- Home

- »

- Plastics, Polymers & Resins

- »

-

Biodegradable Plastic Market Size, Industry Report, 2033GVR Report cover

![Biodegradable Plastic Market Size, Share & Trends Report]()

Biodegradable Plastic Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Starch Blends, Polylactic Acid, Polybutylene adipate-co-terephthalate, PBS, PHA), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-410-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biodegradable Plastic Market Summary

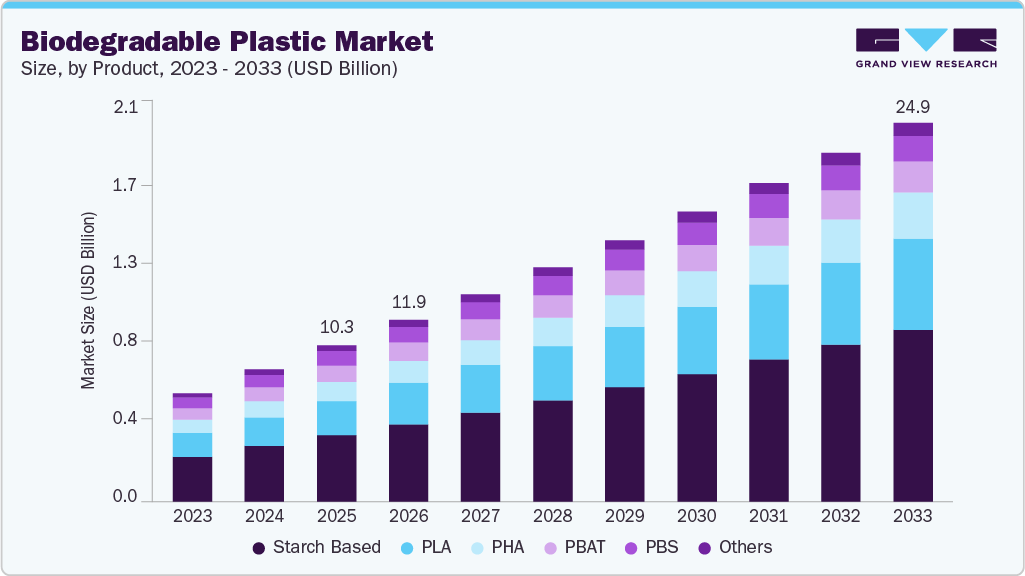

The global biodegradable plastic market size was estimated at USD 10.26 billion in 2025 and is projected to reach USD 24.86 billion by 2033, growing at a CAGR of 11.1% from 2026 to 2033. Advancements in flexible electronics and the integration of nanomaterials are enhancing the performance and reliability of smart textile polymers, making them more suitable for real-world applications.

Key Market Trends & Insights

- Europe dominated the global biodegradable plastic industry with the largest revenue share of 41.42% in 2025.

- The biodegradable plastic industry in China is expected to grow at a substantial CAGR of 15.4% from 2026 to 2033.

- By product, the starch-based segment is expected to grow at a considerable CAGR of 12.1% from 2026 to 2033 in terms of revenue.

- By end use, the packaging segment is expected to grow at a considerable CAGR of 9.8% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 10.26 Billion

- 2033 Projected Market Size: USD 24.86 Billion

- CAGR (2026-2033): 11.1%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

This technological progress is encouraging wider adoption across various sectors, including sportswear, defense, and healthcare. Investment is concentrating on polymers that combine conductivity, sensing, and durability for wearable systems. Market forecasts show strong double-digit growth as system integrators adopt e-textiles for healthcare, sports, and industrial safety. Modular designs and scalable printing processes are shortening time-to-market for new polymer-enabled garments. This is driving consolidation between material suppliers and electronics integrators.

Drivers, Opportunities & Restraints

Regulatory pressure and cost benefits from remote monitoring are pushing hospitals and employers to deploy smart-fabric solutions. Polymers that enable soft, conformable sensors reduce the need for rigid hardware and improve patient comfort. Demand is highest for reliable, wash-stable conductive and dielectric polymer systems. As reimbursement and telemedicine models mature, procurement cycles at hospitals and large enterprises are accelerating adoption.

There is a clear commercial opening for bio-based, biodegradable polymers that meet performance thresholds for strength and conductivity. Brands and regulators are prioritising circularity, creating premium pricing pockets for certified sustainable materials. Technical advances in polymer chemistry and enzyme-based recycling create pathways to cost parity with incumbents. Suppliers who validate lifecycle claims with robust testing will capture apparel and automotive OEM contracts.

High material costs and complex multi-step fabrication remain primary barriers to volume deployment. Many conductive and functional polymer processes are sensitive to process variation and require specialised lines. This raises unit costs and complicates supply chains for apparel manufacturers. Until throughput improves and standard test methods become widespread, adoption will be concentrated in high-value, low-volume segments.

