- Home

- »

- Homecare & Decor

- »

-

Bathroom Accessories Market Size, Industry Report, 2030GVR Report cover

![Bathroom Accessories Market Size, Share & Trends Report]()

Bathroom Accessories Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Towel Rack/Ring, Hook, Paper Holder, Grab Bars), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-418-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bathroom Accessories Market Summary

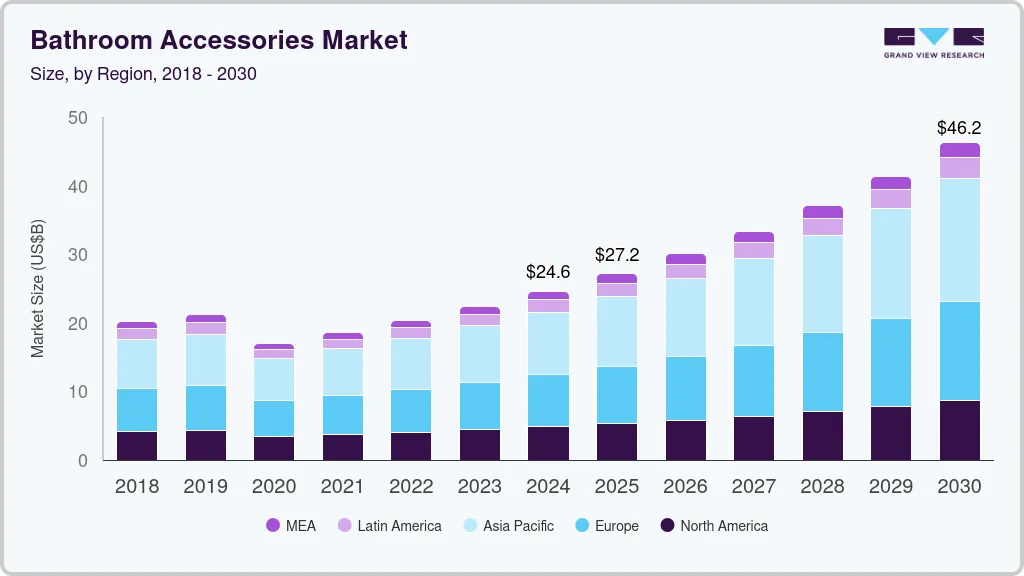

The global bathroom accessories market size was estimated at USD 24,603.5 million in 2024 and is projected to reach USD 46,234.4 million by 2030, growing at a CAGR of 11.2% from 2025 to 2030. The rapid urbanization and increasing construction activities worldwide are boosting demand for new residential and commercial properties, which in turn drives the need for bathroom accessories.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, towel rack/ring accounted for a revenue of USD 10,356.3 million in 2024.

- Grab Bars is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 24,603.5 Million

- 2030 Projected Market Size: USD 46,234.4 Million

- CAGR (2025-2030): 11.2%

- Asia Pacific: Largest market in 2024

Additionally, rising disposable incomes and changing consumer lifestyles, particularly in emerging markets such as China and India, are encouraging more spending on home improvement and renovation projects. The growing emphasis on home decor and personalization of living spaces also plays a crucial role, as consumers seek to enhance the functionality and aesthetics of their bathrooms. Furthermore, the trend towards sustainability and eco-friendly products is influencing consumer preferences, with a rising demand for water-saving fixtures and environmentally responsible materials.

In January 2025, Hansgrohe Group presented its latest innovations at ISH 2025 in Frankfurt, highlighting sustainable water technologies and a new bathroom. With brands AXOR and Hansgrohe, the group aims to inspire with pioneering developments and innovative designs. The exhibition is expected to take place in March 2025 and will feature the "Sustainable Living" area, demonstrating water-saving solutions. AXOR is expected to introduce the new overhead shower collection by Antonio Citterio, while Hansgrohe is expected to unveil innovations in showers, washbasins, and toilets. The event includes product tours, expert discussions, and a special "Innovation Hour," highlighting the latest advancements in shower technology.

Consumer Survey & Insights

The report from Fixr.com reveals a robust demand for bathroom remodels in 2023, with 71% of surveyed top interior designers noting an increased willingness among homeowners to invest in such projects. Despite rising living costs, the desire for home improvements remains strong. In 2023, experts expected a focus on enhancing the aesthetics and functionality of bathrooms, as highlighted by 52% of design professionals. This trend surpassed the drive to increase home value or the necessity for renovations, indicating that homeowners are eager to make their spaces visually appealing and practical. While 48% of experts believe that boosting home value motivates renovations, more people are opting to enhance their existing homes rather than relocate in the current housing market environment.

Ferguson's survey of over 1,099 U.S. consumers highlights current home renovation preferences, focusing on kitchens, bathrooms, lighting, and laundry products. It serves as a guide for making informed renovation decisions to ensure investments are on-trend and add value. The findings suggest that people increasingly view their homes as dynamic spaces evolving with them over time. Preference scales indicate a trend toward flexible options, offering a wide range of choices from quick, easy updates to extensive renovations for enhancing and customizing living spaces.

