- Home

- »

- Pharmaceuticals

- »

-

Biopharmaceutical Excipients Market, Industry Report, 2033GVR Report cover

![Biopharmaceutical Excipients Market Size, Share & Trends Report]()

Biopharmaceutical Excipients Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Solubilizes & Surfactants/ Emulsifiers), By Material, By Dosage Form, By Therapeutic Modality, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-006-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopharmaceutical Excipients Market Summary

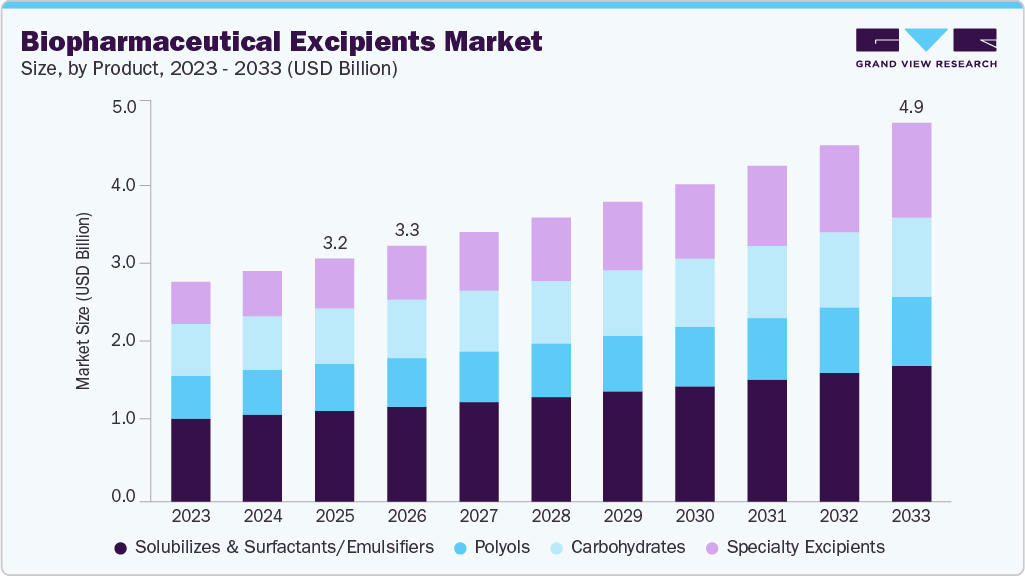

The global biopharmaceutical excipients market size was estimated at USD 3.18 billion in 2025 and is projected to reach USD 4.97 billion by 2033, growing at a CAGR of 5.79% from 2026 to 2033. The industry is growing due to the rapid expansion of biologic drugs such as monoclonal antibodies, vaccines, recombinant proteins, and gene and cell therapies.

Key Market Trends & Insights

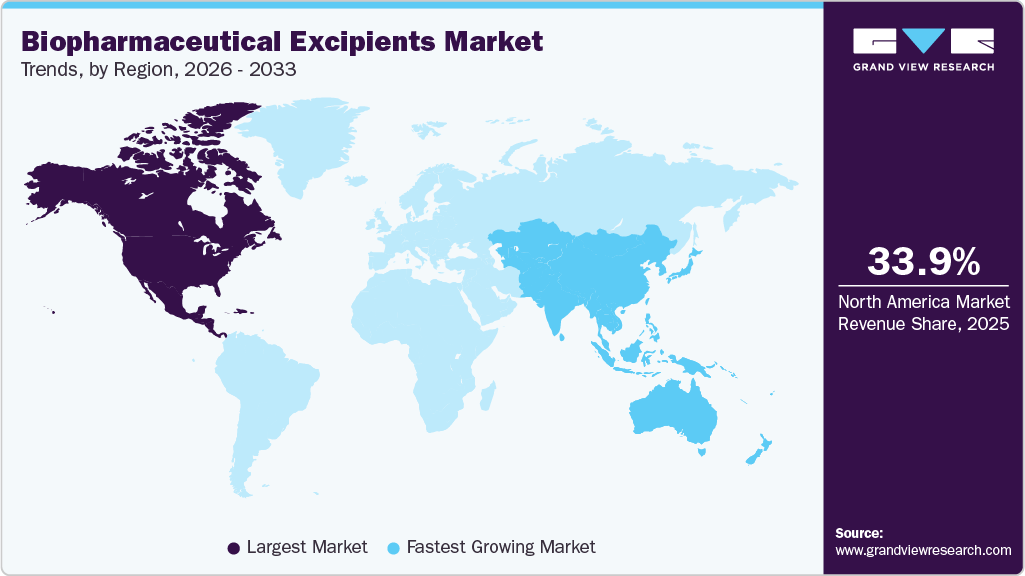

- The North America biopharmaceutical excipients market held the largest share of 33.96% of the global market in 2025.

