- Home

- »

- Renewable Chemicals

- »

-

Bio-based Platform Chemicals Market, Industry Report, 2033GVR Report cover

![Bio-based Platform Chemicals Market Size, Share & Trends Report]()

Bio-based Platform Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (1,3-Propanediol, Glycerol, Aspartic Acid, Lactic Acid, Succinic Acid, Fumaric Acid, Malic Acid, Glucaric Acid), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-793-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-based Platform Chemicals Market Summary

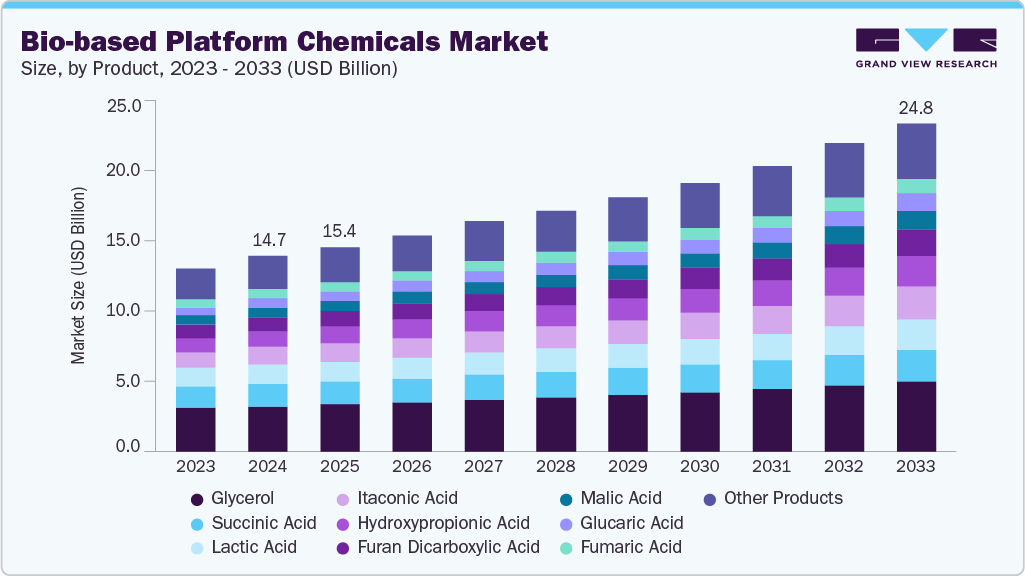

The global bio-based platform chemicals market size was estimated at USD 14.7 billion in 2024 and is projected to reach USD 24.8 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The growing demand for sustainable and eco-friendly alternatives drives interest in producing chemicals from biomass, a renewable feedstock.

