- Home

- »

- Next Generation Technologies

- »

-

Bank Kiosk Market Size, Share And Growth Report, 2030GVR Report cover

![Bank Kiosk Market Size, Share & Trends Report]()

Bank Kiosk Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment, By Location, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-041-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bank Kiosk Market Summary

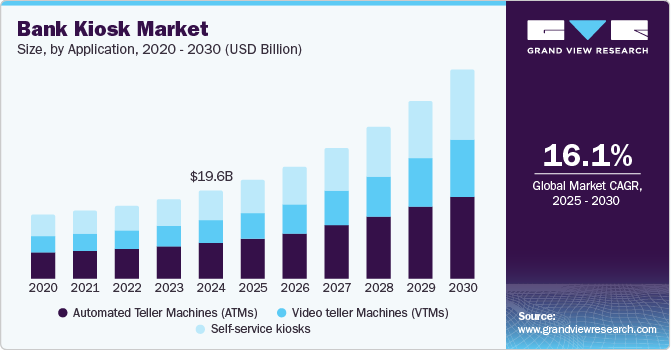

The global bank kiosk market size was estimated at USD 19.57 billion in 2024 and is projected to reach USD 46.36 billion by 2030, growing at a CAGR of 16.1% from 2025 to 2030. The market is driven by consumer demand for self-service banking, technological advancements, and the need for financial inclusion.

Key Market Trends & Insights

- The North America led the overall market in 2024, with a market share of 31.0%.

- Based on component, the hardware segment dominated the overall market, gaining a market share of 40.6% in 2024, witnessing a CAGR of 15.3%.

- Based on deployment, the metropolitan segment dominated in 2024, gaining a market share of 43.9%. It is expected to grow at the fastest CAGR of 14.8%.

- Based on end user, the BFSI market segment is expected to dominate in 2024, gaining a market share of 71.8% and growing at the fastest CAGR of 16.7%.

- Based on location, the off-site segment is expected to dominate in 2024, gaining a market share of 53.4%. and grow at the fastest CAGR of 16.5%.

Market Size & Forecast

- 2024 Market Size: USD 19.57 Billion

- 2030 Projected Market USD 46.36 Billion

- CAGR (2025-2030): 16.1%

- North America: Largest market in 2024

A bank kiosk is a self-service machine that provides customers with various banking services without human interaction. This market has grown significantly in recent years and is expected to continue to grow in the coming years. The significance of kiosks lies in their ability to provide customers with convenience, accessibility, and cost-effectiveness. With the increasing demand for fast and convenient banking services, kiosks are likely to remain a crucial part of the banking industry.

Financial institutions continue to invest in innovative kiosk technologies that provide value-added services to customers, such as mobile banking, contactless payments, and cash recycling. These developments will further improve bank kiosks' efficiency, security, and usability, making them an essential part of the banking ecosystem. Kiosks are further categorized into ATMs, VTMs, and self-service kiosks. One of the main advantages of kiosks is their ability to improve efficiency in banking operations. By automating routine transactions, financial institutions can reduce wait times, decrease transaction times, and free up bank tellers to handle more complex transactions. This increased efficiency leads to a better customer experience and enables financial institutions to serve a greater number of customers at a lower cost. Moreover, kiosks are available 24/7, which means that customers can perform transactions at their convenience without waiting for a bank branch to open.

Another significant advantage of these kiosks is their cost-effectiveness. Kiosks utilized by financial institutions reduce the workload on bank tellers in order to reduce their staffing needs and save money on operational costs. In addition, these kiosks can handle a large volume of transactions simultaneously, increasing banking operations' efficiency. This has led to many financial institutions installing kiosks at multiple locations to improve customer access and reduce overhead expenses. Furthermore, with technological advancements, ATMs have become more secure, reliable, and user-friendly, further enhancing their appeal to customers.

