- Home

- »

- Biotechnology

- »

-

Bioprocess Bags Market Size & Share, Industry Report, 2030GVR Report cover

![Bioprocess Bags Market Size, Share & Trends Report]()

Bioprocess Bags Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (2D Bioprocess Bags, 3D Bioprocess Bags), By Workflow (Upstream Process, Downstream Process, Process Development), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-060-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioprocess Bags Market Summary

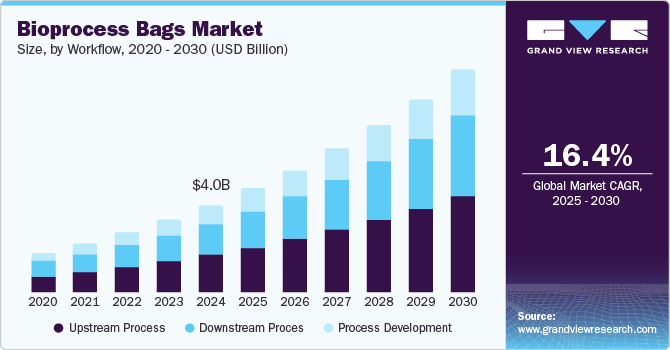

The global bioprocess bags market size was estimated at USD 4,028.0 million in 2024 and is projected to reach USD 10,212.5 million by 2030, growing at a CAGR of 16.40% from 2025 to 2030. The market is being driven by several factors such as, the growing demand for biopharmaceuticals, including monoclonal antibodies and vaccines, advancements in bioprocess technology, such as single-use systems and disposable bioprocess bags, and the increasing adoption of modular manufacturing.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, upstream process accounted for a revenue of USD 1,762.4 million in 2024.

- Downstream Process is the most lucrative workflow segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,028.0 million

- 2030 Projected Market Size: USD 10,212.5 million

- CAGR (2025-2030): 16.40%

- North America: Largest market in 2024

Furthermore, the rising demand for personalized medicine is leading to the development of new biologics and other complex therapeutics, which require specialized manufacturing processes that can benefit from bioprocess bags.

The COVID-19 pandemic has had a significant impact on the bioprocess bags market. The market is primarily driven by the biopharmaceutical industry, which has seen increased demand due to the development of COVID-19 vaccines and other advanced therapies. The production of vaccines and protein therapeutics requires bioprocess bags for the production, storage and transport of biologics, which has led to a surge in demand for these bags. Furthermore, the pandemic has also resulted in a shift in focus towards single-use bioprocess bags. They are preferred over traditional stainless-steel tanks due to their low risk of contamination, increased flexibility, cost effectiveness, and ease of use.

For instance, in February 2022, Dow, Südpack Medica, and Sartorius have joined forces to produce bioprocessing bags that are crucial for manufacturing and transporting vaccines in the global fight against COVID-19. The collaboration involves the production of sterile bioreactor bags made from multi-layered film that can hold up to 2,000 liters. These bags are designed for optimized stirring and high oxygen transfer, making them suitable for mammalian cell culture processes that are microcarrier-based or require high cell density.

These bags are made of flexible plastic materials and are designed to withstand the rigorous demands of the biopharmaceutical manufacturing process. They are available in different sizes and configurations, depending on the specific needs of the manufacturer. The market is expected to see significant growth due to the rising demand for biopharmaceuticals. The demand for biopharmaceuticals is increasing due to several factors, including an aging population, the prevalence of chronic diseases, and a growing demand for personalized medicine. As a result, the bioprocess bags market is expected to grow significantly over the coming years. For instance, in 2022, approximately 340 biologics were approved by the Food and Drug Administration.

Furthermore, the rising outsourcing activity by Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) is expected to drive the demand for bioprocess bags. CMOs and CROs are companies that provide manufacturing and research services to pharmaceutical and biotech companies. The biopharma giants are increasingly outsourcing their bioprocessing activities, including the production, storage, and transportation of biologics, to third-party service providers. Bioprocessing bags are an essential component of biologics manufacturing, and their demand is expected to grow as more companies outsource their bioprocessing activities. For instance, in July 2021, Pall Corporation announced a contract with Exothera S.A. that is valued at more than $7 million. This new agreement is intended to create a suspension-based manufacturing platform capable of producing up to 2000L of product. The platform will utilize a range of technologies including Allegro STR single-use bioreactors to produce various viral vectors used in gene therapies and viral vector-based vaccines.

Type Insights

The 2D bioprocess bags held the highest market share of over 46.28% in 2024. This is due to the increasing demand for biopharmaceuticals and cell therapies. As the prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders continues to rise, there is a growing need for innovative and effective treatments. Biopharmaceuticals offer a promising solution, and the use of 2D bioprocess bags can help to streamline the manufacturing process and reduce costs. The 2D bioprocess bags market is also driven by technological advancements in bag design and materials. Manufacturers are developing bags with improved strength, durability, and resistance to punctures and leaks. In addition, there is a growing trend towards customization and scalability, with bags designed to meet specific requirements of different bioprocessing applications.

