- Home

- »

- Electronic & Electrical

- »

-

Baby Food Maker Market Size, Share, Industry Report, 2030GVR Report cover

![Baby Food Maker Market Size, Share & Trends Report]()

Baby Food Maker Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Food Preparation, Bottle Preparation), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-713-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Food Maker Market Size & Trends

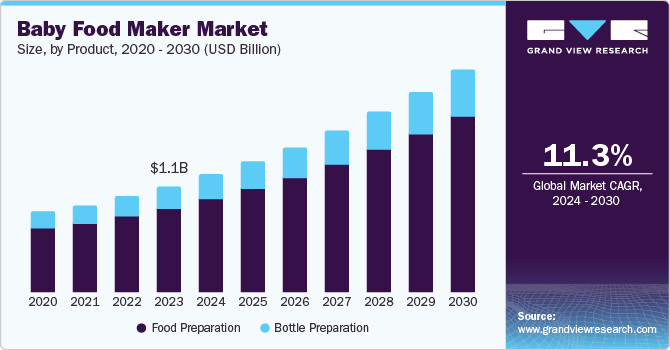

The global baby food maker market size was valued at USD 1.05 billion in 2023 and is projected to grow at a CAGR of 11.3% from 2024 to 2030. This growth is attributable to increasing awareness about nutritional intake in toddlers, a growing working-class woman population, an inclination of people towards a luxury lifestyle supported by rising disposable income, innovations in baby food makers, and expansion in distribution channels. Both offline and online distribution have significantly contributed to market growth. E-commerce platforms have made it easier for consumers to purchase baby food makers from remote locations, driving the growth of market.

Technological innovations in baby food makers have enhanced product performance and increased its applications. For instance, new models of baby food makers come with features like multiple temperature settings and BPA-free materials, making them safer and more efficient.

Moreover, the growing working-class women population is changing parenting methods worldwide. According to the International Labor Organization (ILO) in 2023 there was over 45% labor force participation rate among females worldwide. This demographic shift has created a demand for products like baby food makers, which help working mothers balance their professional responsibilities with childcare by providing a quick and efficient way to prepare baby food. Also, grandparents and other elderly caregivers are often involved in childcare, and baby food makers simplify the food preparation process for them.

Product Insights

The food preparation segment dominated the market and accounted for a revenue share of 79.3% in 2023. Food preparation products can perform various functions in the baby food-making process such as steaming, blending, heating, reheating, and more. Also, there is a growing trend among parents towards preparing homemade baby food due to concerns over additives and preservatives commonly found in commercial products. This shift has driven demand for appliances that facilitate easy home preparation. Also, the multifunctional nature of baby food makers appeals to busy parents who seek convenience without sacrificing quality.

The bottle preparation segment is expected to grow rapidly at a CAGR of 11.6% from 2024 to 2030 due to increased demand for convenience and health consciousness among parents. Moreover, innovations in technology have led to the development of smarter baby food makers equipped with features like app connectivity, allowing parents to monitor and control bottle preparation remotely via smartphones. For instance, Baby Brezza offers Safe + Smart Bottle Warmer connected with the Baby Brezza app to monitor warmers and receive alerts.

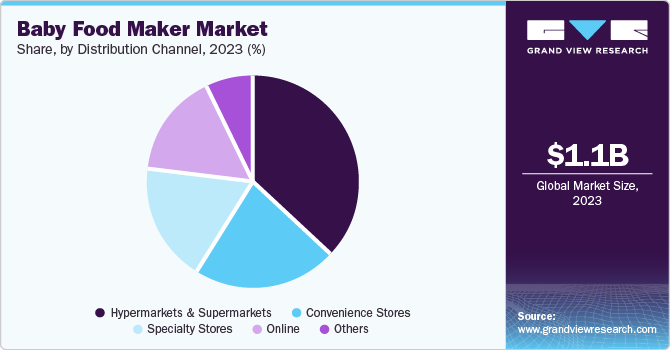

Distribution Channel Insights

The hypermarkets & supermarkets segment dominated the market and accounted for the largest revenue share in 2023. Hypermarkets and supermarkets offer accessibility and convenience to consumers. They also provide an extensive range of products under one roof. This includes a variety of baby food makers, food preparation products, and bottle preparation products. This wide selection allows consumers to easily compare distinct brands and types of baby food makers, facilitating informed purchasing decisions.

The online segment is expected to grow at the fastest CAGR during the forecast period. This growth is due to consumers' increasing awareness of health and nutrition and their preference for buying products easily from home. The rise in e-commerce platforms and digital marketing strategies, such as social media promotions by manufacturers, has further propelled this growth. In addition, product availability, competitive prices, and access to customers' reviews are contributing to the market growth.