- The biopharmaceutical excipients industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the solubilizes & surfactants/emulsifiers segment held the largest market share of 37.25% in 2025.

- By material, the sugars & polyols segment held the largest market share in 2025.

- By dosage form, the parenteral (liquid injectables) segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.18 Billion

- 2033 Projected Market Size: USD 4.97 Billion

- CAGR (2026-2033): 5.79%

- North America: Largest market in 2025 Asia Pacific: Fastest growing market

These complex molecules require high-quality excipients to ensure stability, safety, and effective drug delivery. Increasing investments in biopharmaceutical research and development, along with a strong pipeline of biologics and biosimilars, are significantly boosting demand. Advances in formulation technologies, including injectable, sustained release, and nanoparticle-based systems, further support market growth. In addition, the rising prevalence of chronic and rare diseases is increasing reliance on biologic therapies. Strict regulatory requirements for product quality and purity are also driving the adoption of specialized, high-performance excipients across global biopharmaceutical manufacturing.

Rapid growth in biopharmaceutical therapeutics, particularly monoclonal antibodies, vaccines, biosimilars, and cell/gene therapies, directly propels the biopharmaceutical excipients market by necessitating advanced stabilizers, buffers, and surfactants to address the inherent instability of these complex biologics. Proteins and viral vectors are prone to aggregation, denaturation, and loss of efficacy during manufacturing, storage, and delivery, making excipients essential for maintaining higher-order structure, solubility, and bioavailability. This demand boost as pipelines expand, with each new therapeutic requiring tailored formulations, such as sugars for cryoprotection, amino acids for viscosity control, and polymers for targeted delivery, that go beyond inert fillers to enable scalable production and clinical success.

The surge in approvals underscores this linkage: in 2024, the FDA greenlit around eight to nine cell and gene therapies, including CAR-T products like lifileucel (Amtagvi) for melanoma and Casgevy for sickle cell disease, each demanding specialized excipients for vector stability, freeze-thaw resilience, and transduction efficiency. Similarly, monoclonal antibodies and biosimilars continue to dominate new approvals, with formulations relying on surfactants to mitigate interfacial stress and polyols to ensure long-term shelf life, thereby amplifying recurring needs in parenteral and cold-chain logistics. These instances highlight how biologic complexity drives innovation in excipient science, from high-concentration injectables to nanoparticle systems.

The biopharmaceutical industry has significantly increased R&D spending on advanced therapeutic classes, including monoclonal antibodies, mRNA vaccines, gene therapies, and cell therapies, with a growing emphasis on formulation science at early development stages. As biologics become more complex and delivery-dependent, demand is increasing for specialized excipients that can stabilize sensitive molecules and facilitate targeted, efficient delivery. In 2025, this trend was characterized by Mount Sinai researchers developing a “smarter” mRNA therapy designed to activate only in specific target cells, highlighting the industry’s shift toward precision mRNA platforms. Such innovations inherently rely on advanced formulation systems, particularly optimized lipid and polymer excipients, to protect mRNA, control release, and ensure cellular uptake. Alongside this, biotech companies advancing next-generation mRNA vaccines and therapeutic mRNA programs are investing heavily in formulation platforms that go beyond first-generation lipid nanoparticles used during the COVID-19 era. Collectively, these R&D investments are accelerating the development and adoption of high-performance excipients tailored to emerging biopharmaceutical modalities, thereby driving growth in the global market.

