- Home

- »

- Renewable Chemicals

- »

-

Biodegradable Mulch Films Market Size, Share Report, 2030GVR Report cover

![Biodegradable Mulch Films Market Size, Share & Trends Report]()

Biodegradable Mulch Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (TPS, PLA, PHA, AAC), By Crop (Fruits & Vegetables, Grains & Oilseeds, Flowers & Plants), By Region, And Segment Forecasts

- Report ID: 978-1-68038-855-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biodegradable Mulch Films Market Summary

The global biodegradable mulch films market size was estimated at USD 50.75 million in 2024 and is projected to reach USD 82.82 million by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Increasing demand and need for food crops due to the global population is driving the growth of biodegradable mulch films as a sustainable alternative to conventional plastic films in modern agriculture.

Key Market Trends & Insights

- Asia Pacific dominated the global biodegradable mulch films market with the largest revenue share of 62.36% in 2024.

- By raw material, the thermoplastic starch segment led the market with the largest revenue share of more than 61.25% in 2024.

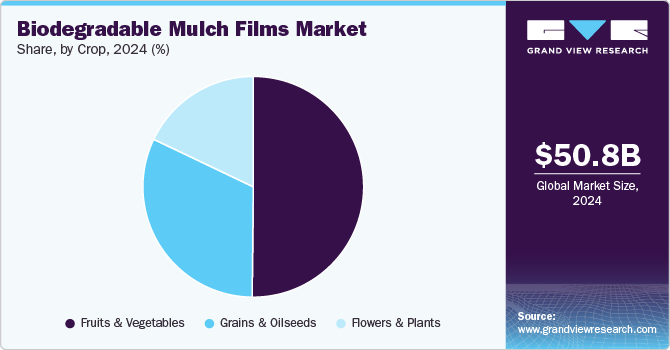

- By crop, the fruits & vegetables segment led the market with the largest revenue share of more than 50.16% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 50.75 Million

- 2030 Projected Market Size: USD 82.82 Million

- CAGR (2025-2030): 8.9%

- Asia Pacific: Largest market in 2024

Depleting arable and agricultural land in developed economies is a major challenge for the global agriculture industry. These biodegradable films offer a limited solution to this fast-developing problem by increasing crop yield and helping address major issues, including water conservation, soil pollution, and climatic change.

The market is witnessing increased demand as sustainability becomes a central theme in global agricultural practices. Farmers and agribusinesses are under pressure to reduce environmental impact, with many regions introducing regulations to curb plastic use. Biodegradable films offer an eco-friendly alternative that reduces soil pollution and eliminates the need for disposal or incineration post-harvest, addressing sustainability and efficiency. In addition, material technology advances have improved biodegradable films' performance and durability, further driving their adoption across agriculture. As a result, more governments and organizations are promoting biodegradable options, fueling market expansion.

Drivers, Opportunities & Restraints

One of the main drivers for biodegradable mulch films is the rising awareness and regulatory support for sustainable agricultural practices. Governments worldwide are implementing strict rules to reduce traditional plastic usage in farming due to its harmful effects on soil and ecosystems. For example, the European Union has introduced directives targeting single-use plastics, which extend to agricultural uses and encourage the adoption of biodegradable alternatives. Farmers and agribusinesses are increasingly adopting these films as they seek compliance and look to reduce long-term soil degradation associated with non-biodegradable plastics, thus driving the market forward.

There is a significant opportunity for growth in emerging markets, especially in regions where agriculture plays a vital economic role, such as Asia-Pacific and Latin America. The focus on sustainable farming is growing in these areas, and biodegradable mulch films present an appealing solution. With government incentives and subsidies promoting green agricultural practices, there is a clear market space for producers to expand their presence and introduce innovative products tailored to local crops and climates. Establishing partnerships with local distributors and providing education on the long-term benefits of biodegradable films could yield a substantial market share in these regions.

