- Home

- »

- Automotive & Transportation

- »

-

Automotive Hydraulics System Market Size Report, 2030GVR Report cover

![Automotive Hydraulics System Market Size, Share & Trends Report]()

Automotive Hydraulics System Market (2024 - 2030) Size, Share & Trends Analysis Report By Sales Channel, By Component, By Application, By On-Highway Vehicles, By Off-Highway Vehicles, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-385-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Hydraulics System Market Trends

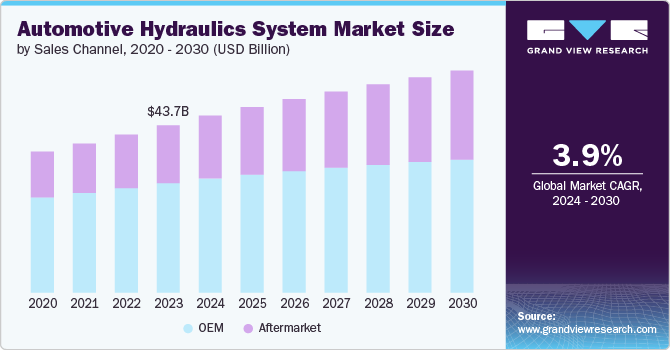

The global automotive hydraulics system market size was estimated at USD 43.71 billion in 2023 and is expected to expand at a CAGR of 3.9% from 2024 to 2030.The rising demand for commercial vehicles, spurred by economic expansion, urbanization trends, and heightened transportation requirements, is a significant catalyst driving growth in the market.

Commercial vehicles, particularly heavy-duty trucks and buses, rely heavily on robust hydraulic systems to manage substantial loads, deliver dependable braking performance, and facilitate efficient power steering. These hydraulic systems play a critical role in ensuring operational safety, reliability, and efficiency across various commercial vehicle applications.

Technological advancements play a pivotal role as manufacturers integrate advanced sensors and electronic controls into hydraulic systems. These innovations enable real-time monitoring and adjustment of fluid pressure and flow, enhancing overall system efficiency and responsiveness. Such advancements are crucial across various automotive applications, from braking and steering to suspension systems, where precise control and reliability are paramount. As automotive manufacturers strive for safer and more efficient vehicles, the integration of smart hydraulic systems continues to evolve, meeting both regulatory requirements and consumer expectations for enhanced performance and safety.

Another significant trend shaping the market is the rise of electric-hydraulic hybrid systems. These systems combine the advantages of hydraulic power with the precision and efficiency of electric controls. By integrating electric actuators and controllers with hydraulic components, manufacturers achieve finer control over system parameters, resulting in smoother operation and reduced energy consumption. Electric-hydraulic hybrids are particularly advantageous in applications requiring variable force and motion control, such as adaptive suspension systems and advanced braking technologies.

Manufacturers are increasingly utilizing high-strength materials and composites to reduce the weight of hydraulic systems without compromising durability or functionality. This trend is driven by the automotive industry's focus on improving fuel efficiency and reducing emissions. Lightweight hydraulic components not only contribute to better vehicle dynamics but also align with global sustainability initiatives. As environmental regulations become more stringent worldwide, the demand for eco-friendly automotive solutions drives innovation in hydraulic system design, favoring materials and technologies that minimize environmental impact while maximizing performance.

The geographical expansion of automotive production and infrastructure development in emerging markets presents new growth opportunities for hydraulic system manufacturers. Regions such as Asia-Pacific are witnessing a surge in automotive sales, driven by economic growth and increasing consumer demand for vehicles equipped with advanced safety and performance features. This expansion not only stimulates demand for hydraulic systems but also encourages local manufacturing and customization to meet regional requirements.As automotive ecosystems evolve globally, market players are strategically positioning themselves to capitalize on these opportunities, fostering innovation and market growth in the automotive hydraulics sector.

Sales Channel Insights

The OEM segment led the market and accounted for 65.3% of the global revenue in 2023.Original Equipment Manufacturers (OEMs) are prioritizing the development of lightweight and compact hydraulic components that enhance vehicle performance while meeting stringent regulatory standards.

