- Home

- »

- Catalysts & Enzymes

- »

-

Bioethanol Yeast Market Size, Share, Industry Report, 2030GVR Report cover

![Bioethanol Yeast Market Size, Share & Trends Report]()

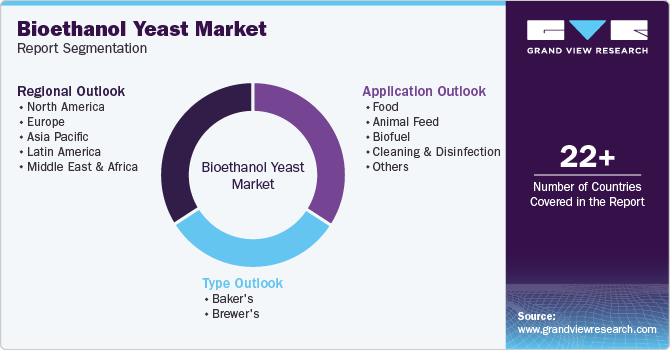

Bioethanol Yeast Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Baker's, Brewer's), By Application (Food, Animal Feed, Cleaning & Disinfection, Biofuel), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-375-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioethanol Yeast Market Size & Trends

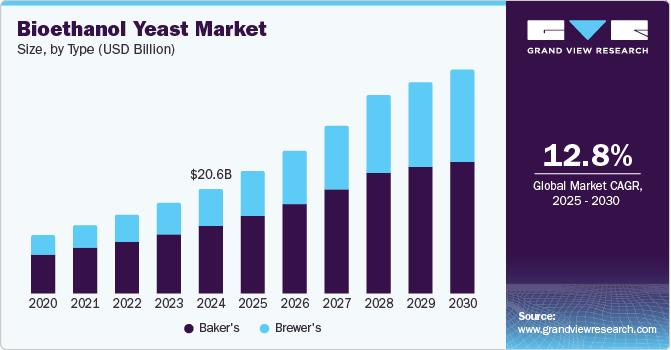

The global bioethanol yeast market size was valued at USD 20.57 billion in 2024 and is expected to grow at a CAGR of 12.8% from 2025 to 2030. This growth is attributed to the increasing demand for renewable energy sources and biofuels, particularly in response to environmental concerns. In addition, growth in the food and beverage industry, fueled by rising disposable incomes and consumer preferences for bakery products and alcoholic beverages, also contributes significantly. Furthermore, advancements in fermentation technology, product innovations, and population growth are expected to drive market growth in the coming years.

Bioethanol yeast refers to specific strains of yeast, primarily saccharomyces cerevisiae, utilized in the fermentation process to convert sugars into ethanol, which is a key component in bioethanol production. As the global demand for renewable energy sources rises, there is an increasing need for bioethanol, prompting the establishment of new production facilities and the expansion of existing ones. This growth is largely influenced by supportive government policies promoting renewable fuels and the economic benefits of scaling production capabilities. New plants are being constructed to satisfy the surging demand, while current facilities are enhancing their capacities to improve efficiency and output. This surge in bioethanol production directly correlates with an increased requirement for bioethanol yeast, as these facilities rely on a consistent supply of high-quality yeast to optimize fermentation processes and maintain stable ethanol yields.

In addition, advancements in agricultural practices have boosted the availability of essential feedstocks such as corn and sugarcane, which are crucial for bioethanol production. Improved farming techniques and higher crop yields contribute to greater agricultural output, enabling producers to source the necessary raw materials for their operations.

Furthermore, ongoing research is focused on developing advanced yeast strains that exhibit superior fermentation capabilities, such as increased ethanol tolerance and resilience to environmental challenges. These innovations can significantly enhance production efficiency and reduce costs. Moreover, advancements in fermentation technologies, such as improved reactors and nutrient management systems, contribute to higher yields and shorter production cycles. As these innovations progress, they will play a vital role in meeting the growing global demand for bioethanol, creating new opportunities within the market.

