- Home

- »

- Medical Devices

- »

-

Biopsy Devices Market Size & Share, Indsutry Report, 2030GVR Report cover

![Biopsy Devices Market Size, Share & Trends Report]()

Biopsy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Needle-based Biopsy Guns, Biopsy Guidance Systems, Biopsy Forceps, Biopsy Needles), By Region, And Segment Forecasts

- Report ID: 978-1-68038-034-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopsy Devices Market Summary

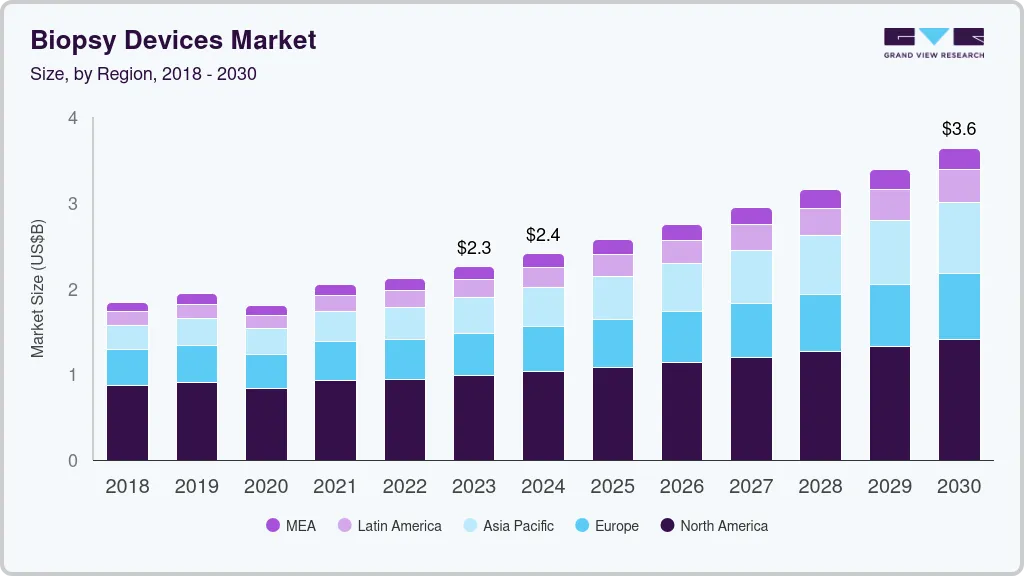

The global biopsy devices market size was estimated at USD 2.25 billion in 2023 and is projected to reach USD 3.64 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030. The rising prevalence of cancer, increasing emphasis on minimally invasive surgeries, the presence of untapped opportunities in emerging economies, especially in the Asia Pacific, and improving healthcare infrastructure are among the key trends encouraging industry growth.

Key Market Trends & Insights

- North America biopsy devices market dominated the overall global market and accounted for 43.1% of revenue share in 2023.

- The U.S. biopsy devices market accounted for a 34.6% share of the global market in 2023.

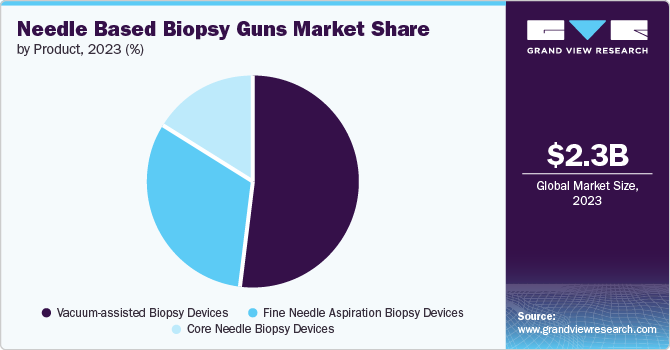

- In terms of product, needle-based biopsy guns segment dominated the market and accounted for the largest market share of 43.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.25 Billion

- 2030 Projected Market Size: USD 3.64 Billion

- CAGR (2024-2030): 7.2%

- North America: Largest market in 2023

According to the Union for International Cancer Control (UICC), more than 35 million new cases of cancer are estimated in 2050, which shows an increase of about 77% from the estimated 20 million cases in 2022. This rise in cancer cases is expected to drive the demand for biopsy devices and foster market growth.In addition, the advantages offered by minimally invasive procedures have driven their demand globally. These procedures result in the quicker recovery of patients and are less traumatic. The rising demand for minimally invasive procedures has further fostered innovation in the market. For instance, in July 2022, doctors introduced a new technology at NewYork-Presbyterian/Columbia, which offers a less invasive, safer, and more timely option to perform lung biopsy.

