- Home

- »

- Automotive & Transportation

- »

-

Automotive Hypervisor Market Size And Share Report, 2030GVR Report cover

![Automotive Hypervisor Market Size, Share & Trends Report]()

Automotive Hypervisor Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Vehicle, By End Use (Economy, Mid-priced, Luxury), By Mode of Operation, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-463-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Hypervisor Market Size & Trends

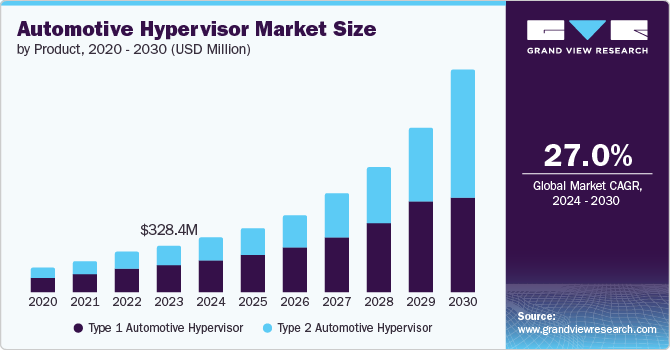

The global automotive hypervisor market size was valued at USD 328.4 million in 2023 and is projected to grow at a CAGR of 27.0% from 2024 to 2030. As vehicles become more technologically advanced, the complexity of their electronic systems increases significantly. Modern cars are equipped with numerous electronic control units (ECUs) that manage various functions, such as engine control, infotainment systems, and advanced driver assistance systems (ADAS). Automotive hypervisors are crucial in managing this complexity by allowing multiple operating systems to run concurrently on a single hardware platform. This capability enables car manufacturers to integrate diverse functionalities more efficiently and without interference, enhancing overall system performance and reliability.

The increasing demand for automotive hypervisors is due to the rapid evolution of autonomous driving technologies and ADAS features. These systems require real-time data processing from sensors and cameras, necessitating robust and secure software environments. Hypervisors facilitate the segregation of safety-critical functions from non-critical ones on the same hardware, ensuring that essential tasks such as collision avoidance and emergency braking operate seamlessly without being compromised by less critical functions like infotainment. Cost efficiency and space optimization also contribute significantly to adopting automotive hypervisors. By consolidating multiple ECUs onto fewer hardware platforms, car manufacturers can reduce production costs and optimize space within vehicles. This consolidation is particularly valuable as vehicles become more compact and lighter, responding to consumer preferences for fuel efficiency and environmental sustainability.

Furthermore, cybersecurity concerns have become increasingly prominent in the automotive sector. With vehicles becoming more connected and autonomous, the risk of cyber threats has heightened. Automotive hypervisors address these concerns by providing enhanced security measures by isolating and segregating critical and non-critical systems. This approach helps prevent unauthorized access and protects sensitive data, ensuring that vehicles remain secure from cyber-attacks.

Additionally, the flexibility offered by automotive hypervisors is crucial for adapting to evolving industry standards, customer demands, and regulatory requirements. Manufacturers can more effectively future-proof their vehicles' software architectures, allowing for easier updates and enhancements over the vehicle's lifespan. This adaptability is essential in an industry with constant technological advancements and regulatory changes.

Product Insights

Type 1 automotive hypervisor segment held the largest market revenue share of 57.9% in 2023. Type 1 automotive hypervisor functions without an operating system as it works directly on the vehicle's hardware. It delivers superior performance, security, and dependability, positioning it as the best alternative for safety-critical and mission-critical applications within the automotive sector. It oversees real-time operations, advanced driver-assistance systems (ADAS), and essential functions. Additionally, it enhances the separation between various software elements, guaranteeing that safety-critical systems remain protected from non-critical operations.

Type 2 automotive hypervisor is projected to grow at the fastest CAGR of 33.4% in the forecast period. Car manufacturers often provide vehicles with advanced third-party software components such as navigation systems, voice assistants, and entertainment apps. Hypervisors provide a secure environment for running these diverse software stacks without compromising safety or performance. Type 2 hypervisors run on existing hardware without requiring dedicated chips or modifications. This cost-effective approach appeals to automakers and suppliers, especially when integrating new features into legacy systems.

Vehicle Insights

Passenger vehicles dominated the market in 2023. The rising demand for connected and autonomous vehicles fuels the adoption of hypervisors. These systems manage software components, ensuring seamless communication between various vehicle functions. Increasing safety awareness drives the integration of advanced driver assistance systems (ADAS) and safety features. Hypervisors are crucial in maintaining safety-critical functions while managing other software tasks. Modern vehicles offer sophisticated infotainment and user interface features. Hypervisors enable seamless interaction between these systems, enhancing the overall driving experience.

