- Home

- »

- Disinfectants & Preservatives

- »

-

Biocides For Leather Market Size, Industry Report, 2030GVR Report cover

![Biocides For Leather Market Size, Share & Trends Report]()

Biocides For Leather Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bactericides, Fungicides), By Application (Curing, Tanning & Dyeing, Beamhouse, Finishing), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-307-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biocides For Leather Market Trends

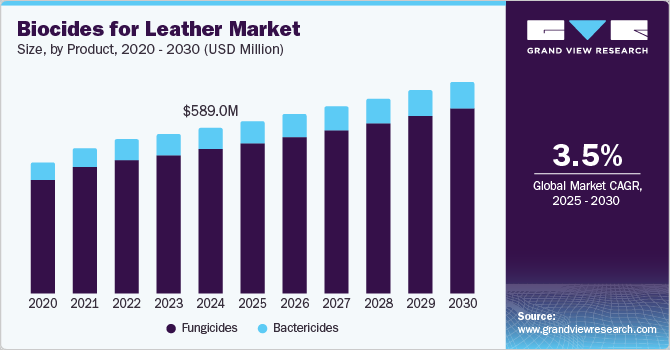

The global biocides for leather market size was valued at USD 589.0 million in 2024 and is expected to grow at a CAGR of 3.5% from 2025 to 2030. This growth is attributed to the growing demand for leather products necessitates effective biocides to prevent microbial degradation, ensuring product longevity and quality. In addition, technological developments have led to the development of more effective and environmentally friendly biocides, aligning with consumer preferences for sustainable solutions. Furthermore, stringent regulations regarding product safety and environmental impact are prompting manufacturers to adopt innovative biocide solutions, further fueling market expansion.

Biocides are chemical agents that inhibit the growth of microorganisms such as bacteria and fungi on leather surfaces, ensuring the preservation and quality of leather products throughout various production stages. A primary factor driving the global biocides market is the escalating demand for leather goods, which are widely used in applications such as footwear, automotive interiors, and clothing. This demand is fueled by rising disposable incomes, evolving fashion trends, and an increasing appreciation for the durability of leather items. As consumers seek high-quality products, the necessity for effective biocides to combat microbial degradation becomes critical.

In addition, the leather industry faces heightened regulatory scrutiny regarding chemical usage. Regulatory bodies worldwide have implemented strict guidelines to mitigate the environmental impact of biocides used during leather production. These regulations aim to ensure that biocides are safe for both human health and the environment, prompting manufacturers to innovate safer alternatives that comply with these standards. This shift addresses regulatory demands and aligns with the growing consumer preference for sustainable and eco-friendly products.

Furthermore, rising consumer demand for leather products and stringent regulations on chemical use significantly drive the growth of the biocides market in the leather industry. The focus on sustainability and safety shapes product development, leading to innovations that enhance performance and environmental compatibility.

Product Insights

Fungicides led the market and accounted for the largest revenue share of 86.8% in 2024. This growth is attributed to the increasing demand for high-quality leather products. Fungicides are essential in preventing mold and fungal growth during various stages of leather processing, such as soaking, tanning, and finishing. In addition, manufacturers must utilize effective fungicides to maintain product integrity and longevity as consumers seek durable and aesthetically appealing leather goods. Furthermore, the rise in consumer awareness regarding hygiene and microbial safety further propels the demand for fungicides, ensuring that leather products remain free from harmful microorganisms.

Bactericides are expected to grow at a CAGR of 2.8% over the forecast period, owing to the need for bactericides that prevent bacterial contamination during leather production, which can lead to significant quality degradation. As the leather industry expands due to rising consumer preferences for leather goods, the demand for effective bactericides increases correspondingly. Moreover, stringent product safety and quality regulations compel manufacturers to incorporate bactericides into their processes.

