- Home

- »

- Next Generation Technologies

- »

-

Autonomous Vehicle Market Size, Industry Report, 2030GVR Report cover

![Autonomous Vehicle Market Size, Share & Trends Report]()

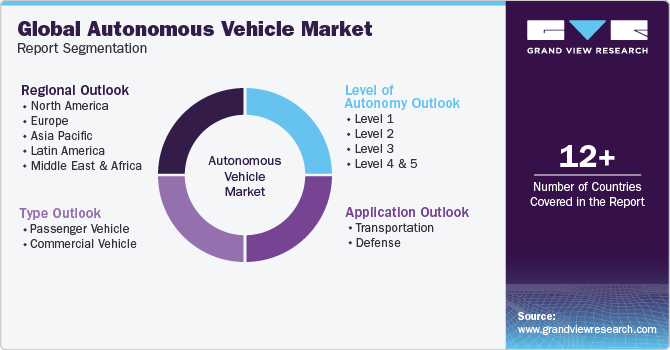

Autonomous Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Level of Autonomy (Level 1, Level 2), By Application (Transportation, Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-401-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Vehicle Market Summary

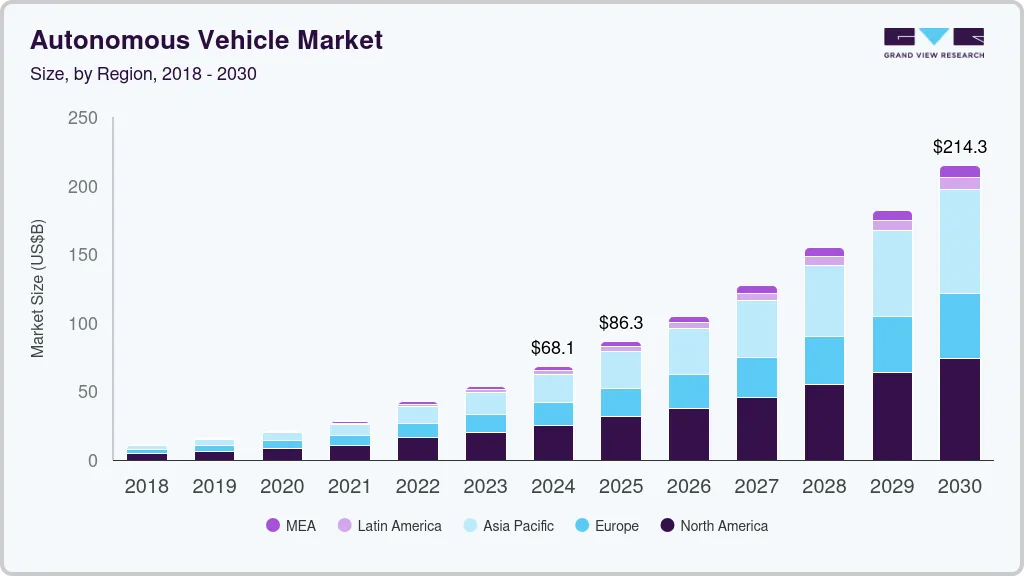

The global autonomous vehicle market size was estimated at USD 68.09 billion in 2024 and is projected to reach USD 214.32 billion by 2030, growing at a CAGR of 19.9% from 2025 to 2030. The industry is driven by the significant demand for tech adoption by customers, road safety, connectivity, advancement in AI, and sensor technology.

Key Market Trends & Insights

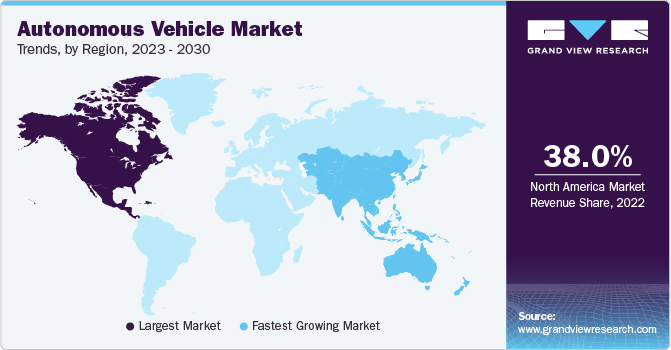

- North America autonomous vehicle market dominated the global industry with a share of over 37.1% in 2024..