Similarly, innovations such as those in June 2025, Ashland’s expanded Viatel bioresorbable polymers demonstrate how specialized excipient technologies are evolving to meet the formulation and delivery challenges posed by modern biologics, including long-acting injectables and advanced mRNA therapies. This expansion highlights the increasing R&D and commercial focus on high-performance excipient platforms that enhance stability, control release, and enable new delivery modalities, thereby further driving growth in the industry.

Market Concentration & Characteristics

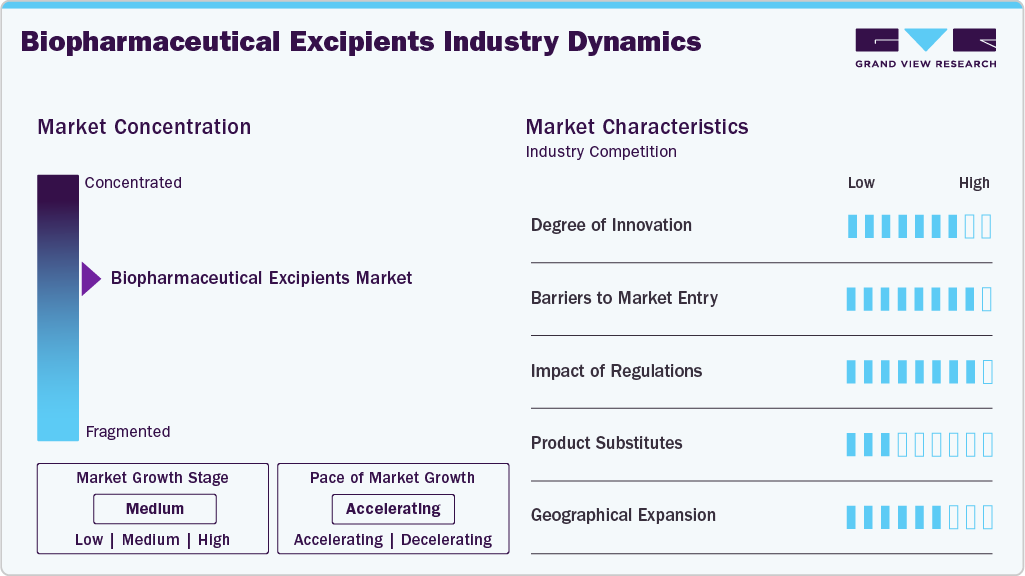

The biopharmaceutical excipients industry shows a high degree of innovation, driven by the evolving needs of advanced treatments such as monoclonal antibodies, vaccines, and cell and gene therapies. Innovation focuses on developing excipients that enhance stability, solubility, and bioavailability, while supporting complex dosage forms such as injectables and lyophilized products. Co-processed and novel excipients are increasingly adopted to manage multiple formulation challenges simultaneously. Continuous improvements are also aimed at reducing degradation, aggregation, and immunogenicity risks. Overall, innovation is closely aligned with improving therapeutic efficacy and patient safety.

Barriers to entry in the market are relatively high due to stringent quality requirements for treatment-related applications. New entrants must demonstrate consistent purity, functionality, and compatibility with sensitive biologic drugs. Extensive validation, toxicological studies, and long development timelines increase costs. Strong relationships between excipient suppliers and biopharmaceutical manufacturers further limit entry into the market. These factors favor established players with proven regulatory and manufacturing capabilities.

Regulations have a significant impact on the market for biopharmaceutical excipients, particularly for treatments administered via parenteral routes. Regulatory agencies require detailed documentation on the safety, source, manufacturing process, and performance of excipients in biologic formulations. Changes in excipient composition often trigger additional regulatory reviews, slowing adoption. Compliance with global pharmacopeial standards is essential for market participation. As a result, regulatory rigor reinforces demand for high-quality, well-characterized excipients.

Product substitution is limited, especially for treatment-focused biologics. Many excipients are formulation-specific and cannot be easily replaced without affecting stability or efficacy. Substituting excipients in approved biologic therapies can require reformulation and regulatory reassessment. This reduces flexibility compared to small-molecule formulations. Consequently, once an excipient is qualified for a treatment, switching costs remain high.