The 3D bioprocess bags segment is anticipated to grow at the fastest CAGR during the forecast period. They are commonly used in the production and storage of biologics, such as monoclonal antibodies, vaccines, and cell-based therapies. They provide a closed and sterile environment for cell culture, reducing the risk of contamination and ensuring the quality and consistency of the end product.The growing demand for regenerative medicine and increasing government funding for regenerative medicine is driving the growth of the industry. For instance, in 2021, The Regenerative Medicine Innovation Project (RMIP) was introduced in collaboration between the US National Institutes of Health (NIH) and the Food and Drug Administration (FDA) to support the development of safe and effective regenerative medicine products. The project aims to provide guidance to researchers and industry on best practices, develop new tools and standards for evaluating regenerative medicine products, and ensure that these products are developed with rigor to protect patient safety.

Workflow Insights

The upstream process segment held the highest market share of 43.76% in 2024. Bioprocessing bags are widely used in upstream processes for cell culture, media preparation, and fermentation. These bags provide a sterile and controlled environment for cell growth and are designed to optimize cell growth and productivity. They are available in various sizes and configurations, allowing for flexibility and scalability in upstream processes. The demand for bioprocessing bags in upstream processes is driven by several factors, including the increasing demand for biopharmaceuticals and vaccines, the shift towards single-use technologies, and the benefits of using disposable bags in terms of cost, efficiency, and risk reduction.

The downstream process is anticipated to register fastest CAGR during the forecast period. Bioprocess bags are widely used in the downstream process for storing and transporting the product during various stages of purification. They offer several advantages over traditional stainless steel vessels, including lower risk of contamination, reduced cleaning and validation requirements, and faster turnaround times. For instance, Sartorius AG offers Flexsafe bags, which are made from high-quality materials and are available in various sizes, ranging from 50 mL to 1,000 L. The bags are designed to be used with Sartorius' Flexboy and Flexboy Advance disposable bioreactors, providing a complete single-use solution for downstream bioprocessing.

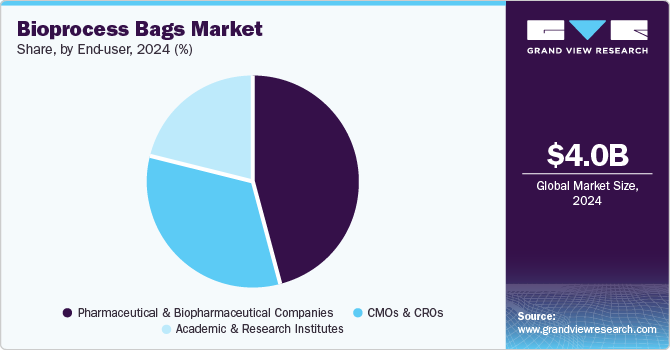

End User Insights

The pharmaceutical & biopharmaceutical companies segment held the highest market share of 45.98% in 2024. The strategic activities adopted key market such as expansion, new product launch, merger & acquisition, and collaboration offer lucrative opportunities. For instance, in February 2021, Saint-Gobain announced launch of highly efficient cell culture bags for T-cell expansion. These new cell culture bags are designed to provide a sterile and controlled environment for the growth and expansion of T-cells, which are an essential component of the immune system and are used in cell-based therapies for the treatment of various diseases.

The CMOs & CROs segment is anticipated to register fastest CAGR over the forecast period. The adoption of contract services is being fueled by several benefits offered by CROs and CMOs, including scalability, flexibility, reduced internal infrastructure requirements, and dedicated supply channels. As a result, these advantages are expected to have a positive impact on the growth of the industry in the coming years. Also, the outsourcing of bioprocessing activities allows companies to focus on their core competencies, reduce costs, and improve efficiency. This trend has led to an increase in the number of CMOs and CROs, which, in turn, is expected to drive the growth of the market.

Regional Insights

North America bioprocess bags market dominated the global market with a share of 35.65% in 2024. The increasing demand for biopharmaceuticals is expected to drive the growth of the bioprocess bags market in the region. Other factors that are expected to contribute to the growth of the bioprocess bags market in North America include the increasing adoption of single-use bioprocessing technologies and the growing focus on reducing the high costs associated with bioprocessing of advanced therapies. In addition, the presence of major biopharmaceutical companies and contract manufacturing organizations (CMOs) in North America is expected to drive the growth of the bioprocess bags market in the region. These companies require high-quality bioprocess bags for their operations.

U.S. Bioprocess Bags Market Trends

Strong investment in biopharmaceutical R&D and cell and gene therapy production is propelling demand for single-use bioprocess bags. The FDA’s proactive stance on advanced biologics manufacturing also supports the market's growth, with increased focus on modular, cost-effective manufacturing solutions.

Europe Bioprocess Bags Market Trends

The European bioprocess bags market benefits from widespread adoption of single-use technologies in biopharma facilities, particularly to meet environmental sustainability goals. The region’s emphasis on reducing carbon footprints and regulatory compliance in waste disposal further drives this shift toward single-use systems.

The UK’s vibrant biotech ecosystem, bolstered by government funding and initiatives like the Life Sciences Vision, emphasizes modular production techniques. This, alongside the focus on domestic biologics production due to Brexit, is enhancing the adoption of bioprocess bags.