The heavy commercial vehicles segment is projected to grow at the fastest CAGR. Automotive hypervisors play a crucial role in ensuring the safety and security of heavy commercial vehicles by enabling the isolation of critical functions within the vehicle’s systems. This segregation helps prevent interference between applications running on the same hardware platform, enhancing overall vehicle safety. According to the Society of Indian Automobile Manufactures (SIAM), 3,59,003 units of medium and heavy commercial vehicles were sold in India. The increasing demand for heavy commercial vehicles drives the automotive hypervisors market. Hypervisors allow heavy commercial vehicles to optimize resource utilization by running multiple virtual machines on a single physical hardware platform.

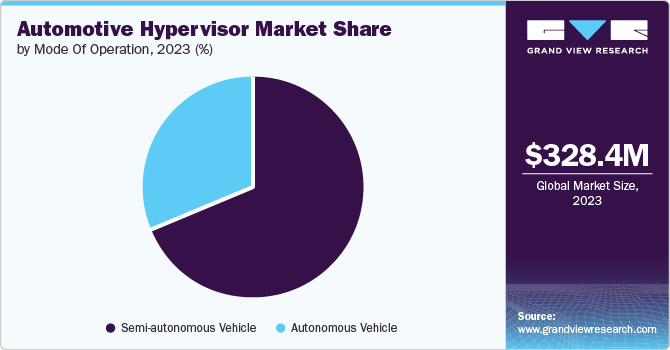

Mode of Operation Insights

The semi-autonomous segment dominated the market in 2023. Semi-autonomous vehicles require efficient resource allocation for tasks such as processing sensor data and executing decision-making algorithms. Automotive hypervisors dynamically adjust to optimize hardware resource allocation for individual applications. This ensures critical operations receive the necessary computing resources without impacting the system's efficiency.

The autonomous vehicles segment is projected to grow at the fastest CAGR over the forecast period. Advanced software systems are crucial for autonomous vehicles to analyze their surroundings, make decisions, and control their actions. Automotive hypervisors help integrate software components, such as sensor data processing, decision-making algorithms, and communication modules, in a safe and efficient environment. The security of self-driving cars is a significant worry because of the potential risks posed by hacking or unauthorized entry into the vehicle's systems. Automotive hypervisors boost cybersecurity by separating important functions, decreasing vulnerability to attacks, and enhancing system security.

End User Insights

The luxury segment dominated the market in 2023. Luxury car makers emphasize providing a high-quality user experience for their clients. Automotive hypervisors facilitate the smooth incorporation of diverse infotainment systems, digital clusters, navigation tools, and other entertainment features inside the vehicle. Safety is a top priority in high-end vehicles, with automotive hypervisors playing a role in improving both active and passive safety components. Hypervisors ensure safe operation by virtualizing important functions like collision avoidance systems, adaptive cruise control, and emergency braking mechanisms without sacrificing safety standards.

The economy segment is projected to grow at the fastest CAGR over the forecast period. Cost efficiency is a key factor driving the adoption of automotive hypervisors in the economy segment. Economy vehicles are produced to offer affordability and appeal to a wider range of consumers who prioritize price. Utilizing hypervisor technology enables car manufacturers to combine Electronic Control Units (ECUs) and decrease vehicle hardware components, resulting in cost savings while maintaining necessary functionalities.

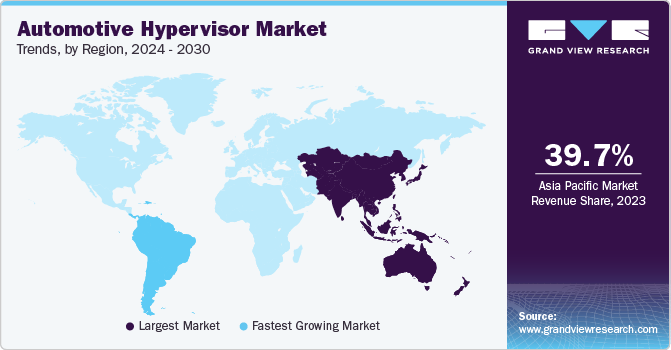

Regional Insights

The North America automotive hypervisor market is expected to grow at a significant CAGR during the forecast period. With an increasing emphasis on vehicle safety and cybersecurity, automotive manufacturers are incorporating hypervisors to isolate critical functions and prevent unauthorized access to sensitive systems. The need for robust security measures in modern vehicles drives the demand for automotive hypervisors in North America. The growing popularity of electric vehicles in North America is another significant driver for the Automotive Hypervisor market. EVs require sophisticated software solutions to manage power distribution, battery performance, and other critical functions, making hypervisors essential in electric vehicle architecture.

U.S. Automotive Hypervisor Market Trends

U.S. automotive hypervisor dominated regional market in 2023. The United States has a strong market for luxury vehicles, with consumers showing increasing interest in high-end cars equipped with advanced features and technologies. Luxury car manufacturers are incorporating more sophisticated systems into their vehicles, including multiple ECUs that require efficient management through hypervisor technology. The demand for luxury cars with advanced functionalities is fueling the growth of automotive hypervisors in the U.S.