Geographical expansion in the industry is closely tied to the growth of biologic treatments across regions. North America and Europe remain dominant due to strong biologics pipelines and established regulatory frameworks. The Asia Pacific is emerging rapidly as manufacturing capacity and access to biologic treatments expand. Localization of excipient production supports supply chain reliability for critical therapies. This expansion reflects the global rise in demand for advanced biopharmaceutical treatments.

Product Insights

The solubilizes & surfactants/emulsifiers segment dominated the market with the largest revenue share of 37.25% in 2025, driven by their critical role in maintaining the stability and performance of complex biopharmaceutical formulations. In an October 2025 industry analysis, polysorbate surfactants, particularly polysorbate 20 and polysorbate 80, were identified as indispensable components in protein therapeutic formulations. These non-ionic surfactants are widely used to stabilize biologics, including monoclonal antibodies, by adsorbing to air-liquid and solid-liquid interfaces during manufacturing, storage, and delivery. This protective mechanism helps prevent protein aggregation, denaturation, particle formation, and loss of potency. However, the analysis also emphasized that polysorbates are susceptible to degradation through oxidation and hydrolysis, making effective control and monitoring essential to ensure long-term product stability and therapeutic efficacy.

The specialty excipients segment is projected to grow at the fastest CAGR of 8.47% over the forecast period, fueled by the increasing complexity of advanced biologics and the need for formulation-specific solutions. Specialty excipients represent a high-value class of excipients engineered to enhance the stability, solubility, and bioavailability of biologic drugs that do not conform to conventional formulation approaches. This category includes co-processed systems and novel stabilizers designed to address challenges such as molecular instability and degradation. According to a 2024 review published in the European Journal of Pharmaceutics and Biopharmaceutics, co-processed excipients, which integrate multiple functional components into a single system, demonstrated superior performance compared to traditional excipients. The review highlighted improved stabilization, enhanced solubility, and stronger protection against degradation in complex biologics, including gene therapies and monoclonal antibodies.

Material Insights

The sugars & polyols segment dominated the market, with the largest revenue share of 35.91% in 2025, due to the rapid expansion of biologics such as monoclonal antibodies, recombinant proteins, vaccines, and peptides. These complex and sensitive molecules are prone to instability during manufacturing, storage, and transportation. Sucrose, trehalose, and mannitol are widely used excipients to maintain structural integrity by reducing protein unfolding, aggregation, and degradation, directly linking their demand to the scale-up of biologics production. For instance, in January 2024, Elsevier published a review in the European Journal of Pharmaceutical Sciences that reported hydration numbers for trehalose ranging from approximately 8.0 to 12.1 compared to sucrose, which ranged from approximately 6.3 to 11.2. It highlighted differences in water interaction and protein stabilization behavior that are critical for biopharmaceutical excipient selection, and noted that trehalose absorbed about 8% (w/w) water after freezing equilibrium, while sucrose absorbed about 4% (w/w), reinforcing why these sugars are preferred stabilizers in biologic formulations, while mannitol was recognized as a widely used polyol excipient alongside these sugars.

The specialty co-processed excipients / novel excipients segment is projected to grow at a CAGR of 8.00% over the forecast period, owing to the increasing limitations of conventional excipient systems in addressing the complex stability challenges of modern biologics. Many advanced biologic drugs exhibit multiple instability mechanisms simultaneously, including sensitivity to shear stress, interfacial exposure, temperature fluctuations, and concentration-related stress. Managing these risks using multiple single-function excipients increases formulation complexity and development risk. Specialty co-processed excipients are engineered to provide integrated functionality within a single system, enabling formulators to address several stability concerns at once while improving efficiency and robustness. For instance, in February 2024, Elsevier B.V., on behalf of KeAi Communications Co. Ltd., published a review titled Co Processed Excipients: Advances and Future Trends, which highlighted enhanced functionality and performance of specialty co-processed excipients. The review reported that liposomal systems ranged from 50 to 1000 nanometers in size, and systems such as Cop AA MCC combined two natural excipients to achieve acceptable bulk density, good flow, and high compatibility, supporting direct compression processes.