- By vehicle type, the passenger vehicle segment led the market and accounted for 69% of the global revenue in 2024.

- By application, the transportation segment accounted for the largest market revenue share of 85.6% in 2024..

- By application, the defense segment is projected to grow significantly over the forecast period.

- By level of autonomy, the Level 1 segment dominated the market with the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 68.09 Billion

- 2030 Projected Market Size: USD 214.32 Billion

- CAGR (2025-2030): 19.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These technological strands enhance vehicle safety and reliability and also expand the scope of autonomous applications across industries, from logistics and transportation to ridesharing and delivery services. The cost-efficiency brought by these advancements makes autonomous solutions more appealing to businesses seeking innovative and competitive-edge offerings.

Industries adopting self-driving transport demonstrate a willingness to embrace innovative technology. As these industries experience the benefits of increased efficiency, reduced costs, and enhanced safety brought by autonomous transport, it encourages further adoption and investment in autonomous vehicle technology across various sectors. Hyundai Motor Group has launched ‘Pleos,’ a new mobility software brand and platform designed to advance software-defined vehicles (SDVs) and create an innovative in-vehicle app ecosystem. Unveiled at the Pleos 25 developer conference in Seoul, Pleos integrates vehicle OS, cloud infrastructure, autonomous driving, and fleet management to enhance connected mobility experiences. The Group also announced plans for Level 2+ autonomous driving by 2027 and introduced the Next Urban Mobility Alliance (NUMA) to foster public-private collaboration for smart, cloud-based urban mobility solutions.”

Vehicle Type Insights

The passenger vehicle segment led the market and accounted for 69% of the global revenue in 2024. There's a growing interest among consumers for more convenient, safe, and efficient transportation options. Autonomous vehicles offer the promise of hands-free and stress-free commuting, appealing to individuals seeking a more relaxed and productive travel experience. Continuous advancements in autonomous vehicle technology, including improved sensors, AI algorithms, and connectivity, have made significant strides in making autonomous passenger vehicles more feasible and reliable. These advancements instill confidence in the safety and performance of these vehicles, further driving consumer interest.

The commercial vehicle segment is anticipated to show the fastest CAGR of 26.3% over the forecast period. Various industries, including commercial transportation, logistics, and delivery services, are increasingly recognizing the benefits of autonomous technology in enhancing their operations. The potential to streamline commercial logistics, optimize supply chains, and meet growing customer demands drives the adoption of autonomous solutions in commercial fleets. A growing ecosystem of technology developers, manufacturers, and investors is dedicated to advancing autonomous systems for commercial use. Continuous innovation and investment in this sector will drive the development and deployment of more sophisticated autonomous commercial vehicles.

Application Insights

The transportation segment accounted for the largest market revenue share of 85.6% in 2024, the growth is driven due to its enormous capacity for efficiency and creativity. By offering safer and more effective transportation options and upsetting conventional travel and logistical practices, autonomous technology has the potential to completely change how people and commodities are moved. Autonomous cars are being adopted by sectors like logistics, shipping, and ridesharing to streamline operations, cut expenses, and satisfy growing consumer needs for dependable transportation. The domination of autonomous vehicles in the transportation business is fueled by this sector's emphasis on better logistics, increased safety, and cost-effectiveness.

The defense segment is projected to grow significantly over the forecast period, as governments are willing to improve the security of the nation and reduce risks to humans in conflict areas. Defense forces are increasingly adopting autonomous vehicles for surveillance, reconnaissance, logistics, and combat support to enhance operational capabilities and reduce risks to human personnel. Technological progress in artificial intelligence, robotics, and autonomous navigation is making these vehicles more reliable and cost-effective, accelerating their deployment in modern military operations. Rising defense budgets and the strategic need for efficient, unmanned systems are further propelling market growth. Autonomous military vehicles are expected to revolutionize combat by performing dangerous missions, improving mission efficiency, and minimizing casualties.