Europe Automotive Hypervisor Market Trends

Europe market is projected to grow with the significant CAGR over the forecast period. Various European countries have implemented stringent regulations mandating the inclusion of safety features in vehicles. Features like blind spot detection, lane departure warning, automatic emergency braking, and parking assist are becoming standard requirements. The demand for Advanced Driver Assistance Systems (ADAS) and safety systems is increasing, leading to a higher adoption of hypervisor technology to support these advanced functionalities.

UK automotive hypervisor market is witnessing a significant growth in the automotive hypervisor market. The UK government has been actively promoting the adoption of electric vehicles (EVs) and autonomous driving technologies to reduce emissions and enhance road safety. These initiatives have created a favorable environment for the growth of the automotive hypervisor market as automakers seek innovative solutions to meet regulatory requirements and improve vehicle performance.

Germany automotive hypervisor market is anticipated to witness a prominent growth. Germany is home to major automotive manufacturers such as Volkswagen, Daimler AG, and BMW, and it is known for its innovation and technological advancements in vehicles. These OEMs are pioneers in adopting and implementing advanced automotive technologies, including hypervisor systems. Their focus on integrating cutting-edge features and ensuring vehicle safety drives the demand for hypervisors in the German automotive market.

Asia Pacific Automotive Hypervisor Market Insights

Asia Pacific held the largest market revenue share of 39.7% in 2023. As consumer awareness regarding connected vehicle technologies increases, a growing demand for vehicles equipped with advanced features powered by hypervisors increases. The rising consumer preference for smart, connected vehicles is driving automakers to integrate hypervisor technology into their product offerings, further boosting market growth in Asia Pacific. The increasing investments by automotive companies and technology firms in research and development activities related to connected vehicles and autonomous driving technologies are fostering the growth of the automotive hypervisor market in Asia Pacific.

India automotive hypervisor market is projected to grow rapidly in this industry. Rising disposable income and changing consumer behavior is driving demand for vehicles with advanced features in the Indian market. According to Autocar India, Mercedes Benz, a luxury car manufacturer, sold 17,400 units of luxury cars in India. Luxury cars and premium segments are witnessing significant growth, leading to higher adoption of technologies like hypervisors to support complex electronic systems and functionalities.

Latin America Automotive Hypervisor Market Insights

Latin America is projected to grow at the fastest CAGR of 29.6% over the forecast period. The rising influence of autonomous vehicle technologies in Latin America is driving the demand for automotive hypervisors. Automotive hypervisors act as key factors in integrating various sensors, control systems, and AI algorithms required for the functioning of autonomous driving features. Stringent regulatory necessities related to vehicle cybersecurity and data protection influence automotive manufacturers in Latin America to invest more in advanced technologies like hypervisors. Compliance with regulations is driving the demand for automotive hypervisors to improve vehicle cybersecurity measures.

Key Automotive Hypervisor Company Insights

Some key companies in the automotive hypervisor market include BlackBerry Limited, Panasonic Holdings Corporation, Green Hills Software, Sasken Technologies Ltd, Visteon Corporation.

-

BlackBerry Limited offers the real time QNX hypervisor, it is a Type 1 hypervisor that comes with virtualization technology, and it allows the secure isolation of multiple operating systems on a single SoC. It also enables safety regulations defined by the ISO also provide extensive design flexibility.

-

Panasonic Automotive Systems has created an innovative virtualization security solution to safeguard advanced cockpit systems, working in cooperation with a virtualization platform. This innovation was showcased in a controlled experimental setting utilizing automotive hypervisor technology.

Key Automotive Hypervisor Companies:

The following are the leading companies in the automotive hypervisor market. These companies collectively hold the largest market share and dictate industry trends.

- BlackBerry Limited

- Continental AG

- Green Hills Software

- Infineon Technologies AG

- NXP Semiconductor N.V.

- Panasonic Holdings Corporation

- Renesas Electronics Corporation

- Sasken Technologies Ltd

- Siemens

- Visteon Corporation

Recent Developments

-

In April 2024, BlackBerry Limited announced the partnership with ETAS GmbH, this partnership aims to sell and market software solutions which will boost the improvements in the safety critical functions integrated in next generation software defined vehicles.

-

In January 2024, Panasonic Holdings Corporation announced the launch of a new system which helps to improve high performance compute system, by aligning multiple CUs into a single platform which helps in handling functions of care features such as driving support and entertainment.

Automotive Hypervisor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 385.7 million

Revenue forecast in 2030

USD 1,617.4 million

Growth Rate

CAGR of 27.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Vehicle, End Use, Mode of Operation, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

BlackBerry Limited; Continental AG; Green Hills Software; Infineon Technologies AG; NXP Semiconductor N.V.; Panasonic Holdings Corporation; Renesas Electronics Corporation; Sasken Technologies Ltd; Siemens; Visteon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Automotive Hypervisor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive hypervisor market report based on product, vehicle, end use, mode of operation, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 1 Automotive Hypervisor

-

Type 2 Automotive Hypervisor

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Economy

-

Mid-Priced

-

Luxury

-

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Autonomous Vehicle

-

Semi-autonomous Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.