Type Insights

Baker's yeast dominated the market and accounted for the largest revenue share of 64.5% in 2024. This growth is attributed to the increasing demand for bakery products, fueled by changing consumer preferences for fresh and artisanal goods. In addition, the rise of home baking, urbanization, and higher disposable incomes have led to a surge in bakery consumption. Furthermore, innovations in yeast strains that enhance fermentation efficiency and product quality further stimulate market growth, as bakers seek to improve their offerings and meet evolving consumer tastes.

The brewer's yeast segment is expected to grow at a CAGR of 15.4% from 2025 to 2030, driven by the expanding craft beer industry and rising consumer interest in diverse alcoholic beverages. In addition, innovations in brewing techniques and the demand for unique flavors have increased the need for specialized yeast strains to enhance fermentation processes. Furthermore, the growing trend towards natural and organic products pushes brewers to adopt cleaner ingredients, including brewer's yeast.

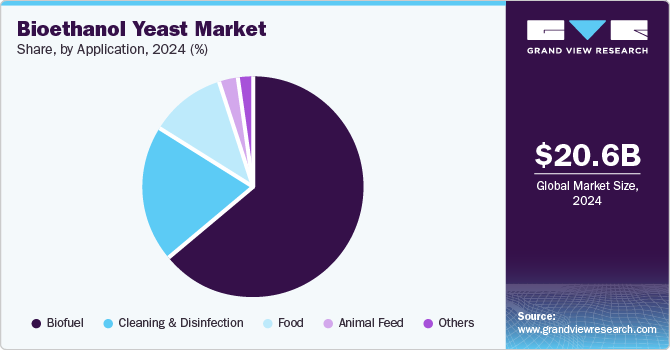

Application Insights

The biofuel segment dominated the market and accounted for the largest revenue share of 64.0% in 2024. This growth is attributed to the increasing demand for renewable energy sources as countries strive to reduce their reliance on fossil fuels. Government policies and incentives promoting biofuel adoption further support this trend. Furthermore, advancements in fermentation technologies enhance the efficiency of converting biomass into bioethanol, making it a more viable alternative fuel. Moreover, as environmental concerns rise, the shift towards sustainable energy solutions bolsters the demand for bioethanol yeast in biofuel production.

The cleaning and disinfection applications are expected to grow at a CAGR of 18.6% over the forecast period, owing to rising awareness of hygiene and sanitation, particularly in the wake of global health crises. Bioethanol yeast produces eco-friendly cleaning agents that effectively eliminate pathogens while being less harmful to the environment. In addition, the shift towards sustainable and biodegradable cleaning products aligns with consumer preferences for natural ingredients, driving demand for bioethanol yeast. Furthermore, this trend is supported by regulatory frameworks encouraging the use of green chemicals in cleaning applications.

Regional Insights

The North America bioethanol yeast market dominated the global market and accounted for the largest revenue share of 41.1% in 2024. This growth is attributed to a strong emphasis on renewable energy sources and government policies that promote biofuels. In addition, the region benefits from advanced agricultural practices that ensure a steady supply of feedstocks such as corn and sugarcane, essential for bioethanol production. Furthermore, the growing consumer preference for sustainable products and expanding biofuel production facilities contribute significantly to market growth. The presence of major industry players further enhances innovation and competitiveness in this sector.

U.S. Bioethanol Yeast Market Trends

The bioethanol yeast market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by its large-scale production capabilities and extensive infrastructure supporting biofuel initiatives. In addition, government mandates for renewable fuel standards have spurred investments in bioethanol plants, increasing demand for high-quality yeast. Furthermore, consumers' rising popularity of environmentally friendly fuels and the automotive industry’s shift towards cleaner energy sources are key factors driving growth.

Middle East & Africa Bioethanol Yeast Market Trends

The Middle East & Africa bioethanol yeast market is expected to grow at a CAGR of 19.0% over the forecast period, owing to the region’s emphasis on diversifying its energy sources amid fluctuating oil prices. In addition, government initiatives promoting renewable energy are beginning to take shape, leading to increased interest in biofuels. Furthermore, the agricultural sector is gradually evolving, providing essential feedstocks for bioethanol production. Moreover, as awareness of environmental issues grows, a rising demand for cleaner energy alternatives will likely drive future growth in this market.