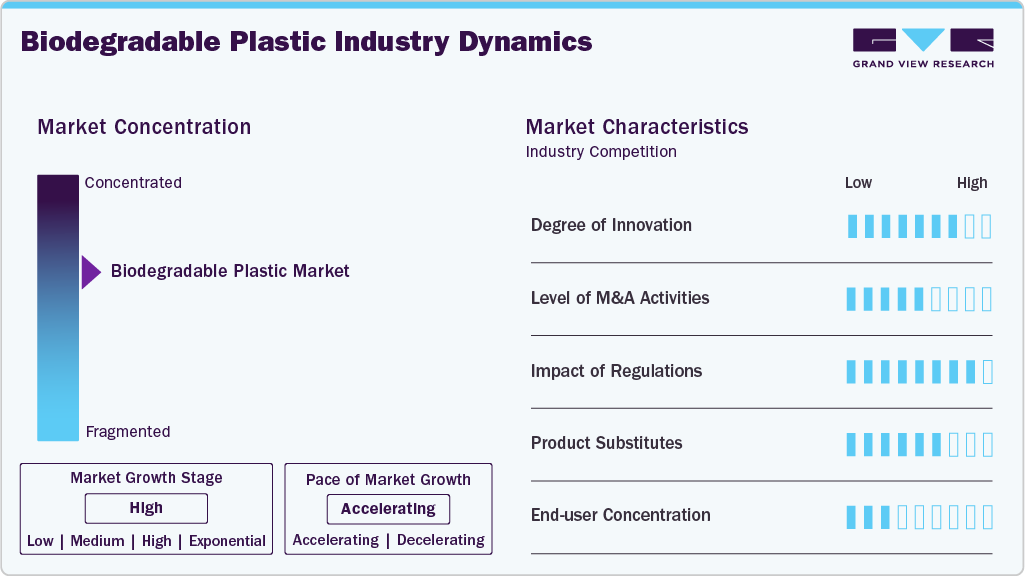

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market exhibits slight concentration, with key players dominating the industry landscape. Major companies such as Cargill Incorporated, PTT MCC Biochem Co., Ltd., Biome Technologies plc, Plantic Technologies Limited, BASF SE, Total Corbion PLA, NatureWorks LLC, Eastman Chemical Company, Trineso, Danimer Scientific, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation intensity is rising as producers focus on improving mechanical strength, heat stability, and composting performance. New catalyst systems and reactive extrusion methods are enabling better molecular control, which improves the durability of biodegradable resins. Growth in the biodegradable plastic industry is also supporting this shift, with tailored compatibilizers and performance enhancers helping materials meet stricter packaging and food-contact requirements. These advancements allow suppliers to address higher value applications and reduce the performance gap with conventional plastics.

Product Insights

Starch-based products dominated the market across all product segments in terms of revenue, accounting for a market share of 42.27% in 2025, and are forecasted to grow at a 12.1% CAGR from 2026 to 2033. The starch-based segment is benefiting from strong interest in low-carbon feedstocks and rapid scale-up of agricultural waste valorization. Producers are improving extrusion and blending technologies to achieve better tensile strength and moisture resistance. This supports wider use of starch blends in flexible packaging and carry bags. These developments reinforce the overall shift toward the bio-based market, where buyers seek materials with clear agricultural traceability and measurable reductions in fossil resource dependence.

The PLA segment is anticipated to grow at a substantial CAGR of 11.9% through the forecast period. PLA demand is rising as brands prioritize high clarity, compostable formats for food contact applications. New reactor designs and optimized lactide purification processes are enabling manufacturers to achieve higher heat resistance and superior film performance. These improvements position PLA as a strong contender in the market, especially for labels, wraps, and fresh produce packaging. The segment benefits from steady investment in fermentation capacity and region-specific biorefinery projects aimed at reducing cost volatility.