Regional Insights

North America baby food maker market held the largest revenue share 34.1% in 2023 due to increasing adoption of baby food makers at homes, increasing women's labor participation in the region, developed retail infrastructure, innovation & product development, high disposable income, and presence of manufacturers. A well-established retail network, including supermarkets, specialty stores, convenience stores, and online platforms, ensures baby food makers' widespread availability. A higher disposable income allows consumers to spend more on premium and convenience-oriented products, propelling the market growth.

U.S. Baby Food Maker Market Trends

The U.S. baby food maker market held a significant market share in North America in 2023 due to developed retail infrastructure, a strong consumer base for innovative technologically advanced products, and strong marketing and brand by manufacturers. In addition, targeted marketing through e-commerce and online shopping platforms increases the sales of baby food makers. With many parents working full-time, convenience becomes crucial in meal preparation. Baby food makers offer a time-saving solution, enabling parents to prepare nutritious meals without extensive cooking or cleanup quickly.

Europe Baby Food Maker Market Trends

Europe baby food maker market held a significant market share in 2023 due to growing awareness among parents about the health & nutrition of toddlers & infants, and a well-developed distribution network in the region including supermarkets, and convenience stores. Organizational marketing activities and growing e-commerce are driving market growth. Moreover, the rise in dual-income households has led to a greater reliance on convenient baby food solutions, as working mothers often have limited time for meal preparation.

The UK baby food maker market held a substantial market share in 2023 owing to increasing parents' awareness about their infants' nutritional needs. The availability of baby food makers in mainstream supermarkets and convenience stores has improved their accessibility and popularity among working parents. In addition, influencers promoting supplements on social media platforms have increased awareness and demand for baby food makers.

Asia Pacific Baby Food Maker Market Trends

The Asia Pacific baby food maker market is expected to grow at the fastest CAGR of 12.7% during the forecast period. This growth is attributed to increasing awareness among parents of the health & nutrition of toddlers & infants, the growing middle class in the region, and rising disposable income. Moreover, the growing middle class in countries such as China, India, and Australia is fueling demand for premium and imported products, including baby food makers. The increasing influence of Western dietary habits and lifestyles is driving the adoption of baby food makers.

India baby food maker market is expected to grow significantly due to rapid urbanization and changing lifestyles, the influence of Western culture, and the growing middle-class and women population participation in the labor force.Rapid urbanization has led to the adoption of improved lifestyles and the increasing adoption of baby food makers. Moreover, the growing middle class with disposable income is driving demand for premium and imported food products, including baby food makers.

Key Baby Food Maker Company Insights

Some of the key companies in the kale chips market include Baby Brezza, Hamilton Beach Brands, Inc., Koninklijke Philips N.V., nuvitababy.com, Newell Brands, Dualit, and others. Organizations are focusing on innovative food maker offerings with multiple functionalities to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

- Baby Brezza offers a range of baby food makers that combine multiple functions, such as steaming, blending, and reheating, into a single appliance. Their product lineup includes models like the Baby Brezza One Step Food Maker Deluxe and the Baby Brezza One Step Food Maker Glass, which feature easy-to-use interfaces and quick preparation times.

Key Baby Food Maker Companies:

The following are the leading companies in the baby food maker market. These companies collectively hold the largest market share and dictate industry trends.

- Baby Brezza

- Hamilton Beach Brands, Inc.

- Koninklijke Philips N.V.

- nuvitababy.com

- Newell Brands

- Infantino, A Blue Box Company.

- Peek A Boo Store

- Munchkin, a Why Brands Inc. company.

- Avec Maman

- Dualit

- nutribullet, LLC

Recent Developments

-

In March 2023, nutribullet, LLC launched the nutribullet Baby Steam + Blend, an all-in-one baby food maker. The product simplifies homemade baby food preparation, giving parents more time with their little ones.

Baby Food Maker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.16 billion

Revenue forecast in 2030

USD 2.21 billion

Growth Rate

CAGR of 11.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; South Africa.

Key companies profiled

Baby Brezza; Hamilton Beach Brands, Inc.; Koninklijke Philips N.V.; nuvitababy.com; Newell Brands; Infantino, A Blue Box Company.; Peek A Boo Store; Munchkin, a Why Brands Inc. company.; Avec Maman; Dualit; nutribullet, LLC

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Food Maker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby food maker report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Preparation

-

Bottle Preparation

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.