Key Market Trends & Insights

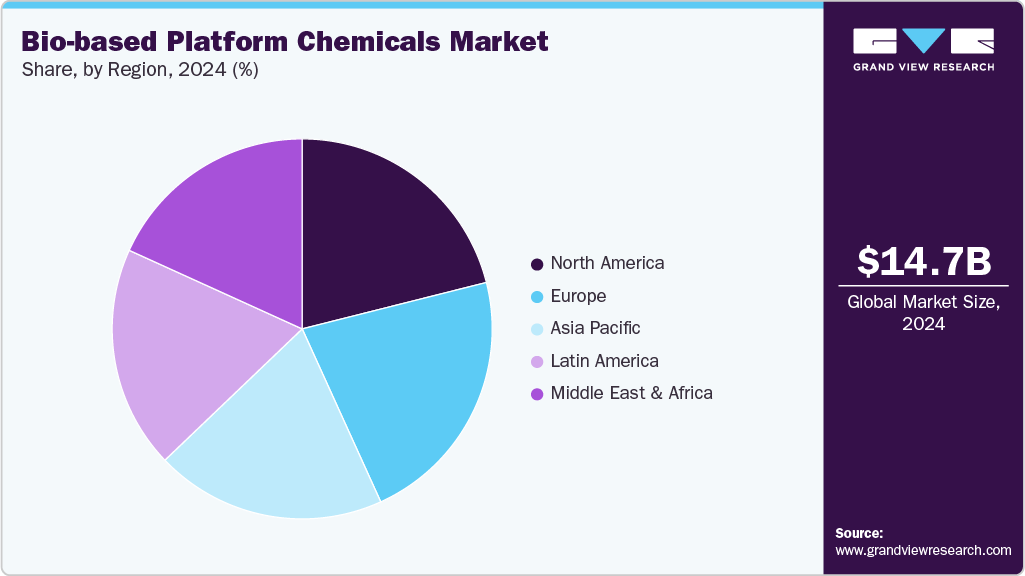

- The Asia Pacific region led the global bio-based platform chemicals market in 2024, accounting for a 33.1% share.

- The bio-based platform chemicals market in China held a substantial share of the APAC market in 2023.

- By product, the glycerol bio-based platform chemicals segment dominated with a market share of 23.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.7 Billion

- 2033 Projected Market Size: USD 24.8 Billion

- CAGR (2025-2033): 5.8%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

To compete effectively with fossil-based refineries, integrated biorefineries are increasingly being utilized to upgrade biomass using a range of feedstocks and conversion technologies. These biorefineries produce biofuels and bio-based platform chemicals, which are gaining significant traction in the global market. Key platform chemicals are in high demand due to their versatility and potential to replace a wide array of fossil-derived industrial chemicals. Their use as building blocks for a broad spectrum of downstream products underscores their growing importance in transitioning to a bio-based economy. Developing integrated biorefinery systems into the current industrial infrastructure is crucial in establishing a successful bio-based chemical industry. By advancing biorefinery technologies, it becomes possible to efficiently and cost-effectively convert biological raw materials into a wide array of bio-based products.

The transportation sector is the primary driver for advancing and implementing new biorefinery technologies. Meeting regulatory mandates for renewable energy, particularly in the short to medium term, requires significant volumes of renewable fuels. Second-generation biofuels are expected to play a key role in addressing this demand, especially for sectors like heavy-duty road transport and aviation, where alternatives to fossil fuels are limited.

Succinic acid (SA) is recognized as one of the leading platform chemicals due to its broad range of applications across multiple industries. Its molecular structure, featuring two terminal carboxylic acid groups, makes it highly versatile and suitable for conversion into numerous valuable derivatives. The biological production of SA presents a cleaner and more sustainable alternative to traditional methods, with the added benefit of helping to mitigate climate change by capturing carbon dioxide, a major greenhouse gas. This bio-based approach recycles renewable carbon from biomass (an indirect form of CO₂) and directly fixes CO₂ into SA, offering a carbon-negative production pathway that can significantly reduce atmospheric CO₂ levels. These compelling environmental and economic advantages drive a shift from fossil-based to microbial production of SA, a trend supported by several commercial-scale bio-SA facilities established in recent years.

While both conventional (e.g., ethanol, biodiesel) and advanced biofuels (e.g., lignocellulosic ethanol & methanol, butanol) are generally not economically viable under current crude oil price conditions, their market entry often depends on government mandates or financial incentives such as tax breaks. However, such support mechanisms are unlikely to sustain the market long-term. Significant cost reductions in production and the widespread adoption of comprehensive carbon pricing mechanisms will be essential to establish a viable and lasting biofuel market.

