- Home

- »

- Medical Devices

- »

-

Biologics Contract Manufacturing Market, Industry Report, 2030GVR Report cover

![Biologics Contract Manufacturing Market Size, Share & Trends Report]()

Biologics Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (MABs, Recombinant Protein), By Indication (Oncology, CVDs), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-921-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biologics Contract Manufacturing Market Summary

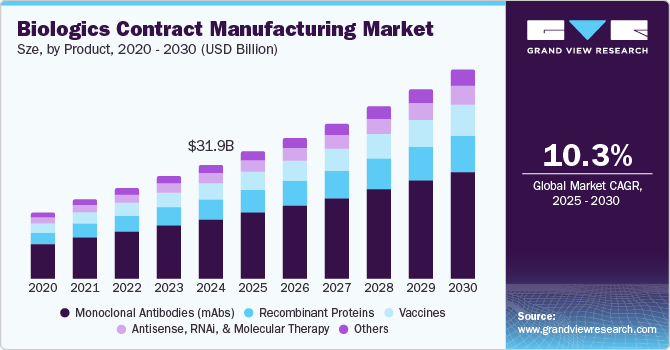

The global biologics contract manufacturing market size was estimated at USD 31.9 billion in 2024 and is projected to reach USD 57.59 billion by 2030, growing at a CAGR of 10.3% from 2025 to 2030. The increasing demand for advanced biologics, investments in biopharmaceuticals by key private and public players, and rising approvals for new biologics are major factors driving market demand.

Key Market Trends & Insights

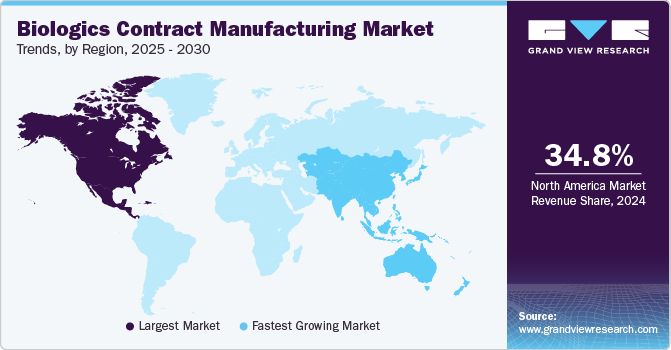

- The North America biologics contract manufacturing market held the largest share of 34.8% in 2024.

- The Asia Pacific biologics contract manufacturing market is projected to grow at the fastest CAGR of 10.9%.

- Based on product, the monoclonal antibodies (mAbs) accounted for the largest share of 52.4% in 2024.

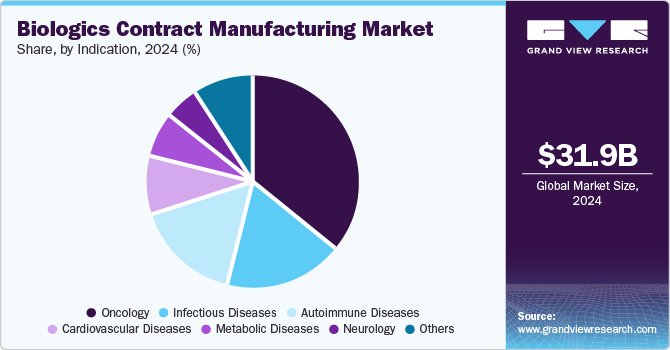

- Based on indication, the oncology accounted for the largest market share of 36.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.9 Billion

- 2030 Projected Market USD 57.59 Billion

- CAGR (2025-2030): 10.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing research and development initiatives by various companies, coupled with the supportive regulatory framework, are also likely to drive the market growth over the forecast period. For instance, in December 2024, the U.S. Food and Drug Administration (FDA) issued draft guidance for its Accelerated Approval Program, designed to fast-track the approval process for new drugs to address unmet medical needs. Such initiatives are expected to drive market expansion over the forecast period.

