- Home

- »

- Plastics, Polymers & Resins

- »

-

Biopharma Plastic Market Size, Share, Industry Report, 2030GVR Report cover

![Biopharma Plastic Market Size, Share & Trends Report]()

Biopharma Plastic Market (2025 - 2030) Size, Share & Trends Analysis Report By Polymer Type (PE, PP, ABS, PET, PVC, PTFE, PC), By Application (Protective Wear, Containers, Bioreactor Bags, Syringes, Depth Filters), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-4

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopharma Plastic Market Size & Trends

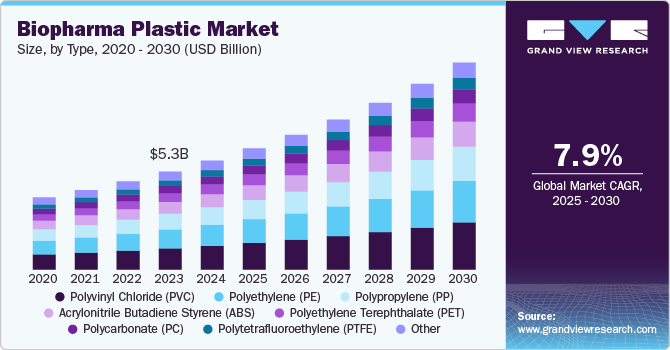

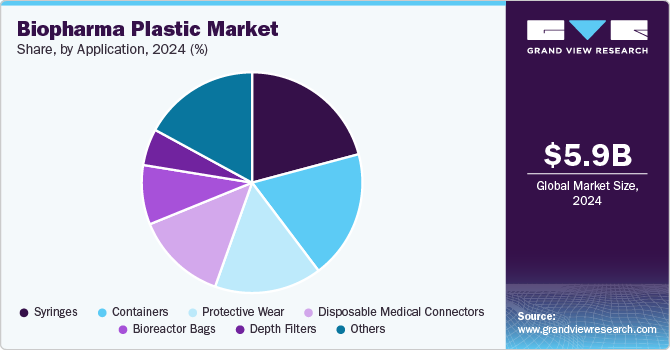

The global biopharma plastic market size was valued at USD 5,942.59 million in 2024 and expected to grow at a CAGR of 7.95% from 2025 to 2030. Factors such as the increase in global healthcare expenditure and increasing cases of cancer across the globe are expected to boost the market growth in the forecast period. Biopharma plastics are widely utilized in the manufacturing of various healthcare applications such as protective wear, containers, syringes, disposable connectors, and bioreactor bags owing to their properties including thermal stability, low chemical reactivity, and high resistivity. Hence, polymer types such as polyethylene (PE), polypropylene (PP), acrylonitrile butadiene styrene (ABS), polyvinyl chloride (PVC), and polytetrafluoroethylene (PTFE) have witnessed a rise in the demand from the biopharma industry.

The biopharma industry is increasingly adopting sustainable plastic in response to growing environmental concerns and stricter regulations. Biodegradable and recyclable are gaining traction as companies seek to reduce their carbon footprint and align with global sustainability goals. Advances in material sciences have enabled the development of high-barrier, eco-friendly that maintain the necessary sterility and durability for pharmaceutical applications. This trend is further supported by rising consumer and governmental pressure for green packaging solutions, making sustainability a key focus in product innovation.

Drivers, Opportunities & Restraints

The biopharma industry's need for flexible and efficient packaging solutions is driving the growth of plastic films. These offer critical properties like moisture resistance, high barrier protection, and transparency, which are essential for storing and transporting sensitive pharmaceutical products. The rapid expansion of biologics, personalized medicines, and temperature-sensitive vaccines has amplified this demand, as plastic are ideal for single-use applications, sterile packaging, and cold-chain logistics. Moreover, their lightweight nature and cost-effectiveness make them a preferred choice for manufacturers seeking efficient supply chain operations.

Emerging economies present significant growth opportunities for the biopharma plastic market due to increasing healthcare infrastructure investments and expanding pharmaceutical production. Countries like India, Brazil, and China are experiencing a surge in drug manufacturing and export activities, boosting the demand for high-quality packaging materials. Additionally, government initiatives to improve access to healthcare and local pharmaceutical production create a favorable environment for biopharma plastic films. Companies that invest in localized production facilities and cater to region-specific regulatory standards stand to gain a competitive advantage in these high-growth markets.

