- Home

- »

- Renewable Chemicals

- »

-

Bio Solvents Market Size, Share And Growth Report, 2030GVR Report cover

![Bio Solvents Market Size, Share & Trends Report]()

Bio Solvents Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By End-use (Chemical Intermediates, Pharmaceuticals, Paints & Coatings, Cosmetics & Personal Care, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-324-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio Solvents Market Size & Trends

The global bio solvents market size was valued at USD 4.06 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. One of the primary drivers is the increasing environmental concerns and stringent government regulations, which are pushing industries to shift towards eco-friendly solvents. Bio solvents, being derived from renewable resources, offer a sustainable and less toxic alternative to conventional petroleum-based solvents.

The growing demand from key end-use industries such as paints and coatings, adhesives, and pharmaceuticals, seeking greener and safer solvents, is fueling the market growth. Furthermore, advancements in technology and increased R&D activities are leading to the development of high-performance bio solvents, thereby driving their adoption.

Regulations play a significant role in shaping the global bio-solvents market. In particular, the Farm Security and Rural Investment Act of the Public Law 107-171 in the U.S. and the Registration,Evaluation, Authorisation, and Restriction of Chemicals (REACH) by the European Union (EU) have made it necessary for manufacturers to use bio based materials in their manufacturing processes. These regulations are a response to the environmental and health risks posed by synthetic solvents, which can irritate the skin, eyes, and nose and release volatile organic compounds (VOCs) that are harmful to the environment.

In addition to these specific laws, general environmental regulations imposed by leading authorities in several countries, especially in Europe and North America, are driving the growth of the bio solvents market. These regulations are aimed at limiting the use of synthetic solvents, which pose serious risks to both human health and the environment. For instance, the Environmental Protection Agency (EPA) and the Department for Environment, Food and Rural Affairs (DEFRA) have imposed stringent regulations regarding the toxicity content of conventional solvents.

Products Insights

The bio-alcohol product segment dominated the market and accounted for a share of 45.6% in 2023 owing to its widespread adoption in industries such as pharmaceuticals, food and beverages, where bioethanol and biobutanol serve as sustainable alternatives to petrochemical solvents. The increasing demand for eco-friendly products, coupled with supportive government regulations promoting renewable resources, has driven the adoption of bio-alcohols. As industries focus on reducing their carbon footprints and minimizing environmental impacts, bio-alcohols are likely to maintain their leading position in the market.

The D-Limonene product segment is anticipated to grow at the fastest CAGR of 4.4% from 2024 to 2030. Derived from citrus fruits, D-Limonene is valued for its biodegradability, non-toxic nature, and pleasant aroma, making it popular in cleaning products, adhesives, and coatings. The shift towards eco-friendly and safe alternatives in industrial and consumer products, driven by increasing awareness of health and environmental impacts, is fueling its growth. Advancements in extraction technologies are also expected to enhance its competitiveness in the market.

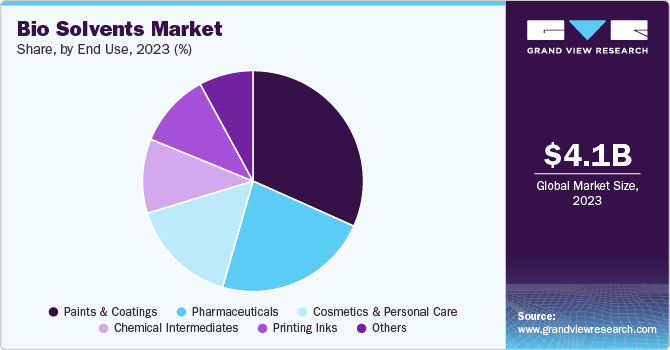

End-use Insights

The paint & coatings segment dominated the market share with 31.5% in 2023 driven by the increasing demand for environmentally friendly and sustainable solutions within the coatings industry. Manufacturers are increasingly adopting bio solvents to comply with stringent VOC regulations and to cater to the rising consumer demand for green products. The segment’s dominance is also fueled by innovations in bio solvent formulations, which have improved their compatibility with a wide range of coating materials, including waterborne and high-solids systems. These advancements not only enhance performance but also reduce the environmental footprint of the coatings, making bio solvents an attractive option for both industrial and decorative applications. The growing construction and automotive industries, coupled with the increased focus on sustainable practices, have further propelled the use of bio solvents in this segment.

The pharmaceuticals end use segment is anticipated to witness the fastest growth, with a CAGR of 4.2% from 2024 to 2030 pertaining to the industry's shift towards more sustainable and less toxic alternatives in drug formulation and production. Bio solvents offer a safer and more sustainable option for drug manufacturing processes, such as extraction, crystallization, and purification, where the purity and stability of solvents are critical. As the industry continues to innovate, with a focus on biopharmaceuticals and personalized medicine, the need for high-purity, environmentally friendly solvents is expected to grow, thereby driving demand in this segment. Regulatory bodies’ increasing support for greener alternatives, coupled with rising R&D activities in green chemistry, are also key factors contributing to the rapid growth anticipated in this segment.