This trend is driven by the automotive industry's push for greater fuel efficiency and reduced emissions, prompting OEMs to innovate hydraulic systems that optimize energy usage and improve overall vehicle dynamics. Additionally, OEMs are leveraging technologies such as predictive maintenance and real-time diagnostics in their hydraulic systems to enhance reliability and address maintenance issues, thereby reducing downtime and operational costs.

The aftermarket segment is expected to register significant growth from 2024 to 2030. Aftermarket providers are focusing on offering cost-effective hydraulic components and systems that cater to diverse customer needs, from enhancing vehicle safety features to improving operational efficiency.

There is a growing emphasis on product customization and compatibility with a wide range of vehicle models, ensuring flexibility and ease of integration for aftermarket installations. Moreover, advancements in e-commerce platforms and digital marketing strategies are facilitating easier access to aftermarket hydraulic products, allowing consumers to research, compare, and purchase components online.

Component Insights

The master cylinder segment accounted for a significant revenue share in 2023. The growing trend towards the integration of advanced materials and technologies to enhance performance and reliability is a significant factor contributing to the growth of the segment. Manufacturers are increasingly using lightweight materials such as aluminum alloys and composites to reduce weight and improve fuel efficiency without compromising on strength.

Additionally, advancements in sealing technologies and precision manufacturing processes are enhancing the durability and longevity of master cylinders, ensuring consistent hydraulic performance over the vehicle's lifespan. Integration with electronic sensors and actuators is also gaining traction, enabling real-time monitoring and adaptive control of brake fluid pressure, which enhances braking responsiveness and safety.

The slave cylinder segment is expected to grow significantly from 2024 to 2030. As vehicle designs evolve to prioritize space optimization and performance, manufacturers are developing slave cylinders with smaller footprints and increased operational efficiency, thereby contributing to the growth of the segment. These advancements aim to improve clutch actuation in manual transmission vehicles, enhancing overall drivability and shifting precision.

Additionally, there is a growing emphasis on reducing friction losses and optimizing hydraulic fluid dynamics within slave cylinders. This focus not only enhances clutch engagement and disengagement but also contributes to smoother gear changes and reduced wear on clutch components.

On-Highway Vehicles Insights

The passenger cars segment accounted for the largest revenue share in 2023. The growth of the segment can be attributed to the growing emphasis on incorporating advanced hydraulic systems to enhance vehicle safety and performance. Manufacturers are increasingly integrating hydraulic technologies with electronic stability control (ESC) and anti-lock braking systems (ABS) to provide superior braking performance and vehicle control.

In addition, the push for fuel efficiency and reduced emissions is driving the development of lightweight hydraulic components, utilizing materials such as aluminum and composites. Additionally, the integration of hydraulic systems with autonomous driving technologies, ensuring precise control and reliability in automated functions is also contributing to the growth of the segment. These advancements cater to consumer demand for safer, more efficient, and technologically advanced passenger vehicles.

The light commercial vehicles segment is expected to grow significantly from 2024 to 2030. Rising demand for better durability and efficiency to meet the rigorous demands of commercial operations is a significant factor contributing to the growth of the segment. Hydraulic systems in LCVs are being designed to handle heavy loads and frequent use, with enhancements in hydraulic braking and power steering systems to ensure reliability and ease of operation. There is also a trend toward optimizing hydraulic systems for better fuel efficiency, crucial for reducing operating costs in commercial fleets. As e-commerce and urban logistics grow, the demand for robust and efficient hydraulic systems in LCVs continues to rise, driving innovation in this segment.

Off-Highway Vehicles Insights

The agriculture equipment segment accounted for the largest revenue share in 2023. The increasing demand for high-power and efficient hydraulic systems that can handle the diverse and demanding tasks of modern farming is a major factor contributing to the growth of the segment.

