- Home

- »

- Food Safety & Processing

- »

-

Bakery Processing Equipment Market, Industry Report, 2033GVR Report cover

![Bakery Processing Equipment Market Size, Share & Trends Report]()

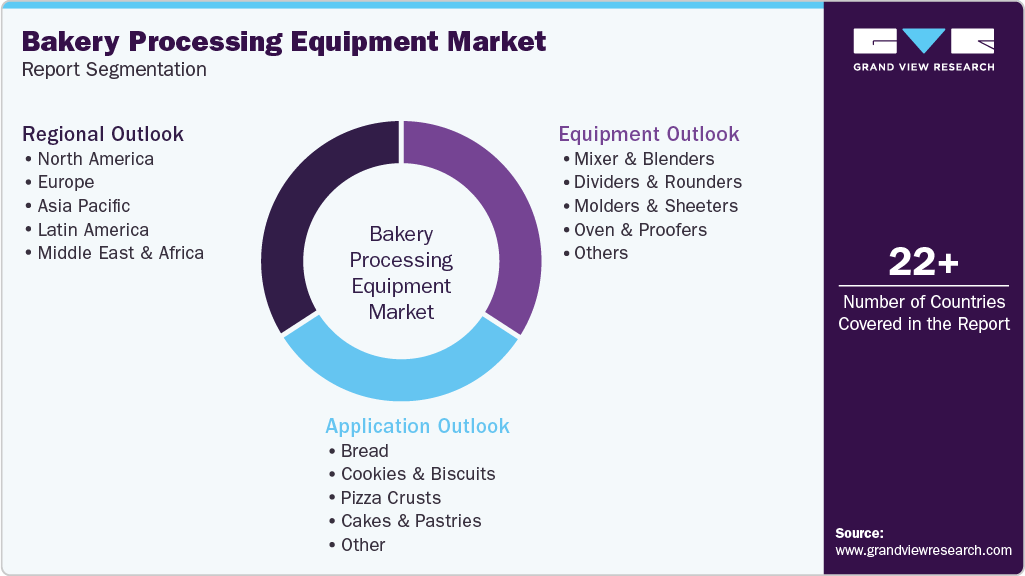

Bakery Processing Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Equipment (Mixer & Blenders, Dividers & Rounders, Molders & Sheeters, Oven & Proofers), By Application (Bread, Cakes & Pastries, Cookies & Biscuits, Pizza Crusts), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-795-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2035

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bakery Processing Equipment Market Summary

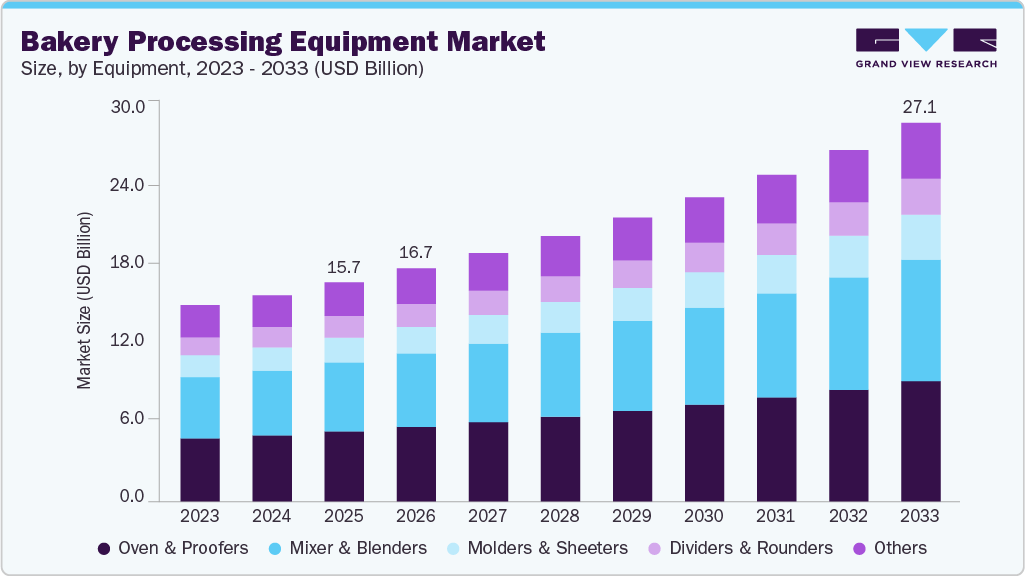

The global bakery processing equipment market size was estimated at USD 15,681.2 million in 2025 and is projected to reach USD 27,123.0 million by 2033, growing at a CAGR of 7.2% from 2026 to 2033. The market isdriven by rising demand for baked goods and changing consumer lifestyles.