Regional Insights

North America dominated the global bio solvents market in 2023 with a share of 28.4% primarily driven by the escalating demand for environmentally friendly alternatives to traditional petroleum-based solvents, catalyzed by stringent regulatory mandates. Moreover, the presence of industry leaders such as Cargill Incorporated and Stepan Company within the region positions North America as a strategic hub for bio solvent development and commercialization, fostering robust growth prospects.

U.S. Bio Solvents Market Trends

The U.S. dominated the North American market in 2023 attributed to several factors, including environmental regulations, increased consumer awareness about eco-friendly products and their health benefits, technological advancements, governmental support, expanding areas of application, and global sustainability efforts.

Canada bio solvents market is expected to grow significantly from 2024 to 2030 owing to the active encouragement for the adoption of renewable resources, which promotes sustainable practices and boosts the demand for bio solvents in various industries. In addition, increased research and development efforts aimed at enhancing product performance are making these bio solvents more cost-effective and efficient, positioning them as an ideal alternative to traditional solvents.

Europe Bio Solvents Market Trends

Europe bio solvents market is expected to grow fastest over the forecast period with a CAGR of 4.5%. This growth can be attributed to the presence of numerous manufacturing companies in the region, including Dow, BASF SE, LyondellBasell, and DuPont, among others. Moreover, the presence of substantial end-use industries, including cosmetics and food & beverage, within Europe is anticipated to drive demand for bio solvents as companies increasingly adopt sustainable practices.

The UK bio solvents market had a significant market share in Europe in 2023 attributed to the expanding applications of bio solvents in various sectors, including personal care products, inks, food processing, and others. Stringent government regulations aimed at reducing VOCs and initiatives such as achieving net-zero carbon emissions by 2050 are expected to create opportunities for the market in the country.

Asia Pacific Bio Solvents Market Trends

Asia Pacific bio solvents market is anticipated to witness significant growth driven by an increase in demand from end-use industries such as paints & coatings, cosmetics, pharmaceuticals, and industrial sectors. Furthermore, the Asia-Pacific region presents a compelling opportunity for businesses due to its low labor costs, reduced capital requirements for production facilities, and favorable market entry conditions.

India bio solvents market held the largest market share in 2023 attributed to stringent environmental policies that encourage the use of bio solvents in production processes, high consumer awareness of green products, the availability of advanced production technologies, favorable government policies towards the manufacturing of bio solvents, and increased corporate social responsibility. However, the reference to “increased end-use industries in Germany” seems misplaced in the context of India’s market and may need to be revised or clarified.

The bio solvents market in China is expected to grow at a CAGR of 4.7% from 2024 to 2030. The rapid expansion of the paint and coatings industry in China has encouraged producers to develop high-quality green and bio-based solvents for dispersing ingredients in paint formulations. These factors are fueling the demand for green/bio-based solvents in the country.

Key Bio Solvents Company Insights

Some of the key companies in the bio solvents market include ADM, POET, LLC., Corbion, Dow, and many other companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Dow Inc. is a multinational corporation based in America and operates in the material science industry with a niche for innovative products such as the bio solvents market. The markets segments in which the company is active include the bio based solvents which are as chemical solvents that are market green solutions to the petroleum base solvents, which find application in coatings adhesives’ and cleaner markets.

-

ADM is a world’s agricultural origination and processing giant with focus on sustainable processing and production of food ingredients. Thus, in the bio solvents market ADM provides a list of biodegradable solvents based on renewable resources for the application in the coatings, adhesives, and personal care segments to replace nonrenewable petroleum solvents.

Key Bio Solvents Companies:

The following are the leading companies in the bio solvents market. These companies collectively hold the largest market share and dictate industry trends.

- Stepan Company

- Tri-Chem Specialties.

- ADM

- POET, LLC.

- BASF

- CREMER OLEO GmbH & Co.

- Corbion

- Dow

- Cargill, Incorporated.

Recent Developments

-

In January 2024, Syensqo Ventures led a USD 2.1 million investment in Bioeutectics, alongside Atento Capital, SOSV, and Fen Ventures. The funding will support Bioeutectics' expansion of its biotechnology platform focused on developing renewable materials and products, such as bio solvents, for applications in the agro, industrial, food, and biopharma sectors.

-

In July 2023, Circa Group AS, the coordinator of the EU-funded ReSolute project, filed patent applications for two novel solvents designed for carbon capture processes. Developed over the past year from the project's platform molecule, levoglucosenone (LGO), the solvents, dubbed Furatech:1 and Furatech:2.

Bio Solvents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.14 billion

Revenue forecast in 2030

USD 5.21 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Belgium; Netherlands; China; India; South Korea; Vietnam; Thailand; Indonesia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Stepan Company; Tri-Chem Specialties.; ADM; POET, LLC.; BASF; CREMER OLEO GmbH & Co.; Corbion; Dow; Cargill, Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio Solvents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio solvents market report based on product, end-use, and region:

- Product Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

- Bio-alcohols

- Glycerol Derivatives

- D-Limonene

- Lactate Esters

- 2-Methyltetrahydrofuran

- Others

- End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Chemical Intermediates

- Pharmaceuticals

- Printing Inks

- Paints & Coatings

- Cosmetics & Personal Care

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Belgium

- Netherlands

- Asia Pacific

- China

- India

- South Korea

- Vietnam

- Thailand

- Indonesia

- Latin America

- Brazil

- Argentina

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- North America

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.