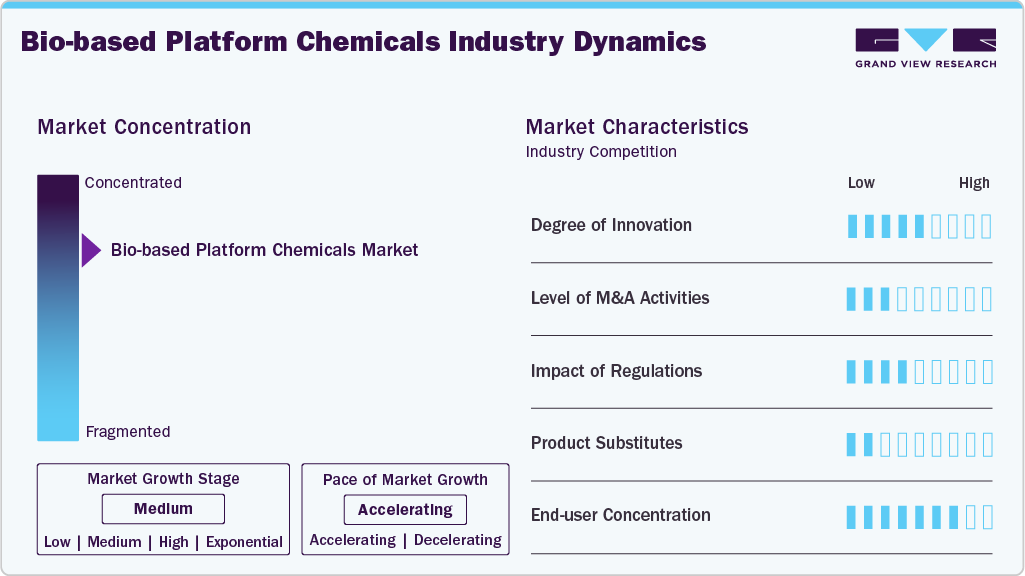

Market Concentration & Characteristics

The bio-based platform chemicals industry is moderately concentrated, with a few major, vertically integrated players holding significant market share. These companies capitalize on economies of scale, proprietary biotechnologies, and well-established global supply chains to reinforce their competitive positions. Their integration across the bio-based value chain, from feedstock sourcing and biomass processing to the production and distribution of platform chemicals, enables them to achieve cost efficiencies, maintain consistent product quality, and ensure reliable supply. This strategic integration supports their operations across various end-use sectors, including automotive, packaging, agriculture, textiles, and specialty chemicals.

At the same time, emerging producers in the Asia-Pacific and Middle East regions are strengthening their foothold in the bio-based platform chemicals industry by leveraging access to low-cost biomass feedstocks, favorable energy prices, and rising local demand. These regional players primarily target price-sensitive markets and large-volume applications such as bioplastics, biofuels, and agricultural chemicals, supported by investments in bio-refining infrastructure within industrial clusters and special economic zones. This dual trend of global consolidation by established players and regional expansion by cost-advantaged newcomers is shaping the competitive market dynamics.

However, the market also faces several challenges. These include evolving environmental regulations, competition from fossil-based alternatives with established infrastructure, and the growing pressure to ensure sustainability in bio-based production. Concerns over land use, feedstock availability, and lifecycle emissions could impact market growth. In response, companies are increasingly investing in advanced bioconversion technologies, feedstock diversification, and digital solutions to improve process efficiency, traceability, and regulatory compliance to build a more resilient and sustainable bio-based chemicals industry.

Product Insights

Glycerol bio-based platform chemicals dominated with a market share of 23.5% in 2024, due to the demand for glycerol in the pharmaceutical sector, which saw notable growth, driven by its non-toxic nature and excellent biocompatibility. Purified glycerol, achievable at up to 99% purity through complex purification and distillation processes, is widely used in pharmaceuticals due to its multifunctional properties. It enhances the texture and stability of formulations by acting as a humectant, regulating water activity, and extending product shelf life. Glycerol also plays a crucial role in medicinal products such as syrups, ointments, lozenges, and capsules, where it provides lubrication and smoothness and serves as a solvent or carrier for active ingredients. Furthermore, it is an essential component in medical-grade nitroglycerin. Its emerging uses as a lubricant and reactant in heterogeneous catalysis further expand its market potential in the pharmaceutical industry.