Key Market Trends & Insights

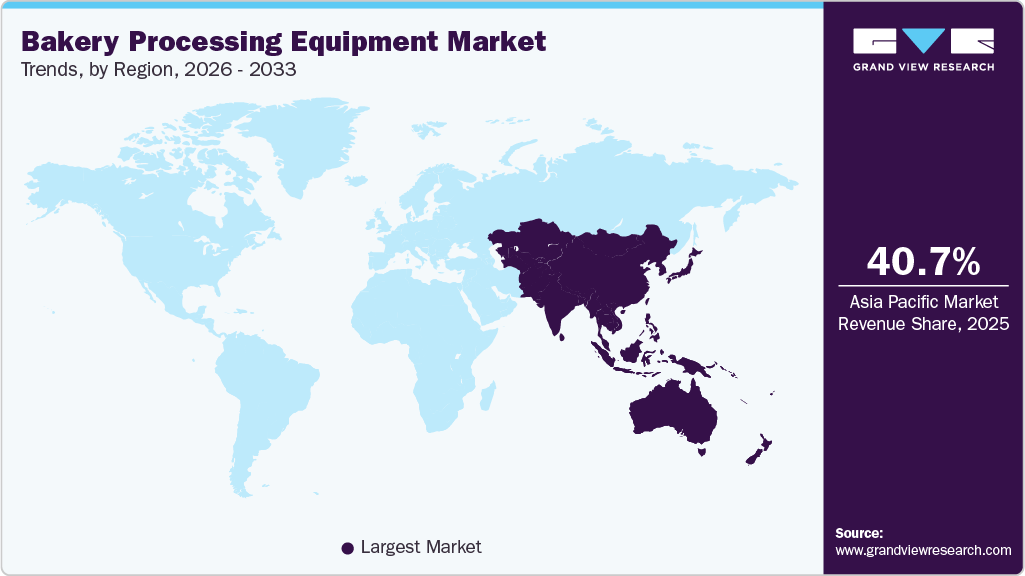

- Asia Pacific dominated the bakery processing equipment market with the largest revenue share of 40.7% in 2025.

- India bakery processing equipment market is growing due to increasing urbanization, rising disposable incomes, and evolving consumer lifestyles.

- By equipment, molders & sheeters segment is expected to grow at the fastest CAGR of 7.9% from 2026 to 2033 in terms of revenue.

- By application, pizza crusts segment is expected to grow at the fastest CAGR of 7.7% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 15,681.2 Million

- 2033 Projected Market Size: USD 27,123.0 Million

- CAGR (2026-2033): 7.2%

- Asia Pacific: Largest market in 2024

As cafes, quick-service restaurants, and retail bakeries proliferate, there is an increasing need for efficient mixing, proofing, baking, and packaging machines. Technological advances, automation, IoT integration, and energy-efficient ovens are enabling higher productivity, consistent quality, and lower labor costs, making modern equipment attractive.

In addition, growing demand for specialty and healthy bakery products (gluten-free, organic, high-protein) is encouraging investment in specialized and flexible equipment capable of handling diverse recipes. Increasing demand for baked goods, expansion of foodservice and retail chains, and continued focus on automation and efficiency are combining to support strong growth in the bakery processing equipment market.