The survey also mentions 65% of respondents prefer a standard bathroom design with a separate enclosed shower over a wet bath design, which features an open walk-in shower. This indicates that traditional bathroom layouts remain popular among homeowners, despite the growing trend of wet baths. While opting for a standard bathroom design may appeal to a broader market, those looking to stand out in the real estate market might consider the more modern wet bath. When it comes to bathroom fixtures soaking tubs emerged as the clear favorite for bathtubs among homeowners.

Product Insights

Towel rack/ring sales accounted for a revenue share of 38.6% in 2024. The increasing demand for stylish and functional bathroom accessories in residential and commercial spaces played a significant role. The growing focus on home improvement and renovation projects, especially in developing countries contributed to the segment's growth. The rising awareness and preference for water-efficient and eco-friendly products further fueled the demand for towel racks and rings.

Furthermore, the rapid urbanization and increasing disposable income in emerging economies encouraged consumers to invest in premium bathroom accessories. In addition, a growing number of product launches is further contributing to market growth. In September 2024, Swadling Brassware, Matki's sister brand, launched the Illustrious Collection, an art deco-inspired range of bathroom accessories. The collection includes towel rails, glass shelving, a toilet roll holder, and more.

Grab bar sales among other bathroom accessories are expected to grow at the fastest CAGR of 13.5% over the forecast period. This growth is attributed to several factors, including the increasing focus on safety and accessibility in bathrooms, especially for older people and individuals with disabilities. Additionally, the rising awareness about the importance of bathroom safety, the growing number of home renovation projects, and rapid innovations are contributing to the demand for bars.

For instance, in July 2024, Gerber Plumbing Fixtures introduced its latest ADA-compliant products: the SteadyStyle Accented Round ADA Grab Bar/Slide Bar Kit and the Octette 8-Function Handshower . Together, these products offer an innovative and practical solution for aging in place. The SteadyStyle Grab Bar not only enhances safety but also adds a decorative touch, marking Gerber's entry into the Decorative Grab Bar category.

Application Insights

The demand for bathroom accessories in residential applications accounted for a revenue share of 64.7% in 2024. The rising disposable income in many regions has enabled consumers to spend more on enhancing their living spaces. The growing awareness of the importance of a well-designed bathroom, coupled with the influence of social media and online platforms showcasing the latest trends, has also contributed to the segment's growth.

Furthermore, the trend towards water-efficient and eco-friendly products has encouraged homeowners to upgrade their bathroom fittings. Lastly, the rapid urbanization in developing countries has resulted in a higher demand for premium bathroom accessories in residential spaces.

The demand for bathroom accessories in commercial applications is expected to grow at the CAGR of 11.8% from 2025 to 2030. This growth is attributed to the increasing emphasis on creating safe and accessible environments in public and commercial spaces, which drives the demand for bathroom accessories such as grab bars and handrails. Additionally, the rising standards for hygiene and cleanliness in commercial settings, such as hotels, restaurants, and healthcare facilities, are contributing to the growth. The growing construction and renovation activities in commercial buildings also play a significant role. Lastly, the trend towards luxury and high-end finishes in commercial bathrooms is encouraging the adoption of premium bathroom accessories.

For instance, in April 2024, Kruger Products launched the Cashmere UltraLuxe Bathroom Guide, an exclusive rating system for Toronto restaurant bathrooms. The guide evaluates bathrooms based on criteria such as lighting, amenities, and comfort. Restaurants can earn 1 to 3 Fleurs, inspired by the bathroom tissue's embossing pattern. The inaugural inductees include DaNico (3 Fleurs), Piano Piano (2 Fleurs), and And/Ore (2 Fleurs). The guide aims to enhance the dining experience by recognizing exceptional bathroom facilities, reflecting Kruger's commitment to luxurious customer experiences.

Regional Insights

Asia Pacific bathroom accessories industry dominated the global market with the largest revenue share of 37.0% in 2024. This growth is attributed to several factors, including the rapid urbanization and economic growth in countries such as China and India. The increasing disposable income and the growing middle class in these regions have led to higher spending on home improvement and renovation projects. Additionally, the rising standards of living and the emphasis on modern, stylish bathroom fittings have contributed to market growth.

In October 2024, Kohler Co. launched its first-ever Studio Kohler in India, located in Banjara Hills, Hyderabad. The space aims to inspire architects, designers, and consumers with exceptional products and innovative bathroom designs. David Kohler, CEO of Kohler Co., and Salil Sadanandan, President of K&B South Asia & Asia Pacific, highlighted the company's commitment to design excellence and innovation. The launch event featured esteemed architects and an interactive zone for experiencing Kohler's products and heritage of colors and finishes

North America Bathroom Accessories Market Trends

The bathroom accessories market in North America held a considerable share of 19.64% in 2024. The growth is attributed to the high standards of living and the emphasis on home improvement and renovation projects in the region. The increasing disposable income and the growing trend towards modern, stylish bathroom fittings have also contributed to the market's growth. Additionally, the focus on water-efficient and eco-friendly products has driven consumer demand for premium bathroom accessories.

