- Home

- »

- Disinfectants & Preservatives

- »

-

Biocides Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Biocides Market Size, Share & Trends Report]()

Biocides Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Halogen Compounds, Organosulfur, Organic acids, Nitrogen, Glutaraldehyde), By End Use (Herbicides, Pesticides), By Region, And Segment Forecasts

- Report ID: 978-1-68038-014-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biocides Market Summary

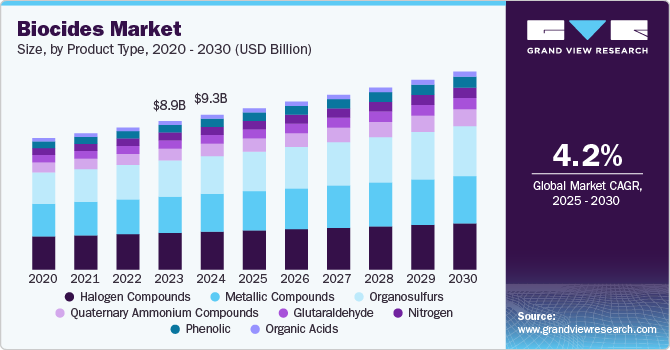

The global biocides market size was estimated at USD 9,291.08 million in 2024 and is projected to reach USD 11,882.06 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The growth is driven by the consumer products segment, where biocides are utilized in various items such as cleaning cosmetics, products, disinfectants, wipes, laundry, toothpaste, and detergents.

Key Market Trends & Insights

- Asia Pacific dominated the biocides market with a share of 37.4% in 2024.

- China biocides market is the largest producer of biocides.

- Based on product type, the halogen compounds segment accounted for the largest revenue market share, 24.6%, in 2024.

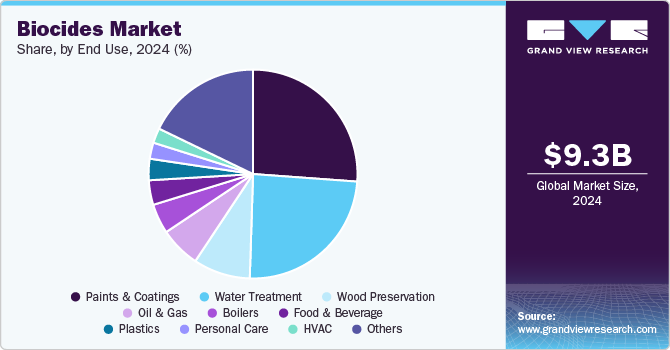

- Based on end use, the paints and coatings segment dominated the end-use segment with a revenue market share of 26.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,291.08 Million

- 2030 Projected Market Size: USD 11,882.06 Million

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

Additionally, biocides are increasingly employed in insecticides, preservatives, fungicides, antiseptics, and herbicides. Biocides are increasingly used in disinfectants, preservatives, antiseptics, insecticides, herbicides, and fungicides. Further, the majority of the demand is driven by the consumer product segment, where biocides are used in cosmetics cleaning products, wipes, general and toothpaste, pet disinfectants, and laundry detergents, among other things.The global biocides market includes two types of biocides, oxidizing, and non-oxidizing biocides, depending on their mechanism of action. Chemicals such as sodium bromide, peracetic acid, and chlorine are used in oxidizing biocide production, while 5-chloro-2-methyl-4-isothiazolin-3-on and 1,2-benzisothiazolin-3-on, among various other chemicals, are used in non-oxidizing biocide production.

Stringent regulations and a growing focus on sustainable development have resulted in a constant decline in chemical production in the European Union. This factor, coupled with relatively higher prices in the EU and the U.S., has provided a competitive advantage to the Asia Pacific countries, including China, Japan, South Korea, India, and Taiwan, due to the abundant availability of raw materials and economical prices.

In terms of biocides demand from the food industry, they are largely used to control microbial contamination in food and beverages. They also find applications in disinfecting food containers, surfaces or pipes used in food logistics and more. Increasing innovations by various multinationals to expand their product portfolio, as well as minimizing hazards caused by biocides, shall lead to broader consumption of the product over the coming years.

Drivers, Opportunities & Restraints

Biocides find substantial applications in the coating and printing industry since paints and coatings are often subject to microbial attack, which eventually leads to degradation. Biocides are utilized extensively in product formulations to make paints and coatings resistant to bacteria, algae, fungi, and other microbes from growing on the painted surface.

The use of biocides in recent years has raised concerns due to adverse health effects, leading to public health scares. Various countries have adopted Chemical Ranking and Scoring (CRS) methods to manage the distribution and handling of biocides globally. CRS provides valuable information about the characteristics of different biocide products, including their toxicity and exposure risks. Many nations across significant regions are implementing policies and regulations to minimize the harmful effects of biocides.

