- Home

- »

- Plastics, Polymers & Resins

- »

-

Bio Plasticizers Market Size, Share & Growth Report, 2030GVR Report cover

![Bio Plasticizers Market Size, Share & Trends Report]()

Bio Plasticizers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Epoxidized Soybean Oil , Castor Oil-based Plasticizers), By Application (Packaging Materials, Consumer Goods, Automotive & transport), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-641-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global bio plasticizers market size was estimated at USD 3.05 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2030. Rising demand for bio-plasticizers from the global packaging industry is anticipated to boost market growth in the coming years. In addition, surging demand for bio-plasticizers for manufacturing plastics utilized across the global textile industry is anticipated to fuel consumption of bio-plasticizers in the coming years. Furthermore, sustainable practices in plastic manufacturing are expected to positively impact the economy while promoting resource efficiency, waste reduction, and pollution, and creating new opportunities for innovation and growth.

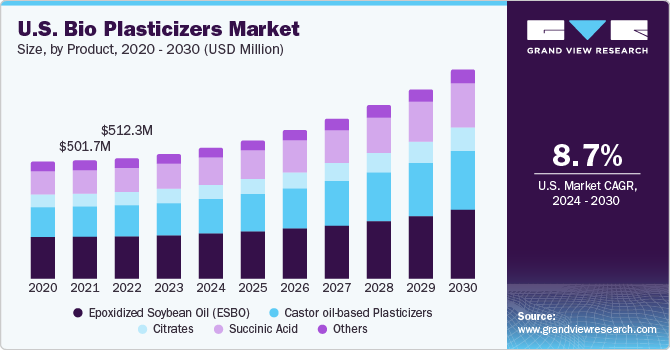

The U.S. bio plasticizers industry is expected to rise significantly over the forecast period on account of the growing demand for bio-based packaging in food and consumer goods industries. Bio plasticizer-based plastics have higher tensile strength and are eco-friendly & convenient for use when compared to conventional plastics. As a result, the demand for bio-plasticizers is further projected to propel over the forecast period. Moreover, expanding composting infrastructure and rising governmental efforts to reduce landfilling, such as the U.S. 2030 Food Loss and Waste Reduction Goal, are anticipated to augment demand for bio-based plastic bags or compostable bags used in the collection of food leftovers and other organic waste material over the forecast period.

Market Dynamics

Growing sustainability concerns from plastic manufacturers and rising demand for eco-friendly plastics across end-users are preponderance for bio plasticizers industry. Rising global concerns over climate change are increasing focal points over sustainability. Plastics are utilized across multiple industries such as packaging, healthcare, building & construction, logistics, aviation, textiles, and others, thereby increasing demand for sustainability in the long run in light of environmental and social impacts. In addition, sustainable practices in plastic manufacturing are expected to positively impact the economy while promoting resource efficiency, waste reduction, and pollution, and creating new opportunities for innovation and growth.

Bio plasticizers across packaging industry provide an environment-friendly solution and help enhance the appearance of the final product. Growing usage of bio-plasticizers in flexible packaging is expected to fuel market growth. Growing demand for food, on account of the increasing global population, is one of the key factors augmenting demand for flexible packaging. Moreover, packaged food industry in the U.S. and Europe has grown tremendously in recent years.

Product Insights

Based on product, epoxidized soybean oil (ESBO) was the largest segment in 2023 accounting for a market share of over 35.0%. Epoxidized soybean oil (ESBO) is a plasticizer made from soybean oil. Plastic materials, especially those comprising polyvinyl chloride (PVC) and being used across industries such as construction, packaging, and consumer goods, can be made more flexible and durable using ESBO.

The demand for ESBO has been propelled on account of various factors such as environmental concerns, health concerns, and regulatory requirements related to conventional plasticizers. Furthermore, ESBO demand has been positively fuelled by rising awareness of environmental and health impacts of traditional plasticizers. Hence, manufacturers are increasingly inclined toward bio-based alternatives.

Application Insights

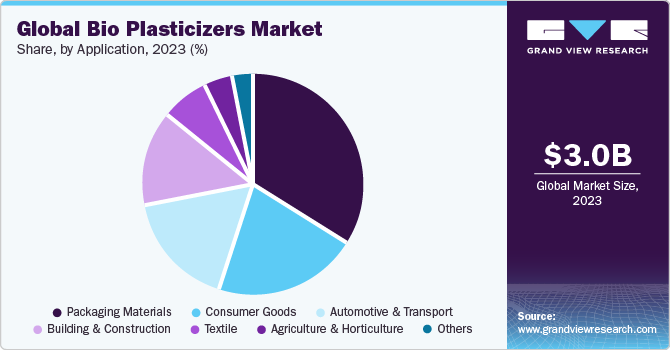

Packaging material was the largest segment of the market in 2023, which accounted for a revenue share of more than 33.0%, followed by the consumer goods segment. Bio-plasticizer-based plastics are widely used in packaging applications such as food & beverage packaging, personal care packaging, films & sheets, and household care products packaging. The increasing inclination of consumers toward sustainable packaging and rising landfill pollution issues worldwide are a few factors leading to a surge in adoption of packaging products developed from bio-plasticizers.