Aspartic acid bio-based platform chemicals are steadily growing in the market with a CAGR of 7.8% over the forecast period. Bio-based aspartic acid, an α-amino acid featuring two carboxylic acid groups and one primary amine group, holds growing market appeal due to its multifunctional chemical structure. This composition makes it valuable in protein biosynthesis and across a wide range of industrial and commercial applications. Increasing demand is observed in food, pharmaceuticals, and medical sciences, where aspartic acid is a key ingredient in formulations and therapeutic compounds. In addition, its derivatives are gaining traction in producing superabsorbent materials, urea synthesis, and, most notably, developing poly (aspartic acid), a biodegradable, cost-effective alternative used as an anti-scaling agent in water treatment systems. The compound’s renewability and low environmental footprint further support its rising demand as industries shift toward sustainable and bio-based alternatives.

Regional Insights

The Asia Pacific region led the global bio-based platform chemicals market in 2024, accounting for a 33.1% share, driven by extensive utilization across end-use sectors such as textiles, pulp and paper, water treatment, and chemical manufacturing. The region's rapid industrialization and urban expansion, particularly in countries like China and India, have spurred demand for sustainable chemical alternatives and advanced treatment technologies, reinforcing the market's strong growth trajectory. These bio-based materials provide long-term durability. It is ideal for high-performance applications, including electronics, automotive interiors and exteriors, energy-related components, and optical devices. It reflects Asia Pacific's growing role as a manufacturing hub and a technology leader in the global shift toward bio-based chemical solutions.

China Bio-based Platform Chemicals Market Trends

The bio-based platform chemicals market in China held a substantial share of the APAC market in 2024 owing to advancements in the field of bio-based platform chemicals, offering both bio-based origin and biodegradability, produced using renewable feedstocks such as sugarcane, cassava, and corn, this material decomposes naturally into carbon dioxide, water, and biomass, making it a truly compostable and environmentally friendly alternative to conventional plastics. It offers excellent printability without surface pre-treatment, making it suitable for packaging, food containers, hot beverage cups, and disposable utensils. Moreover, lactic acid is widely used in the food and beverage industry as a natural preservative and pH regulator, enhancing product safety and shelf life. It plays a key role in flavor development and is commonly found in fermented foods, beverages, and dairy products.

Europe Bio-based Platform Chemicals Market Trends

The bio-based platform chemicals market in Europe held 30.9% of the global revenue share in 2024. This can be credited to the growing use of bio-based methanol, which is gaining significant traction in this region as a renewable fuel and chemical feedstock, supporting the region's shift toward a low-carbon and circular economy. It is produced from various feedstocks such as biogas, black liquor, domestic waste, and captured CO₂. It is used as a clean-burning biofuel, a base for dimethyl ether (DME), and a versatile platform chemical for plastics and resins. Driven by EU policies like RED III and the European Green Deal, market demand for bio-methanol is growing, particularly in the marine, transport, and chemical sectors. In addition, Neste has launched the world's first large-scale renewable propane facility in Rotterdam, producing 40,000 tonnes annually from refinery side-stream gases. Marketed as BioLPG, this bio-based propane is distributed exclusively by SHV Energy across Europe, supporting the transition to cleaner, renewable fuels derived from waste, residues, and vegetable oils.

North America Bio-based Platform Chemicals Market Trends

The bio-based platform chemicals market in North America is growing steadily, with 27.6% of the arket share in 2024, owing to the adoption of ethyl lactate, a bio-based solvent derived from lactic acid, which is gaining traction in the U.S. as an environmentally friendly alternative to petroleum-based solvents and with improved fermentation and processing technologies, making it more competitive. Despite its potential to replace over 80% of conventional solvents in the 4.5 million metric tonnes U.S. solvent market, its higher boiling point and non-drop-in nature require product reformulation and industry collaboration, posing challenges to widespread adoption.