COVID-19 Impact on the Market

The COVID-19 pandemic has significantly impacted the market, both in the short and long term. The pandemic caused delays in the deployment of bank kiosks. Many financial institutions have had to delay or cancel plans to install new kiosks due to budget cuts and operational disruptions caused by the pandemic. This has slowed down market growth in the short term. However, the demand for contactless banking is likely to remain strong even after the pandemic, and financial institutions continue to expand their reach and provide convenient, self-service options for customers.

The pandemic has accelerated the trend toward contactless banking as customers looked for ways to minimize their physical interactions with others. These kiosks provided a convenient and safe way for customers to access banking services without the need for face-to-face interactions. As a result, there has been an increase in demand for bank kiosks since the start of the pandemic. The pandemic has also led to changes in customer behavior, with many customers now preferring self-service kiosks. This market is expected to grow in the long term as financial institutions adapt to providing new and innovative services through self-service channels.

Application Insights

In terms of application, the market is classified into automated teller machines (ATMs), video teller machines (VTMs), and self-service kiosks. Among these, the ATM segment is expected to dominate in 2024, gaining a market share of 41.3%. and grow at a CAGR of 15.2% throughout the forecast period. ATMs have transformed the banking industry by allowing customers to access their bank accounts and conduct various financial transactions 24/7 without interacting with bank staff. ATMs are widely available at bank branches, shopping malls, airports, and other public areas. They provide a convenient, fast, and secure way for customers to withdraw cash, check account balances, transfer funds, pay bills, and even deposit cash or checks. ATMs also reduce bank tellers' workload, enabling financial institutions to provide better customer service and improve operational efficiency.

VTM is anticipated to grow at a considerable CAGR of 17.2% throughout the forecast period. VTMs are an innovative banking technology that combines the convenience of an ATM with the personalized service of a bank teller. VTMs are essentially advanced ATMs that offer customers a live video chat feature that enables them to communicate with a remote bank teller in real-time. Furthermore, VTMs offer a more secure banking experience for customers. By using video technology, VTMs provide an added layer of security for customers conducting transactions, reducing the risk of fraud or identity theft. In addition, by eliminating the need for cash handling, VTMs reduce the risk of physical security breaches, making them a more secure and reliable way for customers to conduct their banking activities.

Component Insights

In terms of component, the market is classified into hardware, software, and services. The hardware segment dominated the overall market, gaining a market share of 40.6% in 2024, witnessing a CAGR of 15.3% during the forecast period. The hardware segment is further categorized into printers, displays, secure keypads, biometrics readers, card readers, and others (card/cash dispensers, cameras, speakers, receipt dispensers, and magnetic stripe readers). The physical enclosure of a bank kiosk needs to be durable and tamper-proof to ensure the security of the kiosk and its components. With rapid technological advancements, hardware components in bank kiosks are becoming more advanced and sophisticated. For example, the introduction of touch screens, biometric scanners, and facial recognition technology has improved the functionality and security of the kiosks. Adopting these advanced components enables banks to remain competitive and meet their customers' needs.

The software segment is anticipated to witness the fastest growth of CAGR of 17.1% throughout the forecast period. Software plays a critical role in this market. Bank kiosks require specialized software to operate and provide financial services to customers. The software components of a bank kiosk include the user interface, transaction processing, security, and maintenance software. Improving customer experience, reducing costs, increasing efficiency, complying with regulations, and leveraging technology advancements are driving the software segment of this market. Adopting advanced software is critical for financial institutions to meet the changing needs of their customers and comply with regulatory requirements.

Deployment Insights

In terms of deployment, the market is classified into rural, urban, and metropolitan areas. Among these, the metropolitan segment dominated in 2024, gaining a market share of 43.9%. It is expected to grow at the fastest CAGR of 14.8% throughout the forecast period. There is a growing need to have enhanced reach and greater accessibility by customers living in metropolitan regions; the adoption of bank kiosk booths has increased in retail points or in local shops, which is driving market growth. As people living in metropolitan cities are well aware of the services offered by these kiosk booths, such as internet banking, easier financial services, NEFT & RTGS, etc., it has a higher penetration of installed bank kiosks than other segments. Furthermore, factors such as high technological advancements such as upgraded ATMs and the proliferation of non-banks in metro cities create lucrative market growth opportunities.

