- Home

- »

- Power Generation & Storage

- »

-

Battery Electrolyte Market Size, Share & Growth Report 2030GVR Report cover

![Battery Electrolyte Market Size, Share & Trends Report]()

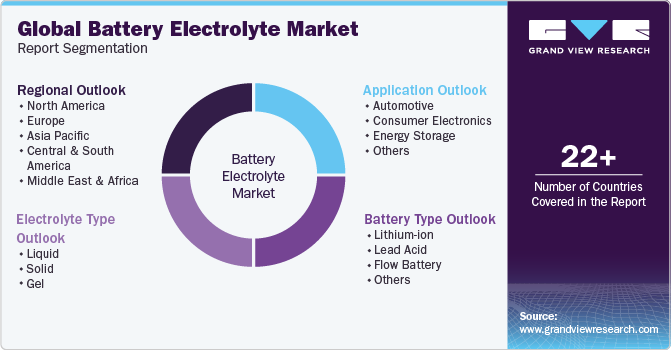

Battery Electrolyte Market (2024 - 2030) Size, Share & Trends Analysis Report By Electrolyte Type (Liquid, Solid, Gel), By Battery Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-259-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Electrolyte Market Summary

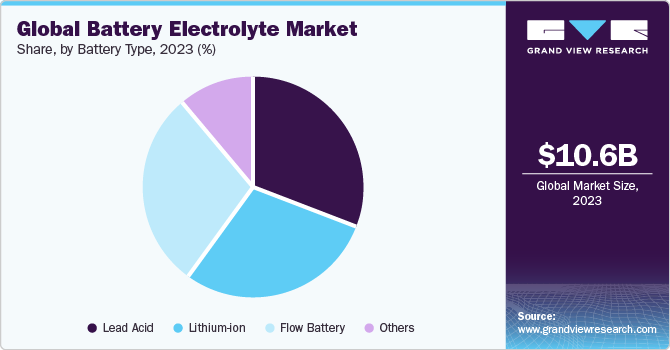

The global battery electrolyte market size was estimated at USD 10.64 billion in 2023 and is projected to reach USD 25.36 billion by 2030, growing at a CAGR of 13.1% from 2024 to 2030. The demand for batteries is expected to increase significantly due to the high adoption in the e-mobility industry.

Key Market Trends & Insights

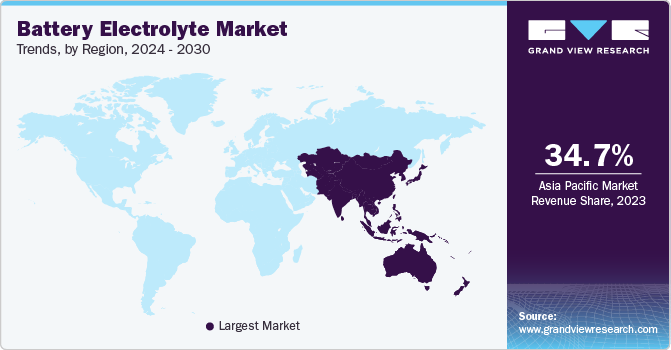

- Asia Pacific dominated the global battery electrolyte market with the largest revenue share of 34.7% in 2023.

- By electrolyte type, the gel segment led the market with the largest revenue share of 42.3% in 2023.

- By battery type, the lead acid segment led the market with the largest revenue share of 34.3% in 2023.

- By application, the energy storage segment is projected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 10.64 Billion

- 2030 Projected Market Size: USD 25.36 Billion

- CAGR (2024–2030): 13.1%

- Asia Pacific: Largest market in 2023

Many battery manufacturers strive to leave the smallest possible environmental footprint. This necessitates the careful sourcing of valuable raw materials, the use of clean energy to power the production of battery cells, and the integration of circular systems into the manufacturing processes.

The market is expected to witness substantial growth over the forecast period, considering the growing demand for high-power range systems. The increasing trend towards the adoption of UPS systems as an essential power backup device is expected to favorably impact the market growth over the coming years.

Strong manufacturing base and rapid growth of automotive industry in the U.S. are expected to augment the demand for vehicle production and this is expected to propel battery manufacturing in the country which is expected propel demand for battery electrolyte in near future BMW, an automotive manufacturer, announced to expand its plant production capacity in Spartanburg, U.S. This capacity addition is expected to increase the number of automobiles manufactured and fuel the demand for lead acid batteries. The growing demand for vehicles in the U.S. is expected to fuel the market growth over the forecast period. The growing demand for electric vehicles in the U.S. on account of rising government efforts to reduce the carbon footprint by deploying eco-friendly products, is expected to augment the market growth in coming years.