The increasing demand for biologics and advanced drugs has also led to increasing demand for CMOs and CDMOs. These organizations are thus engaged in capacity expansion to gain an advantage of the growing market and increase their market share. For instance, in February 2024, Thermo Fisher Scientific Inc. announced the expansion of its biologics manufacturing facility in St Louis, Missouri, U.S. The expansion is expected to increase production from 2,000l to 5,000l for several complex treatments for diseases such as cancer, autoimmune conditions, and rare disorders.

In addition, the growing approvals for new drugs and solutions to treat various diseases are likely to add to the growing demand in the market. For instance, in 2024, the FDA had approved approximately 44 new drugs to treat various diseases. The limitations of biopharma or biotech companies, such as limited capacity and cost-saving alternatives offered by contract manufacturing, are further likely to drive market demand.

Product Insights

Monoclonal antibodies (mAbs) accounted for the largest share of 52.4% in 2024. The extensive use of monoclonal antibodies in different therapeutic areas is likely to drive market growth. The drugs produced by mAbs are used for the treatment of cancer, chronic Hepatitis B (HBV) infection, infectious diseases, and autoimmune diseases, including rheumatoid arthritis. The increasing development in the monoclonal antibodies segment are further likely to drive the segment growth. For instance, in June 2024, the European Medicines Agency announced the approval for the new mAbs facility of Biocon Biologics in India.

The vaccines segment is expected to grow at the fastest CAGR over the forecast period from 2025 to 2030 owing to the emergence and prevalence of various new diseases, outbreaks of infectious diseases, and increasing emphasis on preventive care. Technological advancements in vaccine manufacturing, such as the rise of mRNA vaccines, have led to an increasing demand for contract vaccine manufacturing.

Indication Insights

Oncology accounted for the largest market share of 36.0% in 2024 and is expected to grow at the fastest CAGR of 11.1% over the forecast period. The growing prevalence of cancer and increasing efforts and investments by government and private players to develop new and advanced therapeutic solutions have led to the growth of this segment. In August 2024, NEC Bio Therapeutics and AGC Biologics entered into a partnership agreement to advance the production of NECVAX-NEO1, which is a bacteria-based DNA vaccine aiming to treat patient-specific tumor neoantigens.

The autoimmune diseases segment is expected to grow significantly over the forecast period from 2025 to 2030. The initiatives by key players to develop therapeutic solutions to treat autoimmune diseases are likely to drive market growth. For instance, in September 2023, Recipharm, a global contract development and manufacturing organization, announced a partnership with Ahead Therapeutics to facilitate the development of treatment for a rare autoimmune disease, myasthenia gravis.

Regional Insights

The North America biologics contract manufacturing market held the largest share of 34.8% in 2024. The presence of key CMO players in the market and increasing healthcare expenditure in various countries are likely to drive market growth in the region. According to the Canadian Institute for Health Information, the health expenditure in the country was expected to reach approximately USD 372 billion in 2024.

U.S. Biologics Contract Manufacturing Market Trends

The U.S. biologics contract manufacturing market held a dominant position in 2024 due to the increasing focus on the research and development of new biologics, rise in chronic diseases, increasing investments in healthcare, and increasing number of drug approvals. For instance, in May 2024, Biocon Biologics announced approval from the U.S. FDA for an eye treatment drug. The increasing number of approvals for various drugs and indications is likely to foster demand in the market.

Europe Biologics Contract Manufacturing Market Trends

The Europe biologics contract manufacturing market was identified as a lucrative region in 2024. The well-established regulatory framework in the region and strategic initiatives by key players are major factors driving the market demand in the region. For instance, in November 2024, Samsung Biologics Co., signed two drug manufacturing contracts worth a combined USD 668 million with a European biopharmaceutical firm. Such developments are likely to add to the market growth in the region.

The biologics contract manufacturing market in UK is expected to grow rapidly in the coming years due to the increasing demand for biologics and government support. For instance, in August 2024, Lonza announced it had secured about USD 38.6 million grant for its biologics site in Thames Valley Park, UK. Such expansion initiatives by the key market players are likely to drive market growth in the country.