Middle East & Africa Bio-based Platform Chemicals Market Trends

The bio-based platform chemicals market in the Middle East & Africa is experiencing strong growth, primarily driven by the application and demand for bioplastics, which are gradually increasing as part of broader sustainability efforts. Bioplastics, derived from bio-based platform chemicals such as lactic acid, succinic acid, and 5-HMF, often demonstrate superior greenhouse gas (GHG) performance over fossil-based plastics. Bioplastics can undergo multiple recycling cycles before being incinerated for energy recovery. Nevertheless, as these regions seek to diversify economies and address plastic pollution, especially under Saudi Vision 2030 and African Union sustainability goals, bioplastics from renewable platform chemicals present a viable path toward greener material use and circular economy models.

Latin America Bio-based Platform Chemicals Market Trends

The bio-based platform chemicals market in Latin America is witnessing steady growth, largely driven by the application and demand for lignin-based bio-platform chemicals, which are gradually expanding, supported by developments in lignocellulosic biorefineries. Lignin, a major by-product of the pulp and paper sector, is increasingly being valorized beyond energy generation into higher-value products like resins, adhesives, dispersants, and aromatic chemicals. In addition, Brazilian companies are exploring technologies like organosolv lignin processes to isolate sulfur-free lignin with improved purity, enabling its use in composites, polymers, carbon fibers, and potentially even bio-based jet fuels. As Brazil continues to invest in advanced biorefinery infrastructure and leverages its vast biomass resources, lignin is positioned as a promising feedstock for sustainable material and chemical innovation.

Key Bio-based Platform Chemicals Company Insights

Some of the key players operating in the market include Cargill and DSM-Firmenich.

-

DSM-Firmenich, a global leader in health, nutrition, and biosciences, is a dominant and mature market player. With a broad portfolio of sustainable bio-based ingredients and solutions, DSM-Firmenich leverages decades of expertise in biotechnology to deliver advanced bio-based chemicals, including bio-based flavors, fragrances, and polymers. By integrating cutting-edge biotechnology and material science, DSM-Firmenich provides high-performance bio-based products that meet the growing demand for eco-friendly and sustainable alternatives across various industries, including food and beverage, personal care, and materials science. Through partnerships, collaborations with end-users, and its deep expertise in biotechnology, the company plays a pivotal role in shaping the future of eco-efficient, renewable chemical production. Their dedication to circularity, resource efficiency, and sustainability positions DSM-Firmenich as a key player in the growing demand for bio-based solutions.

GFBIOCHEMICALS and PTT Global Chemical Public Company Limited are emerging market participants.

-

GFBiochemicals, headquartered in Europe, is an emerging player in the bio-based platform chemicals industry, steadily expanding its presence in producing sustainable, high-value bio-based chemicals. Known for being the first company to produce levulinic acid at an industrial scale directly from biomass, GFBiochemicals is leveraging proprietary technology and process innovation to meet the growing demand for renewable, non-toxic, and biodegradable chemical alternatives across multiple industries, including agriculture, personal care, pharmaceuticals, and specialty chemicals. Traditionally focused on green chemistry and renewable feedstocks, GFBiochemicals integrates bio-based platform chemicals, such as levulinic acid and its derivatives, into various applications to support the transition from fossil-derived chemicals. The company is advancing the commercialization of next-generation bio-based solutions through strategic investments in scale-up capabilities, technology partnerships, and collaborations with downstream users. With a strong emphasis on environmental performance, regulatory compliance, and cost-effective production, GFBiochemicals offers tailored, functional bio-based ingredients that meet customers' evolving needs seeking sustainable formulations. Its focus on innovation, supply chain sustainability, and customer-centric product development positions GFBiochemicals as a nimble and forward-thinking contributor to the rapidly evolving market.

Key Bio-based Platform Chemicals Companies:

The following are the leading companies in the bio-based platform chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill

- dsm-firmenich

- GFBIOCHEMICALS

- BASF

- Mitsubishi Chemical Group Corporation.

- PTT Global Chemical Public Company Limited

- DuPont

- Tate & Lyle

- Braskem

- Evonik Industries AG

- Aktin Chemicals, Inc.