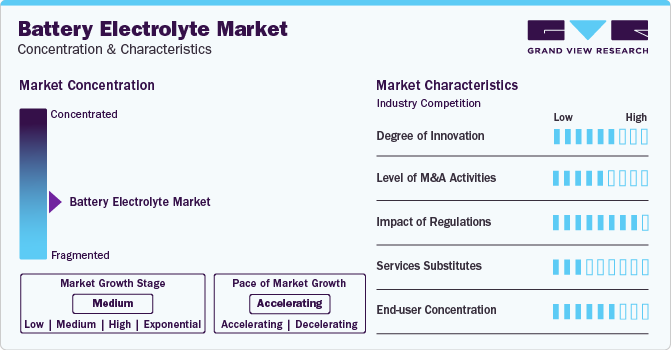

Market Concentration & Characteristics

The market is driven by growing adoption of electric vehicles and rising demand for energy storage systems with adoption of renewable energy. High penetration of vehicles in various countries including Mexico, Germany, the U.S., China, and India will augment industry expansion. Rising disposable income coupled with increasing penetration of market players including Exide Technologies and Johnson Controls will propel market growth over the forecast period.

Industrial power including chemical, shipping, metal, and mining was the largest application for batteries owing to rapid industrialization. The large manufacturing base of chemical companies along with the presence of large giants including Bayer, BASF, Dow Chemical, and AkzoNobel will increase industry penetration over the forecast period. Moreover, the presence of large steel manufacturers including Hebei Iron & Steel Group, Baosteel Group Corp., WISCO, Jiangsu Shagang Group, Shougang Group, Anshan Iron & Steel Group, Shandong Iron & Steel Group, Maanshan Iron & Steel Co., Bohai Iron & Steel Group, and Valin Group is anticipated to further aid market penetration.

Electrolyte Type Insights

Based on electrolyte type, the market is segmented into liquid, solid, and gel. The gel segment led the market with the largest revenue share of 42.3% in 2023. The demand for gel electrolytes, particularly Gel Polymer Electrolytes (GPEs), is increasing due to their potential in advanced high-energy-density and safe rechargeable solid-state batteries, These GPEs offer advantages in enhancing the performance of batteries, making them suitable for high-performance applications. The innovative applications and continuous improvements in gel electrolytes underscore a growing demand for these advanced materials in the energy storage sector.

The solid segment emerged as the fastest-growing segment in the market. The demand for solid electrolytes is projected to surge in the coming years, fueled by their potential to revolutionize battery technology. This growth is driven by their use in next-generation solid-state batteries, which offer significant advantages over traditional lithium-ion batteries. These include improved safety due to the elimination of flammable liquid electrolytes, faster charging times, and longer lifespans, making them ideal for applications like electric vehicles and consumer electronics.

Battery Type Insights

Based on battery type, the market is segmented into lithium-ion, lead acid, flow battery, and others. The lead acid segment led the market with the largest revenue share of 34.3% in 2023, owing to the flourishing telecom sector and increased automobile sales. The rising subscriber base and the impending rollout of 5G services are driving the need for backup lead-acid batteries in the across globe. Lead acid batteries comprise a positive electrode or anode that is manufactured by the use of materials such as lead-antimony and lead-calcium alloys. For better shelf life and long-lasting battery performance, lead-calcium alloys are generally preferred. This battery consists of a pure lead-based negative electrode. Both electrodes are immersed in an electrolytic solution of sulfuric acid.

The lithium-ion batteries emerged as the fastest growing segment with a CAGR of 16.4%.over the forecast period. The demand for lithium-ion batteries is driven by various factors, including the growing electric vehicle (EV) market and the need for energy storage solutions. The global demand for lithium-ion battery cells is forecast to increase from approximately 700 gigawatt-hours in 2022 to 4,700 gigawatt-hours by 2030.

Application Insights

Based on application, the market is segmented into consumer electronics, automotive, energy storage, and others. The automotive segment led the market with the largest revenue share of 30.7% in 2023, due to the rise in environmental concerns regarding the harmful impact of carbon emissions from vehicles owing to the use of fossil fuels has increased research & development activities related to electric vehicles equipped with lithium-ion batteries. Incentives and subsidies given by governments of different countries to encourage consumers to opt for electric vehicles have considerably brought down the prices. The easy availability of publicly accessible electric charging booths for these vehicles has also increased their popularity, particularly in Europe and North America. These factors are expected to contribute to market growth in the automotive end-use segment over the forecast period.

The energy storage emerged as the fastest growing segment with CAGR of 14.3% over the forecast period, owing to the rise in environmental concerns regarding high-volume carbon emissions from the global marine industry, shipbuilding companies have started developing electricity-powered ships. These ships utilize battery energy storage systems to optimize the use of available electrical energy for propulsion. Thus, the surged usage of energy storage systems in various industries worldwide is expected to fuel the growth of lithium-ion batteries in the energy storage application segment over the forecast period.

