- Home

- »

- Clothing, Footwear & Accessories

- »

-

Badminton Equipment And Products Market Size Report, 2030GVR Report cover

![Badminton Equipment And Products Market Size, Share & Trends Report]()

Badminton Equipment And Products Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Apparel, Shoes, Racquets, Strings, Shuttlecocks), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-019-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Badminton Equipment And Products Market Summary

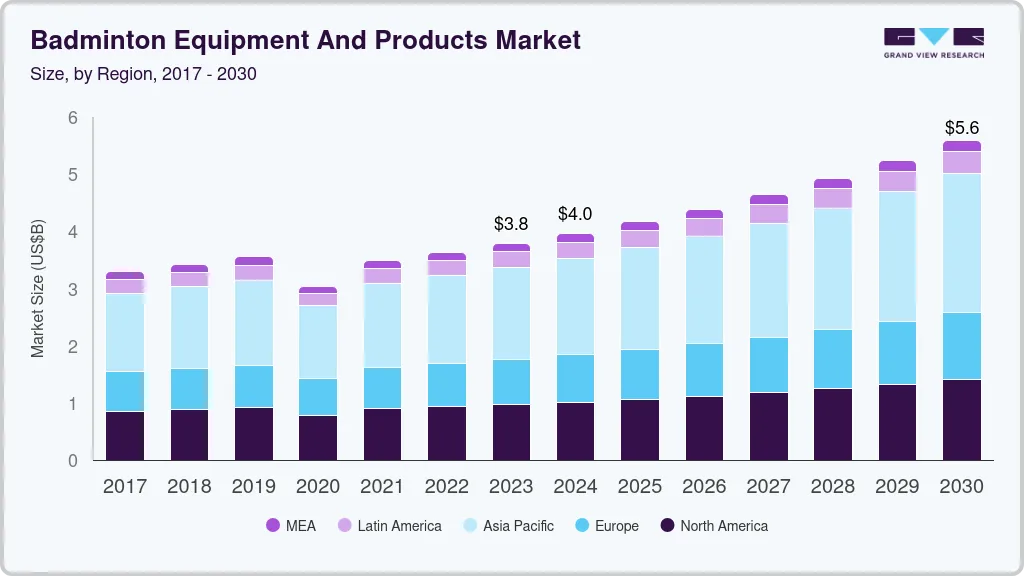

The global badminton equipment and products market size was estimated at USD 3,787.4 million in 2023 and is projected to reach USD 5,593.3 million by 2030, growing at a CAGR of 5.6% from 2024 to 2030. The market is mainly driven by the growing interest and popularity of badminton sport among citizens from all age groups across the globe.

Key Market Trends & Insights

- The Asia Pacific dominated the market for badminton equipment and products and accounted for a 42.3% share of the global revenue in 2022.

- The North America is expected to emerge as the second-largest regional market.

- Based on product, the products racquets segment led the market and accounted for a 33.5% share of the global revenue in 2022.

- Based on distribution channel, the hypermarkets/supermarkets segment dominated the market and accounted for a 33.9% share of the global revenue in 2021.

Market Size & Forecast

- 2023 Market Size: USD 3,787.4 Million

- 2030 Projected Market Size: USD 5,593.3 Million

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

Moreover, the market growth is anticipated to be aided by an increase in badminton competitions at the national and international levels, and government and corporate sponsorship for badminton. For instance in September 2022, USA Badminton and Badminton World Federation announced the partnership to heighten badminton popularity and commercial growth in the U.S. Additionally, it is anticipated that an increase in participants, training facilities, and playgrounds will fuel the industry over the upcoming years. COVID-19 has had a severe impact on the badminton equipment and products industry. Store closures due to quarantine and lockdown measures have resulted in grim consequences, with sales decreasing considerably from January to April 2020. Moreover, the pandemic disrupted production as well as sales of badminton equipment and products across many countries through offline channels due to social distancing and stay-home policies. In addition, the pandemic situation has goaded people to spend more judiciously and avoid frivolous purchasing.

Moreover, the various organizations USA Badminton (USAB), and Badminton World Federation (BWF) among others further support the growth in the popularity of badminton sports across the globe, thus creating significant growth opportunities for the market growth. For instance, USAB is the recognized national governing body for the sport of badminton in the U.S. As the national governing body, the main goal of the organization is to create and foster increased participation in the sport of badminton nationwide as well as develop and support American athletes.

Moreover, the Arab Badminton Federation (ABF), supported by the BWF, continued to deliver various development initiatives to popularise the game under several strategic areas. Virtual Development Initiative Launched in 2020 as a response to the pandemic, virtual development webinars continue to be popular in Arab-speaking countries. The ABF continues to strengthen regional partnerships and work closely with Special Olympics UAE, Special Olympics Middle East and North Africa, and the West Asia Para Federation. These initiatives further increase the popularity of badminton and further increases the demand for badminton products across the globe.

Additionally, manufacturers of badminton equipment are constantly working to provide new features to their products to meet consumer demand. For instance, the new POWER CUSHION ECLIPSION Z for footwear was introduced by YONEX CO., LTD. in January 2021. With its emphasis on stability, the ECLIPSION series gives athletes the assurance they need to execute even the most intricate or sophisticated footwork.

Product Insights

Among products racquets segment led the market and accounted for a 33.5% share of the global revenue in 2022. The rising demand for high quality and material-based racquets coupled with significant innovation by the market players in the racquets further augmented the market growth. Moreover, the high import of racquets in the U.S., UK, Germany, and other developed economies further supported the market. As per the International Trade Centre in 2021, U.S. UK, and Germany imported racquets around the value of USD 36.7 million, 9.1 million, and 21.6 million respectively.