Hydraulic systems are favored for their ability to efficiently manage heavy loads and operate various machinery, including tractors, harvesters, and sprayers. Farmers are leveraging the precision offered by adjustable flow rates and pressure levels to optimize equipment performance, enhancing productivity while minimizing waste. The superior energy efficiency of hydraulic systems, which transmit power through pressurized fluid with minimal loss, is a significant advantage over traditional mechanical systems.

Construction segment is expected to grow at notable CAGR from 2024 to 2030. The growth of the segment can be attributed to the rising adoption of advanced hydraulic systems that enhance machine performance, durability, and efficiency. Hydraulic systems are crucial in construction equipment such as excavators, loaders, and bulldozers, where they provide the high power and precise control needed for heavy lifting, digging, and material handling.

The industry is seeing increased demand for hydraulic components that are robust and capable of withstanding harsh working conditions while maintaining reliability and performance. Additionally, advancements in hydraulic technology are enabling better energy efficiency and reduced operational costs, which are key considerations for construction companies looking to improve productivity and sustainability.

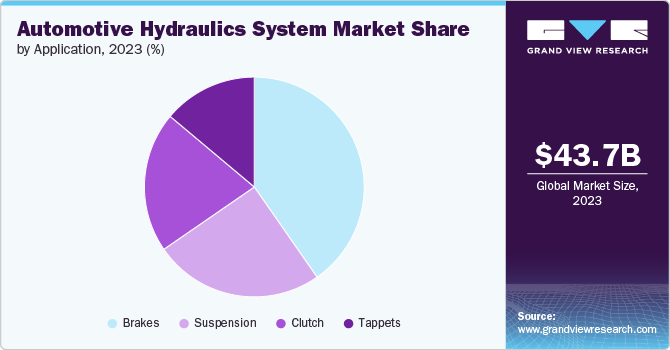

Application Insights

The brakes segment accounted for the largest revenue share in 2023 and is expected to retain its dominance over the forecast period. Hydraulic braking systems offer superior stopping power and reliability, essential for ensuring driver and passenger safety in various driving conditions. Additionally, advancements in hydraulic brake technology, such as anti-lock braking systems (ABS) and electronic stability control (ESC), have further increased their adoption across passenger cars and commercial vehicles. The widespread regulatory requirements mandating advanced braking systems in new vehicles also drive the dominance of hydraulic brakes in the market.

The clutch segment is expected to grow significantly from 2024 to 2030. The clutch segment is emerging in the automotive hydraulics market due to increasing demand for smoother and more efficient transmission systems in vehicles. Hydraulic clutches offer better control and reduced driver fatigue compared to mechanical clutches, enhancing the overall driving experience. As manual transmissions remain popular in certain regions and vehicle types, the adoption of hydraulic clutches is rising to meet performance and comfort expectations. Additionally, advancements in hydraulic clutch technology, such as self-adjusting systems and integration with electronic controls, are driving their growing presence in the market.

Regional Insights

Asia Pacific automotive hydraulics system market dominated the global market and accounted for 33.16% in 2023. Asia Pacific registers the largest share in the global market owing to the region's significant automotive manufacturing base and rapidly growing vehicle production. Countries such as China, Japan, and India are major automotive hubs, contributing to the high demand for hydraulic systems in both passenger and commercial vehicles. Additionally, the increasing urbanization and rising disposable incomes in these countries are driving higher vehicle sales, further boosting the market. The presence of leading automotive manufacturers and ongoing investments in advanced automotive technologies also support the dominant market share of the Asia Pacific region.

Europe Automotive Hydraulics System Market Trends

The European automotive hydraulics system market is poised for significant growth from 2024 to 2030. Europe registers a significant share in the automotive hydraulics system market due to its strong emphasis on advanced automotive technologies and stringent safety regulations. The presence of leading automotive manufacturers in Germany, France, and Italy drives demand for high-performance hydraulic systems in both luxury and commercial vehicles. Additionally, the region's focus on sustainable and fuel-efficient technologies encourages the adoption of lightweight and energy-efficient hydraulic components. Government initiatives promoting electric and hybrid vehicles also support the growth of advanced hydraulic systems in Europe.