Regional Insights

The battery electrolyte market in North America is anticipated to grow at the fastest CAGR during the forecast period. The growing number of battery manufacturers such as Exide, Johnson Controls, and Odyssey in the U.S. are expected to promote market growth over the forecast period. The growing demand for electric vehicles in the U.S. and Mexico, on account of rising government efforts to reduce the carbon footprint by deploying eco-friendly products, is expected to augment the market growth in coming years.

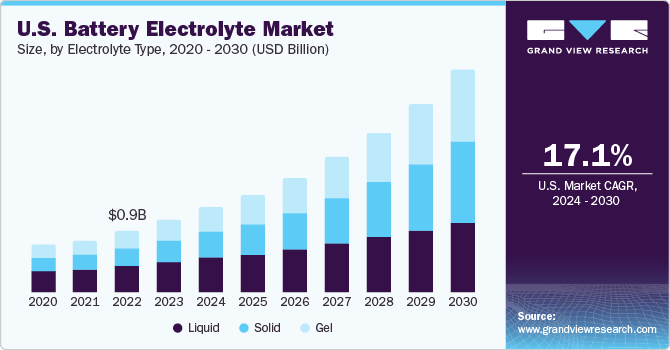

U.S. Battery Electrolyte Market Trends

The battery electrolyte market in U.S. accounted for largest revenue share of 63.7% in North America. Increasing sales of electric vehicles in the U.S., owing to supportive federal policies coupled with the presence of market players in the country, are expected to drive the demand for batteries in the U.S. over the forecast period. The federal policies include the American Recovery and Reinvestment Act of 2009, which offers tax credits to consumers for purchasing electric vehicles. The new Corporate Average Fuel Economy standards (CAFE) mandate the fuel economy of passenger cars and light commercial vehicles plying on roads in the U.S., resulting in the surged adoption of electric vehicles in the country in turn propelling the market growth in the country.

The Canada battery electrolyte market is expected to grow at significant CAGR of 17.5% during the forecast period, owing the growing demand for vehicle charging infrastructure and the installation of renewable energy systems are expected to stimulate market growth. The high demand for telecom towers coupled with ongoing innovations to reduce the cost of lithium-ion batteries is expected to spur market growth. Subsidies and a favorable regulatory framework are anticipated to drive market growth over the forecast period.

Asia Pacific Battery Electrolyte Market Trends

The Asia Pacific dominated the battery electrolyte market with the revenue share of 34.7% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The robust manufacturing base of batteries in China, Japan, and India along with the commitment of governments toward infrastructure development is expected to drive the market growth. Further, the growing FMCG companies in India, China, and Singapore are expected to augment the demand for batteries, thereby driving the market growth over the forecast period. In addition, rapid industrialization, increasing government infrastructure spending, and increasing FDIs are expected to promote market growth.

The China battery electrolyte market accounted for largest revenue share of 55.5% in Asia Pacific in 2023. According to the China Association of Automobile Manufacturers (AMMA), the use of electric vehicles is steadily rising in the country. China was the world's largest market for electric vehicles in 2023 and this trend is anticipated to continue, thereby driving the market growth over the forecast period.

The battery electrolyte market in Japan is also expected to grow at the fastest CAGR of 12.3% during the forecast period. In Japan, lithium-ion batteries are used increasingly as they can be charged at a fast rate and have a longer lifespan than other types of batteries. The presence of companies such as Vehicle Energy Japan Inc.; KAYO Battery (Shenzhen) Company Limited; and Mitsubishi Corporation in Japan is anticipated to contribute to the market growth of the lithium-ion battery market in the country over the forecast period.

Europe Battery Electrolyte Market Trends

The battery electrolyte market in Europe is experiencing significant demand driven by the region's increasing adoption of energy storage systems, electric vehicles, and consumer electronics. The market is witnessing substantial growth, particularly in the lithium-ion battery segment, which is expected to dominate due to its wide range of applications. Europe has seen a surge in battery usage, from energy storage systems to electric vehicles, with lithium-ion batteries projected to be the leading battery type in the region

The Germany battery electrolyte market accounted for largest revenue share of 18.6% in Europe in 2023, owing to the increasing use of lithium-ion batteries in energy storage systems, electric vehicles, and consumer electronics. Germany is the world’s leading market for energy storage systems as well as the development of renewable energies. Approximately 33% of the electricity consumed in Germany is derived from renewables and this share is expected to reach 80% by 2050. This is expected to create growth opportunities for battery manufacturers in the country over the forecast period.