The market presents significant opportunities driven by increasing awareness of hygiene and the need for effective infection control across various industries, including healthcare, pharmaceuticals, and food processing. Growing regulatory support for safer chemical alternatives and the rising demand for sustainable products also pave the way for innovation. Additionally, the expansion of the agricultural sector and the need for pest control further enhance the market potential for biocides. As consumer preferences shift toward eco-friendly solutions, there is a ripe environment for new product development and strategic partnerships.

Product Type Insights

“Halogen Compounds held the revenue share of over 24.6% in 2024.”

The halogen compounds segment accounted for the largest revenue market share, 24.6%, in 2024 and is expected to continue to dominate the industry over the forecast period. This is due to the use of halogens such as chlorine, fluorine, and iodine in biocide compositions. Another iodine-based compound known as iodophor enhances iodine's stability and biocidal potency. Chlorine, one of the most used halogens, is highly effective as an antibacterial and oxidizing agent, making it ideal for municipal drinking water plants and wastewater treatment facilities, among other applications.

Organosulfur is expected to grow the fastest in the region, with a CAGR of 4.7% over the forecast period. Organosulfur biocides are widely used in recirculating and evaporative water systems to prevent biofouling caused by algae or bacteria growth. A notable example of organosulfur biocide is 2-Mercaptobenzothiazole (MBT). These biocides are chlorine-free and non-oxidizing, making them ideal for non-corrosive applications such as cooling water systems. Additionally, they have significant applications in heavy engineering industries, automobiles, and air conditioning.

End Use Insights

“Water Treatment segment is anticipated to register a revenue CAGR of 5.9% over the forecast period.”

The paints and coatings segment dominated the end-use segment with a revenue market share of 26.0% during the forecast period. Paints and coatings are highly vulnerable to microbial contaminants from water and the air due to their exposure to bulk handling and storage systems. Using biocides in paints and coatings serves several important functions: preserving the dry film, preventing microbial growth, and ensuring in-can preservation. Biocides also inhibit fungal development after the paint has dried and the film has formed. They are applied during the processing of paints and coatings and in the treatment of wastewater generated during production. Therefore, applying biocides in paints and coatings is essential for manufacturers to prevent product deterioration.

Water treatment is a significant application within the biocides market. It involves biocides to prevent antifouling, film formation, and contamination by bacteria or algae in various water systems. These systems include cooling towers, pools and spas, paper manufacturing processes, municipal drinking water treatment facilities, and industrial water treatment systems. Common biocides used in these applications include hypobromous acid, sodium bromide, silver, bromine, hydrogen peroxide, stabilized bromine, chlorine tablets, calcium hypochlorite, sodium hypochlorite, quaternary ammonium compounds (QACs), Bronopol, and isothiazolinones.

Regional Insights

In North America, constantly evolving regulations and research developments among manufacturers, formulators, and end-users impact the biocides market. The U.S. sectors of water treatment, paints and coatings, and wood preservation primarily drive this market.

U.S. Biocides Market Trends

The U.S.regulations concerning water quality are stringent, supporting the use of EPA-registered biocides in water treatment plants. Some of the country's most extensive water treatment facilities include the Blue Plains Advanced Wastewater Treatment Plant. Additionally, the significant use of wood in construction across residential, commercial, and industrial sectors has contributed to the increased application of biocides for wood preservation.

“China held over 43.6% revenue share of the overall Asia Pacific Biocides market.”

Asia Pacific Biocides Market Trends

Water treatment is expected to be a prominent consumer of the product, followed by cleaning products. The heightened disinfectant production has greatly benefited cleaning products, considerably boosting the demand for cost-effective and efficient biocide active ingredients. Pulp and paper are expected to witness a rise in demand for biocides, supported by the growing high-end paper production, extensive recycling, and tighter regulations regarding effluent discharges from the pulp and paper industry.

China biocides market is the largest producer of biocides. China is one of the largest producers of freshwater fish, and this projects lucrative growth opportunities for biocides in cleaning products. A larger number of commodity chemicals, such as sodium hypochlorite, are expected to hinder the consumption of biocides in the country. China's regulations are relatively like those of the UK and the U.S. Therefore, the country projects a wider scope of potential for all biocide products.

Europe Biocides Market Trends

The European biocides market has seen significant consolidation due to the withdrawal of companies like BWA Water Treatment from the UK. High costs associated with product registration in the region have further accelerated this trend towards consolidation. Additionally, the enforcement of Biocidal Product Regulations (BPR) in Europe has impacted on the sales of biocides that are harmful to the environment or human health.