The shoe segment is anticipated to be the fastest-growing segment with a CAGR of 5.9% from 2023 to 2030. Shifting trends from conventional to badminton-specific shoes among players is playing a crucial role in expanding customer reach. Significant product launches and innovations by manufacturers further create significant opportunities for market growth. For instance, in October 2022, Yonex Yonex Co., LTD announced the launch of POWER CUSHION AERUS Z badminton shoes. The AERUS series is a lightweight series aimed at providing swift footwork for all players who like to stay light and on their toes.

Distribution Channel Insights

Hypermarkets/supermarkets distribution channels dominated the market and accounted for a 33.9% share of the global revenue in 2021. Stores with multiple brands of badminton gear and accessories are among the most well-liked distribution methods. Before making a purchase, clients at these establishments can select from a wide range of brands. Customers like to shop at brick-and-mortar establishments, including big-box stores and independent retailers of badminton equipment. These shops prefer to offer clients exclusive bargains since they quickly adapt to the market's newest products, which supports increased sales.

The online distribution channel is expected to witness the fastest growth over the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market owing to a wider distribution network and greater product availability. Such factors influence manufacturers to sell their products through online channels. Amazon.com, Inc. and Dick sporting Goods, Badminton Warehouse among others are some of the major online retailers of badminton equipment and products across the globe.

Regional Insights

Asia Pacific dominated the market for badminton equipment and products and accounted for a 42.3% share of the global revenue in 2022. The presence of a large number of badminton players in this region has been one of the important factors driving the regional market. The significant popularity of badminton in China, Japan, Indonesia, and other countries contributed to the largest share of the badminton equipment and products industry. As per the pledge sports survey, China accounted for more than 100 million badminton players followed by Japan and Indonesia which had around 4 million and 1 million badminton players respectively in 2019.

Followed by Asia Pacific, North America is expected to emerge as the second-largest regional market for badminton equipment and products over the forecast period. The product demand has been increasing due to the high concentration of badminton players who prefer badminton equipment and products with unique characteristics and brand value. The rising imports of badminton products in the U.S. further contribute to the growth of the market. As per the International Trade Centre U.S. imported badminton racquets that were valued at around USD 19.3 million in 2017 which further increased to USD 36.6 million in 2021.

Key Companies & Market Share Insights

Prominent market players are likely to focus on establishing their business across the globe owing to the rapidly expanding customer base in countries, such as India, Indonesia, and others. In this respect, key market participants are expected to invest in research & development activities to remain competitive over the forecast period.

Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

-

In October 2022, Yonex Co., LTD launched POWER CUSHION AERUS Z badminton shoes. The POWER CUSHION AERUS X is designed as a comfortable lightweight model built with limited features.

-

In October 2022, Babolat announced the launch of two new badminton racquets EVO AERO and EVO AERO LITE delivering effortless power, comfort, and more spin. Babolat EVO racquets are targeted at players who enjoy fun, energetic games more than competitive, play-to-win matches.

-

In June 2022, Yonex Co., LTD announced the re-announcement of the COMFORT Z series, which is a favorite of badminton legend, Lin Dan.

Some of the prominent players in the badminton equipment and products market include:

-

YONEX Co., Ltd.

-

Mizuno Corporation

-

Li Ning (China) Sports Goods Co., Ltd.

-

Babolat

-

Apacs Sports (M) Sdn Bhd

-

FELET International Holdings Sdn. Bhd.

-

ASICS Corporation.

-

GOSEN CO., LTD.

-

Yehlex

-

VICTOR RACKETS IND.CORP.

Badminton Equipment And Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,787.4 million

Revenue forecast in 2030

USD 5,593.3 million

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; Denmark; China; Japan; Indonesia; India; Brazil; UAE

Key companies profiled

YONEX Co., Ltd., Mizuno Corporation, Li Ning (China) Sports Goods Co., Ltd., Babolat, Apacs Sports (M) Sdn Bhd, FELET International Holdings Sdn. Bhd., ASICS Corporation, GOSEN CO., LTD., Yehlex, VICTOR RACKETS IND.CORP.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Badminton Equipment And Products Market Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global badminton equipment and products market on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Apparel

-

Shoes

-

Racquets

-

Strings

-

Shuttlecocks

-

Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets/Supermarkets

-

Specialty and Sports Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global badminton equipment and products market was estimated at USD 3,628.8 million in 2022 and is expected to reach USD 3,787.4 million in 2023.

b. The global badminton equipment and products market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 5,593.3 million by 2030.

b. Asia Pacific dominated the badminton equipment and products market with a share of 42.3% in 2022. This is attributed to the presence of a large number of badminton players in this region has been one of the important factors driving the regional market. The significant popularity of badminton in China, Japan, Indonesia, and other countries contributed to the largest share of the badminton equipment and products industry.

b. Some key players operating in the badminton equipment and products market include YONEX Co., Ltd., Mizuno Corporation, Li Ning (China) Sports Goods Co., Ltd., Babolat, Apacs Sports (M) Sdn Bhd, FELET International Holdings Sdn. Bhd., ASICS Corporation, GOSEN CO., LTD., Yehlex, VICTOR RACKETS IND.CORP.

b. Key factors that are driving the badminton equipment and products market growth include the market mainly driven by growing interest and popularity of badminton sport among citizens from all age groups across the globe. Moreover, the market growth is anticipated to be aided by an increase in badminton competitions at the national and international levels, and government and corporate sponsorship for badminton.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.