Application Insights

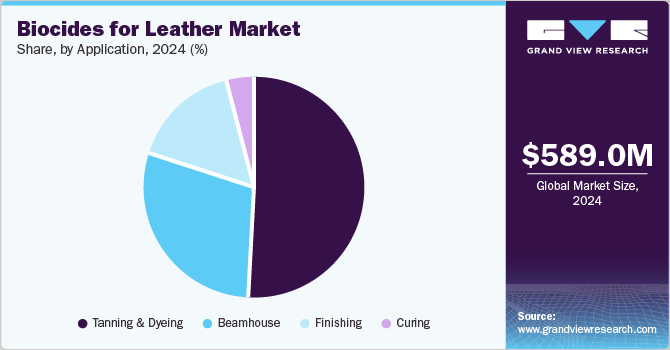

The tanning and dyeing applications dominated the market and accounted for the largest revenue share of 51.4% in 2024. This growth is attributed to the increasing demand for high-quality leather products. As leather is extensively used in various sectors such as fashion, automotive, and furniture, the need for effective biocides to prevent microbial contamination during tanning and dyeing processes becomes crucial. In addition, these biocides protect against bacteria and fungi, ensuring that the leather maintains its quality and durability. Furthermore, advancements in biocide formulations that are both effective and environmentally friendly are enhancing their adoption in these applications.

The finishing segment is expected to grow at a CAGR of 3.4% from 2025 to 2030, driven by the necessity of preserving leather products' aesthetic appeal and functional properties. In addition, finishing processes often involve treatments that can attract microbial growth; thus, incorporating biocides is essential to prevent spoilage and ensure product longevity. Furthermore, the rising consumer awareness regarding hygiene and product safety further drives the need for effective biocides in finishing applications. Moreover, regulatory pressures for safer chemical use push manufacturers to innovate and adopt advanced biocide solutions that meet environmental standards while maintaining leather quality.

Regional Insights

North America biocides for leather market is expected to grow at a CAGR of 3.7% over the forecast period, owing to the increasing demand for high-quality leather products across various industries, including automotive and fashion. In addition, the U.S. leads this growth, driven by rising consumer preferences for durable leather goods and the need for effective antimicrobial solutions to prevent microbial degradation. Furthermore, stringent regulations regarding product safety and environmental impact are prompting manufacturers to adopt advanced biocide formulations that comply with these standards, further fueling market expansion.

U.S. Biocides for Leather Market Trends

Biocides for leather market in the U.S. held the dominant position within the North American market and accounted for the largest revenue share in 2024, owing to the booming automotive sector, which requires high-quality leather upholstery. The presence of large meat processing companies ensures a steady supply of raw materials for leather production, enhancing market growth. Furthermore, increasing consumer awareness about hygiene and antimicrobial protection in leather products drives manufacturers to incorporate effective biocides into their processes.

Asia Pacific Biocides for Leather Market Trends

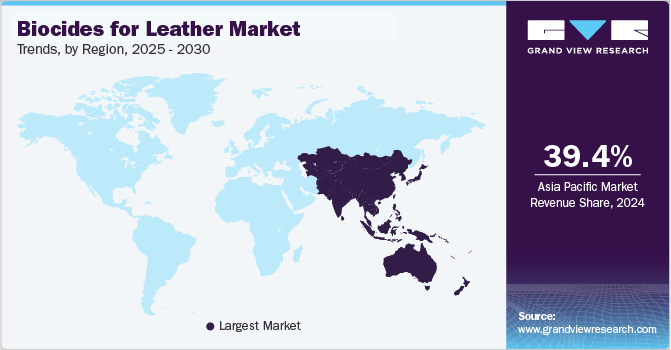

The Asia Pacific biocides for leather market dominated the global market and accounted for the largest revenue share of 39.4% in 2024. This growth is attributed to its extensive leather manufacturing capabilities and abundant raw materials. In addition, countries such as China and India are major contributors, driven by rising disposable incomes and increasing consumer demand for high-quality leather products. Furthermore, the region's modernization of production processes and government initiatives to enhance industrial growth further bolster the market. Moreover, the focus on sustainable practices and developing eco-friendly biocide formulations also play a crucial role in this growth trajectory.