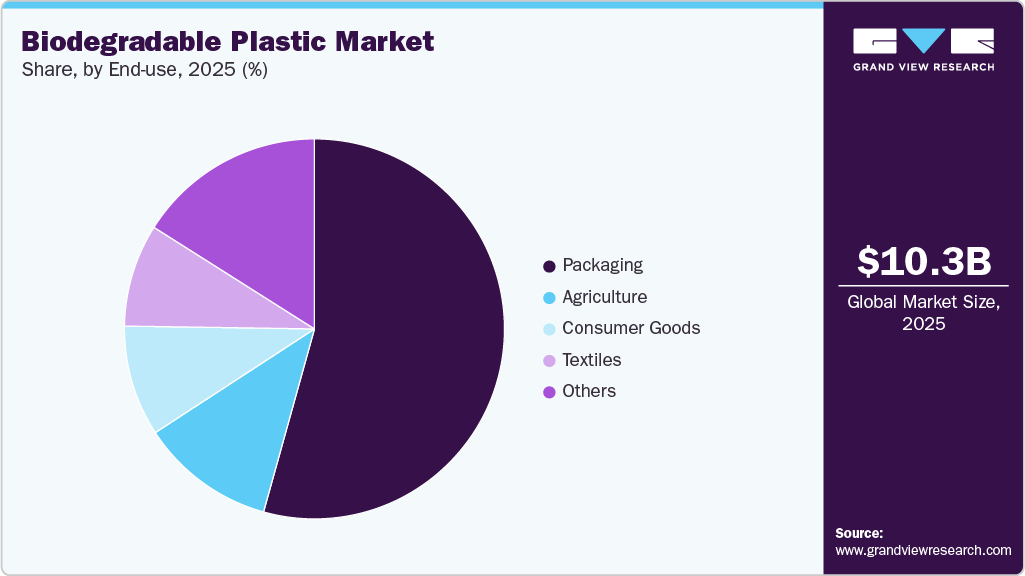

End Use Insights

Packaging dominated the market across the end-use segmentation in terms of revenue, accounting for a market share of 54.21% in 2025, and is forecasted to grow at a 9.8% CAGR from 2026 to 2033. Packaging demand is expanding as retailers and foodservice chains adopt compostable solutions that align with waste diversion goals. Companies are switching to biodegradable trays, cups, and multilayer formats that meet performance benchmarks for rigidity and barrier protection. Growth in the biodegradable disposable plastic tableware market is further accelerating innovation in coatings and additives that maintain shelf appeal. The packaging segment gains from policy momentum that rewards materials compatible with organic waste collection systems.

The consumer goods segment is expected to expand at a substantial CAGR of 9.5% through the forecast period. In consumer goods, a key driver is the push for low-impact materials in everyday household and personal care items. Brands are redesigning product lines with compostable handles, casings, and accessory components that fit circular product strategies. This trend strengthens the market as companies seek verified sustainability claims and improved end-of-life outcomes. Better processing technologies and stronger retail commitments help expand adoption across stationery, cosmetics, and small durable items.

Regional Insights

The Europe biodegradable plastic market held the largest share, accounting for 41.42% of the revenue in 2025, and is expected to grow at the fastest CAGR of 9.5% over the forecast period. Europe remains a frontrunner due to stringent packaging waste directives and the rapid implementation of extended producer responsibility frameworks. The region’s focus on harmonized compostability standards and improved biowaste collection systems strengthens confidence in biodegradable materials. Retailers in the food and fresh produce segments are adopting compostable solutions to comply with upcoming recyclability and reuse targets. These policies create a favorable environment for investment in next-generation biopolymers.

Germany Biodegradable Plastic Market Trends

The biodegradable plastic market in Germany is driven by its advanced recycling ecosystem and strong industrial R&D capabilities. Local producers are investing in enzyme-based degradation technologies and tailored additives that support higher material performance. Retail chains are trialing biodegradable films and serviceware to meet lifecycle assessment requirements under national packaging laws. Supportive funding programs for bio-based materials and circular manufacturing further enhance adoption prospects.

North America Biodegradable Plastic Market Trends

The biodegradable plastic market in North America is experiencing a surge in demand for biodegradable plastics as retailers align their packaging portfolios with emerging state-level compostability standards. Investment in organic recycling and municipal composting programs is expanding, which creates a more reliable end-of-life pathway. Brands in foodservice and e-commerce are accelerating trials of compostable mailers and inserts to meet corporate sustainability reporting requirements. These developments support higher adoption of high-performance biodegradable resins in mainstream applications.

The U.S. biodegradable plastic market is growing considerably, as regulatory momentum is accelerating the procurement of certified compostable materials. States such as California and Washington are enforcing clearer labeling rules and establishing infrastructure grants for composting facilities. Large consumer goods companies are shifting procurement to biodegradable formats to meet Scope 3 emissions targets and packaging reduction mandates. This creates long-term demand visibility, encouraging suppliers to scale domestic biopolymer and additive production.

Asia Pacific Biodegradable Plastic Market Trends

The biodegradable plastic market in the Asia Pacific demand is expanding as governments target pollution reduction and push for alternatives to conventional single-use plastics. Countries such as Japan, South Korea, and India are introducing procurement incentives and eco-labeling schemes that favor biodegradable options. Rapid growth in food delivery, e-commerce, and organized retail amplifies the need for sustainable, flexible packaging. Regional manufacturing investments in feedstocks such as starch and PLA strengthen supply availability and reduce cost barriers.