The rural segment is expected to witness the highest growth rate of 17.9% during the forecast period. A number of people from developing economies, such as Southeast Asia, which includes countries like Pakistan, India, Thailand, Indonesia, and others, have no access to financial services. Governments, Banks, and Financial Institutions in these economies are increasingly adopting new advanced solutions to offer banking services to the group of unbanked people to shift from ATM machines and traditional bank branch offices towards advanced financial solutions. This major shift to increase the banking penetration of unbanked groups of people is majorly driven by government regulations such as the adoption of payment and subsidies, agricultural subsidies, and government aid through bank accounts only. Furthermore, the banking industry and government are working together to provide financial access to lower-income level groups living in mainly rural areas, which is one of the major reasons for the increasing penetration of these kiosks in rural areas.

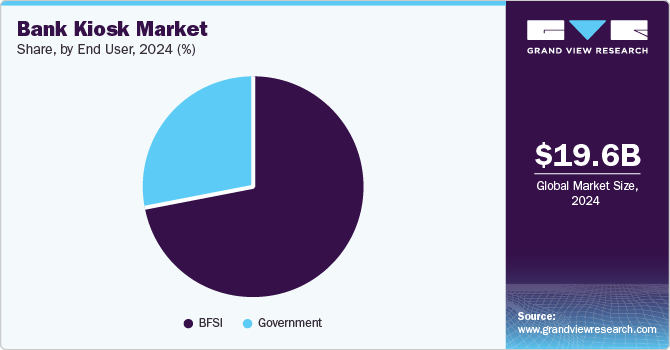

End User Insights

In terms of end user, the market is classified into BFSI and government. Among these, the BFSI market segment is expected to dominate in 2024, gaining a market share of 71.8% and growing at the fastest CAGR of 16.7% throughout the forecast period. Bank kiosks play a significant role in the BFSI (Banking, Financial Services, and Insurance) sector, providing a wide range of benefits to both customers and financial institutions.

From a financial institution's perspective, these kiosks offer a cost-effective solution for expanding their reach and providing customer services without investing in expensive brick-and-mortar branches. By installing kiosks in high-traffic areas like shopping malls, airports, and train stations, financial institutions can reach a larger number of customers and offer services in areas where they may not have a physical branch presence. This helps financial institutions increase market penetration and brand awareness while reducing operational costs.

Location Insights

In terms of location, the market is classified into on-site and off-site. Among these, off-site is expected to dominate in 2024, gaining a market share of 53.4%. and grow at the fastest CAGR of 16.5% throughout the forecast period. Off-site deployment of bank kiosks refers to placing self-service banking kiosks outside traditional bank branches in shopping malls, airports, universities, and other public areas. The significance of off-site deployment of bank kiosks in the market lies in their ability to increase accessibility, convenience, and customer engagement.

By placing these kiosks in high-traffic areas, financial institutions can reach a wider customer base, including those who may not have easy access to a traditional bank branch. This increased accessibility can lead to increased adoption of financial services, particularly among underserved populations, such as low-income households, students, and rural communities. In conclusion, the significance of off-site deployment of these kiosks in the market lies in their ability to increase accessibility, convenience, customer engagement, and cost savings for financial institutions.

Regional Insights

North America led the overall market in 2024, with a market share of 31.0%. The North American region is equipped with well-developed infrastructure and spends a large amount on an extensive research and development base, which makes the region the top revenue contributor in the market during the projected period. The unabated growth of ATMs and self-service kiosks in line with the growing technological advancements in the U.S. and Canada is also expected to fuel market growth across North America as industry incumbents strongly emphasize automating various functions to enhance operational efficiency. Moreover, small and medium players in North America, which offer components and services to giants such as NCR Corporation, Diebold Nixdorf, Incorporated, and Brink’s, Inc., have also propelled the market growth. The U.S. is expected to retain its dominance over the forecast period owing to convenience and accessibility, cost-effectiveness, technological advancements, regulatory requirements, and changing consumer behavior. As the demand for self-service banking options continues to grow, we can expect the market in the U.S. to continue to expand in the years to come.

