- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Automotive Glass Market Size, Share, Industry Report, 2030GVR Report cover

![Automotive Glass Market Size, Share & Trends Report]()

Automotive Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tempered Glass, Laminated Glass), By Vehicle Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-234-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Glass Market Summary

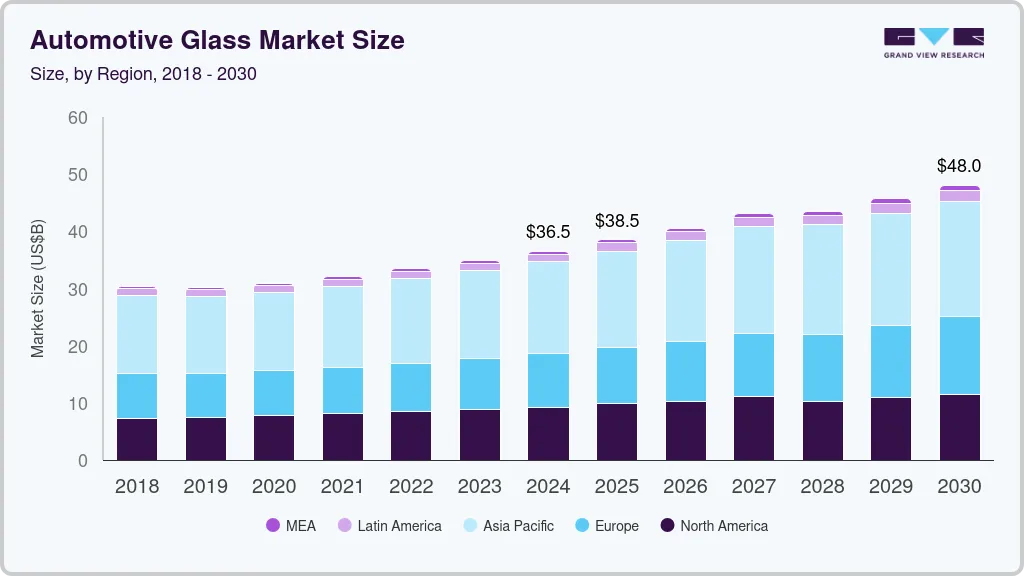

The global automotive glass market size was estimated at USD 36.48 billion in 2024 and is projected to reach USD 48.02 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. An increasing emphasis on lightweight cars because of rising harmful emissions from vehicles that adversely affect the environment is driving glass penetration in the automotive industry.

Key Market Trends & Insights

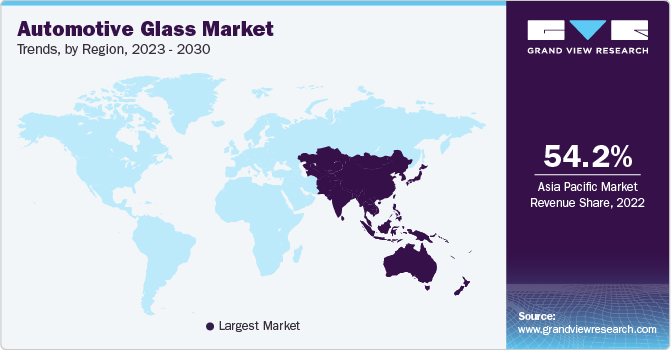

- Asia Pacific dominated the automotive glass market with the largest revenue share of 44.1% in 2024.

- The automotive glass market in the U.S. is anticipated to grow at a significant CAGR during the forecast period.

- By vehicle type, the passenger cars segment led the market with the largest revenue share of 68.5% in 2024.

- By product, the tempered glass segment led the market with the largest revenue share of 51.1% in 2024.