Level of Autonomy Insights

The Level 1 segment dominated the market with the highest revenue share in 2024. Basic driver assistance features such as adaptive cruise control or lane-keeping assistance, known as Level 1 autonomy, lead the autonomous market due to their ease of use and extensive integration in contemporary vehicles. These systems offer essential safety and convenience without necessitating substantial infrastructure modifications or incurring high expenses. Moreover, the widespread inclusion of Level 1 autonomy as standard or optional features across different car models by automakers enhances accessibility for consumers, further solidifying its prevalence in the market.

The Level 4 & 5 segment is expected to show the fastest CAGR over the forecast period. This segment in autonomous vehicles represents higher degrees of automation, enabling vehicles to operate without human intervention. The rising interest in these levels is mainly due to technological advancements in sensors, artificial intelligence, and computing power, which ensure safety and more reliable self-driving capabilities. Moreover, industries and consumers are recognizing the potential benefits, such as increased safety, efficiency, and convenience, which fuels the growth of these higher-level autonomous vehicles.

Regional Insights

North America autonomous vehicle market dominated the global industry with a share of over 37.1% in 2024 due to the huge infrastructure of North America, especially in some regions like Silicon Valley, California makes it an ideal location to test new technologies like driverless cars. The development and uptake of autonomous systems are greatly aided by this existing infrastructure and encouraging environment. There is a sizable market for drones, driverless cars, and other autonomous systems because the local populace is generally open to new technologies. This customer acceptance and demand fuel additional advancements in the sector.

U.S. Autonomous Vehicle Market Trends

The U.S. autonomous vehicle market is rapidly evolving, driven by strong investments from tech and automotive giants like Tesla, Waymo, and GM's Cruise. Tesla is set to launch its robotaxi service in Austin by mid-2025 using autonomous Model Y vehicles. Major cities are increasingly piloting AV programs, especially for ride-hailing and delivery services. The regulatory landscape is becoming more supportive, with several states allowing commercial AV operations. Consumer adoption is growing, especially for Level 2 and 3 autonomous features. This momentum indicates strong market expansion over the next five years.

Europe Autonomous Vehicle Market Trends

Europe autonomous vehicle market is growing as big manufacturers like Volkswagen and BMW are investing in AI and connected car technology, which is encouraging Europe to become a big player in this industry. Greener transportation alternatives are promoted by supportive laws and sustainability programs like the EU Green Deal. Autonomous taxis and shuttles are being tested extensively in cities like Paris and Helsinki in an effort to improve urban mobility and lower pollution. Concerns such as cybersecurity and infrastructure are being addressed by continuous investments in smart infrastructure and public awareness campaigns. Overall, Europe's strong focus on sustainability and technology is driving the fast expansion of the use of autonomous vehicles.

Asia Pacific Autonomous Vehicle Market Trends

Asia Pacific autonomous vehicle market is expected to grow with the fastest CAGR of 25.0% from 2025 to 2030. Countries such as China, Japan, and South Korea have densely populated cities facing transportation challenges. In these urban areas, autonomous cars are considered a way to ease traffic, increase mobility, and reduce transportation costs. Furthermore, the focus on connected and powered automobiles in Asia Pacific aligns with the trend toward autonomous vehicles. The market for autonomous vehicles is expanding as a result of the region's focus on sustainable energy, which has generated interest in these technologies.

Key Autonomous Vehicle Company Insights

The market is marked by intense competition, with a small number of global competitors holding a substantial market share. The primary emphasis is on creating innovative products and fostering collaboration among the key industry participants. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2024, Renault Group is innovating with WeRide by setting up a trial of electric and autonomous shuttles that will facilitate access to the Roland-Garros stadium during matches, while demonstrating the maturity of new technologies for automated public transport services.