Latin America Biocides Market Trends

In South America, the growing adoption of water-based paints and coatings, known for being more environmentally friendly, is likely to drive product consumption in the paint and coatings sector. Additionally, the demand for ultra-low sulfur in the marine transportation industry is expected to contribute to market growth in fuel applications.

Middle East & Africa Biocides Market Trends

Saudi Arabia holds a significant share of the biocides market in the Middle East and Africa, mainly due to its high demand for freshwater and the presence of significant petrochemical and plastics manufacturers like SABIC. As the country pursues economic diversification, other sectors such as food and beverages, personal care, and HVAC may offer promising growth opportunities.

Key Biocides Company Insights

Some of the key players operating in the market include Troy Corporation, Neogen Corporation, and Shanghai Zhongxin Yuxiang Chemicals Co. Ltd.

-

BASF SE is a chemical production company operating through its subsidiaries and joint ventures in over 80 countries with more than 390 production sites spread across the globe. It also has 13 operating divisions and around 84 sub-business units worldwide. The company operates through six business segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions. The product portfolio of the chemical segment includes intermediates, monomers, petrochemicals, and catalysts.

-

Solvay SA is a global manufacturer of specialty chemicals and advanced materials. Advanced materials, advanced formulations, and performance chemicals are their key product categories. The company serves its products to end-use markets such as oil & gas, automotive, consumer goods, healthcare, food & feed, and electrical & electronics.

Key Biocides Companies:

The following are the leading companies in the biocides market. These companies collectively hold the largest market share and dictate industry trends.

- Troy Corporation

- Chemtreat, Inc.

- Neogen Corporation

- Finoric LLC

- Shanghai Zhongxin Yuxiang Chemicals Co. Ltd.

- Iro Group Inc.

- Hubei Jinghong Chemicals Co. Ltd.

- Wuxi Honor Shine Chemical Co. Ltd.

- Albemarle Corporation

- Lubrizol

- BASF SE

- Solvay SA

- LANXESS AG

- Lonza

Recent Developments

-

In April 2024, Solvay announced a new partnership with a leading agricultural firm to produce environmentally friendly biocides for crop protection. This collaboration aims to provide sustainable solutions that reduce the environmental impact of traditional chemical treatments.

-

In March 2024, BASF introduced a new line of biocides designed for the paint and coatings industry. These biocides offer long-lasting protection against microbial growth, enhancing coatings' durability and lifespan.

-

In March 2024, LANXESS increased its production capacity by acquiring a biocide manufacturing plant in the U.S., strengthening its presence in the North American market. This acquisition, completed in March 2024, is in line with the company's strategy to grow its Material Protection Products Division.

Biocides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,683.54 million

Revenue forecast in 2030

USD 11,882.06 million

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; and South Africa.

Key companies profiled

Troy Corporation; Chemtreat, Inc.; Neogen Corporation; Finoric LLC; Shanghai Zhongxin Yuxiang Chemicals Co. Ltd.; Iro Group Inc.; Hubei Jinghong Chemicals Co. Ltd.; Wuxi Honor Shine Chemical Co. Ltd.; Albemarle Corporation; Lubrizol; BASF SE; Solvay SA; LANXESS AG; Lonza

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biocides Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global biocides market report on the basis of product type, end use and region.

-

Product Type Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Halogen Compounds

-

Metallic Compounds

-

Organosulfur

-

Organic acids

-

Quaternary Ammonium Compounds

-

Phenolic

-

Nitrogen

-

Glutaraldehyde

-

-

End Use Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Food & Beverage

-

Personal Care

-

Wood Preservation

-

Paints & Coatings

-

Plastics

-

HVAC

-

Boilers

-

Oil & Gas

-

Fuels

-

Pulp & Paper

-

Cleaning Products

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biocides market size was estimated at USD 9,291.08 million in 2024 and is expected to reach USD 9,683.54 million in 2025.

b. The global biocides market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 11,882.06 million by 2030.

b. Asia Pacific dominated the biocides market with a share of 37.4% in 2024. This is attributable to the significant demand for paints and coatings in the automotive and construction industry in the region.

b. Some key players operating in the biocides market include Troy Corporation, Chemtreat, Inc., Neogen Corporation, Finoric LLC, Shanghai Zhongxin Yuxiang Chemicals Co Ltd, Iro Group Inc., Hubei Jinghong Chemicals Co Ltd, Wuxi Honor Shine Chemical Co Ltd, Albemarle Corporation, Lubrizol, BASF SE, Solvay SA, Lanxess AG, Lonza.

b. Key factors that are driving the biocides market growth are growing demand from applications such as disinfecting food containers, surfaces, or pipes used in food logistics, and more and also due to significant rise in the adoption of high-performance chemicals to enhance the durability, shelf-life and prevent deterioration caused by the microorganisms such as bacteria, viruses, and fungi have driven the consumption of biocides across the end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.