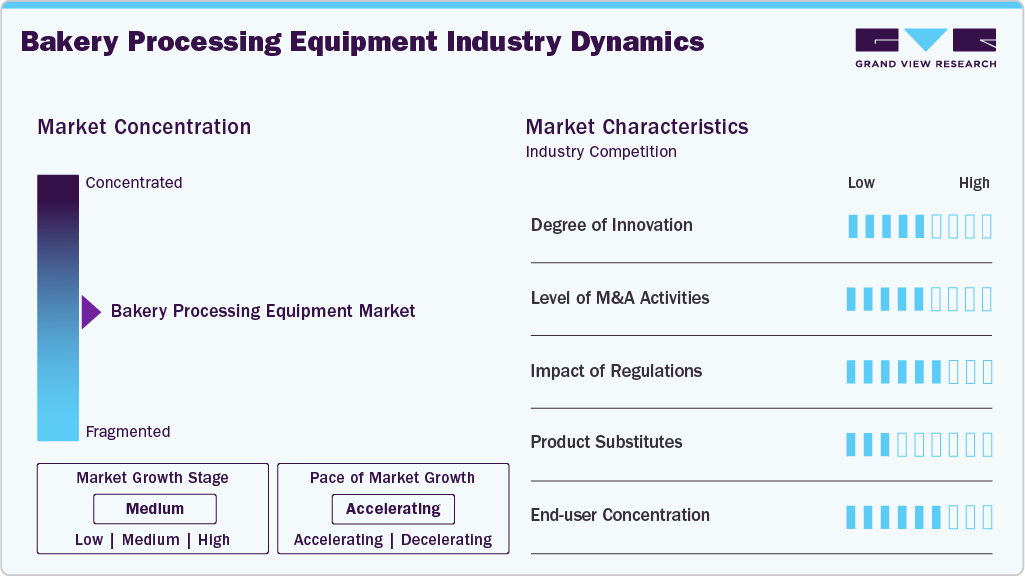

Market Concentration & Characteristics

The bakery processing equipment market is moderately fragmented, with numerous small and mid-sized manufacturers competing alongside a few large global players. No single company dominates, as bakeries and industrial producers demand diverse, customizable solutions for mixing, baking, proofing, and packaging. Regional preferences, specialized product requirements, and varying levels of automation contribute to market diversity. Continuous innovation and technology adoption create opportunities for new entrants, while established companies maintain market share through brand reputation, service networks, and integrated equipment offerings.

With many manufacturers developing automated, modular, and energy-efficient machines are significantly innovating. New systems increasingly include smart sensors, IoT connectivity, and real-time process control for consistent product quality. These innovations allow bakeries to boost productivity, reduce labor costs, and respond quickly to changing product demands, fostering continuous modernization across industrial and artisanal bakery operations.

M&A activity in the bakery-processing equipment market has been moderate, with some consolidation among mid-sized and larger firms to broaden product offerings and technological capabilities. This consolidation helps companies combine expertise, expand geographic reach, and offer turnkey solutions for bakeries needing full production lines. It also enables economies of scale, making advanced, automated equipment more accessible and supporting overall market growth and innovation diffusion.

Food safety, hygiene standards, and energy-efficiency regulations strongly influence the bakery-processing equipment market. Manufacturers design machines with hygienic surfaces, easy-to-clean construction, and materials that meet strict sanitary guidelines to ensure compliance. Rising energy costs and environmental standards drive demand for energy-efficient ovens, waste-minimizing mixers, and sustainable production processes, prompting bakeries to upgrade or replace older, inefficient equipment to meet regulatory and operational requirements.

Drivers, Opportunities & Restraints

Rising demand for baked goods globally is a key driver of the bakery processing equipment market. Urbanization, changing lifestyles, and increasing consumption of ready-to-eat and packaged bakery products are pushing bakeries and industrial producers to invest in automated, high-capacity equipment. This growing need for efficiency, consistency, and higher production volumes drives adoption of modern mixers, ovens, proofers, and packaging systems across commercial and industrial bakery operations.

The increasing demand for specialty and healthier bakery products presents significant opportunities. Consumers are seeking gluten-free, organic, high-protein, and functional baked goods, which require versatile and flexible processing equipment. Manufacturers can develop innovative, customizable machines capable of handling diverse recipes, small batch production, and specialized processing techniques. This trend opens new markets for equipment suppliers, particularly those offering modular, automated, and energy-efficient solutions that cater to evolving consumer preferences.

High initial costs of advanced bakery processing equipment pose a challenge, especially for small and medium-sized bakeries. Complex machinery often requires skilled operators and ongoing maintenance, which can limit adoption. Moreover, rapid technological changes and varying regional regulatory standards for food safety and hygiene create barriers to entry and operational consistency. These factors may slow the replacement of older equipment and impact market growth for new, innovative systems.

Equipment Insights

Oven & proofers segment hold the dominant share in the market and accounted for a revenue share of 32.0% in 2025, these machines are essential for baking goods and remain the backbone of production lines. As demand for bakery products increases worldwide, bakeries invest in advanced ovens and proofers, including energy-efficient, automated, and multi-functional models, to boost throughput and ensure consistent quality. Improvements in heating technology, temperature control, and batch capacity make this segment especially attractive for large-scale and high-volume bakeries, supporting its continued dominance.