Growing cancer prevalence is driving the need for effective diagnostic procedures. This has encouraged various government bodies to increase their spending on cancer research. For instance, in the year 2022, total funds available to the National Cancer Institute amounted to USD 6.8 billion, which shows an increase of 5.7% from the previous fiscal year.

Government and healthcare bodies across the world are also making efforts to curb the high costs associated with cancer treatment. Various healthcare institutes are also encouraging people to undergo regular diagnostic examinations through awareness campaigns. For instance, the "Right to Know" campaign by the Centers for Disease Control and Prevention aims to create awareness regarding the importance of breast cancer screening among women with disabilities.

Product Insights

Needle-based biopsy guns dominated the market and accounted for the largest market share of 43.1% in 2023. The increasing demand for needle-based biopsy guns to collect samples from soft tissues of internal organs is driving the growth of the overall market. In addition, the rising need for rapid and gentle procurement of cell samples for biopsy has led to the development of technologically advanced biopsy devices such as vacuum-assisted biopsy (VAB) devices. For instance, in August 2022, Mammotome introduced a Vacuum-Assisted Breast Biopsy System, which can help in lesion excision. Such developments are likely to foster market growth.

The biopsy needle segment is expected to grow significantly over the forecast period. Technological advancements and the increasing demand for these needles to access difficult anatomy while performing biopsies are major drivers of segmental growth. The increasing innovation and launch of advanced products are further expected to drive segment growth. For instance, in May 2024, Cook introduced the biopsy needle EchoTip AcuCore EUS to be used in precision gastrointestinal lesion biopsies.

Regional Insights

North America biopsy devices market dominated the overall global market and accounted for 43.1% of revenue share in 2023, Owing to rising cancer cases and the increasing development of technologically advanced biopsy devices in the region. For instance, in September 2023, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Limaca Medical's Precision GI endoscopic ultrasound biopsy device. Such developments in the region are expected to foster further growth in the market.

U.S. Biopsy Devices Market Trends

The U.S. biopsy devices market accounted for a 34.6% share of the global market in 2023. According to the National Cancer Institute, approximately 2,001,140 new cases of cancer are expected to be diagnosed in 2024 in the U.S. This rise in the cancer prevalence in the country, coupled with the presence of strong healthcare and regulatory environment to support the development of technologically advanced medical devices is expected to drive the market growth in the country.

Europe Biopsy Devices Market Trends

Europe biopsy device market was identified as a lucrative region in 2023. The rising prevalence of cancer cases and the need to develop advanced devices to facilitate early diagnosis and treatment are major factors driving the demand for biopsy devices in the Europe region. For instance, according to the information published by the World Health Organization, cancer is the second most important cause of death in the region, with over 3.7 million new diagnoses and 1.9 million deaths every year.

The UK biopsy devices market is expected to grow rapidly in the coming years due to the presence of key players in the region, increasing awareness regarding preventive healthcare, and initiatives to promote early diagnosis and treatment. For instance, 'Be Clear on Cancer' (BCoC) and 'Help Us Help You' (HUHY) are nationwide public awareness campaigns on cancer.

Asia Pacific Biopsy Devices Market Trends

The Asia Pacific biopsy devices market is expected to grow at the fastest CAGR over the forecast period. The growth can be attributed to the rising incidences of cancer, the increasing need for advanced equipment to meet rising patient demand and advancement in the healthcare infrastructure in the growing economies of the region, such as China and India. According to Global Cancer Statistics 2020, one-half of all cases and 58.3% of cancer deaths were estimated to occur in Asia. The different governments in this region are taking initiatives such as awareness programs and organization of screening to facilitate diagnosis and treatment, which is further expected to drive market growth.