Dosage Form Insights

The parenteral (liquid injectables) segment dominated the market with the largest revenue share of 60.43% in 2025, due to its critical role in the administration of biologics such as monoclonal antibodies, vaccines, and gene therapies that require direct delivery into the bloodstream for rapid and controlled therapeutic effect. These formulations are commonly offered as ready-to-use solutions or suspensions, supporting accurate dosing and ease of administration. Growth in this segment is further driven by the rising demand for biologic drugs that rely on advanced excipient systems to maintain stability, solubility, and bioavailability. Key excipients include surfactants, stabilizers, tonicity adjusters, and buffering agents. According to a September 2025 review on protein formulation strategies, polysorbate 80 was identified as a widely used non-ionic surfactant for reducing interfacial stress and protein aggregation, while sugars and polyols such as sucrose, trehalose, mannitol, and glycerol were highlighted for improving stability and physiological compatibility in injectable biologics.

The lyophilized (freeze-dried) segment is projected to grow at a CAGR of 4.85% over the forecast period due to the increasing use of freeze-dried formulations for biologic products such as monoclonal antibodies, vaccines, and gene therapies that require enhanced stability. These products are supplied as solid dosage forms that are reconstituted prior to administration, offering improved shelf life and reduced degradation by eliminating water while preserving the structural integrity of active pharmaceutical ingredients. According to a 2025 review on lyophilization technology for injectable pharmaceuticals, lyophilization was described as a low-temperature dehydration process that removes water through sublimation, enabling retention of product quality and extending the shelf life of high-value biologics. This approach also supports easier storage, transportation, and reliable reconstitution, further driving adoption across biopharmaceutical formulations.

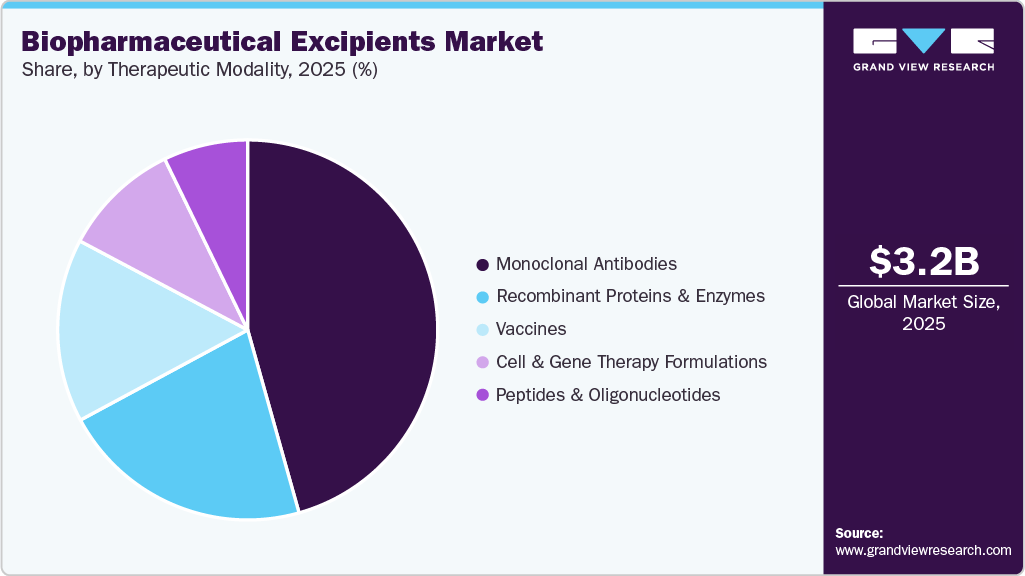

Therapeutic Modality Insights

The monoclonal antibodies segment dominated the market with the largest revenue share of 45.64% in 2025, due to their widespread clinical adoption across multiple therapeutic areas and the increasing complexity of their formulations. This trend was reinforced by formulation research and evolving regulatory approvals. For instance, in August 2025, Biophysical Reviews, published by Springer Nature, examined high-concentration monoclonal antibody formulations for subcutaneous administration and highlighted their growing impact on excipient demand. The article reported that, as of 2023, the U.S. Food and Drug Administration had approved 168 monoclonal antibodies, with approximately 43 percent indicated for oncology, about 23 percent for immunologic disorders, nearly 9 percent for neurologic diseases, and around 5 percent each for hematology and respiratory conditions. Infectious diseases, ophthalmology, and gastroenterology each accounted for roughly 3.5 to 4 percent, while cardiology and endocrinology represented about 2 percent each. The review further noted that nearly 60 percent of approved monoclonal antibodies were dosed at 200 mg or higher per administration, 54 percent were manufactured below 50 mg/mL, and high-concentration formulations, defined as 100 to 200 mg/mL injectables, included 45 marketed products, underscoring rising formulation complexity and excipient intensity.