The primary restraint for the market is the high cost compared to conventional plastic mulch films. Despite the environmental benefits, many farmers are reluctant to switch due to the price premium of biodegradable materials. In regions where margins are tight and access to capital is limited, this cost difference can be prohibitive, hindering widespread adoption. Furthermore, inconsistent product performance in extreme weather conditions has raised concerns among some users, particularly those in regions with challenging climates, creating an additional barrier to growth.

Raw Material Insights

Thermoplastic starch (TPS) dominated the global market, with more than 61.25% of the share in 2024. TPS degrades into harmless products when placed in soil. Growing environmental concerns regarding the use of conventional synthetic polymers in the production of agricultural films have shifted the focus toward the use of biodegradable materials, which are made from renewable resources. The above factors are anticipated to raise the demand for thermoplastic starch in biodegradable mulch film production.

Crops with high starch content are the major source of food calories. However, starch is commonly thought of as a bad card or thickener for gravies and sauces. Starch is used to prepare TPS, which flows at an elevated pressure and temperature. The high demand for TPS may be attributed to the easy availability of starch at low prices coupled with its inability to produce harmful products when placed in soil.

PLA is one of the most promising biopolymers manufactured from lactic acid and starch. It can also be produced chemically by treating sugar and starch. PLA can be processed using ordinary equipment. PLA products are gaining popularity in various other applications, especially those with short shelf lives. Increasing government incentives, consumer awareness, and the availability of raw materials are the major factors for market growth. However, PLA's cost is higher than that of synthetic plastics, thus driving the market negatively.

PHAs are biodegradable plastics prepared by synthesized microbial fermentation of sugar or glucose. They have been used in fixation and orthopedic applications, bioplastic production, tissue engineering, food services, packaging, agriculture, and the pharmaceutical industry. The enhanced properties of PHA bring additional value to the applications in which they are used. Advancements in the industrialization process of PHA are expected to drive the cost of PHA and make it a substitute for conventional plastic.

Crop Insights

Fruits & vegetables were the major crop type segment and accounted for more than 50.16% of the global biodegradable mulch film demand in 2024. This segment is anticipated to witness the fastest growth in revenue from 2025 to 2030. Using biodegradable mulch films reduces fruit rot by preventing contact between fruit & soil and improves the product quality.

Biofilms’ demand for fruits & vegetables is anticipated to witness above-average growth in the coming years and gain a substantial market share by 2030. Fruits and vegetables are rich in vitamins, minerals, fiber, and antioxidants, making them essential to a healthy diet. This awareness has led to an uptick in demand for fresh produce.

Regional Insights

The biodegradable mulch films market in North America is expected to grow significantly over the forecast period. Environmental awareness and stringent regulations on plastic usage in agriculture are key market drivers in North America. Canadian agricultural regions, in particular, are facing mounting pressure to reduce plastic waste from farming operations, and both government and environmental organizations advocate for eco-friendly alternatives.

U.S. Biodegradable Mulch Films Market Trends

TheU.S. biodegradable mulch films market is driven by a blend of environmental policy initiatives and the need to protect soil health. As a leader in agricultural production, the U.S. is taking steps to reduce plastic waste in farming by promoting sustainable alternatives. Subsidies, incentives for sustainable practices, and the growing popularity of eco-conscious farming and organic produce encourage biodegradable mulch adoption among American farmers.

Asia Pacific Biodegradable Mulch Films Market Trends

Asia Pacific dominated the global biodegradable mulch film polymers market and accounted for the largest revenue share of 62.36% in 2024, which is attributable to the rapid expansion of the agriculture sector and a growing focus on sustainable farming practices. Key countries in this region, such as India, Thailand, and Vietnam, are large agricultural producers and face challenges with soil degradation due to extensive plastic mulch use. As governments promote environmentally friendly agricultural inputs and offer subsidies for sustainable products, farmers are becoming more open to biodegradable alternatives.