The Germany biologics contract manufacturing market held a substantial market share in 2024 owing to technological advancements in the healthcare sector. The presence of a strong biopharmaceutical industry, advanced manufacturing capabilities, and focus on innovation is further expected to drive the market growth in the country.

Asia Pacific Biologics Contract Manufacturing Market Trends

The Asia Pacific biologics contract manufacturing market is projected to grow at the fastest CAGR of 10.9% over the forecast period from 2025 to 2030. This growth can be attributed to the presence of developing economies in the region, such as China and India, and increasing efforts to advance the healthcare infrastructure and access. The companies operating in the region are also engaged in various development initiatives, driving market growth. For instance, in January 2024, AbbVie Inc. announced the investment of approximately USD 223 million for a new biologics manufacturing facility in Singapore.

The biologics contract manufacturing market in China is expected to account for a significant market share due to technological advancements in the healthcare sector, its rapidly growing biopharmaceutical industry, cost-effective manufacturing capabilities, and government support for healthcare innovation. In addition, increasing R&D investments, expanding infrastructure, and demand for advanced therapies in the country are further expected to drive market growth.

The Japan biologics contract manufacturing market held a substantial market share in 2024 owing to the advanced biotechnology sector, strong R&D focus, and commitment to innovation in biologics. The development initiatives and collaborations among the companies are further expected to drive market growth. For instance, in May 2024, Japan-based AGC Biologics and BioConnection entered into a collaborative partnership to offer drug development and production services to the biopharma industry.

Key Biologics Contract Manufacturing Company Insights

Some of the key companies in the biologics contract manufacturing market include Wuxi Biologics, FUJIFILM Diosynth Biotechnologies, Lonza, Samsung Biologics, AbbVie Inc., and others. These companies are engaged in various strategic development initiatives, such as partnerships, collaborations, expansion, and product approval, to gain a competitive advantage over other players in the market.

-

WuXi Biologics is a global company specializing in end-to-end solutions that allow its partners to discover, develop, manufacture, and commercialize biologics for various indications worldwide. The company had around 359 projects in the pre-clinical development stage, 311 in early-phase clinical trials, 56 in late-phase clinical trials, and 16 in commercial manufacturing by June 2024.

-

FUJIFILM Diosynth Biotechnologies collaborates with biopharmaceutical and biotech companies to support the development and production of biologics, advanced therapies, and vaccines. The company has production facilities in the U.S. and Europe and uses processes such as mammalian cell culture, microbial fermentation, and insect cell culture.

Key Biologics Contract Manufacturing Companies:

The following are the leading companies in the biologics contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Wuxi Biologics

- FUJIFILM Diosynth Biotechnologies.

- Boehringer Ingelheim International GmbH

- Lonza

- Samsung Biologics.

- AbbVie Inc.

- Catalent

- Bioreliance (Merck KGaA)

- Thermo Fisher Scientific Inc.

- Eurofins Scientific

Recent Developments

-

In November 2024, FUJIFILM Diosynth Biotechnologies entered into a long-term manufacturing supply agreement with TG Therapeutics, Inc., for BRIUMVI (ublitiximab-xiiy), developed by the company, an FDA-approved drug to treat relapsing forms of multiple sclerosis (RMS)..

-

In November 2024, Lonza revealed plans to expand its Ibex biopark facility in Visp, Switzerland, by adding two 1,200-liter production suites. This expansion is expected to increase the plant's size by an additional 2,000 square meters.

-

In January 2024, WuXi Biologics announced the expansion of the manufacturing capacity of its facility in Worcester, Massachusetts, to 36,000 liters.

Biologics Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 35.33 billion

Revenue forecast in 2030

USD 57.59 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Wuxi Biologics, FUJIFILM Diosynth Biotechnologies., Boehringer Ingelheim International GmbH, Lonza, Samsung Biologics., AbbVie Inc., Catalent, Bioreliance (Merck KGaA), Thermo Fisher Scientific Inc., Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biologics Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biologics contract manufacturing market report based on product, indication, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies (mAbs)

-

Recombinant Proteins

-

Vaccines

-

Antisense, RNAi, & Molecular Therapy

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Autoimmune Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Metabolic Diseases

-

Neurology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.