The cell & gene therapy formulations segment is projected to grow at the fastest CAGR of 9.18% over the forecast period due to the transition from small-scale, patient-specific treatments to standardized and repeatable commercial products, which has directly expanded demand within the biopharmaceutical excipients market. Early development programs relied on bespoke formulations, whereas commercialization has required robust and reproducible excipient systems to ensure batch-to-batch consistency and regulatory compliance. Viral vectors and cell-based products are highly sensitive to formulation conditions, positioning excipients as integral elements of process design rather than late-stage additives. For instance, in September 2025, the Social Science Research Network published a study on systematic formulation optimization that evaluated up to 20 excipients across six categories. The study reported adeno-associated virus concentrations above 1×10¹³ viral genomes per mL, melting temperatures above 70 °C, ultrafiltration and diafiltration recovery exceeding 90 percent, and retention of 60 percent infectivity and 87 percent viral particle concentration at 40 °C, underscoring the commercial importance of advanced excipient systems.

Regional Insights

The North America biopharmaceutical excipients marketheld the largest market share of 33.96% in 2025 due to the strong concentration of biologic drug developers and contract manufacturing organizations. The high adoption of monoclonal antibodies, vaccines, and advanced injectable therapies has fueled the demand for excipients. Manufacturers in the region are focusing on high-purity excipients for parenteral and lyophilized formulations. Mature regulatory standards have increased reliance on well-characterized excipient systems. Continuous pipeline activity in biologics has supported steady consumption volumes. Strong integration between formulation development and commercial manufacturing has reinforced market leadership.

U.S. Biopharmaceutical Excipients Market Trends

The U.S. biopharmaceutical excipients industry held the largest share in North America due to extensive biologics approvals and commercialization activity. High usage of injectable biologics increased demand for surfactants, buffers, and stabilizers. Complex high-concentration formulations raised excipient intensity per dose. The large-scale manufacturing of monoclonal antibodies and gene therapies has supported sustained consumption. The strong presence of innovator and biosimilar manufacturers will continue to strengthen supplier partnerships, as continuous product lifecycle extensions maintain long-term excipient demand.

Europe Biopharmaceutical Excipients Market Trends

The biopharmaceutical excipients industry in Europe has shown stable growth driven by strong biologics development across therapeutic areas. Increasing production of biosimilars has boosted the demand for formulation-consistent excipients. Regional manufacturers have emphasized the importance of quality compliance and pharmacopeial alignment. Injectable and freeze-dried dosage forms dominated excipient usage. Moreover, innovation in co-processed excipients supported advanced biologic formulations. Cross-border manufacturing activities continue to enhance regional market integration.

The UK biopharmaceutical excipients industry has benefited from a strong focus on biologics research and formulation development. Demand has remained high for excipients supporting parenteral and high-value injectable drugs. Growth in specialty biologics has increased reliance on stabilizers and surfactants. Contract development and manufacturing activities will continue to strengthen excipient sourcing requirements. In addition, emphasis on formulation robustness has supported the adoption of novel excipient systems. Long-term biologics pipelines sustained steady market expansion.

The biopharmaceutical excipients industry in Germany is growing due to its strong pharmaceutical manufacturing base. High production volumes of biologics and biosimilars have increased excipient consumption. Besides, precision-driven formulation development is supporting the demand for specialty excipients. Focus on injectable and lyophilized biologics has driven the use of buffers and cryoprotectants. Advanced manufacturing infrastructure has ensured consistent quality requirements as strong export activity supports large-scale excipient utilization.

The France biopharmaceutical excipients industry grew steadily with rising biologics production capacity. The increasing development of vaccines and therapeutic proteins supported excipient demand. An emphasis on formulation stability is driving the use of surfactants and sugars. Domestic biologics manufacturing has increased localized sourcing of excipients. Furthermore, complex dosage forms have required higher functional excipient content. Long-term investments in biopharmaceutical production are expected to fuel growth.