U.S. Bank Kiosk Market Trends

The bank kiosk market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. This growth is driven by the increasing adoption of self-service technologies and the demand for enhanced customer experiences in banking. Digital transformation initiatives across U.S. banks have accelerated the use of kiosks, allowing for quicker, more efficient services and cost reductions in branches. Moreover, the growing acceptance of contactless payments and remote banking services after the COVID-19 pandemic has solidified kiosks as a valuable customer touchpoint. Banks are also adopting advanced AI-based kiosks for services like customer onboarding, account management, and customer support, catering to rural and urban clients. Regulatory requirements concerning data security and customer identification are expected to influence kiosk technology deployment, with enhanced data privacy features becoming a standard. Major banks are likely to increase their investment in kiosk technology to remain competitive, appealing to tech-savvy customers who prefer minimal-contact transactions.

Asia Pacific Bank Kiosk Market Trends

The bank kiosk market in Asia Pacific is expected to develop substantially by the projection period and grow at a CAGR of 18.0%. Asia-Pacific is poised for the fastest growth as several manufacturing entities in the region are adopting advanced technologies to rake in various benefits, such as increasing the efficiency of banking operations, thereby driving the adoption of bank kiosks across Asia Pacific. Market players are responding to the situation by introducing innovative solutions in line with the evolving demands of the incumbents of various applications and end-use industries. The growing demand for self-service kiosks in countries such as China and India is expected to fuel the demand for bank kiosks over the forecast period.

India bank kiosk market is expected to grow at a significant CAGR from 2025 to 2030. Government initiatives toward financial inclusion and digital transformation in banking services largely drive growth in this market. The Indian government has been actively promoting kiosk banking through schemes like Pradhan Mantri Jan Dhan Yojana, which provides financial services to the unbanked population. Bank kiosks are crucial in reaching rural and semi-urban populations, where banking penetration has traditionally been low. Furthermore, the Reserve Bank of India’s push for cashless transactions and digital banking has led to increased demand for kiosks in public spaces like railway stations, airports, and post offices. Many financial institutions in India are also partnering with technology providers to develop multifunctional kiosks that offer a wide range of banking services, such as bill payments, fund transfers, and cash withdrawals. The emphasis on biometric authentication for secure transactions is also set to drive technological advancements in kiosk infrastructure in India.

The bank kiosk market in Japan is expected to grow significantly over the forecast period. This growth is fueled by the country’s aging population and an increasing demand for automated banking solutions that offer convenient and secure access to financial services. Japanese banks are adopting kiosks to streamline operations and cater to a tech-savvy population with a strong preference for digital transactions. In addition, kiosks are being deployed in rural and remote areas to address challenges related to branch closures, providing essential banking services where traditional bank branches are sparse. Japan’s robotics and artificial intelligence advancements also contribute to developing sophisticated kiosk systems that handle diverse customer needs, from basic account services to more complex financial transactions. Data security remains a high priority, with stringent regulations protecting customer information. Japanese banks are expected to integrate more personalized kiosk features to enhance customer satisfaction and optimize operational costs.

Europe Bank Kiosk Market Trends

The bank kiosk market in Europe is expected to grow at a significant CAGR from 2025 to 2030. The European banking sector increasingly embraces digital transformation to offer more convenient and efficient services, responding to customer demand for self-service options. Factors such as high labor costs and the rising closure of traditional bank branches in several European countries have contributed to the popularity of kiosks in public spaces. The European Union’s regulatory focus on data protection and cybersecurity, as well as the adoption of the General Data Protection Regulation (GDPR), has driven the need for secure kiosk solutions that comply with stringent data security standards. Kiosks in Europe are used for basic transactions and advanced services like loan applications and insurance, catering to diverse customer needs. Europe’s focus on sustainability also influences the design and implementation of energy-efficient, eco-friendly bank kiosks, making the region a pioneer in sustainable banking practices.