-

Tesla, Inc. is an electric vehicle and clean energy company known for its innovative electric cars, energy storage solutions, and solar products. Its major offerings in autonomous vehicles include advanced driver-assistance features powered by Tesla's Full Self-Driving (FSD) software, which enables capabilities such as automated lane changes, traffic-aware cruise control, and city street navigation. Tesla’s vehicles, including the Model S and Model X, come equipped with hardware designed to support future autonomous driving enhancements. The company continuously updates its autonomous driving software via over-the-air updates, aiming to achieve full self-driving capabilities. Tesla also supports its vehicles with a global network of Superchargers for convenient long-distance travel.

-

Zoox, a subsidiary of Amazon, specializes in developing fully autonomous, purpose-built electric vehicles designed specifically for ride-hailing services. Unlike retrofitted cars, Zoox’s vehicles are bi-directional, have no steering wheel or manual controls, and are engineered from the ground up for autonomy, targeting Level 5 automation-meaning no human intervention is required at any point. Their robotaxis use a sophisticated sensor suite including lidar, radar, and cameras, paired with powerful onboard computing to navigate complex urban environments safely. Zoox operates test fleets in cities like San Francisco, Las Vegas, and Seattle, and is one of the few companies permitted to test driverless vehicles without safety drivers in California. The company leverages advanced simulation for software validation and continuous improvement, aiming to redefine urban mobility with safe, efficient, and sustainable autonomous transportation.

Key Autonomous Vehicle Companies:

The following are the leading companies in the autonomous vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- AUDI AG.

- Ford Motor Company

- Mercedes-Benz Group

- Nuro, Inc.

- Pony.ai

- Tesla

- Toyota Kirloskar Motor

- Volkswagen Group

- Waymo LLC

- Zoox, Inc.

Recent Developments

-

In 2025, China introduced new regulations to support Level 3 (L3) autonomous driving for personal vehicles, establishing a clear legal framework that allows automakers such as XPeng, Li Auto, and Tesla to gear up for mass production of L3-equipped cars. This move signals the start of the large-scale global commercialization of L3 autonomous vehicles.

-

In January 2025, Sony and Honda came together to launch an autonomous electric vehicle, named Afeela EV, in Japan and the U.S. by 2026. This vehicle comprises AI and technologies that improve the self-driving capability of EVs. This collaboration has made another milestone in the autonomous vehicle market.

-

In October 2024, a partnership between Toyota Motor Corporation and NTT with an investment of 500 billion yen by 2030 to launch “Mobility AI Platform” integrated with high communication infrastructure, computing to connect people and vehicles, and advanced AI. The aim is to achieve zero traffic accidents, focus on Passenger Vehicle Defined Vehicles (SDVs) and data-driven driving technologies.

Autonomous Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 86.32 billion

Revenue forecast in 2030

USD 214.32 billion

Growth Rate

CAGR of 19.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, application, level of autonomy, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

AUDI AG; Zoox, Inc.; Waymo LLC; Tesla; Toyota Kirloskar Motor; Ford Motor Company; Volkswagen Group; Pony.ai; Nuro, Inc.; Mercedes-Benz Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Vehicle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autonomous vehicle market report based on vehicle type, application, level of autonomy, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Industrial

-

Commercial

-

Personal

-

-

Defense

-

-

Level of Autonomy Outlook (Revenue, USD Million, 2018 - 2030)

-

Level 1

-

Level 2

-

Level 3

-

Level 4 & 5

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous vehicles market size was estimated at USD 68.09 billion in 2024 and is expected to reach USD 86.32 billion in 2025.

b. The global autonomous vehicles market is expected to grow at a compound annual growth rate of 19.9% from 2025 to 2030 to reach USD 214.32 billion by 2030.

b. North America dominated the autonomous vehicles market with a share of 37.1% in 2024. This is attributable to advanced infrastructure, particularly evident in regions such as California's Silicon Valley, which serves as an ideal testing ground for autonomous vehicles.

b. Some key players operating in the autonomous vehicles market include AB Volvo; Bayerische Motoren Werke AG; Ford Motor Company; General Motors; Hyundai Motor Group; Mercedes-Benz AG; Renault SA; Tesla, Inc; Toyota Motor Corporation; and Volkswagen Group

b. Key factors that are driving the autonomous vehicles market growth include the rising need for road safety, environmental impact due to traditional vehicles, and increased energy savings by autonomous vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.