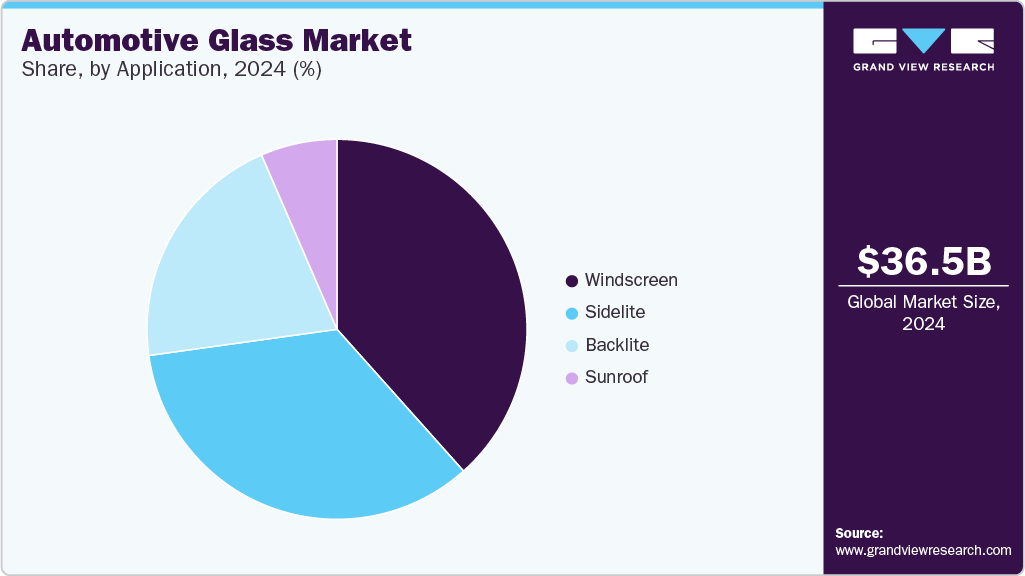

- By application, the windscreen segment led the market with the largest revenue share of 38.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 36.48 Billion

- 2030 Projected Market Size: USD 48.02 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

According to the International Organization of Motor Vehicle Manufacturers (OICA), the production of automobiles reached 92.5 million vehicles globally in 2024. The substantial production volume is attributed to the development of the automotive manufacturing sector, particularly in countries such as China and India, owing to increasing government initiatives regarding motor vehicle regulations.

The automotive glass industry is experiencing significant advancements, with technologies like smart glass and Gorilla Glass enhancing vehicle comfort, efficiency, and safety. Gauzy's advanced smart glass technologies are revolutionizing the automotive industry by integrating dynamic light and vision control into vehicle design. Their Suspended Particle Device (SPD) and Polymer Dispersed Liquid Crystal (PDLC) innovative glass solutions offer instant opacity adjustment, UV and infrared light blocking, and glare reduction. These capabilities enhance passenger comfort, improve energy efficiency, and contribute to safety by reducing heat buildup and glare. Notably, leading automakers like Mercedes-Benz, Ferrari, and BMW have adopted Gauzy's smart glass, underscoring its growing importance in the automotive sector.

Technological advancements in the automotive sector and continuous upgrades in vehicle designs have compelled market players to introduce advanced products for automotive manufacturers. In 2025, AGC introduced a co-developed Photovoltaic Head-Up Display (PHUD) technology, unveiled at CES, enhancing driver experience and comfort. In addition, they are pioneering switchable glazing solutions, reflecting their commitment to innovation in automotive glass technology.

The rise in the production of electric vehicles and the incorporation of various new technologies in terms of display and battery are expected to positively influence the demand for automotive glass over the forecast period. For instance, in December 2024, Hyundai introduced a Metal-Coated Heated Glass system in its luxury Genesis EV models. This 48-volt system rapidly clears ice from the windshield in just five minutes, significantly faster than traditional defrosting systems, enhancing safety and convenience for drivers.

The market's major challenge concerns the raw materials required to produce glass. Raw materials and energy utilization account for a significant share of the cost structure of glass, and their supply directly impacts glass production and its prices. For instance, the price of a key raw material, soda ash, has witnessed a constant increase over the past few months, one of the reasons being its limited supply. To remedy this situation, soda ash manufacturers are increasing their production capacities to fulfill the demand from key markets such as automotive glass, chemicals, and industrial products.

Growing emphasis on fuel efficiency and reduced harmful emissions from vehicles has increased the production of lightweight and electric vehicles. This is anticipated to boost the demand for glass in the automotive industry in the coming years. The automotive industry has witnessed significant technological innovations over the past years. Ashok Leyland signs MoU with Tamil Nadu govt to invest USD 14.1 million. The heavy commercial vehicle domain expert said that this investment is assigned for strategic initiatives to drive innovation, technological advancements, and overall business expansion.