In October 2024, Brondell launched its Nebia Yuba Showerhead collection, featuring patented Nebia spray technology. The Yuba range offers high-performance, water-saving showers at an affordable price, providing up to 40% more water savings than standard showerheads and 75% more force compared to EPA WaterSense specifications. Brondell aims to deliver sustainable, high-quality showering experiences.

Bathroom accessories market in the U.S. is expected to grow at a CAGR of 10.0% from 2025 to 2030. The high standards of living and the emphasis on home improvement and renovation projects have led to increased consumer spending on stylish and functional bathroom fittings. The growing trend towards water-efficient and eco-friendly products is also a significant driver, as consumers become more environmentally conscious. Additionally, the influence of social media and online platforms showcasing the latest trends has encouraged homeowners to invest in modern bathroom accessories. The rising disposable income and the focus on creating luxurious and comfortable living spaces have further fueled market growth.

Europe Bathroom Accessories Market Trends

Europe bathroom accessories industry is expected to grow at a significant CAGR of 11.3% over the forecast period. The increasing focus on home improvement and renovation projects, especially in countries with aging infrastructure, has driven demand for new and stylish bathroom fittings. The growing awareness of water conservation and the preference for eco-friendly products have also played a crucial role. Additionally, the rising disposable income and the trend towards luxury and high-end finishes in bathrooms have encouraged consumers to invest in premium bathroom accessories.

In July 2024, Heritage Bathrooms, part of the Bristan Group, launched an exclusive capsule collection in 70 B&Q stores and online at diy.com. The collection includes taps, showers, baths, toilets, vanity units, and accessories in contemporary and timeless designs. Notable products are the Oxted Freestanding Bath, Upperton sanitaryware, and Winterbourne storage units.

Key Bathroom Accessories Company Insights

The bathroom accessories industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the bathroom accessories market include LIXIL Corporation, TOTO Ltd., Kohler Co., Roca Sanitario S.A.U., Moen Incorporated, and others.

- TOTO Ltd. is renowned for its luxurious and innovative bathroom products. TOTO is known for its advanced technology, such as the Neorest toilets and the Tornado flush system, which provide exceptional performance and comfort.

Key Bathroom Accessories Companies:

The following are the leading companies in the bathroom accessories market. These companies collectively hold the largest market share and dictate industry trends.

- LIXIL Corporation

- TOTO Ltd.

- Kohler Co.

- Roca Sanitario S.A.U.

- Moen Incorporated

- Hansgrohe

- Gerber Plumbing Fixtures Llc

- Monarch Bath Pvt. Ltd.

- Bolina Holding Co Ltd

- American Specialties, Inc.

Recent Developments

-

In February 2024, Villeroy & Boch has acquired Ideal Standard. Ideal Standard's strengths in regional presence, sales strategies, and product portfolios enhance the group's competitiveness. The acquisition aims to expand the core business, increase international presence, and foster a strong cultural fit, ensuring resilience and future growth in a challenging market environment.

Bathroom Accessories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.16 billion

Revenue forecast in 2030

USD 46.23 billion

Growth Rate

CAGR of 11.2% from 2025 to 2030

Actuals

2018 - 2024

Forecast

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

LIXIL Corporation; TOTO Ltd.; Kohler Co.; Roca Sanitario S.A.U.; Moen Incorporated; Hansgrohe; Gerber Plumbing Fixtures Llc; Monarch Bath Pvt. Ltd.; Bolina Holding Co Ltd; American Specialties, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bathroom Accessories Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bathroom accessories market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Towel Rack/Ring

-

Hook

-

Paper Holder

-

Grab Bars

-

Others (Toilet Brush Hold)

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bathroom accessories market size was estimated at USD 24.60 billion in 2024 and is expected to reach USD 27.16 billion in 2025.

b. The global bathroom accessories market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 46.23 billion by 2030.

b. Asia Pacific dominated the bathroom accessories market with a share of 37.04% in 2024. This is attributable to economic reopening measures by developing countries that have led to the construction industry’s gradual recovery, which in turn, is contributing to the stabilizing of demand for materials.

b. Some key players operating in the bathroom accessories market include LIXIL Group Corporation, TOTO Ltd., Kohler Co., Roca Sanitario, S.A., Moen Incorporated, Hansgrohe Group, Gerber Plumbing Fixtures LLC, Monarch Bath Pvt. Ltd., Bolina Holding Co., Ltd., ASI American Specialties, Inc., and others.

b. Key factors that are driving the market growth include rising instances of home remodeling projects across countries is revamping the growth of the overall bathroom accessories market. With rising home prices, consumers are increasingly investing in home improvement or home remodeling projects rather than buying new homes.

b. Towel rack/ring sales accounted for a share of 38.61% in 2024 in the bathroom accessories market. This is attributed to the fact that apart from being highly functional, heated towel rails and racks add an ultra-stylish flair to bathroom spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.