The UK bank kiosk market is expected to grow significantly from 2025 to 2030. The banking sector in the UK is highly developed, and banks focus on reducing operational costs while improving customer satisfaction through technological advancements. Bank kiosks are seen as a solution to streamline customer service in branches while providing self-service options for tasks like cash deposits, withdrawals, and check processing. As branch closures continue in the UK, particularly in rural areas, kiosks are increasingly deployed to maintain access to essential banking services. The rise of digital banking and mobile banking has led customers to prefer self-service options, and kiosks offer a bridge between digital and physical banking experiences. Furthermore, the UK's stringent data protection laws necessitate secure kiosk systems that protect customer information and prevent fraud. Banks in the UK are expected to continue investing in kiosk technology to balance cost efficiency with customer satisfaction.

Key Bank Kiosk Company Insights

The market is fragmented and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies in bank kiosks used by several banking and financial institutions, intensifying competition among these players. Some prominent players in the market include NCR Corporation, Diebold Nixdorf, Incorporated, Nautilus Hyosung America, Inc., OKI Electric Industry Co. Ltd., Euronet Worldwide, Inc., Brink’s, Inc., Azkoyen Group, Hitachi Channel Solutions, Corp., and Fiserv, Inc, among others. These companies are also collaborating with local & regional players to gain a competitive edge over their peers and capture a significant market share.

Some key companies operating in the bank kiosk market include NCR Corporation, Diebold Nixdorf, Incorporated, and Fiserv, Inc.

-

NCR Corporation holds a competitive edge in the market through its advanced technology solutions and a strong reputation for innovation in self-service banking. With a long history in the financial technology industry, NCR leverages its expertise to develop multifunctional kiosks that integrate seamlessly with bank systems, providing customers with an efficient and secure experience. NCR’s focus on end-to-end digital transformation services allows banks to modernize and personalize customer interactions through kiosks, mobile, and online platforms. The company’s solutions prioritize security and flexibility, with features such as biometric authentication and high-speed connectivity. NCR’s global presence and extensive support network also make it a preferred choice for financial institutions looking for reliable deployment and maintenance services. This extensive experience positions NCR as a leader in transforming banking experiences worldwide.

-

Diebold Nixdorf, Incorporated stands out by delivering robust, high-security solutions tailored to the ever-evolving financial sector demands. Known for its ATM and banking technology expertise, Diebold Nixdorf offers bank kiosks with advanced security features, such as biometric verification and fraud detection mechanisms, which address growing concerns around data protection and financial security. The company also emphasizes an “always on” approach, focusing on kiosk reliability through predictive maintenance and remote monitoring, ensuring minimal downtime. With a presence in over 100 countries and a strong focus on innovation in retail and banking, Diebold Nixdorf enables banks to offer a seamless and efficient customer experience. Its partnerships with leading banks and tech companies enhance its solutions’ adaptability and scalability, giving it a distinct edge in this competitive market.

-

Fiserv, Inc. brings a unique competitive advantage to the market through its comprehensive suite of financial services and technology expertise. The company is widely recognized for integrating digital banking, payments, and transaction processing capabilities within its kiosk solutions, making it a valuable partner for financial institutions focused on digital transformation. Fiserv’s strength lies in connecting kiosks with broader banking platforms, enabling seamless data flow between digital and physical touchpoints. This connectivity supports a unified customer experience and enables banks to offer a wide range of services, from fund transfers to personalized product recommendations. Fiserv also emphasizes data analytics and security in its solutions, helping banks enhance their decision-making while ensuring compliance with regulatory standards. With its extensive network and innovative approach, Fiserv is a key player in reshaping banking interactions.

Brink’s, Inc. and Nautilus Hyosung America, Inc. are some of the emerging companies in the target market.