Despite the decline in vehicle production overall, the demand for automotive glass is anticipated to remain steady over the forecast period due to the increasing production of commercial vehicles and electric cars. The rising production of commercial vehicles is a positive sign for the global market for automotive glass. In addition, a significant rise in the production of EVs is further anticipated to provide lucrative opportunities for the growth of the automotive glass industry.

Along with advancements in vehicles, such as the transition from fuel-based to electric and from manual to automatic, technological developments are also being witnessed in the case of glass, such as Gentex Corporation's dimmable and display glass technology. The company introduced a full-display mirror, which turns the rearview mirror into a screen. This can be seen in the Chevy Bolt EV.

Furthermore, solar technology is being increasingly incorporated into the automotive industry and is anticipated to be an excellent feature in electric cars over the coming years. In 2025, Cadillac Celestiq, an ultra-luxury EV, will feature a smart glass roof with quadrant-level opacity control, allowing passengers to adjust transparency for optimal comfort. The vehicle also boasts a 55-inch 8 K-equivalent display and a 38-speaker Dolby Atmos sound system, showcasing Cadillac's commitment to innovation in the EV sector.

Rapidly changing consumer demand has led to numerous advancements in the technology used in automotive glass products. Moreover, the increasing demand for sunroofs in recent years has led to an increase in the utilization of automotive glass. A high consumer focus on luxury is expected to propel vehicle innovation. Today, automotive manufacturers offer either built-in or optional sunroof systems, especially in mid- and premium car segments, which, in turn, is anticipated to propel the demand for automotive glass over the forecast period.

However, one key disadvantage-high manufacturing costs-restricts the growth of the automotive glass industry. Over 90% of the world’s automotive glass is manufactured by the float glass process. Float glass plants require significantly large capital to become functional and only become profitable if they work at a capacity utilization of over 70%. A major share of the overall cost structure of automotive glass is accounted for by its raw material and energy consumption.

Drivers, Opportunities & Restraints

The growth of automotive glass is due to the rising adoption of electric vehicles (EVs). EVs often require specialized glass solutions to enhance energy efficiency and passenger comfort. Lightweight and energy-efficient glass materials help reduce vehicle weight, improve battery performance, and extend driving range. As the global EV market expands, the demand for advanced automotive glass technologies is expected to increase.

Another significant driver is the automotive industry's focus on sustainability. There is a growing demand for eco-friendly and energy-efficient glass solutions, such as solar control glass and lightweight laminated glass, which improve cabin efficiency and passenger comfort while supporting sustainability goals.

Technological advancement also presents substantial opportunities. Innovative glass technologies, such as electrochromic and photochromic glass, offer benefits like glare reduction, thermal insulation, and privacy control. These technologies are particularly valuable in luxury and electric vehicles, where energy efficiency and passenger comfort are paramount.

Fluctuations in raw material prices, such as silica and soda ash, contribute to production cost volatility, affecting profit margins and potentially leading to higher consumer prices. Supply chain disruptions, including shortages of essential materials and logistical challenges, further exacerbate these issues, causing production and delivery schedule delays. The environmental concerns associated with glass manufacturing and the pressure to adopt more sustainable practices also pose significant challenges, as the glass production process is energy-intensive and contributes to carbon emissions.

Vehicle Type Insights

The passenger cars segment led the market with the largest revenue share of 68.5% in 2024. This is attributed to factors such as changing consumer trends, the steadily growing middle-class population, and increasing environmental concerns, which lead to the demand for low-emission and lightweight vehicles on the roads.

On the other hand, the light commercial vehicles segment is expected to register at the fastest CAGR of 3.8% over the forecast period. Commercial vehicles are expected to register a rapid growth in demand, owing to the surge in transportation and construction activities. Vietnamese EV manufacturer VinFast has broken ground on its first integrated EV manufacturing facility in Thoothukudi, Tamil Nadu.

The plant, spanning 400 acres, represents a planned investment of up to USD 2 billion, with an initial commitment of USD 500 million over the first five years. The facility is expected to commence operations by the end of June 2025, with a starting capacity of 50,000 units per year, scalable up to 150,000 units based on market demand.