The molders & sheeters segment is expected to grow at the fastest CAGR of 7.9% from 2026 to 2033 in terms of revenue. Molders and sheeters segment is expected to grow rapidly as bakeries increasingly seek dough-handling solutions that deliver uniform thickness, shape, and dough consistency. These machines, which use rollers to flatten and shape dough, are gaining popularity, especially for products such as pizza crusts, flatbreads, and specialty bakery items. The shift toward artisanal products, varied dough types, and small-batch flexibility encourages adoption of sheeters and molders. As automation rises and bakeries aim for efficient, consistent production, demand for this segment is expected to increase significantly.

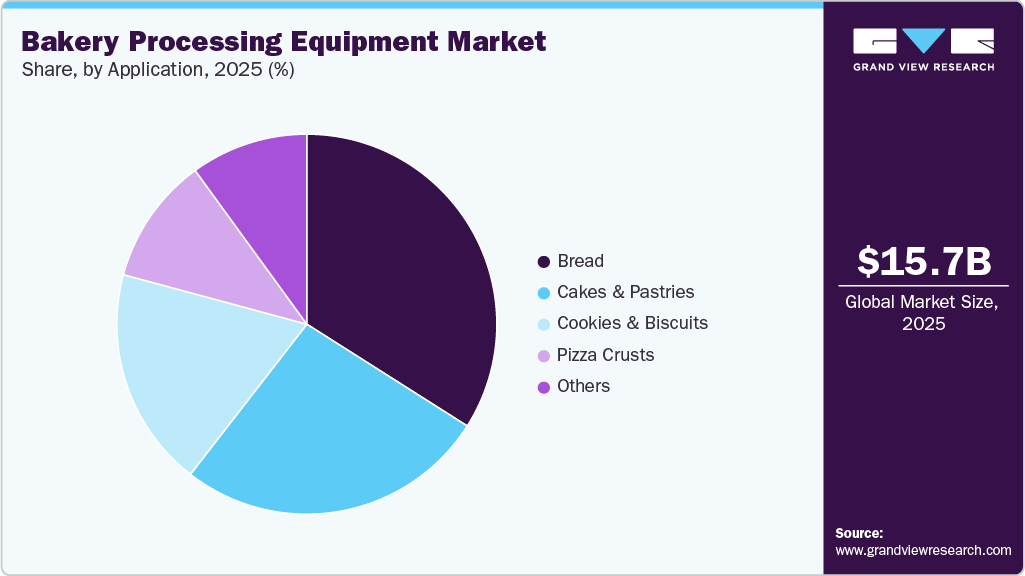

Application Insights

Bread segment dominates the bakery processing equipment market and accounted for a share of 34.0% in 2025, as bread remains a staple food in many regions, ensuring constant demand. As consumer habits shift toward healthier or specialty breads, such as whole-grain, gluten-free, or artisan loaves, bakeries require versatile, high-capacity equipment for mixing, proofing, shaping, and baking. The stable demand for bread drives investment in efficient, automated machinery, helping producers scale output while maintaining consistent quality and meeting diverse consumer preferences.

The pizza crusts segment is expected to grow at the fastest CAGR of 7.7% from 2026 to 2033 in terms of automotive revenue. The pizza crust application segment is projected to grow rapidly as demand for pizza expands globally, especially through fast-food chains, quick-service restaurants, and home-delivery platforms. This growth prompts bakeries and food producers to adopt specialized equipment, such as mixers, sheeters, dough dividers, and conveyors, that can handle large volumes and maintain consistent crust quality. As consumers increasingly seek varied and convenient meal options, the need for efficient, scalable pizza-crust production boosts equipment adoption and fuels segment growth.

Regional Insights

Bakery processing equipment market in North America is growing at CAGR of 5.0% over the forecast period, due to high consumer demand for baked goods, increasing urbanization, and expansion of retail and foodservice sectors. Automation and modern machinery adoption are rising to improve efficiency, productivity, and product consistency. Growth is further supported by preference for convenience and artisanal products, coupled with investments in food safety, energy-efficient equipment, and technological upgrades across industrial and commercial bakeries, strengthening overall market development.

U.S. Bakery Processing Equipment Market Trends

Bakery processing equipment market in U.S. is expanding with rising consumption of packaged and ready-to-eat baked goods. Bakeries are increasingly investing in automated and energy-efficient machinery to improve production efficiency and maintain stringent food safety standards. The demand for diverse bakery products, including artisanal, premium, and convenience offerings, fuels modernization efforts.