Strict regulatory requirements for pharmaceutical packaging are a key restraint in the biopharma plastic market. Ensuring compliance with standards such as the U.S. FDA, European Pharmacopoeia, and ISO increases the complexity and cost of production. Manufacturers must invest heavily in research, testing, and certification to meet stringent guidelines for safety, sterility, and chemical compatibility. Additionally, the evolving landscape of environmental regulations poses further challenges, as companies need to innovate rapidly to develop sustainable solutions without compromising performance. These factors can delay product launches and increase operational costs, particularly for smaller players.

Polymer Type Insights

Polyvinyl chloride (PVC) dominated the global market and accounted for over 21.50% share of the overall revenue in 2024. Polyvinyl chloride has the ability to undergo many processes without breaking or cracking, which accounts for its multiple uses in the market. It is extremely flexible, resistant, and can easily withstand high temperatures, making it suitable for the production of syringes, disposable connectors, depth filters, and other applications of biopharma plastics.

Biopharma plastic polymers are used to provide a smooth durable finish having high resistance to UV and chemical exposure. Biopharma plastic polymers are also impressive for their oxidation resistance capacity, water-repellency with simultaneous vapor permeability, and outstanding mechanical properties, thus ensuring that the end product is durable, sustainable, and economic. The hydrophobic nature of biopharma polymers has led to the increased usage of biopharma plastics in protective wear in the healthcare industry.

Factors such as suitable demographics for production, increasing health concerns, and growth in healthcare expenditure are expected to drive the market for biopharma plastics along with polymers. Moreover, the presence of large-scale PP molding facilities and the manufacturing sector is projected to propel the market growth over the forecast period. Other polymer types such as polyethylene and polytetrafluoroethylene are mainly used in various applications owing to their properties such as gloss, durability, and detergent resistance. The aforementioned factors are likely to boost market growth over the forecast period.

Application Insights

Syringes dominated the market and accounted for more than 20.85% share in terms of revenue in 2024. Growth in the demand for prefilled syringes owing to their usage convenience, low costs, minimal microbial contamination, low injection errors, and dilution errors is expected to boost the growth of the market.

Additionally, the surging adoption of advanced healthcare technologies, the growing production of large molecules, and the rising expenditure for the development of advanced healthcare facilities are fueling the growth. The growth of this segment can be attributed to the ease of usage and convenience offered by disposable biopharma plastic syringes.

The presence of well-developed healthcare infrastructures in different countries of the world is also fueling the demand for these devices. This, in turn, is expected to have a positive impact on the demand for biopharma plastics used for developing different medical devices. In addition, the increasing demand for prefilled syringes owing to their usage convenience, low costs, minimal microbial contamination, low injection errors, and dilution errors is anticipated to contribute to the growth of syringes segment of biopharma plastics market from 2022 to 2030.

Regional Insights

The growth of the biopharma plastic market in North America is driven by the region's advanced pharmaceutical infrastructure and strong focus on innovation. The increasing adoption of biologics, cell therapies, and gene therapies requires high-barrier, sterile, and flexible packaging solutions, creating significant demand for plastic films.

U.S. Biopharma Plastic Market Trends

In the U.S., the biopharma plastic market is propelled by the robust demand for innovative packaging solutions in response to the rapid expansion of biologics and specialty drugs. The nation's emphasis on cold-chain logistics, particularly for mRNA vaccines and temperature-sensitive pharmaceuticals, has elevated the need for plastic with superior barrier properties. Moreover, initiatives to promote localized pharmaceutical manufacturing, supported by government grants and incentives, are driving the adoption of advanced packaging materials. Rising awareness of sustainability and circular economy practices is also pushing companies toward eco-friendly plastic film solutions.

Asia Pacific Biopharma Plastic Market Trends

Asia Pacific biopharma plastic market dominated the global market and accounted for largest revenue share of 30.92% in 2024, which is attributable to the rising pharmaceutical production and increasing focus on improving healthcare access across emerging economies. Countries like India and Indonesia are experiencing a surge in demand for cost-effective and durable packaging materials due to growing generic drug manufacturing. The region's investment in cold-chain logistics, driven by vaccine distribution and biologics production, has amplified the need for specialized plastic with superior barrier properties. Additionally, partnerships between global and regional pharmaceutical companies are boosting innovation in packaging solutions tailored to meet local requirements.

In China, the rapid expansion of the pharmaceutical sector and significant government initiatives to boost domestic drug manufacturing are major drivers for the biopharma plastic market. The growing prevalence of chronic diseases and increased healthcare spending have accelerated the demand for advanced packaging solutions that ensure product stability and safety.