Product Insights

The tempered glass segment led the market with the largest revenue share of 51.1% in 2024. Its large share is attributed to low cost, strength, and robustness. The product holds a strength that is 4-5 times greater than a basic float and is more cost-effective than laminated automotive glass. As a result, it is the most preferred type of glass in automotive, particularly for windows and backlights.

The laminated glass segment is expected to grow at the fastest CAGR of 4.8% during the forecast period. The structure consists of a PVB layer sandwiched between two glass layers. It mainly finds application in windscreens owing to safety characteristics that allow it to stay intact even after accidents occur, which prevents the passengers in the vehicle from getting hurt or injured. It is also preferred for sunroofs, which are expected to drive segment growth. Companies such as Volvo, Ferrari, and Tesla use laminated glass in all their cars that have panoramic sunroofs.

Application Insights

The windscreen segment led the market with the largest revenue share of 38.4% in 2024. Windshields are essential in a vehicle's structure; hence, automotive and glass manufacturers are developing new technologies to enhance their appearance and features. For instance, the introduction of new types of windshields with self-cleaning glass is anticipated to drive segment growth over the forecast period.

The sidelite segment is expected to grow at the fastest CAGR over the forecast period. For several years, automotive manufacturers have preferred tempered glass for sidelites or the side windows of cars. The sidelite segment is expected to outpace the windscreen in terms of volume demand by 2030. Increased utilization of tempered automotive glass in sidelites, particularly in the aftermarket, is anticipated to propel market growth in the coming years. The increasing number of road accidents is a primary reason for the growing use of glass in the automotive aftermarket. As a safety implementation, manufacturers are now switching to laminated glass for side windows to prevent severe injuries in case of accidents with a heavy impact.

End Use Insights

The OEM segment led the market with the largest revenue share of 81.0% in 2024, as the majority of automotive glass is used for vehicle production. The OEM segment is anticipated to register at a significant CAGR during the forecast period, owing to the establishment of new automotive plants, particularly for electric vehicles. For instance, Tesla’s factory in Shanghai, China, delivered its first 15 Model 3 cars in December 2019.

The aftermarket segment is anticipated to grow at the fastest CAGR during the forecast period, driven by factors such as the high use of old vehicles, the need for maintenance and upgradation for these vehicles, and increasing road accidents. Rising cases of road traffic accidents globally, coupled with high vehicle production, are anticipated to boost the consumption of glass in the automotive aftermarket. The rising popularity of car rental services is projected to propel segment growth further, as new fleet owners have raised the maintenance standards of vehicles. This has led glass suppliers to develop dedicated offerings for fleet owners and customized solutions.

Regional Insights

The automotive glass market in North America is expected to grow at a substantial CAGR during the forecast period. The region has been witnessing a significant increase in the sales of commercial vehicles, which is expected to play an essential role in driving the demand for automotive glass in the coming years. Manufacturers are including value-added features such as solar control, de-icing and de-misting, integrated antennas, and integrated rain and light sensors for automatic wiper or headlight activation to offer differentiated products and drive profit.

U.S. Automotive Glass Market Trends

The automotive glass market in the U.S. is anticipated to grow at a significant CAGR during the forecast period. The U.S. has one of the largest automotive markets in the world. Owing to continuous technological advancements, the applications of automotive glass in the U.S. are highly technical. The presence of numerous glass and car manufacturers is expected to play a key role in fuelling the demand for automotive glass in the economy. Technological advancements, high consumer disposable income, and luxurious lifestyle practices are anticipated to impact the demand over the coming years.

In February 2024, auto glass shop proprietors in the U.S. witnessed a notable upsurge in the demand for auto glass. This surge was primarily attributed to a surge in vehicle break-ins and a supply shortage that has persisted since the onset of the COVID-19 pandemic. Auto glass retailers are currently facing a challenging situation as they navigate the combined impact of shipment delays and an increased incidence of vehicle break-ins.

Asia Pacific Automotive Glass Market Trends

Asia Pacific dominated the automotive glass market with the largest revenue share of 44.1% in 2024. Countries like China and India have witnessed changing consumer demands regarding vehicle styling, safety, and comfort. This has led to a high focus among manufacturers on enhancing their efficiency to meet the rising vehicle demand. Asia Pacific has witnessed a high demand for premium vehicles due to changing consumer lifestyles and rising disposable income. This has led to increased production of cars with sunroofs, positively affecting market growth.