-

As an emerging player in the market, Brink’s, Inc. leverages its longstanding expertise in cash management and security solutions to deliver a unique value proposition. Known primarily for its secure logistics and cash handling, Brink’s offers bank kiosks with a strong emphasis on cash automation and secure cash recycling, which appeal to financial institutions looking to optimize branch operations and reduce manual cash handling. Brink’s kiosks provide an added layer of security and efficiency, integrating seamlessly with back-end systems to streamline cash flow and improve transaction accuracy. Their established reputation in secure services gives Brink’s a significant advantage as banks increasingly prioritize secure, automated solutions that minimize cash handling risks. Brink’s focus on secure, user-friendly kiosks positions it as a compelling alternative in the market.

-

Nautilus Hyosung America, Inc. stands out as an emerging player with a strong focus on advanced ATM and self-service banking technologies. The company has quickly gained traction through its innovative approach, delivering kiosks with user-friendly interfaces and multi-functional capabilities, from cash dispensing to more complex transactions like loan processing. Nautilus Hyosung America leverages its parent company's expertise in financial hardware to provide durable, adaptable kiosks that meet the diverse needs of banks and credit unions in North America. By emphasizing both reliability and a broad range of self-service options, Nautilus Hyosung America effectively addresses the rising demand for customer-centric solutions in banking. Its agile, customer-focused approach makes it an attractive option for financial institutions seeking innovative, scalable solutions in the kiosk space.

Key Bank Kiosk Companies:

The following are the leading companies in the bank kiosk market. These companies collectively hold the largest market share and dictate industry trends.

- NCR Corporation

- Diebold Nixdorf, Incorporated

- Nautilus Hyosung America, Inc.

- OKI Electric Industry Co. Ltd.

- Euronet Worldwide, Inc.

- Brink’s, Inc.

- Azkoyen Group

- Hitachi Channel Solutions, Corp.

- Fiserv, Inc.

Bank Kiosk Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.97 billion

Revenue forecast in 2030

USD 46.36 billion

Growth rate

CAGR of 16.1% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, location, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; UAE; KSA; Saudi Arabia

Key companies profiled

NCR Corporation; Diebold Nixdorf; Incorporated; Nautilus Hyosung America, Inc.; OKI Electric Industry Co. Ltd.; Euronet Worldwide, Inc.; Brink’s, Inc.; Azkoyen Group; Hitachi Channel Solutions, Corp.; Fiserv, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bank Kiosk Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bank kiosk market based on component, deployment, location, application, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Printers

-

Thermal printer

-

Laser printer

-

Passbook printer

-

-

Display

-

Secure Keypad

-

Biometrics Reader

-

Card Reader

-

Others (Card/Cash Dispenser, Camera, Speaker, Receipt Dispenser, Magnetic stripe readers)

-

-

Software

-

Services

-

Managed Services

-

Professional Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Rural

-

Urban

-

Metropolitan

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

On-site

-

Off-site

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automated Teller Machines (ATMs)

-

Video teller Machines (VTMs)

-

Self-service kiosks

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bank kiosk market size was estimated at USD 19.57 billion in 2024 and is expected to reach USD 21,976.5 million in 2025.

b. The global bank kiosk market is expected to grow at a compound annual growth rate of 16.1% from 2025 to 2030 to reach USD 46.36 billion by 2030.

b. The North America is expected dominate the market and is expected to grow at a CAGR of 15.9%. The North America region is equipped with well-developed infrastructure and spends large amount on extensive research and development base, which makes the region to be the top revenue contributor in the bank kiosk market during the projected period.

b. Some prominent players in the market include NCR Corporation, Diebold Nixdorf, Incorporated, Nautilus Hyosung America, Inc., OKI Electric Industry Co. Ltd., Euronet Worldwide, Inc., Brink’s, Inc., Azkoyen Group, Hitachi Channel Solutions, Corp., and Fiserv, Inc, among others

b. Key factors driving the bank kiosk market growth includes the consumer demand for self-service banking, technological advancements, and the need for financial inclusion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.