Key Biodegradable Plastic Company Insights

The biodegradable plastic industry is highly competitive, with several key players dominating the landscape. Major companies include Cargill Incorporated, PTT MCC Biochem Co., Ltd., Biome Technologies plc, Plantic Technologies Limited, BASF SE, Total Corbion PLA, NatureWorks LLC, Eastman Chemical Company, Trineso, and Danimer Scientific. The biodegradable plastic industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Biodegradable Plastic Companies:

The following are the leading companies in the biodegradable plastic market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill Incorporated

- PTT MCC Biochem Co., Ltd.

- Biome Technologies plc

- Plantic Technologies Limited

- BASF SE

- Total Corbion PLA

- NatureWorks LLC

- Eastman Chemical Company

- Trineso

- Danimer Scientific

Recent Developments

-

In March 2025, NatureWorks LLC launched its new “Ingeo Extend” PLA platform, offering enhanced biodegradation and improved film-making efficiency, a move strengthening its position in the market.

-

In April 2025, Amcor PLC completed its all-stock acquisition of Berry Global (valued at USD 8.4 billion), expanding its global packaging footprint and bolstering its capabilities to deliver sustainable and biodegradable packaging solutions.

Biodegradable Plastic Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11.91 billion

Revenue forecast in 2033

USD 24.86 billion

Growth rate

CAGR of 11.1% from 2026 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Cargill Incorporated; PTT MCC Biochem Co., Ltd.; Biome Technologies plc; Plantic Technologies Limited; BASF SE; Total Corbion PLA; NatureWorks LLC; Eastman Chemical Company; Trineso; Danimer Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodegradable Plastic Market Report Segmentation

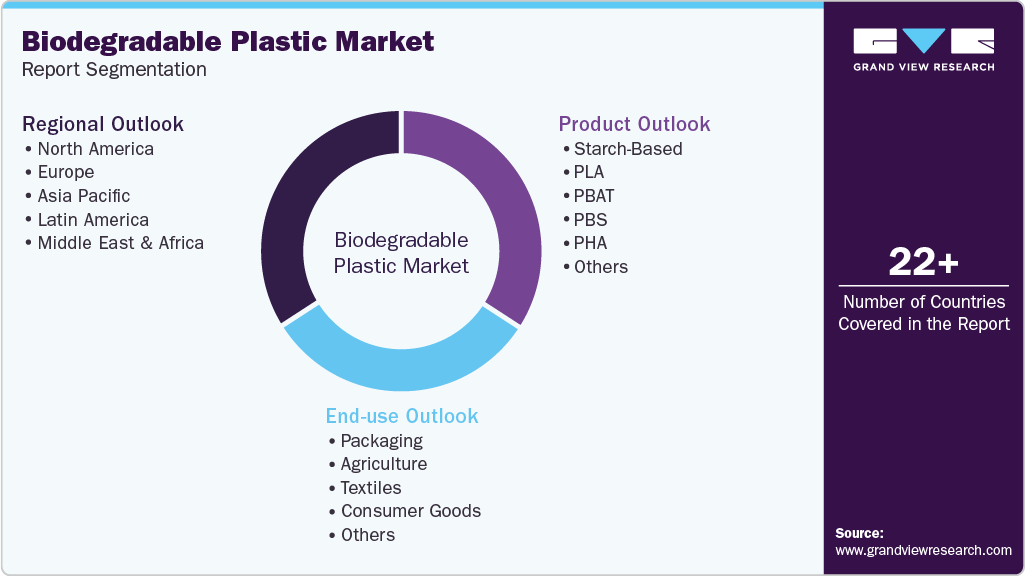

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biodegradable plastic market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Starch-Based

-

PLA

-

PBAT

-

PBS

-

PHA

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Food Packaging

-

Non-Food Packaging

-

-

Agriculture

-

Textiles

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global biodegradable plastics market size was estimated at USD 10.26 billion in 2025 and is expected to reach USD 11.91 billion in 2026.

b. The global biodegradable plastics market is expected to grow at a compound annual growth rate of 11.1% from 2026 to 2033 to reach USD 24.86 billion by 2033.

b. Starch-based products dominated the market across all product segments in terms of revenue, accounting for a market share of 42.27% in 2025, and are forecasted to grow at a 12.1% CAGR from 2026 to 2033.

b. Some key players operating in the biodegradable plastics market include Cargill Incorporated, PTT MCC Biochem Co., Ltd., Biome Technologies plc, Plantic Technologies Limited, BASF SE, Total Corbion PLA, NatureWorks LLC, Eastman Chemical Company, Trineso, and Danimer Scientific.

b. Advancements in flexible electronics and the integration of nanomaterials are enhancing the performance and reliability of smart textile polymers, making them more suitable for real-world applications. This technological progress is encouraging wider adoption across various sectors, including sportswear, defense, and healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.