Mexico bakery processing equipment market is expanding due to growing urbanization, rising disposable incomes, and increasing demand for bakery products across retail and foodservice channels. Bakeries are adopting automated mixers, ovens, and packaging equipment to improve efficiency and output consistency. The market is supported by modernization of small and medium-sized bakeries, along with a growing consumer preference for ready-to-eat and premium baked goods. These factors collectively drive sustained growth across the country’s bakery industry.

Europe Bakery Processing Equipment Market Trends

Europe’s bakery processing equipment market is growing steadily, as consumers increasingly demand premium and artisanal baked goods. Well-established bakery traditions support investment in efficient mixers, ovens, and energy-saving machinery. Automation adoption improves production speed, consistency, and hygiene. Regulatory focus on food safety and sustainability encourages modern equipment use. Expansion of retail and foodservice sectors, combined with consumer preference for convenience products, drives steady market development, with technological upgrades strengthening industrial and commercial bakery operations across the region.

Bakery processing equipment market in Germany is a major market in Europe, due to a strong bakery culture, high demand for artisanal and premium products, and modernization efforts. Industrial and commercial bakeries are investing in automated ovens, mixers, and energy-efficient machinery to improve productivity and consistency. Stringent food safety regulations and sustainability initiatives encourage adoption of advanced equipment. Rising demand in retail and foodservice channels supports the market.

The UK bakery processing equipment market is growing due to increasing consumer demand for artisanal, premium, and convenience baked goods. Bakeries are investing in automated mixers, ovens, and energy-efficient equipment to enhance productivity, maintain quality, and ensure food safety compliance. Expansion of cafés, retail bakeries, and foodservice outlets drives demand for modern equipment. Technological upgrades, rising urbanization, and evolving consumer lifestyles are encouraging modernization of industrial and commercial bakeries, fueling steady market growth across the country.

Asia Pacific Bakery Processing Equipment Market Trends

Asia Pacific is a dominant market and accounted for the 40.7% share in 2025, due to urbanization, rising disposable incomes, and a growing middle-class population. Changing lifestyles and increasing consumption of convenience baked goods drive demand for automated mixers, ovens, and packaging machinery. Industrial and commercial bakeries are investing in modern equipment to improve efficiency, consistency, and food safety standards.

Bakery processing equipment market in China is expanding rapidly due to urbanization, industrial bakery growth, and rising consumer demand for convenience and premium baked goods. Bakeries are adopting automated mixers, ovens, and packaging systems to increase efficiency, product consistency, and hygiene. Investments in modern production facilities and food safety standards are increasing. Growth is supported by expanding retail and foodservice channels, a growing middle class, and rising adoption of Western-style bakery trends, making China one of the fastest-growing markets globally.

India bakery processing equipment market is growing due to increasing urbanization, rising disposable incomes, and evolving consumer lifestyles. Demand for Western-style and convenience baked goods is expanding rapidly. Retail bakeries, cafés, and foodservice outlets are investing in automated mixers, ovens, and packaging machinery to improve productivity, efficiency, and product consistency. Modernization of production facilities and adherence to food safety standards are driving adoption. Overall, technological upgrades, growing industrial production, and rising bakery consumption fuel strong market growth.

Middle East & Africa Bakery Processing Equipment Market Trends

Middle East and Africa growth is witnessing moderate growth, due to rising disposable incomes, urbanization, and expansion of retail and foodservice sectors. Industrial and commercial bakeries are adopting automated mixers, ovens, and packaging systems to increase production efficiency, consistency, and hygiene. Growing demand for convenience baked goods, investment in modern production facilities, and evolving consumer preferences are key drivers.

Saudi Arabia bakery processing equipment market is expanding due to rising demand for convenience and premium baked goods, increasing disposable incomes, and growth in retail and foodservice channels. Bakeries are investing in automated mixers, ovens, and packaging machinery to improve productivity, consistency, and food safety compliance. Modernization of small and large-scale bakeries is accelerating.

Latin America Bakery Processing Equipment Market Trends

Latin America bakery processing equipment market is significantly expanding, due to rising consumption of bakery products, urbanization, and expanding retail and foodservice channels. Bakeries are investing in automated ovens, mixers, and packaging equipment to improve efficiency, consistency, and product quality. Modernization of small and medium-sized bakeries is supporting growth. Demand for convenience baked goods, premium and artisanal products, and technological adoption are key drivers, enabling steady expansion of the industrial and commercial bakery equipment market across the region.