The battery electrolyte market in UK is expected to grow at a significant CAGR of 17.7%.over the forecast period. Factors such as the policy measures focusing on incentivizing the uptake of EVs, investments in national electric vehicle technology innovation, and development of charging infrastructure are expected to fuel the demand for electric vehicles. Thus, the policies aimed at promoting the growth of electric vehicles are expected to fuel the demand for lithium-ion batteries over the coming years.

Central & South America Battery Electrolyte Market Trends

The battery electrolyte market in Central & South America is anticipated to grow at the fastest CAGR during the forecast period. The market growth is driven by the increasing demand for consumer electronics and the emergence of dominant battery material suppliers in the region. Brazil is expected to dominate the market due to the high demand for consumer electronics and the increasing deployment of electric vehicles.

The Brazil battery electrolyte market accounted for largest revenue share of 27.5% in Central & South America in 2023.Brazil has witnessed a preference shift toward ethanol, which is obtained from sugar beet, as an alternative to diesel and gasoline. Currently, the electric vehicle market lags in the country as a result of a low number of potential buyers and the lack of availability of charging infrastructure. However, the government of Brazil is taking various initiatives to support the electric vehicle market by exempting annual car ownership tax and import tax on electric vehicles. This is expected to fuel the demand for market growth in the country over the coming years.

Middle East & Africa Battery Electrolyte Market Trends

The battery electrolyte market in Middle East and Africa is expected to grow at a significant CAGR during the forecast period, owing to the region's increasing need for energy storage solutions, the rise in renewable energy projects, the growing adoption of electric vehicles (EVs), and supportive government initiatives promoting sustainable energy practices.

The UAE battery electrolyte market accounted for the largest revenue share of 37.5% in Middle East & Africa in 2023. Rapid industrialization coupled with improving infrastructure in the UAE is expected to positively impact product demand. Growing construction sector due to economic recovery, advanced real estate regulatory framework, and increasing infrastructure projects is expected to drive the demand for lithium-ion batteries for power backup solutions. In turn, propelling demand for market over forecast period.

Key Battery Electrolyte Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new Electrolyte Type development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In January 2024, Australian Vanadium (AVL) announced development of flow battery electrolyte plant in Wangara, Western Australia. AVL aims to achieve 33MWh of annual production

-

In October 2023, Toyota and Idemitsu announced collaboration to produce sulfide solid electrolytes for EVs

-

In April 2023, Neogen Chemicals and MU Ionic Solutions announced partnership for manufacturing of electrolytes for EV batteries in India

Key Battery Electrolyte Companies:

The following are the leading companies in the battery electrolyte market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Co.

- UBE Industries Ltd

- Guangzhou Tinci Materials Technology Co. Ltd

- Mitsubishi Chemical Holdings Corporation

- Targray Industries Inc

- NOHMs Technologies Inc.

- Shenzhen Capchem Technology Co. Ltd

- Mitsui Chemicals Inc.

- NEI Corporation

Battery Electrolyte Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.12 billion

Revenue forecast in 2030

USD 25.36 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Electrolyte type, battery type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; Hungary; China; Japan; South Korea; Australia; India; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

3M Co.; UBE Industries Ltd; Guangzhou Tinci Materials Technology Co. Ltd; Mitsubishi Chemical Holdings Corporation; Targray Industries Inc.; NOHMs Technologies Inc.; Shenzhen Capchem Technology Co. Ltd; Mitsui Chemicals Inc.

NEI Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Electrolyte Market Report Segmentation

This report forecasts revenue, capacity, and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the battery electrolyte market report based on electrolyte type, battery type, application, and region:

-

Electrolyte Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Solid

-

Gel

-

-

Battery Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Lead Acid

-

Flow Battery

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Energy Storage

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global battery electrolyte market size was estimated at USD 10.64 billion in 2023 and is expected to reach USD 12.12 billion in 2024.

b. The global battery electrolyte market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 25.36 billion by 2030.

b. Based on Electrolyte Type, the Proton exchange membrane fuel cell (PEMFC) was the dominant segment in 2023, with a share of about 60.0% in 2023. This is attributable to the more durable than other Electrolyte Type types. In addition, it provides advantages such as low weight and volume as compared with other available fuel cell types.

b. Some of the key players operating in this industry include Fuel Cell Energy, Inc., Ballard Battery Type Systems, SFC Energy AG, Nedstack Fuel Cell Electrolyte Type B.V., Bloom Energy, Doosan Fuel Cell America, Inc., Ceres Battery Type Holdings Plc, Plug Battery Type, Inc., Nuvera Fuel Cells, LLC.

b. The rise in demand for unconventional energy sources is one of the key factors fostering market growth. Fuel cells are one of the fastest-growing alternative Battery Type storage and backup solutions, primarily due to their ability to generate electricity using a variety of fuels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.