Europe Bioethanol Yeast Market Trends

The bioethanol yeast market in Europe is expected to experience substantial growth over the forecast period, driven by stringent environmental regulations and a strong commitment to reducing carbon emissions. In addition, the European Union's policies favor renewable energy adoption, encouraging investments in bioethanol production facilities. Furthermore, consumer awareness regarding sustainability has led to increased demand for biofuels as an alternative to fossil fuels. Moreover, advancements in fermentation technology and the availability of diverse feedstocks support the growth of this market across various member states.

Germany bioethanol yeast market dominated the European market and accounted for the largest revenue share in 2024, due to its robust renewable energy sector and innovative agricultural practices. In addition, the country’s focus on energy transition policies has facilitated significant investments in biofuel technologies, driving demand for efficient yeast strains. Furthermore, Germany's strong automotive industry is increasingly adopting biofuels, further boosting the need for bioethanol production.

Asia Pacific Bioethanol Yeast Market Trends

The bioethanol yeast market in the Asia Pacific is expected to grow rapidly over the forecast period, owing to increasing urbanization and rising energy demands. In addition, countries such as India and Indonesia invest heavily in renewable energy projects, including biofuels, as part of their commitment to sustainable development. Furthermore, abundant agricultural resources support feedstock supply for bioethanol production. Moreover, technological advancements in fermentation processes enhance production efficiency, making bioethanol a more attractive option for energy generation across the region.

The growth of the China bioethanol yeast market is expected to be driven by its reliance on fossil fuels and enhancement of energy security. Government policies promoting renewable energy sources are driving investments in biofuel production facilities. Furthermore, the availability of diverse feedstocks, such as corn and sugarcane, supports this growth. Moreover, China's focus on environmental sustainability has led to increased consumer demand for cleaner fuels, positioning bioethanol as a viable alternative within its energy landscape.

Key Bioethanol Yeast Company Insights

Some of the key players in the global bioethanol yeast industry include Novozymes, Associated British Foods plc, DSM, and others. These companies adopt various strategies, such as investing in research and development to innovate yeast strains, forming strategic partnerships for enhanced collaboration, expanding production capacities to meet growing demand, and focusing on sustainability and alternative feedstocks.

-

AB Mauri produces various yeast strains and fermentation solutions tailored for biofuel applications. In addition, the company manufactures both bakery and non-bakery yeast products specifically designed for bioethanol production. The company operates within the broader segments of food and beverage, animal nutrition, and bioethanol, providing innovative fermentation technologies that enhance efficiency and sustainability in bioethanol production processes.

-

Cargill, Inc. produces a range of yeast products that serve the biofuel industry, facilitating the fermentation process essential for converting feedstocks into bioethanol. Operating within the agricultural sector, the company is involved in various segments, including food ingredients, animal nutrition, and biofuels, leveraging its extensive expertise to develop high-quality yeast solutions that meet the evolving demands of the bioethanol market.

Key Bioethanol Yeast Companies:

The following are the leading companies in the bioethanol yeast market. These companies collectively hold the largest market share and dictate industry trends.

- Novozymes

- Associated British Foods plc

- DSM

- AB Mauri

- Cargill, Inc.

- AngelYeast Co., Ltd.

- LALLEMAND Inc.

- Leiber GmbH

- Lesaffre

- Foodchem International Corporation

- Omega Yeast Labs, LLC.

- Pacific Ethanol, Inc.

- Oriental Yeast Co., Ltd

Bioethanol Yeast Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.94 billion

Revenue forecast in 2030

USD 43.63 billion

Growth Rate

CAGR of 12.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, China, Japan, India, Germany, UK, France, Italy, Brazil, and Saudi Arabia.

Key companies profiled

Novozymes; Associated British Foods plc; DSM; AB Mauri; Cargill, Inc.; AngelYeast Co., Ltd.; LALLEMAND Inc.; Leiber GmbH; Lesaffre; Foodchem International Corporation; Omega Yeast Labs, LLC.; Pacific Ethanol, Inc.; Oriental Yeast Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioethanol Yeast Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global bioethanol yeast market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Baker's

-

Brewer's

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Animal Feed

-

Biofuel

-

Cleaning & Disinfection

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.