Europe Automotive Glass Market Trends

The automotive glass market in Europe is experiencing significant growth, driven by advancements in innovative glass technologies, increased demand for electric vehicles (EVs), and a focus on safety and energy efficiency. Germany leads the market, accounting for 23.5% of the European automotive glass share in 2024, due to its robust automotive manufacturing base and focus on innovation.

Middle East & Africa Automotive Glass Market Trends

The automotive glass market in the Middle East & Africa is experiencing steady growth, driven by infrastructure development, increasing vehicle production, and a rising demand for advanced glass technologies. Countries like Saudi Arabia, the UAE, and South Africa are at the forefront, with Saudi Arabia aiming to establish itself as a new regional automotive hub. The market is characterized by a shift towards laminated and tempered glass, which offer enhanced safety and durability.

Key Automotive Glass Company Insights

The market relies heavily on raw material manufacturers, suppliers, distributors, and end-users. Although several players are in the industry, the market is consolidated due to a few major manufacturers, such as AGC Ltd., Saint-Gobain, Fuyao Glass Industry Group Co., Ltd., and NSG Group.

Leading manufacturers are developing and implementing new strategies to increase their market share. In addition to capacity expansions, mergers, acquisitions, and new product developments, integration across different stages of the value chain is a significant strategy adopted by key players to help them gain a competitive advantage over other manufacturers.

Key Automotive Glass Companies:

The following are the leading companies in the automotive glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Saint-Gobain

- Xinyi Glass Holdings Limited

- Vitro

- Central Glass Co., Ltd.

- Corning Incorporated

- Guardian Industries

- TAIWAN GLASS IND. CORP.

- Şişecam

Automotive Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.48 billion

Revenue forecast in 2030

USD 48.02 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative Units

Revenue in USD million/billion, Volume in thousands sq. meters, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Turkey; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; South Africa; Morocco

Key companies profiled

AGC Inc.; Fuyao Glass Industry Group Co., Ltd.; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; Xinyi Glass Holdings Limited; Vitro; Central Glass Co., Ltd.; Corning Incorporated; Guardian Industries; TAIWAN GLASS IND. CORP.; Şişecam

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Glass Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive glass market report based on product, vehicle type, application, end use, and region.

-

Product Outlook (Volume, Thousand sq. meters; Revenue, USD Million, 2018 - 2030)

-

Tempered Glass

-

Laminated Glass

-

Others

-

-

Vehicle Type Outlook (Volume, Thousand sq. meters; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Application Outlook (Volume, Thousand sq. meters; Revenue, USD Million, 2018 - 2030)

-

Windscreen

-

Backlite

-

Sidelite

-

Sunroof

-

-

End Use Outlook (Volume, Thousand sq. meters; Revenue, USD Million, 2018 - 2030)

-

Original Equipment Manufacturer (OEM)

-

Aftermarket

-

-

Regional Outlook (Volume, Thousand sq. meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global automotive glass market size was estimated at USD 36.48 billion in 2024 and is expected to reach USD 38.48 million in 2025.

b. The global automotive glass market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 48.02 billion by 2030.

b. Asia Pacific dominated the automotive glass market with a share of over 54.0% in 2022. The share is attributed to countries like China, Japan, India, and South Korea, which together account for more than half of the global automotive production as of 2022.

b. Some of the key vendors of the global automotive glass market are AGC Inc.; Fuyao Glass Industry Group Co., Ltd.; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; Xinyi Glass Holdings Limited; Vitro; Central Glass Co., Ltd.; Corning Incorporated; Guardian Industries; TAIWAN GLASS IND. CORP.; Şişecam.

b. Growth of automotive glass is due to the rising adoption of electric vehicles (EVs). EVs often require specialized glass solutions to enhance energy efficiency and passenger comfort. Seeking high-performance materials and technological advancements and the shift towards lightweight, durable glass materials help reduce vehicle weight, thereby improving battery performance and extending driving range. As the global EV market continues to expand, the demand for advanced automotive glass technologies is expected to increase.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.