastroPlus Advanced Compartmental Absorption and Transit (ACAT) model in support of the ongoing research programs for the treatment of gastrointestinal diseases.

Biosimulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.57 billion

Revenue forecast in 2030

USD 10.00 billion

Growth rate

CAGR of 17.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, therapeutic area, deployment model, pricing model, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Certara, USA; Dassault Systèmes; Advanced Chemistry Development; Simulation Plus; Schrodinger, Inc.; Chemical Computing Group ULC; Physiomics Plc; Rosa & Co. LLC; BioSimulation Consulting Inc.; Genedata AG; Instem Group of Companies; PPD, Inc.; Yokogawa Insilico Biotechnology GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biosimulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global biosimulation market report based on product, application, therapeutic area, deployment model, pricing model, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Molecular Modeling & Simulation Software

-

Clinical Trial Design Software

-

PK/PD Modeling and Simulation Software

-

Pbpk Modeling and Simulation Software

-

Toxicity Prediction Software

-

Other Software

-

-

Services

-

Contract Services

-

Consulting

-

Other (Implementation, Training, & Support etc.)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Disease Modeling

-

Other (Precision Medicine, Toxicology, etc.)

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease

-

Infectious Disease

-

Neurological Disorders

-

Others

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

Hybrid Model

-

-

Pricing Model Outlook (Revenue, USD Million, 2018 - 2030)

-

License-based Model

-

Subscription-based Model

-

Service-based Model

-

Pay Per Use Model

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences Companies

-

Pharmaceutical Companies

-

Biopharma Companies

-

Medical Device Companies

-

CROs/CDMOs

-

-

Academic Research Institutions

-

Others (Regulatory Authorities, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biosimulation market size was estimated at USD 3.91 billion in 2024 and is expected to reach USD 4.57 billion in 2025.

b. The global biosimulation market is expected to grow at a compound annual growth rate of 16.98% from 2025 to 2030 to reach USD 10.00 billion by 2030.

b. North America dominated the biosimulation market with a share of 49.90% in 2024. This is attributable to the growing number of collaborations by key players for improving drug discovery capabilities and adopting in-silico models during enforcement of regulatory policies to ensure high patient safety & treatment standards.

b. Some key players operating in the biosimulation market include Certara, USA; Dassault Systèmes; Advanced Chemistry Development; Simulation Plus; Schrodinger, Inc.; Chemical Computing Group ULC; Physiomics Plc; Rosa & Co. LLC; BioSimulation Consulting Inc.; Genedata AG; Instem Group of Companies; PPD, Inc.; Yokogawa Insilico Biotechnology GmbH.

b. Key factors that are driving the biosimulation market growth include increasing cases of drug relapse due to acquired drug resistance in diseases such as cancer, tuberculosis, and other bacterial infections, advancements in computational modeling, increasing adoption in drug discovery, rising R&D costs, regulatory support, demand for personalized medicine, and growing focus on reducing clinical trial failures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.