Asia Pacific Biopharmaceutical Excipients Market Trends

The biopharmaceutical excipients industry in the Asia Pacific is expected to register the fastest CAGR of 6.53% over the forecast period, driven by the rapid expansion of biologics manufacturing. Growing adoption of monoclonal antibodies and vaccines has increased excipient volumes. Rising investment in formulation development is boosting the demand for specialty excipients. Expansion of contract manufacturing has fueled large-scale excipient procurement. The increasing focus on injectable and freeze-dried products is expected to support functional excipient usage. In addition, cost-efficient manufacturing has attracted global biologics production.

The Japan biopharmaceutical excipients industry has advanced through strong adoption of high-quality biologics. Emphasis on formulation precision is increasing the demand for stabilizers and buffering agents. Injectable biologics have dominated therapeutic usage patterns. High standards for product consistency continue to support reliance on proven excipient systems. Growth in specialty biologics has increased the performance requirements for excipients. Stable domestic production has ensured consistent market demand.

The biopharmaceutical excipients industry in China has expanded rapidly with increasing biologics manufacturing capacity. The large-scale production of therapeutic proteins and vaccines has increased excipient demand. The focus on biosimilars is accelerating the formulation of new drugs. China has also witnessed injectable dosage forms driving the consumption of surfactants and tonicity adjusters. The scaling of commercial manufacturing has increased standardized excipient usage. Strong export orientation supported continuous volume growth.

Latin America Biopharmaceutical Excipients Market Trends

The biopharmaceutical excipients industry in Latin America has shown moderate growth supported by expanding biologics access. The increasing use of injectable therapies has raised excipient consumption as market development remained gradual and structured. Local manufacturing of biosimilars is bolstering the demand for formulation excipients. The stability-focused excipients have gained importance in regional supply chains. Growth in hospital-administered biologics is expected to support parenteral excipient usage.

The Brazil biopharmaceutical excipients industry has benefited from rising domestic biologics production. Demand for excipients has increased across injectable and vaccine formulations. The expansion of biosimilar manufacturing is supporting formulation consistency needs. The parenteral dosage forms have dominated excipient utilization. Increasing clinical adoption of biologics and local manufacturing activity have supported steady growth.

Middle East & Africa Biopharmaceutical Excipients Market Trends

The biopharmaceutical excipients industry in the Middle East and Africa has expanded robustly, driven by increasing adoption of biologic treatments. Injectable therapies have formed the core of excipient demand. Regional manufacturing initiatives are supporting localized excipient usage. The focus on stability and shelf life has increased demand for robust excipient systems, and import reliance has supported consistent consumption of high-quality excipients.

The Saudi Arabia biopharmaceutical excipients industry has grown with the rising utilization of biologic therapies. In addition, an increased demand for injectable treatments is supporting excipient consumption. A focus on local pharmaceutical manufacturing has strengthened formulation requirements. High-quality excipients have gained importance for parenteral stability, and the expansion of healthcare services has increased biologic drug usage. Moreover, long-term development plans have supported gradual market growth.Key Biopharmaceutical Excipients Company Insights

Merck KGaA and BASF SE continue to strengthen their positions in market through broad portfolios of high-purity excipients used in biologics, injectables, and advanced drug delivery systems. Roquette Frères, Evonik Industries AG, and Clariant focus on specialty and functional excipients that support stability, solubility, and controlled release in complex biologic formulations. Colorcon, DFE Pharma, and J. RETTENMAIER & SÖHNE GmbH + Co KG emphasize formulation performance and compliance for parenteral and solid dosage biologics. IMCD, along with Signet Excipients Pvt. Ltd and Associated British Foods plc expand market reach through distribution networks and customized excipient solutions. Sigachi Industries Limited and Spectrum Chemical Manufacturing Corp. contribute through pharmaceutical-grade excipients supporting biologics manufacturing. The market remains competitive, driven by formulation complexity, rising biologics production, and long-term supplier partnerships.