The biodegradable mulch films market in China is driven by the government’s focus on reducing agricultural plastic pollution. China has been one of the world’s largest users of plastic mulch films, leading to severe soil contamination issues that are now a significant concern for policymakers. Recent regulations target the reduction of plastic waste in farming and promote eco-friendly alternatives, aligning with China’s larger environmental goals.

Europe Biodegradable Mulch Films Market Trends

The biodegradable mulch films market in Europe is driven primarily by the European Union’s stringent regulations to reduce single-use plastics across various sectors, including agriculture. With the EU’s Green Deal and Farm to Fork strategy promoting sustainable farming, European farmers are increasingly pressured to adopt eco-friendly materials. France, Spain, and Italy are particularly active markets due to government support for green initiatives and high agricultural production levels.

Key Biodegradable Mulch Films Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies BASF SE; Kingfa Sci & Tech Co Ltd; BioBag International AS; AEP Industries Inc.; RKW SE; British Polythene Industries PLC; Armando Alvarez; Al-Pack Enterprises Ltd.; Novamont; and AB Rani Plast OY. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector invest heavily in research and development to enhance their raw materials' performance, cost-effectiveness, and sustainability.

Key Biodegradable Mulch Films Companies:

The following are the leading companies in the biodegradable mulch films market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Kingfa Sci & Tech Co Ltd

- BioBag International AS

- AEP Industries Inc.

- RKW SE

- British Polythene Industries PLC

- Armando Alvarez

- Al-Pack Enterprises Ltd.

- Novamont

- AB Rani Plast OY

Recent Developments

-

In February 2024, NUREL introduced two new grades of INZEA biopolymers for agricultural mulch films. These materials enhance crop production while addressing environmental concerns linked to traditional plastic mulches. These biodegradable materials are certified to decompose in soil without harming the environment, helping to eliminate the costs and issues associated with plastic waste management.

-

In October 2023, Mondi partnered with Cotesi and introduced a sustainable alternative to traditional plastic mulching films used in agriculture. Their new product, Advantage Kraft Mulch, is made entirely from 100% kraft paper sourced from responsibly managed forests. This paper solution is designed to protect crops from environmental factors like birds and weeds while compostable after use, thus eliminating waste associated with plastic disposal.

Biodegradable Mulch Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.18 million

Revenue forecast in 2030

USD 82.82 million

Growth rate

CAGR of 8.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, crop, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; UK; France; Italy; The Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

BASF SE; Kingfa Sci & Tech Co Ltd; BioBag International AS; AEP Industries Inc.; RKW SE; British Polythene Industries PLC; Armando Alvarez; Al-Pack Enterprises Ltd.; Novamont; AB Rani Plast OY

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodegradable Mulch Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biodegradable mulch films market report based on raw material, crop, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermoplastic Starch (TPS)

-

Starch Blended with Polylactic Acid (PLA)

-

Starch Blended with Polyhydroxyalkanoate (PHA)

-

Aliphatic Aromatic Copolyesters (AAC)

-

Others

-

-

Crop Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Grains & Oilseeds

-

Flowers & Plants

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biodegradable mulch films market size was estimated at USD 50.75 billion in 2024 and is expected to reach USD 54.18 billion in 2025.

b. The global biodegradable mulch films market is expected to grow at a compound annual growth rate of 8.86% from 2025 to 2030 to reach USD 82.82 billion by 2030.

b. Fruits & vegetables segment dominated the biodegradable mulch films market with a share of 50.16% in 2024. This can be attributed to the ease of application owing to the perennial nature of crops.

b. Some key players operating in the biodegradable mulch films market include AEP Industries, Inc.; Ab Rani PlastOy.; Al-Pack Enterprises Ltd.; RKW SE; BASF SE; BioBag International AS; British Polythene Industries PLC; Novamont S.p.A.; Armando Alvarez; and Kingfa Sci & Tech Co. Ltd.

b. Key factors that are driving the biodegradable mulch films market growth include increasing demand in greenhouse applications coupled with rising environmental concerns about synthetic counterparts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.