Europe Biopharma Plastic Market Trends

Europe’s biopharma plastic market is primarily driven by stringent regulatory requirements for pharmaceutical packaging and the region's leadership in sustainable practices. The European Medicines Agency (EMA) mandates high levels of product safety and quality, spurring demand for advanced with chemical resistance and sterility. The region’s strong focus on reducing plastic waste has encouraged the development of biodegradable and recyclable tailored for biopharmaceutical applications.

Key Biopharma Plastic Company Insights

The Biopharma Plastic Polymers market is highly competitive, with several key players dominating the landscape. Major companies BASF SE; LyondellBasell Industries Holdings B.V.; SABIC; LG Chem; Toray Industries, Inc.; Solvay; Dow, Inc.; DuPont de Nemours, Inc.; Saint-Gobain Performance Plastics; Tekni-Plex; Chevron Phillips Chemical Co., LLC; Exxon Mobil Corporation; Formosa Plastics Corporation; Covestro AG; TEIJIN LIMITED; Mitsui & Co. Plastics Ltd.; and INEOS Group; CHIMEI. The biopharma plastic polymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Biopharma Plastic Companies:

The following are the leading companies in the biopharma plastic market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- LyondellBasell Industries Holdings B.V.

- SABIC

- LG Chem

- Toray Industries, Inc.

- Solvay

- Dow, Inc.

- DuPont de Nemours, Inc.

- Saint-Gobain Performance Plastics

- Tekni-Plex

- Chevron Phillips Chemical Co., LLC

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Covestro AG

- TEIJIN LIMITED

- Mitsui & Co. Plastics Ltd.

- INEOS Group

- CHIMEI

Recent Developments

-

In July 2024, Thermo Fisher Scientific Inc., a biotech company, launched new biodegradable for its single-use bioproduction containers (BPCs) as part of its Aegis and CX product lines. These have received International Sustainability and Certification (ISCC Plus) accreditation and will be available to biopharmaceutical manufacturers starting in early 2025.

-

In February 2024, Green Elephant Biotech launched a new plant-based 96-well plate aimed at enhancing sustainability in laboratory settings. This product is made entirely from polylactic acid (PLA), which is derived from corn starch, and is designed to replace traditional single-use plastic plates that are made from fossil fuels.

Biopharma Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,607.53 million

Revenue forecast in 2030

USD 11,290.12 million

Growth rate

CAGR of 7.95% from 2025 to 2030

Historical data

2019 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S., Canada, Mexico, Germany, UK, France, Italy, China, India, Japan, Brazil, Argentina, GCC Countries, South Africa

Key companies profiled

BASF SE; LyondellBasell Industries Holdings B.V.; SABIC; LG Chem; Toray Industries, Inc.; Solvay; Dow, Inc.; DuPont de Nemours, Inc.; Saint-Gobain Performance Plastics; Tekni-Plex; Chevron Phillips Chemical Co., LLC; Exxon Mobil Corporation; Formosa Plastics Corporation; Covestro AG; TEIJIN LIMITED; Mitsui & Co. Plastics Ltd.; INEOS Group; CHIMEI

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopharma Plastic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented biopharma plastic market report on the basis of product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, Volume, Kilotons, 2019 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate (PET)

-

Polyvinyl Chloride (PVC)

-

Polytetrafluoroethylene (PTFE)

-

Polycarbonate (PC)

-

Other

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2019 - 2030)

-

Protective Wear

-

Containers

-

Bioreactor Bags

-

Syringes

-

Depth Filters

-

Disposable Medical Connectors

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biopharma plastic market size was estimated at USD 5,942.59 million in 2024 and is expected to reach USD 6,607.53 million in 2025.

b. The global biopharma plastic market is anticipated to propel at a growth rate of 7.95% from 2025 to 2030 to reach USD 11,290.12 million by 2030.

b. Polyvinyl chloride (PVC) dominated the global market and accounted for more than 22.53% share of the overall revenue in 2024. Polyvinyl chloride has the ability to undergo many processes without breaking or cracking, which accounts for its multiple uses in the market.

b. The key global players across the biopharma plastics market include BASF SE, SABIC, Dow, Inc., LyondellBasell Industries Holdings B.V., Solvay, DuPont de Nemours, Inc., LG Chem, Saint-Gobain Performance Plastics, Tekni-Plex, Toray Industries, Inc., Chevron Phillips Chemical Co., LLC, Exxon Mobil Corporation, Formosa Plastics Corporation, Covestro AG, TEIJIN LIMITED, Mitsui & Co. Plastics Ltd., INEOS GROUP, and CHIMEI

b. Rise in global healthcare expenditure and increasing cases of cancerous patients across the globe are anticipated to propel the demand for biopharmaceuticals, hence are expected to boost the demand for biopharma plastics during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.