Key Biopharmaceutical Excipients Companies:

The following are the leading companies in the biopharmaceutical excipients market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Colorcon

- BASF SE

- Associated British Foods plc

- Signet Excipients Pvt. Ltd (IMCD)

- Sigachi Industries Limited

- Spectrum Chemical Manufacturing Corp.

- Roquette Frères

- IMCD

- Clariant

- DFE Pharma

- J. RETTENMAIER & SÖHNE GmbH + Co KG

- Evonik Industries AG

Recent Developments

-

In October 2025, Evonik’s EUDRACAP was expanded with a new series of colon functional capsules. These capsules are designed to improve biopharmaceutical formulations by providing targeted release and pH‑dependent functionality. The new range allows for improved drug bioavailability, especially for drugs requiring localized release in the colon. This product innovation further positions Evonik as a leader in functional excipients tailored to the needs of the biopharma sector.

-

In June 2025, BASF opened a GMP Solution Center in Wyandotte, Michigan, dedicated to producing high-quality excipients that support biopharmaceutical manufacturing. This expansion enhances BASF's ability to serve the biopharma industry by providing excipient solutions that meet rigorous regulatory requirements for biologic formulations. The center is key to developing next-gen excipients for injectables and other sensitive therapies, positioning BASF to support growing market demands for biologic drugs.

-

In May 2023, Roquette introduced PEARLITOL ProTec, a plant-based excipient solution for the biopharmaceutical market, designed to enhance the stability of active ingredients that are sensitive to moisture. This excipient is particularly useful in injectable biologics and mRNA vaccines, offering improved shelf life and performance in extreme conditions. The new line strengthens Roquette's position in biologic excipient solutions.

Biopharmaceutical Excipients Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.35 billion

Revenue forecast in 2033

USD 4.97 billion

Growth rate

CAGR of 5.79% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, material, dosage form, therapeutic modality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Merck KGaA; Colorcon; BASF SE; Associated British Foods plc; Signet Excipients Pvt. Ltd (IMCD); Sigachi Industries Limited; Spectrum Chemical Manufacturing Corp.; Roquette Frères; IMCD; Clariant; DFE Pharma; J. RETTENMAIER & SÖHNE GmbH + Co KG; Evonik Industries AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopharmaceutical Excipients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biopharmaceutical excipients market report based on product, material, dosage form, therapeutic modality, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Solubilizes & Surfactants/Emulsifiers

-

Triglycerides

-

Esters

-

Others

-

-

Polyols

-

Mannitol

-

Sorbitol

-

Others

-

-

Carbohydrates

-

Sucrose

-

Dextrose

-

Starch

-

Others

-

-

Specialty Excipients

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Sugars & Polyols

-

Polymers

-

Amino Acids

-

Inorganic Salts & Buffers

-

Specialty Co-Processed Excipients / Novel Excipients

-

-

Dosage Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Parenteral (Liquid injectables)

-

Lyophilized (Freeze-dried)

-

Others

-

-

Therapeutic Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibodies

-

Recombinant Proteins & Enzymes

-

Vaccines

-

Cell & Gene Therapy Formulations

-

Peptides & Oligonucleotides

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biopharmaceutical excipients market size was estimated at USD 3.18 billion in 2025 and is expected to reach USD 3.35 billion in 2026.

b. The global biopharmaceutical excipients market is expected to grow at a compound annual growth rate of 5.79% from 2026 to 2033 to reach USD 4.97 billion by 2033.

b. Carbohydrates dominated the biopharmaceutical excipients market with a share of 23.00% in 2025. This is attributed to the wide use of sucrose, starch, and dextrose across drug formulations along with the rapid adoption of carbohydrates as bulking agents.

b. Some key players operating in the biopharmaceutical excipients market include Merck KGaA, Signet Chemical Corporation Pvt. Ltd., Sigachi Industries Pvt. Ltd., Associated British Foods, Spectrum Chemical Manufacturing Corp., Roquette Frères, IMCD, Clariant, DFE Pharma, Colorcon, J. RETTENMAIER & SÖHNE GmbH + Co KG, BASF SE, and Evonik Industries AG.

b. Key factors that are driving the biopharmaceutical excipients market growth include the advent of innovative excipients, an increase in the number of distribution agreements between vendors, and gradual expansion of the application of biopharmaceutical excipients to provide cutting-edge drug formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.