France’s strong government support for the pharmaceutical sector, combined with increasing adoption of single-use bioprocessing to optimize production costs, is driving market demand. The country is focusing on strengthening its biologics and vaccine production capabilities, boosting the need for bioprocess bags.

Germany's highly developed biotech and pharmaceutical sector, which prioritizes efficient manufacturing processes, is spurring the demand for single-use bioprocess bags. Government incentives for innovation and environmental sustainability in production methods are further fostering market growth.

Asia Pacific Bioprocess Bags Market Trends

The Asia Pacific bioprocess bags market is estimated to be the fastest-growing region with CAGR due to the growing population, with increasing healthcare needs. As a result, there is a growing demand for biopharmaceuticals in the region, which is driving the growth of the bioprocess bags market. Another factor driving the growth of the bioprocess bags market in the Asia Pacific region is the increasing investment in the biopharmaceutical industry. Governments and private investors in countries like China, Japan, and South Korea are investing heavily in the biopharmaceutical industry, which is expected to drive the demand for bioprocess bags.

The China bioprocess bags market is expanding due to substantial investments in biopharma manufacturing and the local government’s support of biotech innovation. Demand is also fueled by the rapid scaling of biosimilars and biologics production to cater to domestic and global markets.

Japan bioprocess bags market is driven by technological advancements in the biotech sector and the country's push toward local biopharmaceutical production. In addition, Japan’s focus on efficient, cost-saving manufacturing practices is increasing the adoption of single-use systems.

MEA Bioprocess Bags Market Trends

Growth in the bioprocess bags market is supported by the expansion of pharmaceutical manufacturing in the region, with increased investment from global biotech companies establishing operations. A focus on healthcare infrastructure development is further propelling market interest.

Saudi Arabia’s Vision 2030 plan, aimed at diversifying the economy and boosting local pharmaceutical production, is driving demand for bioprocess bags. The country’s focus on improving healthcare standards and supporting local biotech manufacturing has spurred market growth.

In Kuwait, the demand for bioprocess bags is rising due to increased government investment in healthcare and efforts to develop local biopharma capabilities. The shift toward enhancing pharmaceutical production capabilities is expected to fuel bioprocess bag adoption in the coming years.

Key Bioprocess Bags Company Insights

The market for Bioprocess Bags is highly competitive with the presence of well-established as well as small and mid-sized emerging players. A prominent number of players are rapidly opting for geographical expansion, strategic collaborations, and partnerships through mergers and acquisitions in emerging and economically favorable regions.

Key Bioprocess Bags Companies:

The following are the leading companies in the bioprocess bags market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- Saint-Gobain

- Corning Incorporated

- Entegris

- Meissner Filtration Products, Inc.

- PROAnalytics, LLC

- CellBios Healthcare And Lifesciences Pvt Ltd.

Recent Development

-

In March 2023, Sartorius AG acquired France-based Polyplus for around USD 26.2 billion. This deal helps company expand its product portfolio in the market.

-

In August 2022, Thermo Fisher Scientific Inc opened its largest single use technology production facility in Greater Nashville, at USD 150 m. The Lebanon, Tennessee plant is the largest manufacturing facilities of company’s biologics production network.

-

In April 2022, Thermo Fischer Scientific, Inc. has announced the opening of a new manufacturing facility in Ogden, Utah, that will manufacture materials and technology needed for the development of new vaccines and therapies. This investment will enable the company to meet the increasing demand for single-use technology and contribute to the development of innovative therapies and vaccines. The facility is state-of-the-art and valued at USD 44 million.

Bioprocess Bags Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.78 billion

Revenue forecast in 2030

USD 10.21 billion

Growth rate

CAGR of 16.40% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, workflow, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG, Danaher Corporation; Merck KGaA; Saint-Gobain; Corning Incorporated; Entegris; Meissner Filtration Products, Inc.; PROAnalytics, LLC; CellBios Healthcare & Lifesciences Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Bioprocess Bags Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the bioprocess bags market based on type, workflow, end user, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Bioprocess Bags

-

3D Bioprocess Bags

-

Other Bags & Accessories

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Process

-

Downstream Process

-

Process Development

-

-

End user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

CMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioprocess bags market size was estimated at USD 4.03 billion in 2024 and is expected to reach USD 10.21 billion in 2025.

b. The global bioprocess bags market is expected to grow at a compound annual growth rate of 16.40% from 2025 to 2030 to reach USD 10.21 billion by 2030.

b. The upstream process segment held the largest share of 43.75% in 2024. Bioprocessing bags are widely used in upstream processes for cell culture, media preparation, and fermentation.

b. Some key players operating in the bioprocess bags market include Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, Saint-Gobain, Corning Incorporated, Entegris, Meissner Filtration Products, Inc., PROAnalytics, LLC, CellBios Healthcare And Lifesciences Pvt Ltd.

b. The market is being driven by several factors such as, the growing demand for biopharmaceuticals, including monoclonal antibodies and vaccines, advancements in bioprocess technology, such as single-use systems and disposable bioprocess bags, and the increasing adoption of modular manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.