North America Automotive Hydraulics System Market Trends

The North American automotive hydraulics system market is anticipated to register significant growth from 2024 to 2030. The region's focus on vehicle safety and performance standards fuels the adoption of advanced hydraulic systems in both passenger and commercial vehicles. The growing trend of automation and smart technologies in the automotive sector further enhances the market for hydraulic systems with integrated electronic controls. Additionally, the strong aftermarket segment in North America supports continuous demand for hydraulic components and systems.

U.S. Automotive Hydraulics System Market Trends

The U.S. automotive hydraulics system market is anticipated to register significant growth from 2024 to 2030. Innovations in hydraulic technology, coupled with a strong focus on R&D by leading automotive manufacturers, contribute to the market's growth.

Key Automotive Hydraulics System Copmany Insights

Key players operating in the market are continually invest in R&D to develop advanced hydraulic systems that enhance vehicle performance, safety, and efficiency, catering to the evolving demands of the automotive industry. Additionally, strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market reach and technological capabilities. The focus on sustainability and the integration of electronic controls with hydraulic systems are key trends driving competition and innovation in this dynamic market.

Several companies in the market are focusing on introducing advanced hydraulic brake systems with enhanced features. For instance, in March 2023, ZF Friedrichshafen AG’s Industrial Division introduced its latest brake-by-wire offering at CONEXPO/CONAGG 2023, scheduled for March 14-18 in Las Vegas. As one of the global leaders in both electrohydraulic and hydraulic braking systems, ZF Friedrichshafen AG delivers safe and efficient brake technology to customers in heavy-duty, off-highway, construction, mining, and agriculture sectors. The company’s newest brake-by-wire solution marks a significant advancement, enabling vehicle manufacturers to manage deceleration through electronic signals that adjust brake pressure as required. This innovation eliminates the need for hydraulic lines in the cab, paving the way for remote and autonomous vehicle operations.

Key Automotive Hydraulics System Companies:

The following are the leading companies in the automotive hydraulics system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH.

- MZW Motor

- FTE Automotive Group

- Schaeffler Technologies AG & Co.

- ZF Friedrichshafen AG

- JTEKT Corporation

- Nexteer

- BorgWarner Inc.

- Hitachi Astemo Americas, Inc.

- Warner Electric..

Automotive Hydraulics System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.15 billion

Revenue forecast in 2030

USD 57.93 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Sales channel, component,on-highway vehicles,off-highway vehicles, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Robert Bosch GmbH., MZW Motor, FTE Automotive Group, Schaeffler Technologies AG & Co., ZF Friedrichshafen AG, JTEKT Corporation, Nexteer, BorgWarner Inc., Hitachi Astemo Americas, Inc.,Warner Electric.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Hydraulics System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive hydraulics system market based on sales channel, component, on-highway vehicles, off-highway vehicles, application, and region.

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Master Cylinder

-

Slave Cylinder

-

Reservoir

-

Hose

-

-

On-Highway Vehicles Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Off-Highway Vehicles Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture Equipment

-

Construction Equipment

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Brakes

-

Clutch

-

Suspension

-

Tappets

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive hydraulics system market size was estimated at USD 43.71 billion in 2023 and is expected to reach USD 46.15 billion in 2024.

b. The global automotive hydraulics system market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 57.93 billion by 2030.

b. Asia Pacific dominated the automotive hydraulics system market with a share of 33.16% in 2023. Asia Pacific registers the largest share in the global market owing to the region's significant automotive manufacturing base and rapidly growing vehicle production.

b. Some key players operating in the automotive hydraulics system market include Robert Bosch GmbH., MZW Motor, FTE Automotive Group, Schaeffler Technologies AG & Co., ZF Friedrichshafen AG, JTEKT Corporation, Nexteer, BorgWarner Inc., Hitachi Astemo Americas, Inc.,Warner Electric.

b. Key factors that are driving the market growth include rising demand for commercial vehicles and geographical expansion of automotive production and infrastructure development in emerging markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.