India's biopsy device market is expected to grow significantly owing to the rising efforts by public and private players to facilitate the diagnosis and treatment of cancer and the development of healthcare infrastructure in the country. For instance, in July 2024, the MR Fusion Biopsy machine was installed at Sir H.N. Reliance Foundation Hospital, which is the first such machine to be introduced in Maharashtra, India. The step is expected to enhance cancer care in the country and drive further growth in the market.

Key Biopsy Devices Company Insights

Some players in the market include Cardinal Health Inc., Hologic, Inc., and Danaher Corporation, and others. These players are majorly engaged in R&D to develop technologically advanced products to help them retain a strong position in the market. For instance, in August 2022, Devicor Medical Products, Inc. introduced the Mammotome DualCore Dual Stage Core Biopsy System, which is expected to help the company in advancing its biopsy device portfolio.

-

Cardinal Health, Inc. is a global healthcare services and products company operating majorly in two segments: Pharmaceutical and Medical. The company also engages in the production of minimally invasive biopsy devices such as fine needle core biopsy (FNCB), bone marrow biopsy & aspiration needles, and Tissue Biopsy Kits.

-

Hologic, Inc. is a global company engaged in developing, manufacturing, and supplying medical imaging systems, diagnostic products, and surgical products, including biopsy devices. The company has introduced advanced biopsy devices such as the Eviva Breast Biopsy system, and Brevera breast biopsy system to gain a competitive edge.

Key Biopsy Devices Companies:

The following are the leading companies in the biopsy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health Inc.

- Hologic, Inc.

- Danaher Corporation

- CONMED Corporation

- Cook Medical

- DTR Medical

- INRAD, Inc.

- Devicor Medical Products Inc.

- Gallini Srl

- TransMed7, LLC.

Recent Developments

-

In April 2024, Single Pass announced the FDA clearance of the Kronos biopsy closure device, its class II medical device.

-

In May 2023, Argon Medical Devices introduced the SuperCore Advantage semi-automatic biopsy instrument, a soft tissue biopsy product in the U.S.

-

In February 2023, TransMed7 announced its plans to introduce its US-guided biopsy devices.

Biopsy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.40 billion

Revenue forecast in 2030

USD 3.64 billion

Growth Rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; Japan; China; South Korea; Thailand; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cardinal Health Inc.; Hologic, Inc.; Danaher Corporation; CONMED Corporation; Cook Medical; DTR Medical; INRAD, Inc.; Devicor Medical Products Inc.; Gallini Srl; TransMed7, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopsy Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global biopsy devices market report on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Needle-based Biopsy Guns

-

Vacuum-assisted Biopsy (VAB) Devices

-

Fine Needle Aspiration Biopsy (FNAB) Devices

-

Core Needle Biopsy (CNB) devices

-

-

Biopsy Guidance Systems

-

Manual

-

Robotic

-

-

Biopsy Needles

-

Disposable

-

Reusable

-

-

Biopsy Forceps

-

General Biopsy Forceps

-

Hot Biopsy Forceps

-

-

Others

-

Brushes

-

Curettes

-

Punches

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Thailand

-

Australia

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global biopsy devices market size was valued at estimated at USD 2.25 billion in 2023 and is expected to reach USD 2.40 billion in 2024.

b. The global biopsy devices market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 3.64 billion by 2030

b. North America dominated the biopsy devices market with a market share of 43.1% in 2023. Two major factors accounting for the aforementioned conclusion include high biopsy procedure volume and market penetration rates of technologically advanced products in the U.S.

b. Some of the key players in the market are Cardinal Health Inc., Hologic, Inc., Danaher Corporation, CONMED Corporation, Cook Medical, DTR Medical, INRAD, Inc., Devicor Medical Products Inc., Gallini Srl and TransMed7, LLC

b. Some of the factors contributing to the growth of the market are the increasing prevalence of cancer coupled with high unmet patient needs due to the increasing importance of accurate diagnostic procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.