A strict ban on single-use plastics in many countries, such as the UK, Taiwan, New Zealand, and Zimbabwe, along with several states of the U.S. (New York, California, and Hawaii), is significantly driving the demand for bio plasticizer based plastics in packaging end-use segment. The consumer goods segment is one of the key contributors to the growth of bio plasticizer-based plastics market. Major consumer goods considered under this segment are electronic devices, household appliances, and others. Several products, such as vacuum cleaners, loudspeakers, touch-screen computer cases, and mobile cases, are made from biodegradable plastics.

Regional Insights

North America witnessed the highest market share of above 35.0% in 2023 owing to growing demand from packaging industry in countries such as the U.S., Canada, and Mexico. Rising environmental concerns and a global attempt to reduce pollution are propelling demand for bio plasticizers in packaging industry across the region. Certain key factors such as stringent government regulations and clean-up initiatives taken by the U.S. EPA, such as short-term cleanups of National Priorities List (NPL) sites, waste sites, or sites with the possibility of release of hazardous materials, are likely to drive regional demand for bio plasticizers in the coming years.

ASTM D6400 is the standard specification for plastic products falling under the category of compostable or biodegradable products, which must decompose completely in a composting setting without leaving behind any harmful residues afterward. Such government measures are further expected to augment the demand for bio plasticizers in the coming years. The U.S. bio plasticizers industry is expected to rise significantly over the forecast period on account of growing demand for bio-based packaging in food and consumer goods industries. Bio-plasticizer-based plastics have higher tensile strength and are eco-friendly & convenient for use compared to conventional plastics.

Key Companies & Market Share Insights

Research activities across bio plasticizer industry are focused on new materials, which combine several properties and are projected to gain wide acceptance in this industry in the coming years. Furthermore, strategic initiatives such as mergers & acquisitions, joint ventures, production, expansion, and others are carried out by key players across market space to maintain market competitiveness. In March 2023, OQ Chemicals introduced their new bio-based product, namely, OxBalance Isononanoic Acid, which is utilized for manufacturing of bio-based plastics. This product has been launched in line with the requirement of manufacturers for shifting towards a circular economy.

Key Bio Plasticizers Companies:

- Avient Corporation

- BASF SE

- Cargill, Incorporated

- DIC Corporation

- Dow, Inc.

- Evonik Industries AG

- LANXESS

- Solvay

- ACS Technical Products

- Emery Oleochemicals

- Matrìca S.p.A.

- Roquette Frères

- Zhejiangjiaao Enprotech Stock Co., Ltd.

- GRUPO PRINCZ IPASA

- Goldstab Organics Pvt. Ltd.

- JUNGBUNZLAUER SUISSE AG

- Valtris Specialty Chemicals

Bio Plasticizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.22 billion

Revenue forecast in 2030

USD 5.32 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

Aveint Corporation; BASF SE; Cargill, Incorporated; DIC Corporation; Dow, Inc.; Evonik Industries AG; LAXNESS; Solvay; ACS Technical Products; Emery Oleochemicals; Matrìca S.p.A.; Roquette Frères; Zhejiangjiaao Enprotech Stock Co., Ltd.; GRUPO PRINCZ IPASA; Goldstab Organics Pvt. Ltd.; JUNGBUNZLAUER SUISSE AG; Valtris Specialty Chemicals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio Plasticizers Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global bio plasticizers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Epoxidized Soybean Oil (ESBO)

-

Castor oil-based Plasticizers

-

Citrates

-

Succinic Acid

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Packaging Materials

-

Consumer Goods

-

Automotive & Transport

-

Building & Construction

-

Textile

-

Agriculture & Horticulture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio plasticizers market size was estimated at USD 3.05 billion in 2023 and is expected to reach USD 3.22 billion in 2022.

b. The global bio plasticizers market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 5.32 billion by 2030.

b. North America dominated the bio plasticizers market with a share of 35.79% in 2023. This is attributable to the growing consumption of PVC in various industries such as pharmaceuticals, automotive & transportation, and building & construction.

b. The global bio plasticizers market is dominated by presence of a large number of highly innovative players such as BASF SE, Dow, Lanxess AG, Evonik Industries Ag, Solvay, Emery Oleochemicals, Roquette Frères and Avient Corporation, and among others.

b. Environment-friendliness of bio plasticizers along with cost benefits over their synthetic or petroleum-derived counterparts is expected to drive the demand over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.