- Champlor

- LyondellBasell Industries Holdings B.V.

- NIPPON SHOKUBAI CO., LTD.

- Novozymes A/S, part of Novonesis Group

Recent Developments

-

In January 2025, Mitsubishi Chemical Group adopted plant-derived bioengineering plastic DURABIO by U.S.-based accessory brand PopSockets for its iPhone 16 cases, grips, and wallets. This highlights the rising demand for bio-based platform chemicals in consumer electronics and lifestyle products. These accessories reflect a growing preference for sustainable, high-performance materials that reduce reliance on fossil resources and lower carbon footprints.

-

In December 2024, Tate & Lyle and BioHarvest Sciences announced a strategic partnership to develop the next generation of plant-based ingredients for healthier food and beverages. The collaboration focuses on utilizing BioHarvest's proprietary Botanical Synthesis platform, which produces non-GMO, sustainable plant-derived molecules. This innovative process allows for producing plant-based ingredients without growing the entire plant, thus reducing land and water usage. This partnership highlights the accelerating demand for bio-based ingredients in the food industry, driven by consumer preferences for more natural, plant-derived options that address sustainability challenges.

-

In September 2024, Lygos’ partnership with CJ BIO highlights growing market demand for bio-based specialty chemicals, including bio-based aspartic acid. While the initial focus of the Fort Dodge biorefinery complex is on commercial production of Soltellus biodegradable polymers and Ecoteria malonates (up to 40,000 MT/year, expandable to 100,000 MT/year), the agreement includes plans to expand production to bio-based aspartic acid. This planned expansion indicates a strategic response to increasing market interest in sustainable alternatives to petroleum-derived chemicals.

Bio-based Platform Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.4 billion

Revenue forecast in 2033

USD 24.8 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; Italy; France, Spain, China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Cargill; dsm-Firmenich; GFBIOCHEMICALS; BASF; Mitsubishi Chemical Group Corporation; PTT Global Chemical Public Company Limited; DuPont; Tate & Lyle; Braskem; Evonik Industries AG; Aktin Chemicals, Inc.; Champlor; LyondellBasell Industries Holdings B.V.; NIPPON SHOKUBAI CO., LTD.; Novozymes A/S, part of Novonesis Group

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-based Platform Chemicals Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global bio-based platform chemicals market report based on product and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Succinic Acid

-

Malic Acid

-

Hydroxypropionic Acid

-

Glucaric Acid

-

1,3-Propanediol (PDO)

-

1,5-Pentanediamine

-

Furan Dicarboxylic acid

-

Glycerol

-

Aspartic Acid

-

Itaconic Acid

-

Lactic Acid

-

Fumaric Acid

-

1,3-Butanediol

-

1,4-Butanediol

-

Farnesene

-

Isobutanol

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-based platform chemicals market size was estimated at USD 14.7 billion in 2024 and is expected to reach USD 15.4 billion in 2025.

b. The bio-based platform chemicals market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 24.8 billion by 2033.

b. The glycerol-based segment led the market and accounted for the largest revenue share of 23.5% in 2024, due to the demand for glycerol in the pharmaceutical sector seen notable growth, driven by its non-toxic nature and excellent biocompatibility.

b. Some of the key players operating in the bio-based platform chemicals market include Cargill, dsm-firmenich, GFBIOCHEMICALS, BASF, Mitsubishi Chemical Group Corporation, PTT Global Chemical Public Company Limited, DuPont, Tate & Lyle, Braskem, Evonik Industries AG, Aktin Chemicals,Inc., Champlor, LyondellBasell Industries Holdings B.V., NIPPON SHOKUBAI CO., LTD. and Novozymes A/S, part of Novonesis Group.

b. The growth is attributed to bio-based platform chemicals’s growing demand for sustainable and eco-friendly alternatives, which drives interest in producing chemicals from biomass, a renewable feedstock.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.