Bakery processing equipment market in Brazil is witnessing significant growth in the bakery processing equipment market due to increasing demand for baked goods, rising disposable incomes, and expansion of retail and foodservice outlets. Bakeries are adopting automated ovens, mixers, and packaging machinery to improve productivity, efficiency, and product quality. Growth is further fueled by consumer preference for convenience and artisanal bakery items.

Key Bakery Processing Equipment Company Insights

Some of the key players operating in the market include Ali Group, Baker Perkins, Bühler

-

Baker Perkins is a century-old food-processing equipment manufacturer, established in 1918 from the merger of Joseph Baker & Sons and Perkins Engineers. It provides integrated machinery and production lines for bread, biscuits, cookies, crackers, breakfast cereals, snacks, confectionery, and pet food. The company specializes in end-to-end systems covering mixing, dough-forming, baking, and packaging. Its deep process expertise helps bakeries improve efficiency, product consistency, hygiene, and cost-effectiveness, making it a leading partner for industrial and commercial baking solutions.

-

Bühler is a Swiss multinational company founded in 1860, specializing in processing and plant-engineering technologies for grain, food, and advanced materials. Through its divisions, it provides equipment and solutions for milling, flour processing, bakery, pasta, chocolate, and snacks, covering the value chain from raw ingredients to finished products. Bühler operates a global Bakery Innovation Centre to support customers with process optimization, recipe development, automation, training, and full-scale plant design, helping bakeries enhance efficiency, quality, and product innovation worldwide.

Key Bakery Processing Equipment Companies:

The following are the leading companies in the bakery processing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Ali Group

- Baker Perkins

- Bühler

- GEA Group

- Middleby Corporation

- Markel

- John Bean Technologies Corporation

- Rheon Automatic Machinery

- Anko Food Machine

- Gemini Bakery Equipment

- Allied Bakery Equipment

- Global Bakery Solutions

- Erica Record LLC

- Sinmag Equipment Corporation

- Koenig Maschinen GmbH

Recent Developments

-

In October 2025, Middleby Food Processing opened a new 65,000‑square‑foot innovation centre in Italy. The facility Middleby Centro di Innovazione (MCI) near Venice is dedicated to advancing bakery, and snack processing technologies. It allows equipment demonstration, product R&D, customer testing, and operator training.

-

In June 2025, GEA launched Bake Extruder at IBA Düsseldorf, which is designed for medium to large-scale biscuit production, offering high-speed, high-volume performance, flexibility, and hygienic operation, usable standalone or integrated with downstream ovens for optimized productivity.

Bakery Processing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 16,684.2 million

Revenue forecast in 2033

USD 27,123.0 million

Growth rate

CAGR of 7.2% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Ali Group; Baker Perkins; Bühler; GEA Group; Middleby Corporation; Markel; John Bean Technologies Corporation; Rheon Automatic Machinery; Anko Food Machine; Gemini Bakery Equipment; Allied Bakery Equipment; Global Bakery Solutions; Erica Record LLC; Sinmag Equipment Corporation; Koenig Maschinen GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bakery Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bakery processing equipment market report based on equipment, application, and region:

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Mixer & Blenders

-

Dividers & Rounders

-

Molders & Sheeters

-

Oven & Proofers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bread

-

Cookies & Biscuits

-

Pizza Crusts

-

Cakes & Pastries

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bakery processing equipment market size was estimated at USD 15,681.2 million in 2025 and is expected to be USD 16,684.2 million in 2026.

b. The global bakery processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.2% from 2026 to 2033 to reach USD 27,123.0 million by 2033.

b. Oven & proofers segment hold the dominant share in the market and accounted for a share of 32.0% in 2025, these machines are essential for baking goods and remain the backbone of production lines. As demand for bakery products increases worldwide, bakeries invest in advanced ovens and proofers, including energy-efficient, automated, and multi-functional models, to boost throughput and ensure consistent quality.

b. Some of the key players operating in the global bakery processing equipment market include Ali Group, Baker Perkins, Bühler , GEA Group, Middleby Corporation , Markel, John Bean Technologies Corporation, Rheon Automatic Machinery, Anko Food Machine, Gemini Bakery Equipment, Allied Bakery Equipment, Global Bakery Solutions, Erica Record LLC, Sinmag Equipment Corporation, Koenig Maschinen GmbH

b. Key factors driving the global bakery processing equipment market include rising demand for convenience and artisanal baked goods, automation adoption, urbanization, growing retail and foodservice sectors, technological advancements, and increasing focus on efficiency, hygiene, and consistent product quality.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.