Biocides for leather market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its status as one of the largest leather producers worldwide. The country's booming automotive and fashion industries drive substantial demand for leather goods, necessitating effective biocides to ensure product quality and longevity. In addition, china's competitive labor costs and significant investments in modernizing leather production facilities also contribute to increased biocide consumption. Furthermore, the government's support for sustainable practices in manufacturing further enhances the adoption of innovative biocide solutions.

Europe Biocides for Leather Market Trends

Europe biocides for leather market is expected to grow significantly over the forecast period, driven by its rich heritage in leather craftsmanship and a strong demand for luxury leather goods. In addition, the region's emphasis on sustainability and environmentally friendly production practices drives innovations in biocide formulations that meet stringent regulatory requirements. Furthermore, increasing consumer awareness about microbial contamination and the need for effective preservation methods are propelling market growth. Moreover, European manufacturers invest in research and development to create safer biocide solutions that align with evolving consumer preferences.

The growth of biocides for leather market in Italy is driven by its high-quality leather production and luxury fashion brands. The demand for biocides is driven by Italy's commitment to maintaining quality standards in leather goods while adhering to strict environmental regulations. In addition, as consumers increasingly seek sustainable products, Italian manufacturers focus on developing eco-friendly biocides that ensure product longevity without compromising safety. Furthermore, this trend toward sustainability, combined with Italy's strong position in the global leather market, is expected to drive continued growth in biocide usage.

Key Biocides for Leather Market Company Insights

Some of the key players in the market include Vink Chemicals GmbH & Co. KG, Troy Corporation, DuPont de Nemours, Inc., and others. These companies adopt various strategies to enhance their market presence and gain a competitive edge. These include investing in research and development to innovate and create advanced biocide formulations that meet evolving regulatory standards and consumer demands. In addition, companies establish strategic partnerships and collaborations with leather manufacturers to ensure a steady supply chain and enhance product distribution. Furthermore, they emphasize sustainability by developing eco-friendly biocides, aligning with the growing consumer preference for environmentally responsible products.

-

Lanxess AG manufactures a range of biocides, including fungicides and bactericides, which are essential during various stages of leather processing, such as tanning and finishing. Operating within the specialty chemicals segment, the company focuses on providing innovative and effective antimicrobial solutions that enhance the quality and durability of leather goods while ensuring compliance with environmental regulations.

-

Vink Chemicals GmbH & Co. KG manufactures biocides that prevent microbial growth during the tanning and finishing processes, ensuring that leather goods remain durable and aesthetically appealing. The company is positioned within the specialty chemicals sector, emphasizing sustainable practices and the development of eco-friendly solutions that meet the increasing demands for safety and environmental responsibility in the leather industry.

Key Biocides for Leather Companies:

The following are the leading companies in the biocides for leather market. These companies collectively hold the largest market share and dictate industry trends.

- Lanxess AG

- Buckman Laboratories International, Inc.

- Vink Chemicals GmbH & Co. KG

- Troy Corporation

- DuPont de Nemours, Inc.

- ICL Performance Products LP

- Akzo Nobel N.V.

- Archroma Management LLC

- Ashland Global Holdings Inc.

- Huntsman International LLC

- SUEZ SA

Biocides for Leather Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 612.6 million

Revenue forecast in 2030

USD 752.9 million

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; UAE; Saudi Arabia; South Africa.

Key companies profiled

Lanxess AG; Buckman Laboratories International, Inc.; Vink Chemicals GmbH & Co. KG; Troy Corporation; DuPont de Nemours, Inc.; ICL Performance Products LP; Akzo Nobel N.V.; Archroma Management LLC; Ashland Global Holdings Inc.; Huntsman International LLC; SUEZ SA.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biocides for Leather Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global biocides for leather market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fungicides

-

Bactericides

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tanning & Dyeing

-

Beamhouse

-

Finishing

-

Curing

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.